I was writing [a reply](https://medium.com/@shelby_78386/apparently-not-400244cca3cc) to a comment on @**PlanB**’s insightful blog [Modeling Bitcoin’s Value with Scarcity](https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25). That comment is reproduced below because while contemplating my reply to the comment, I stumbled onto (in my sleep) some mathematical and economic theory secrets about Bitcoin which apparently were unknown to the public until now. If correct and true these secrets reveal a highly disturbing, dystopian outcome for Bitcoin and the world, with the Bitcoin valuation accelerating instead of slowing down as the _immutable_ 1 MB block size becomes full due to skyrocketing transaction fees. Most (apparently incorrectly) assume the valuation of Bitcoin will be negatively impacted by skyrocketing transaction fees. Note I may have been [the first person to ever](https://bitcointalk.org/index.php?topic=340686.0) raise the spiraling transaction fees issue (c.f. [also](https://bitcointalk.org/index.php?topic=1870270.msg18592457#msg18592457), [also](https://bitcoin.stackexchange.com/questions/8779/how-can-market-based-transaction-fees-scale) and [also](https://bitcointalk.org/index.php?topic=1767014.msg18569924#msg18569924)). --- @**Hamoun Ghanbari** [wrote](https://medium.com/@hamoun.gh/amazing-article-finally-something-that-is-worth-reading-cb3930d9bc43): > (ii) also thinking in terms of ‘efficient markets’, if the home market knows about this law shouldn’t the price just jump right now instead of gradually waiting for the SF to increase? Apparently not. I’m tentatively [qualitatively (with some quantitative support) modeling](https://steemit.com/trading/@anonymint/re-anonymint-re-anonymint-most-important-bitcoin-chart-ever-20190521t130454806z) the lag with a differential equations conceptualization, but see also the transaction fees ramifications in following model development. # “Unforgeable Costliness” > (i) you mentioned “unforgeable costliness”. Another conclusion from your article seems to be that proof-of-work (with gradual increase in SF) is essential to the economic value of bitcoin and adoption. since POW makes marginal cost of creating a coin equal to it’s market value. > > I’m wondering about the implications of this for pre-mined coins or coins with proof-of-stake. “Unforgeable costliness” [was explained by Nick Szabo](http://unenumerated.blogspot.com/2008/08/) as necessary for “bit gold” before Bitcoin was even announced! As you may know that Szabo’s “bit gold” proposal predicted many of the properties of Bitcoin. Szabo seems to think it’s the improbability of being able to replicate the cost that imparts the _public **confidence**_ consensus in the money, i.e. that others will accept it as a [transfer of utility](https://www.jstor.org/stable/1061553?seq=1#page_scan_tab_contents) in the [double coincidence of wants](http://en.wikipedia.org/wiki/Coincidence_of_wants). Using the data for the [annual BTC mined](https://en.bitcoin.it/wiki/Controlled_supply) and the [price history I researched](https://steemit.com/trading/@anonymint/re-anonymint-most-important-bitcoin-chart-ever-20190511t061008384z), I roughly estimate the weighted cumulative mined value: `(2625000 × $000.0015) +` `(2625000 × $000.10) +` `(2625000 × $003) +` `(2625000 × $007) +` `(1312500 × $100) +` `(1312500 × $500) +` `(1312500 × $300) +` `(1312500 × $500) +` `(656250 × $1000) +` `(656250 × $5000) +` `(656250 × $5000) ≈ $9 billion` <center>[](https://twitter.com/yassineARK/status/1130964385202102272)</center> That’s less than a 10th of the modeled and actual market capitalization. That does provide a substantive value compared to the float, which is much smaller than the market cap. # “Unforgeable Costliness” in the S/F Model @**PlanB**’s [stock-to-flows (S/F) model](https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25) stocks market capitalization valuation equation is driven solely by the opportunity cost to produce (aka mine) new units of the monetary resource — [otherwise](https://www.zerohedge.com/news/2019-05-25/drop-gold-myths-naturalist-exposition-golds-manifest-superiority-bitcoin-money) the resource is not monetary. The S/F model predicts the market capitalization will increase `≈10X` for every halving of the annual production of the resource: <center></center> Why `10X` increase for only a doubling of the S/F ratio? I visualized this quantitatively on a [Matryoshka doll](https://en.wikipedia.org/wiki/Matryoshka_doll) manifold of three _fractal_, _recursive_, _relativistic_ dimensions: <center></center> The base `3` orthogonal factors of `2` (i.e. `2 × 2 × 2 = 2³`) are due to following increases in opportunity cost (i.e. time has a cost): * Doubling of the cost to produce a proportional unit of the stock. * Doubling of the time to produce a proportional unit of the stock. * Doubling of the time to debase the stock. I posit these combine to produce a commensurate increase in energy consumption every 4 years, depending on whether energy remains a constant proportion of mining costs. https://digiconomist.net/bitcoin-electricity-consumption Each factor is an orthogonal dimension because each contributes to valuation. For example, although flow and stock determine both of that latter two factors, each factor independently contributes to valuation. Increased stock is an increased mass and inertia for public confidence, which is separate from the [Quantity Theory of Money](https://en.wikipedia.org/wiki/Quantity_theory_of_money#Fisher%27s_equation_of_exchange) valuation benefit from decreased rate of debasement. A “proportional unit of the stock” means for example `1` non-proportional unit in `100` units of stock is equivalent to `2` non-proportional units in `200` units of stock. The base factors are fractal and infinitely recursive as shown in the above equation, because the factors are increasing over time (acceleration, but with decelerating acceleration) without any change to the rate of the flow. They’re relativistic because they’re relative to the stock, which is mutually relative to the base factors. The fractal, recursive, relativistic part of the equation above provides the `.3` of the exponent. One way of visualizing it is the analogy of walking on an escalator. The speed of walking is supplemented by the speed of the escalator. So thus analogously the flow of mining is changing while the ratio of the flow to the stocks is also changing. These are like relativistic mirrors facing each other, so there’s an infinite recursion of the fractal pattern (aka self-similarity at different scales). Do gullible readers contemplate whether I might be Satoshi? I hope not. 😨 # “Unforgeable Costliness” for Cryptocurrency in the S/F Model So it’s the friction of the work of the _all_ miners that is required to produce a (non-proportional) unit of the resource which determines the flow and thus the market capitalization. Remember from Economics 101 that supply and demand curves meet at the price of the _marginal_ (i.e. highest cost) producer. The flow of intangible tokens is _dictated_ by the protocol of decentralized cryptocurrencies, instead of the interaction of the marginal cost of production and valuation of the monetary resource. The marginal cost of production for monetary physical resources (e.g. gold), by definition of being monetary, must evolve slowly with incremental technological innovation: <center>[](https://www.goldbroker.com/news/above-ground-gold-stock-how-much-is-there-why-does-matter-546)</center> This work required to mine a (non-proportional) unit of a physical resource is set by factors in nature and laws of physics. Whereas, the work applied to produce a (non-proportional) unit of an intangible, token resource is set by the interaction of the valuation of the intangible monetary resource and the flow dictated by the protocol. This distinction is diametric: * To rapidly decrease the (supply of) flow of a physical resource, the valuation (and thus price) must decline. But a decrease in the flow increases the S/F valuation. And vice versa. Thus only technological evolution and slow accumulation of mined flow can sustain changes in flow and ([inflation-adjusted](https://medium.com/@mouk.rvm/hi-planb-eb8f1179eb58)) valuation. * A rapid, protocol-dictated decrease of the supply of flow of an intangible, token resource reduces the work applied for mining to that of all the miners remaining up to and including marginal (i.e. highest cost) miner. Thus given that all _fungible_ resources are power-law distributed, the hashrate-weighted work costs of the miners are presumably power-law distributed. Thus a protocol-dictated halving of the flow which is the miner’s reward, [only causes a _negligible_ fraction](https://www.blockchain.com/en/charts/hash-rate?timespan=all&scale=1) of the systemic hashrate to stop mining at the same valuation, i.e. the work applied to mining is nearly [inelastic](https://www.investopedia.com/terms/e/inelastic.asp) to income greater than or equal to half of the marginal cost of production. The ≈4 years between halvings allows for two doublings of Moore’s law for the electrical efficiency of the ASIC mining hardware, so that cost of production for most of the systemic hashrate is much lower than the marginal miners. Thus after the halving the systemic hashrate (but not the work) being applied per (non-proportional) unit of production is nearly double (at the same valuation). The halving of the flow (i.e. a doubling in time cost in two orthogonal dimensions) along with this doubling of cost per minted token causes the valuation to increase by a factor of `10`. The increase in valuation restores the profitability of some of the marginal miners which would have been lost by the halving. The key here is that the work applied recovers (as efficiency of mining hardware is improved) at the new level of electrical efficiency after the halving. Since systemic hashrate (or analogously mining difficulty) is a _directional_ proxy for the work that will be consumed, the halving doesn’t cause any reduction in “work” for valuation. **`This seems to indicate that the S/F valuation of Bitcoin will peak either when Moore’s law for ASICs stops or more likely` [when Bitcoin _soon_ consumes most of the world’s electricity](https://steemit.com/bitcoin/@anonymint/ps05c9)!** Or [possibly go to `0` valuation if](https://assets.ctfassets.net/r1dr6vzfxhev/2t4uxvsIqk0EUau6g2sw0g/45eae33637ca92f85dd9f4a3a218e1ec/iota1_4_3.pdf#page=26) quantum computers [are invented](https://medium.com/the-quantum-resistant-ledger/no-ibms-quantum-computer-won-t-break-bitcoin-but-we-should-be-prepared-for-one-that-can-cc3e178ebff0). <center>[](https://www.danheld.com/blog/2019/1/5/pow-is-efficent)</center> <center>[](https://www.streetwisereports.com/article/2017/11/29/what-is-the-impact-of-the-bitcoin-ecosystem.html)<br/><br/>[](https://www.coindesk.com/bitcoin-mining-can-longer-ignore-moores-law)</center> Uh oh, some of you may now really be contemplating if I’m Satoshi. 😲 **So now we know why cryptocurrency scales so much faster to monetary dominance than** the 1000s of years that gold required: @**Philip Barton** [wrote](http://timesofgold.com/2016/01/26/the-stock-to-flow-ratio/): > Two pertinent and closely related points emerge from all this: > > 1. Gold was accumulated for thousands of years before it was used in the marketplace, which means that, > > 2. Gold’s stability of value was formed before it became money. > > These points are of the utmost significance to the unveilings of money’s origins. What these overlooked, but indisputable historical facts confirm is that long before its commercial use was understood, Gold was already perceived to be a store of stable value. The primary function of money was formed independent of the exchange of goods. This was the first Eureka moment in the tracking down of money’s origins. ### UPDATE 10 Months Later The analytical explanation for the ratcheting I had alluded to above is in my latest blog [Bitcoin’s Pivotal, Religious Moment of Transformative Truth Has Likely Arrived (Tomorrow)](https://steemit.com/bitcoin/@anonymint/bitcoin-s-pivotal-religious-moment-of-transformative-truth-has-likely-arrived-tomorrow): > <center>[<br/>Bitcoin’s Cost of Production — A Model for Bitcoin Valuation](https://medium.com/@DataDater/bitcoins-cost-of-production-a-valuation-approach-for-bitcoin-dcd76951040a)</center> > > Essentially the CoP model predicts that more efficient mining hardware drives up the CoP for the weighted average miner. > > Note the metrics and methodology employed to make the chart above are inexact and don’t account for all possibilities for a precipitous decline in the CoP. > > I [commented](https://medium.com/@shelby_78386/excellent-but-the-reason-your-model-isnt-predicting-the-highs-and-also-the-reason-it-didn-t-f4e3a1809359) on the CoP blog as follows (but note Medium has censored all my posts, lol): > >> Excellent, but ostensibly the reason your model isn’t predicting the peak highs and also the reason it didn’t predict the current spike low to$4k is because you haven’t factored the CoP of the marginal miner into your analysis, c.f. also section [Naive S/F Model Neglects Transaction Fees](https://steemit.com/bitcoin/@anonymint/secrets-of-bitcoin-s-dystopian-valuation-model). Thus you have missed the causal correlation that ratchets the price higher. Your regression fit gives you a predictive fit but doesn’t explain the causative economics. Let me help you on that. I wrote the following on my recent blog [Bitcoin’s Pivotal, Religious Moment of Transformative Truth Has Likely Arrived (Tomorrow)](https://steemit.com/bitcoin/@anonymint/bitcoin-s-pivotal-religious-moment-of-transformative-truth-has-likely-arrived-tomorrow) in the section _“Filbfilb Citing Possible 61.8% Retracement”_: >> >>> Note according to Economics 101 the price of Bitcoin (where supply and demand curves meet) — would be set by the CoP of the highest cost marginal miner — which would be higher than a price based on the weighted average miner CoP but also subject to more precipitous drops when for example Bitmain S9s are taken offline during a price drop (which I have confirmed is happening in a panic). When the price rose above ~$`8.5k` the S9s became profitable in January, but then the hashrate moved up considerably because of all the S17s and s19s coming out of production. Also recently Whatsminer is ramping up massive production of efficient miners via Samsung’s fab to compete with Bitmain and TMSC. So the price moved up to where any drop in the price would render S9s uneconomic. So then it was a self-feeding spiral in CoP down to `$4k` wherein the S9s are very much profitable again. If the price can accelerate upwards, the S9s remain profitable. This plunge is the SLINGSHOT to gather the energy for my posited moonshot price rise. >> >> Hope you write a second blog and incorporate my suggestion. This is your baby, I prefer for you to get the credit for it. Please just mention I made a suggestion. # The Scalar Factor of the S/F Model Note the model I described above explains the `SF³.³` exponent in @**PlanB**’s S/F model, but it doesn’t explain why the scalar factor `e¹⁴.⁶` so that Bitcoin is aligning with gold’s and silver’s valuations at the same S/F ratios. Cryptocurrency has a difficulty adjustment which maintains a protocol-dictated flow regardless of the work applied. Thus for cryptocurrency the scalar factor is determined by the _inertia_ of the history of the work being applied. I posit that this inertia is a public confidence, self-fulfilling driven phenomenon. The total work applied to mining a cryptocurrency can be precisely and objectively estimated _ex post facto_ by summing all the zeros in the proofs-of-work of all mined blocks, because these comprise a history of the mining difficulty and systemic hashrate that was applied. Other than if there’s some additional ramifications (which don’t meet Szabo’s criteria) in the mining subsequent to the premine, I contemplate that the main issues with a large premine are: 1. The lower levels of work inertia both in terms of less duration of history and lower starting point for future halvings. 2. The centralization of risk of dumping that can bloat the float concomitant, which presumably would weigh on the confidence and thus on the valuation as a reliable store-of-value which is correlated with the level of applied mining work. # Naive S/F Model Neglects Transaction Fees The mined value is not the same as the mined cost, both because of [transaction fees in the block subsidy](https://btc.com/stats/fee) and because only the marginal miners have a cost which is near to the price. The latter can be ignored (except for its interaction with the former) for the reasons I provided when I described the model — the effect of the marginal miners is essential to, integral with, and won’t alter the trajectory of, the S/F model applied to cryptocurrency. However the former if not incorporated into the model could potentially cause the a divergence from an otherwise naive projection of the S/F model. The [transaction fees](https://btc.com/stats/fee) rewarded to the miners must be subtracted from the hashrate-weighted average miners’ presumably power-law distributed production costs. Miners can thus increase their hashrate (and applied work) proportional to the implied ratio. **Thus the applied work and valuation should increase compared to @_PlanB_’s naive S/F model. The result should be an acceleration of the Bitcoin price compared to @_PlanB_’s naive S/F model.** IOW, the amount of work required to mine a token increases by the aforementioned implied ratio of the transaction fee subsidy. **Thus the spiking of transaction fees may explain valuation spikes.** The transaction fees for gold and silver are not conveyed to miners. For physical resources, we might view transaction fees (including the bid/ask spread) as necessary for sustaining the ecosystem and thus being part of the “unforgeable costliness”. One might attempt to reason that if the wealthy, who will be able to afford to transact on Satoshi’s immutable 1 MB blocksize ([Bitco[~~i~~]n Core and SegWit are altcoins](https://bitcointalk.org/index.php?topic=178336.msg51172969#msg51172969), c.f. also my blogs), are also the miners then the transaction fees are paid to themselves when they transact and thus are not recouped from cost of mining. However miners can’t only mine at the instant they want to transact unless they have huge percentage of the network hashrate, in which case they wouldn’t likely be the marginal miners. # Projecting Bitcoin’s Transaction Fees The left axis on the chart below is daily (`144` blocks per day) subsidy: <center>[](https://blog.picks.co/bitcoins-security-is-fine-93391d9b61a8)</center> Note the orange projection of the future transaction fees might be modeled too low. However, unlike the BTC price, the lows are not progressing significantly higher (which might be due to the previously very high minimum fee cited below). Perhaps either this is indicative that lulls in the transaction demand will persist, or that as BTC transistions from a purely speculation driven, [high pricing volatility asset to a lower volatility](https://bitcointalk.org/index.php?topic=178336.msg51172647#msg51172647) international settlement asset in a two-tiered monetary system, then the lows will increase and/or the highs will decrease. The highs are ostensibly increasing non-linearly up to now and again I posit the possibility that the plotted regression fit is too low for the analogous [reasoning that the regression fits of the price have been](https://steemit.com/trading/@anonymint/re-anonymint-re-anonymint-most-important-bitcoin-chart-ever-20190521t130454806z), but… **It seems impossible to reliably project any trend from the history of transaction fees** thus far because there [was a recommended minimum fee](https://www.coindesk.com/bitcoin-transaction-fees-slashed-tenfold) before 2016, some [pools enforced small block sizes](http://hashingit.com/analysis/39-the-myth-of-the-megabyte-bitcoin-block) (c.f. [also](https://bitcointalk.org/index.php?topic=178336.msg51169892#msg51169892)) before 2015, and [1 MB blocks weren’t even full until the peak 2017](https://bitinfocharts.com/comparison/bitcoin-size.html). The best data point in the transaction fee history thus far seems to be a comparison of the peaks in 2013 and 2017. Roughly there’s a doubling of fees to `0.0036 BTC`per KB and the consumed block size increased from [less than `200 KB`](http://hashingit.com/analysis/39-the-myth-of-the-megabyte-bitcoin-block) to approximately `1000 KB`. So that’s `≈10X` increase, which seems to correlate with the S/F valuation model but we don’t have enough reliable history to gain confidence in the correlation. **I intuitively want to disregard the `≈10X` compounding increase scenario for transaction fees as it seems ludicrous and the ramifications would be catastrophic.** But I can’t because actually it seems like what should happen if the S/F valuation model is correct. However, the uber wealthy transact exponentially less, so perhaps as most of humanity is kicked off-chain by rising transactions fees (and the previously posited “SegWit donations” restoration), the uber wealthy will spend a much lower percentage for transaction fees (which seems to make sense). But this wouldn’t stop the transaction fees as priced in dollars from rising to extreme levels. # Bitcoin Maximalism? My intuition is that the _quantitative_ stocks-to-flows model is _qualitatively_ indicative of the public confidence that the token supply won’t be debased and in the “unforgeable costliness” being sui generis. Otherwise there’s no value if there can be competing variants of the same store-of-value market capitalization in the stocks-to-flows model. The aforementioned _Scalar Factor_ distinguishes the sui generis from the copy coins. However, it’s quite unsettling to contemplate an unrelenting rise in the Bitcoin market capitalization and what this [might mean for the world’s well being](https://medium.com/@shelby_78386/rise-of-hard-money-is-a-harbinger-of-misery-7614c6859f00). And it’s [the Schelling point of the _immutable_ 1 MB blocksize](https://bitcointalk.org/index.php?topic=178336.msg51169892#msg51169892) which gives Bitcoin the sui generis throne. There can be no other altcoin which will ever have the same duration of history of being immutable. And obviously immutability is crucial to the confidence of avoiding debasement. The next closest is Litecoin, but it was launched 2.75 years after Bitcoin and so it can only achieve a “silver” to Bitcoin’s “gold” stock-to-flows valuation. I wrote: > LTC’s current S/F of `11.29` and `≈25` for BTC computes to a relative market capitalization of `(11.29^3.3) ÷ (25^3.3) ≈ 0.0725` in the S/F model. But there are [61,892,225 LTC](https://www.litecoinblockhalf.com/) versus [17,713,300 BTC](https://www.bitcoinblockhalf.com/) tokens in circulation. Thus the S/F modeled LTC/BTC price ratio is currently `0.0725 × 17713300 ÷ 61892225 ≈ 0.021`. This is asymptotically approaching the modeled ratio `0.025`. Litcoin achieved the `0.021 BTC` price recently. Charlie Lee set the parameters of Litecoin such that the stock-to-flows ratio will always be less than half of Bitcoin (thus the market capitalization less than one-tenth and given 4X greater supply thus `0.025` token price). Did someone who designed Bitcoin advise Charlie? How did he know or did he just make a lucky guess? Perhaps if a higher the stock-to-flows ratio had been targeted (i.e. with a faster rate of halving), Litecoin would either have failed due to insufficient security (perhaps due to insufficient confidence in the security, thus collapsing price that pays for the security) or its price would presumably have deviated lower (i.e. a lower _Scalar Factor_) than the model price due to perceived insufficient security. Perhaps the only plausible way to finance a higher stocks-to-flows ratio earlier is to have much greater transaction volume. At the peak at the end of 2017, the relative market capitalizations of Ethereum, Litecoin and Monero were roughly proportional to their respective daily transaction fee volume. Ethereum had a huge gain due to constrained block size given the ICO mania mostly consisting of ERC-20 token smart contracts. Note though that live by the sword, die by the sword, and these transaction volume peaks are more volatile. So priced weighted by volatility then Bitcoin maintained its sui generis lead. Monero (XMR) was launched 5.25 years after Bitcoin with [an accelerated halving schedule](https://docs.google.com/spreadsheets/d/1qXi7zUSIh7F6UuSuhOryyFbHEy_LJuym3I3neAga_2s/edit?pli=1#gid=239466694). On the peak Jan 2018 the market cap nearly attained `$8 billion`, while the S/F ratio of `13.3` had the modeled market cap of `$11 billion`. Note Monero has a use case with a significant transaction volume and significant fees to diminish spamming the anonymity mixsets. On the following chart only BTC and LTC have a market capitalization that exceeds the mining difficulty. The difficulty displayed is presumably normalized to the presumed relative median electrical efficiency compared to Bitcoin. <center>[](https://bitinfocharts.com/comparison/difficulty-marketcap-btc-ltc-eth-xmr.html#log)</center> So the only possible explanations I can think of for Ethereum (ETH) and XMR are: * Both ETH and XMR have inexorable debasement and not a limit on the number of tokens that will be minted with mining. * If there’s a secret miner who has a much higher efficiency than presumed (thus the difficulty should be displayed much lower). This is plausible given they were designed to be ASIC-resistant. * If the relative duration of accumulated history matters to the _Scalar Factor_. * If botnets are mining which expend energy but at no cost to the beneficiary, analogous to proof-of-stake having “nothing at stake”. * If Ethereum and Monero are perceived to be centralized, because for example Vitalik forked to remove the DAO attacker, the decision on when the halve the block reward is centralized, and Monero has centralized minimum transaction fee decision to control the [adaptive block size algorithm](https://gist.github.com/shelby3/e0c36e24344efba2d1f0d650cd94f1c7#oligarchy-or-hara-kiri-if-adaptive-block-size-protocol). * XMR has no halvings. ETH has only irregular reductions in block reward at Vitalik’s discretion. So intuitively for cryptocurrencies, I presume it’s a race to establish a significant Scalar Factor before Bitcoin’s transaction fees Scalepocalypse sends the BTC price to the moon even faster than `≈10X` every 4 years. **So presumably being first matters.** --- @**realr0ach** [wrote](https://bitcointalk.org/index.php?topic=178336.msg51166986#msg51166986): > This dumb “stock to flow” poster guy Anonymint & Infofront are citing looks like he’s lying about silver and gold to try and make Bitcoin look better. There’s more like 100,000 tons of silver around, NOT 500,000 as he claims. So silver stock to flow is more like 4 instead of 22. Although I didn’t check his “flow” number, so even that might be off too. His gold stock number is also WAY too high. In other words, probably everything in that picture is incorrect. <center></center> > It’s also not even really possible to have valid flow figures in the first place for numerous reasons I won’t go into. Do you include the ETFs whose only reason for existing is to suppress price? For all intents and purposes, someone trading a paper receipt of ownership for silver around is the same thing as physical flow. The only purpose of the flow metric is to signify transfer of ownership, and that’s what’s occuring (doesn’t matter if the ETF vaults are empty or gold plated tungsten). He probably leaves all of that out solely to try and make Bitcoin look better. If I am correct in my intuition about the valuation of the stocks-to-flows modeling public confidence, then the arguments about the tinfoil-dunce-cap conspiracies about gold and silver **are irrelevant**, since the public confidence is presumably based on the “official” data. Presumably if the public believed (or understood the relevance of) the stock-to-flows ratio for silver is `4`, then the silver price would be much **lower** than it is. Remember money is what ever public confidence believes money is. That is why exponentially increasing [hyperinflation can only result when the government can’t even sell its own bonds](https://www.armstrongeconomics.com/uncategorized/hyperinflation-v-inflation/) (c.f. [also](https://www.armstrongeconomics.com/uncategorized/defining-hyperinflation-the-coming-new-currency/) and [also](https://www.armstrongeconomics.com/uncategorized/hyperinflation-is-it-even-possible/)), as it’s [indicative that the public has lost all confidence in the government](https://www.armstrongeconomics.com/history/hyperinflation/hyperinflation-unfolds-only-when-public-confidence-collapses/) and its currency. For example, QE can never be said HYPERinflation without loss of public confidence in the government. As long as majority of the public is willing to boil like frogs in the pot of fiat malfeasance, then public confidence continues and no hyperinflation results. Saifedean Ammous, Bitcoin economist and author of seminal book, “The Bitcoin Standard” which [was the inspiration for](https://stephanlivera.com/episode/67) the S/F model which we are discussing, [has this hyperinflation concept](https://stephanlivera.com/episode/69) correct, except he thinks hyperinflation (when it occurs) is triggered by an initial burst of inflation. Correlation is not proof of a causal relationship, he should study Armstrong’s blogs which I have linked in this paragraph. Also how does @**realr0ach** explain the fact that (regardless of the correlation to gold and silver) the model has backtested the BTC price since inception with the stated high-level of statistical correlation? As for claimed manipulation which purportedly causes flows to be lower than would be otherwise, that’s all just part of the ecosystem and the stock-to-flows model valuation applies. Also seems @**realr0ach** may not understand the definition of flows that applies in the model. It’s not transaction flow but rather the annual debasement (i.e. mining production) of the total supply. **EDIT:** @**PlanB** [updated his chart](https://bitcointalk.org/index.php?topic=5147618.msg51375745#msg51375745) with the corrected S/F ratio for silver: > [](https://bitcointalk.org/index.php?topic=5147618.msg51375745#msg51375745) And then [he updated it again](https://bitcoinist.com/bitcoin-stock-to-flow-targets-100-trillion-surpassing-gold/) including diamonds and thinks he sees a trend with Bitcoin headed to $100+ trillion to fill in the gap on the [“S/F periodic table”](https://bitcoinist.com/bitcoin-stock-to-flow-targets-100-trillion-surpassing-gold/): > [](https://bitcoinist.com/bitcoin-stock-to-flow-targets-100-trillion-surpassing-gold/)

| author | anonymint |

|---|---|

| permlink | secrets-of-bitcoin-s-dystopian-valuation-model |

| category | bitcoin |

| json_metadata | {"tags":["economics","future","apocalypse","money"],"image":["https://i.imgur.com/ZhXLAYC.png","https://i.imgur.com/n3BAe6e.png","https://i.imgur.com/yTHZPgO.png","https://i.imgur.com/MEHNtky.png","https://i.imgur.com/OqjL3ET.png","https://i.imgur.com/g5xGiN8.png","https://i.imgur.com/fdeuCp5.png","https://i.imgur.com/4jDQhaz.png","https://i.imgur.com/PtdML32.png","https://i.imgur.com/ZuBtPaV.png","https://i.imgur.com/4sfE5v4.png","https://i.imgur.com/Un8d4Rb.png","https://i.imgur.com/4NRjJY3.png"],"links":["https://medium.com/@shelby_78386/apparently-not-400244cca3cc","https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25","https://bitcointalk.org/index.php?topic=340686.0","https://bitcointalk.org/index.php?topic=1870270.msg18592457#msg18592457","https://bitcoin.stackexchange.com/questions/8779/how-can-market-based-transaction-fees-scale","https://bitcointalk.org/index.php?topic=1767014.msg18569924#msg18569924","https://medium.com/@hamoun.gh/amazing-article-finally-something-that-is-worth-reading-cb3930d9bc43","https://steemit.com/trading/@anonymint/re-anonymint-re-anonymint-most-important-bitcoin-chart-ever-20190521t130454806z","http://unenumerated.blogspot.com/2008/08/","https://www.jstor.org/stable/1061553?seq=1#page_scan_tab_contents","http://en.wikipedia.org/wiki/Coincidence_of_wants","https://en.bitcoin.it/wiki/Controlled_supply","https://steemit.com/trading/@anonymint/re-anonymint-most-important-bitcoin-chart-ever-20190511t061008384z","https://twitter.com/yassineARK/status/1130964385202102272","https://www.zerohedge.com/news/2019-05-25/drop-gold-myths-naturalist-exposition-golds-manifest-superiority-bitcoin-money","https://en.wikipedia.org/wiki/Matryoshka_doll","https://digiconomist.net/bitcoin-electricity-consumption","https://en.wikipedia.org/wiki/Quantity_theory_of_money#Fisher%27s_equation_of_exchange","https://www.goldbroker.com/news/above-ground-gold-stock-how-much-is-there-why-does-matter-546","https://medium.com/@mouk.rvm/hi-planb-eb8f1179eb58","https://www.blockchain.com/en/charts/hash-rate?timespan=all&scale=1","https://www.investopedia.com/terms/e/inelastic.asp","https://steemit.com/bitcoin/@anonymint/ps05c9","https://assets.ctfassets.net/r1dr6vzfxhev/2t4uxvsIqk0EUau6g2sw0g/45eae33637ca92f85dd9f4a3a218e1ec/iota1_4_3.pdf#page=26","https://medium.com/the-quantum-resistant-ledger/no-ibms-quantum-computer-won-t-break-bitcoin-but-we-should-be-prepared-for-one-that-can-cc3e178ebff0","https://www.danheld.com/blog/2019/1/5/pow-is-efficent","https://www.streetwisereports.com/article/2017/11/29/what-is-the-impact-of-the-bitcoin-ecosystem.html","https://www.coindesk.com/bitcoin-mining-can-longer-ignore-moores-law","http://timesofgold.com/2016/01/26/the-stock-to-flow-ratio/","https://steemit.com/bitcoin/@anonymint/bitcoin-s-pivotal-religious-moment-of-transformative-truth-has-likely-arrived-tomorrow","https://medium.com/@DataDater/bitcoins-cost-of-production-a-valuation-approach-for-bitcoin-dcd76951040a","https://medium.com/@shelby_78386/excellent-but-the-reason-your-model-isnt-predicting-the-highs-and-also-the-reason-it-didn-t-f4e3a1809359","https://steemit.com/bitcoin/@anonymint/secrets-of-bitcoin-s-dystopian-valuation-model","https://btc.com/stats/fee","https://bitcointalk.org/index.php?topic=178336.msg51172969#msg51172969","https://blog.picks.co/bitcoins-security-is-fine-93391d9b61a8","https://bitcointalk.org/index.php?topic=178336.msg51172647#msg51172647","https://www.coindesk.com/bitcoin-transaction-fees-slashed-tenfold","http://hashingit.com/analysis/39-the-myth-of-the-megabyte-bitcoin-block","https://bitcointalk.org/index.php?topic=178336.msg51169892#msg51169892","https://bitinfocharts.com/comparison/bitcoin-size.html","https://medium.com/@shelby_78386/rise-of-hard-money-is-a-harbinger-of-misery-7614c6859f00","https://www.litecoinblockhalf.com/","https://www.bitcoinblockhalf.com/","https://docs.google.com/spreadsheets/d/1qXi7zUSIh7F6UuSuhOryyFbHEy_LJuym3I3neAga_2s/edit?pli=1#gid=239466694","https://bitinfocharts.com/comparison/difficulty-marketcap-btc-ltc-eth-xmr.html#log","https://gist.github.com/shelby3/e0c36e24344efba2d1f0d650cd94f1c7#oligarchy-or-hara-kiri-if-adaptive-block-size-protocol","https://bitcointalk.org/index.php?topic=178336.msg51166986#msg51166986","https://www.armstrongeconomics.com/uncategorized/hyperinflation-v-inflation/","https://www.armstrongeconomics.com/uncategorized/defining-hyperinflation-the-coming-new-currency/","https://www.armstrongeconomics.com/uncategorized/hyperinflation-is-it-even-possible/","https://www.armstrongeconomics.com/history/hyperinflation/hyperinflation-unfolds-only-when-public-confidence-collapses/","https://stephanlivera.com/episode/67","https://stephanlivera.com/episode/69","https://bitcointalk.org/index.php?topic=5147618.msg51375745#msg51375745","https://bitcoinist.com/bitcoin-stock-to-flow-targets-100-trillion-surpassing-gold/"],"app":"steemit/0.2","format":"markdown"} |

| created | 2019-05-23 21:36:33 |

| last_update | 2020-03-13 20:48:06 |

| depth | 0 |

| children | 48 |

| last_payout | 2019-05-30 21:36:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.636 HBD |

| curator_payout_value | 0.186 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 31,806 |

| author_reputation | 28,085,935,540,836 |

| root_title | "Secrets of Bitcoin’s Dystopian Valuation Model" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 85,382,297 |

| net_rshares | 1,394,395,134,002 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| anonymint | 0 | 15,459,700,029 | 100% | ||

| felixxx | 0 | 515,574,626,850 | 100% | ||

| warofcraft | 0 | 30,946,806,381 | 20% | ||

| roy2016 | 0 | 251,113,501,020 | 50% | ||

| quillfiller | 0 | 409,080,742 | 100% | ||

| baah | 0 | 7,770,256,891 | 100% | ||

| jackhircus | 0 | 137,474,754,721 | 75% | ||

| preparedwombat | 0 | 257,786,610,835 | 100% | ||

| codypanama | 0 | 4,151,498,126 | 100% | ||

| droida | 0 | 2,700,686,688 | 100% | ||

| ratticus | 0 | 4,441,796,312 | 10% | ||

| unrared | 0 | 14,037,283,789 | 20% | ||

| zoidsoft | 0 | 71,084,437,541 | 100% | ||

| johnnyflynn | 0 | 0 | 100% | ||

| lauch3d | 0 | 28,962,036,545 | 100% | ||

| jesseluther | 0 | 3,145,198,215 | 100% | ||

| luegenbaron | 0 | 19,746,297,782 | 100% | ||

| zedpal | 0 | 263,442,958 | 100% | ||

| melaniecarpio | 0 | 271,898,842 | 100% | ||

| michellecarpio | 0 | 355,941,678 | 100% | ||

| iconoclaps | 0 | 163,760,417 | 100% | ||

| devsup | 0 | 28,268,317,051 | 7% | ||

| longlu | 0 | 142,601,458 | 100% | ||

| hozn4ukhlytriwc | 0 | 124,599,131 | 15% |

I [wrote](https://www.quora.com/In-a-hypothetical-scenario-if-scientists-were-to-figure-out-how-to-transmute-steel-into-precious-metals-like-silver-and-gold-what-would-happen-to-the-world-economy/answer/Jason-Hommel-1/comment/98349790) on to Jason Hommel on Quora: > I doubt it’s an IQ issue. I think it’s decades of ingrained domain knowledge and my passion for technology, especially computer science. The annual mined flow has a cost of production and supply meets demand at the cost of the most marginal producer. So the mined annual flow is the opportunity cost at which someone can buy gold, i.e. the mined flow is part of the float. So it provides a baseline valuation for all the above ground gold, because gold has a very small float. Because gold is held by the wealthy, who spend only a very small portion of their net worth annually. So assets with a high stocks-to-flows ratio have a higher multiple valuation on the cost of the mined flow, which is what PlanB’s chart is exemplifying in my blog. From this is derived a model of how Bitcoin’s valuation increases as the annual mined flow is forcibly halved every 4 years by the protocol of Bitcoin. Gold does not have a protocol. That’s why Bitcoin could grow valuation so quickly whereas gold required 1000s of years. Anyway, that is the model and the theory: > > [Secrets of Bitcoin’s Dystopian Valuation Model](https://steemit.com/bitcoin/@anonymint/secrets-of-bitcoin-s-dystopian-valuation-model) > > That is a very new insight that originates from PlanB. I augmented the understanding. PlanB got offended and banned from his Twitter feed. > > Jason I suggest you read the posts attributed to me in the following linked `bitcointalk.org` thread for more insight. However my posts there (posted by others on my behalf because I am banned there for trying to spread the truth) may or may not be comprehensible due to your lack of familiarity with the terminology. It is amazing that we have a fake Bitcoin (named Core) which is masquerading as the real Bitcoin and most everyone believes Core is the real Bitcoin but it is not and they are going to lose their Bitcoins because they have been deceived by scammers. That should be valuable information and everyone I inform seems to come away thanking me and offering to give me a donation, but I told them I am okay right now. I am hopefully building good will. I mean nearly everyone including exchanges, perhaps CBOE futures markets, etc. are hodling the Core address instead of the Legacy addresses. Lol. It is going to be an amazing sight when they all wake up one day and all their Bitcoin has gone poof, because they did not read what I wrote. > > [Long term advance notice!](https://bitcointalk.org/index.php?topic=5147618.msg51401646#msg51401646) > > [“Bitco[i]n” Will Collapse to $775 Price Soon](https://steemit.com/bitcoin/@anonymint/bitco-i-n-will-collapse-to-usd775-price-soon)

| author | anonymint |

|---|---|

| permlink | pt1mqy |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"links":["https://www.quora.com/In-a-hypothetical-scenario-if-scientists-were-to-figure-out-how-to-transmute-steel-into-precious-metals-like-silver-and-gold-what-would-happen-to-the-world-economy/answer/Jason-Hommel-1/comment/98349790","https://steemit.com/bitcoin/@anonymint/secrets-of-bitcoin-s-dystopian-valuation-model","https://bitcointalk.org/index.php?topic=5147618.msg51401646#msg51401646","https://steemit.com/bitcoin/@anonymint/bitco-i-n-will-collapse-to-usd775-price-soon"],"app":"steemit/0.1"} |

| created | 2019-06-13 15:23:24 |

| last_update | 2019-06-13 15:23:24 |

| depth | 1 |

| children | 0 |

| last_payout | 2019-06-20 15:23:24 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 2,905 |

| author_reputation | 28,085,935,540,836 |

| root_title | "Secrets of Bitcoin’s Dystopian Valuation Model" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 86,563,541 |

| net_rshares | 0 |

Too lazy to read all this, but it looks pretty cool.

| author | felixxx |

|---|---|

| permlink | ps07ja |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"steemit/0.1"} |

| created | 2019-05-24 10:23:33 |

| last_update | 2019-05-24 10:23:33 |

| depth | 1 |

| children | 0 |

| last_payout | 2019-05-31 10:23:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 52 |

| author_reputation | 218,729,231,048,348 |

| root_title | "Secrets of Bitcoin’s Dystopian Valuation Model" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 85,410,896 |

| net_rshares | 14,841,208,692 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| anonymint | 0 | 14,841,208,692 | 100% |

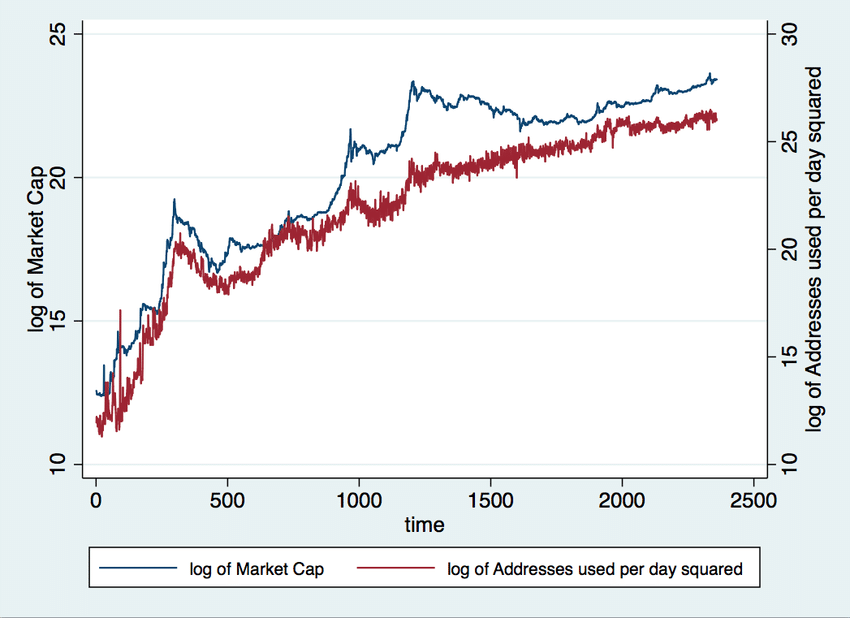

I see the point in a model being "predictive" (post-dictive) but also I think all models should take into consideration all the other post-dicitve and predictive models. There is a good body of evidence validating Metcalfe on communication-networks like: Facebook und Tencent: [Zhang et al. 2015](https://link.springer.com/article/10.1007/s11390-015-1518-1) Bitcoin, Ethereum, Dash [Alabi 2017](https://www.sciencedirect.com/science/article/pii/S1567422317300480) Bitcoin: [Peterson 2018](https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3078248), [Civitarese 2018](https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3107895) Sarnoffs Function ***V = a × n*** a: USD/MAU Reeds Function ***V = a × (2^(n) − 1)*** a: USD/MAU Odlyzkos Function ***V = a × n log(n)*** a: USD/MAU Metcalfes Function ***V = a × n²*** a: USD/MAU²  [[Cermak 2017]](https://www.researchgate.net/publication/316851272_Can_Bitcoin_Become_a_Viable_Alternative_to_Fiat_Currencies_An_Empirical_Analysis_of_Bitcoin%27s_Volatility_Based_on_a_GARCH_Model?_sg=2WtM2tmKJWkU5n4ZXOfQZM0W1TNP_o1Os9aBl55pc2Z6xSckitl__Pbln21GKDPoLGxp2NrC0Q) and it filters the network-value by use. There are times when Bitcoin follows Metcalfe, which is dependent on the number of monthly active users (MAU) (n log(n)), but there are also times when the dynamic is driven by speculation. And this goes so far that bubbles and bottoms become somehow predictable ([Sornette et al. 2018](https://arxiv.org/abs/1803.05663) - Are Bitcoin Bubbles Predictable? Combining a Generalized Metcalfe's Law and the LPPLS Model). This is in line with the phenomenon, that in a retail-driven market, the public interest and gossip on social-media was in hindsight "predictive" for bitcoins price. **Evidence for Social-Media being predictive:** > [(Lui und Tsyvinki 2018)](http://www.nber.org/papers/w24877.pdf): Risks and Returns of Cryptocurrency [(Phillips und Gorse 2018)](https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5905883/):Cryptocurrency price drivers: Wavelet coherence analysis revisited [(ElBahrawi et al. 2017)](https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5717631/): Evolutionary dynamics of the cryptocurrency market [(Wang und Vernge 2017)](https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5234770/): Buzz Factor or Innovation Potential: What Explains Cryptocurrencies’ Returns? [(Kim et al. 2016)](https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4988639/): Predicting Fluctuations in Cryptocurrency Transactions Based on User Comments and Replies [(Kristoufek 2015)](http://journals.plos.org/plosone/article/file?id=10.1371/journal.pone.0123923&type=printable): What Are the Main Drivers of the Bitcoin Price? Evidence from Wavelet Coherence Analysis [(Garcia et al. 2014)](https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4233744/): The digital traces of bubbles: feedback cycles between socio-economic signals in the Bitcoin economy [(Matta et al. 2015)](https://pdfs.semanticscholar.org/1345/a50edee28418900e2c1a4292ccc51138e1eb.pdf): Bitcoin Spread Prediction Using Social And Web Search Media [(Garcia und Schweizer 2015)](http://rsos.royalsocietypublishing.org/content/2/9/150288):Social signals and algorithmic trading of Bitcoin [(related Studies)](https://www.ncbi.nlm.nih.gov/pubmed?cmd=link&linkname=pubmed_pubmed&uid=29668765&log$=relatedarticles&logdbfrom=pmc) Now you come with a new model which says: underlying all of this, there is the self-fullfilling narrative of a store of value. how does this fit the narrative?

| author | lauch3d |

|---|---|

| permlink | ps040h |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"image":["https://cdn.steemitimages.com/DQmVmkCxmkFEsaUt8ZtLa2c2GcLA1LtNfkK9ATB7MLBakZv/image.png"],"links":["https://link.springer.com/article/10.1007/s11390-015-1518-1","https://www.sciencedirect.com/science/article/pii/S1567422317300480","https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3078248","https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3107895","https://www.researchgate.net/publication/316851272_Can_Bitcoin_Become_a_Viable_Alternative_to_Fiat_Currencies_An_Empirical_Analysis_of_Bitcoin%27s_Volatility_Based_on_a_GARCH_Model?_sg=2WtM2tmKJWkU5n4ZXOfQZM0W1TNP_o1Os9aBl55pc2Z6xSckitl__Pbln21GKDPoLGxp2NrC0Q","https://arxiv.org/abs/1803.05663","http://www.nber.org/papers/w24877.pdf","https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5905883/","https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5717631/","https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5234770/","https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4988639/","http://journals.plos.org/plosone/article/file?id=10.1371/journal.pone.0123923&type=printable","https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4233744/","https://pdfs.semanticscholar.org/1345/a50edee28418900e2c1a4292ccc51138e1eb.pdf","http://rsos.royalsocietypublishing.org/content/2/9/150288","https://www.ncbi.nlm.nih.gov/pubmed?cmd=link&linkname=pubmed_pubmed&uid=29668765&log$=relatedarticles&logdbfrom=pmc"],"app":"steemit/0.1"} |

| created | 2019-05-24 09:07:30 |

| last_update | 2019-05-24 09:07:30 |

| depth | 1 |

| children | 2 |

| last_payout | 2019-05-31 09:07:30 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.240 HBD |

| curator_payout_value | 0.079 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 3,585 |

| author_reputation | 35,293,764,570,552 |

| root_title | "Secrets of Bitcoin’s Dystopian Valuation Model" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 85,407,787 |

| net_rshares | 522,190,158,101 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| anonymint | 0 | 15,076,860,317 | 100% | ||

| felixxx | 0 | 507,113,297,784 | 100% |

Thanks for reminding me to consider the relationship to Odlyzko-Tilly network scaling. I have an immediate insight that relates this to the model I have presented in my blog, which will extend and leverage what I read on Eric S. Raymond’s [Odlyzko-Tilly-Raymond scaling](http://esr.ibiblio.org/?p=7460) blog 2 years ago: > The _explanation_ of `O(n log n)` that the authors give is that in a world where not all connections have equal value, people build only the connections with the best cost-benefit ratio, and due to an effect called the “gravity law” the value of traffic between any two nodes falls off superlinearly with distance. This produces a substantial disincentive to build long-distance links, leading to a network of clusters of clusters with `O(n log n)` link density and value scaling. > > After Odzylko/Tilly, complexity theorists looked at real-world networks and found that they frequently evolve towards a topology that is _self-scaling_ or _fractal_ — clusters of clusters at any scale you examine. Circulatory systems in the body, neural networks in the brain, road and rail networks in human cities, the Internet itself — over and over, we find self-scaling nets anywhere evolution is trying to solve optimal-routing problems. > > So here is my small stone to add to the Odlyzko/Tilly edifice: their assumption in 2006 was stronger than it needed to be. You still get selective pressure towards an `O(n log n)` self-scaling network even if the cost of connections still varies but the value of all potential connections is _equal_, not variable. The only assumptions you need are much simpler ones: that the owner of each node has a finite budget for connection-building small in relation to the cost of providing links to all nodes, and that network hops have a nonzero cost. What Eric is actually implying (and he may or may not have made this connection) is that the fungible wealth resources of the node owners is power-law distributed. The power-law distribution has a crucial role in the Bitcoin valuation model, as you can read in my blog above. So here my additional insight is that the `n log(n)` scaling applies when the node owners (i.e. the participants) are power-law distributed. So that is the case for Bitcoin when the block size isn’t full and the transaction fees aren’t skyrocketing. But note that I explained in my blog that when the transaction fees are significant, this increases the energy per mined coin, the increase which is magnified by a power of `10`, thus presumably leading (or being lead?) to those bubbles in the price history. So the insight of my blog appears to apply to Eric’s insight, in that if the block size will (and past soft limits on block size cited in my blog) prevent participation by the long-tail of minions in the power-law distribution, then mathematically we can conclude the scaling factor will no longer be `n log(n)` but heading closer to `n²`! **The limited block size is what is going to cause the valuation of BTC to accelerate!** Note that the wealth concentration tail of the power-law distribution [is itself separately power-law distributed](https://arxiv.org/abs/0710.0917) (and I expect this to be infinitely recursively fractal), so thus this is again relativistic and I expect to be able to find a model similar to the one I found for `e^3.3` which computes a cap (limit) on the scaling. Note that the long-tail of minions in the power-law distribution of wealth has been found [to deviate](http://math.mit.edu/classes/18.01/F2011/income-distribution.pdf) from a power-law distribution [only sometimes for each country](https://arxiv.org/abs/1304.0212). I believe this is an ephemeral condition (illusion) of debt and socialism. > To see why, we need to recognize a new concept of the “access cost” of a node. The value of a node is by hypothesis constant: the access cost is the sum over all other nodes of any cost metric over a path to each node – distance, hop count, whatever. > > In this scenario, each node owner wants to find the best links to the network, but the valuation minimizes access costs . Under this assumption, everyone is still trying to solve an optimal routing problem, so you still get self-scaling topology and `O(n log n)` statistics. So Bitcoin’s _immutable_ 1 MB block size is optimizing access costs for the wealthy, because they won’t have to pay for cost of carrying all the riff-raff along with them on the Bitcoin blockchain. Such costs avoided include: * Avoiding the [deflationary Mad Max, scorched earth which would otherwise result](https://steemit.com/bitcoin/@anonymint/ps05c9). * Not having to accept any lack of trustlessness in and/or wait for [recursive zk-starks](https://ethresear.ch/t/are-starks-ready-for-recursion/1742/4) (c.f. [also](https://www.reddit.com/r/ethereum/comments/690y1u/scaling_tezos_in_which_we_do_not_pursue_sharding/), [also](https://www.reddit.com/r/Monero/comments/a4in5a/instant_sync_full_validation_overlay_network/), [also](http://coders-errand.com/problem-encoding-for-zk-starks/) and [also](https://steemit.com/cryptocurrency/@anonymint/re-anonymint-re-anonymint-re-anonymint-scaling-decentralization-security-of-distributed-ledgers-20190224t110133471z)) to become viable enough to put unlimited, verified transaction volume in a small block. P.S. If and when I have some additional time to allocate to this, I will read those of your references which I hadn’t read in the past and potentially edit this comment or make a new comment reply if any additional thoughts are spawned.

| author | anonymint |

|---|---|

| permlink | ps0b3x |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"links":["http://esr.ibiblio.org/?p=7460","https://arxiv.org/abs/0710.0917","http://math.mit.edu/classes/18.01/F2011/income-distribution.pdf","https://arxiv.org/abs/1304.0212","https://steemit.com/bitcoin/@anonymint/ps05c9","https://ethresear.ch/t/are-starks-ready-for-recursion/1742/4","https://www.reddit.com/r/ethereum/comments/690y1u/scaling_tezos_in_which_we_do_not_pursue_sharding/","https://www.reddit.com/r/Monero/comments/a4in5a/instant_sync_full_validation_overlay_network/","http://coders-errand.com/problem-encoding-for-zk-starks/","https://steemit.com/cryptocurrency/@anonymint/re-anonymint-re-anonymint-re-anonymint-scaling-decentralization-security-of-distributed-ledgers-20190224t110133471z"],"app":"steemit/0.1"} |

| created | 2019-05-24 11:40:45 |

| last_update | 2019-05-24 13:56:33 |

| depth | 2 |

| children | 1 |

| last_payout | 2019-05-31 11:40:45 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.404 HBD |

| curator_payout_value | 0.133 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 5,557 |

| author_reputation | 28,085,935,540,836 |

| root_title | "Secrets of Bitcoin’s Dystopian Valuation Model" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 85,413,631 |

| net_rshares | 878,168,215,184 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| quillfiller | 0 | 399,934,196 | 100% | ||

| tipu | 0 | 849,074,881,498 | 1.14% | ||

| lauch3d | 0 | 28,383,364,412 | 100% | ||

| jimmies | 0 | 310,035,078 | 100% |

This post is supported by $0.48 @tipU upvote funded by @lauch3d :)<br><strong><a href="https://steemit.com/@tipu/tipu-voting-service-quick-guide-updated-05-10-2018" target="_blank">@tipU voting service</a></strong>: instant, profitable upvotes + <strong><a href="https://steemit.com/steemit/@tipu/tipu-new-feature-profit-sharing-tokens-for-voting-service-users" target="_blank">profit sharing tokens</a></strong> | <strong><a href="https://tipu.online" target="_blank">For investors</a></strong>.

| author | tipu |

|---|---|

| permlink | re-ps0b3x-20190524t124244 |

| category | bitcoin |

| json_metadata | "" |

| created | 2019-05-24 12:42:45 |

| last_update | 2019-05-24 12:42:45 |

| depth | 3 |

| children | 0 |

| last_payout | 2019-05-31 12:42:45 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 496 |

| author_reputation | 55,955,130,339,961 |

| root_title | "Secrets of Bitcoin’s Dystopian Valuation Model" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 85,416,537 |

| net_rshares | 14,814,696,562 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| anonymint | 0 | 14,814,696,562 | 100% |

Can you take a look at much newer solutions: snowblossom (proof of iops of storage with large snow fields &nyzo (proof of diversity) both written from scratch in JAVA, both are working now: quick intro of the 2 projects online: Snowblossom https://fx-c.com/cryptocurrencies-that-will-change-the-world/#Snowblossom_SNOW nyzo https://fx-c.com/cryptocurrencies-that-will-change-the-world/#NYZO I think they may solve some of the problems, but they are too new tho, newer than most other projects. and almost no one is talking about them now. I hope you can join their discord to talk with the developers of above projects. They are active on discord.

| author | longlu |

|---|---|

| permlink | ps7ucy |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"links":["https://fx-c.com/cryptocurrencies-that-will-change-the-world/#Snowblossom_SNOW","https://fx-c.com/cryptocurrencies-that-will-change-the-world/#NYZO"],"app":"steemit/0.1"} |

| created | 2019-05-28 13:19:54 |

| last_update | 2019-05-28 13:24:27 |

| depth | 1 |

| children | 3 |

| last_payout | 2019-06-04 13:19:54 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 650 |

| author_reputation | 241,382,382 |

| root_title | "Secrets of Bitcoin’s Dystopian Valuation Model" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 85,629,111 |

| net_rshares | 15,298,010,681 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| anonymint | 0 | 15,151,552,447 | 100% | ||

| longlu | 0 | 146,458,234 | 100% |

more info about nyzo and snow: https://medium.com/@flashygordy/teamtalks-19-nyzo-aa4a24748aa2 https://medium.com/@flashygordy/teamtalks-24-snowblossom-39aca646815f https://medium.com/@nyzoco/the-nyzo-mesh-time-and-diversity-as-a-currency-85c676631516 Note: None of these were written by the coins developers or team members nyzo developer is anon

| author | longlu |

|---|---|

| permlink | ps7xf1 |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"links":["https://medium.com/@flashygordy/teamtalks-19-nyzo-aa4a24748aa2","https://medium.com/@flashygordy/teamtalks-24-snowblossom-39aca646815f","https://medium.com/@nyzoco/the-nyzo-mesh-time-and-diversity-as-a-currency-85c676631516"],"app":"steemit/0.1"} |

| created | 2019-05-28 14:25:54 |

| last_update | 2019-05-28 14:25:54 |

| depth | 2 |

| children | 2 |

| last_payout | 2019-06-04 14:25:54 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 363 |

| author_reputation | 241,382,382 |

| root_title | "Secrets of Bitcoin’s Dystopian Valuation Model" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 85,632,177 |

| net_rshares | 150,461,904 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| longlu | 0 | 150,461,904 | 100% |

## Debunking those who think they’ve invented ASIC resistant proof-of-work <br/> > Can you take a look at much newer solutions: snowblossom (proof of iops of storage with large snow fields I [explained](https://medium.com/@shelby_78386/consensus-is-pow-mining-based-on-a-random-reads-into-a-large-snow-field-65e462cb517) the invalidity of his assumption on the author’s blog: >> **Consensus is PoW mining** based on a random reads into a large snow field. This makes the mining more IO bandwidth intensive than CPU/GPU/ASIC. Sure, someone could build something that does more raw IOPS than a regularly available NVME drive or DDR4 stick, but it probably won’t be much more price effective. This means mining will be in the hands of a large number of people. Hopefully. > > [Incorrect assumption](https://bitcointalk.org/index.php?topic=1361602.msg15546448#msg15546448). I presume you understand that the [economics of proof-of-work is fundamentally tied to the electrical power consumption](https://medium.com/@shelby_78386/secrets-of-bitcoins-dystopian-valuation-model-cbf95efa3542), and not so much the hardware cost. A consumer memory or storage device is not power optimized, because it has to trade-off many different use case patterns. When the use case is narrowed by a specific proof-of-work algorithm, then there are further optimizations that can be made. Ethereum’s [Ethash was designed to be memory I/O intensive](https://www.grin-forum.org/t/scheduled-pow-upgrades-proposal/820) and yet [significantly more efficient ASICs](https://www.coindesk.com/ethereum-miner-linzhi-calls-out-project-coders-for-proposed-asic-ban) were created: > >> A major motivation for memory hard PoWs is to limit performance by the memory IO bottleneck […] it behooves a memory hard PoW to also have increasing memory requirements. Ethereum’s ethash PoW recognized this in having a linearly growing dataset (growing by 8 MB every 125 hours […] > > The predominance of electrical power cost in TCO would be especially true for _commodity_ memory technologies which don’t advance as fast as Moore’s law, but [less true for ASICs which employ large amounts of memory on die because](https://www.grin-forum.org/t/obelisk-grn1-chip-details/4571) of the high cost of non-commoditized silicon: > >> A typical highly optimized Bitcoin mining chip produces between 0.3 and 0.5 watts per square millimeter. Because of this heat profile, a typical $1200 miner may cost $1200 per year to operate, primarily due to the cost of electricity. For an American mining on typical consumer electricity rates, that annual cost is more like $2400 per year, meaning that consumers really cannot afford to mine at home. >> >> Our Cuckatoo31 chip has a heat signature that’s less than 0.1 watts per square millimeter […] The same $1200 spent on a mining device results in electricity costs that are closer to $400 per year for a typical mining farm, and $800 per year for a typical consumer. The total cost of ownership gap between a consumer and a professional farm is substantially lower for cuckatoo miners […] When optimizing over total cost of ownership, wafer pricing becomes a lot more important […] 16nm silicon is cheaper and more accessible, which means that 16nm chips are more competitive [and [increasing the cost of the silicon relative to electricity in the TCO may increase mining centralization due to not needing to seeking out lowest electrical power costs](https://www.grin-forum.org/t/scheduled-pow-upgrades-proposal/820/22)] > > Additionally there’s an asymmetry because memory devices only consume a fraction of the power in a computer system, so a customized rig will have much better efficiencies, even if ASICs are not factored into the mix. > > The Snowblossom design is going to be more power efficient running on GPUs than CPUs, because of the IOPS efficiencies on GPUs due to coalescing of memory accesses. This will make CPUs uneconomic. Yet compared to ASICs, GPU memory access coalescing and latency masking is optimized _only up_ [to the level where the GPU typically becomes computation-bounded](https://github.com/LinzhiChips/linzhichips.github.io/raw/master/docs/LWP10-Random-Logic-Design.pdf), so as to make GPUs cost effective for the general purpose computation for which they’re designed. Whereas, in theory [an ASIC can be designed achieve higher levels of such efficiencies](https://www.coindesk.com/ethereum-miner-linzhi-calls-out-project-coders-for-proposed-asic-ban), because essentially the ASIC will never be computation-bounded due to the ability to optimize the computation circuits for the specific Snowblossom algorithm. > > Additionally, apparently the Snowblossom fields are read-only, so the ASIC designer may have the option of choosing among a wide range of [non-volatile random-access memory](https://en.wikipedia.org/wiki/Non-volatile_random-access_memory) technologies so as to further optimize the power consumption per “hash”. GPU-only proof-of-work doesn't scale equitably [because the supply of GPUs can't scale](https://www.grin-forum.org/t/grin-improvement-proposal-1-put-later-phase-outs-on-hold-and-rephrase-primary-pow-commitment/4653/13), so is actually worse and more irresponsible design than ASIC friendly proof-of-work. > > Additionally memory technologies have many factors (c.g. the first link in this comment post) which can be presumably optimized for given pattern of the repetitive use case, e.g. optimizing for prioritization of read (not including writes) power efficiency in the case of Snowblossom. There’s even a risk that [competition in the ASIC space decreases due to complexities of segmenting the memory systems](https://www.grin-forum.org/t/obelisk-grn1-chip-details/4571/17) and/or some [miraculous technological innovation in memory technology could become patented, enabling a monopoly on mining the proof-of-work](https://www.grin-forum.org/t/scheduled-pow-upgrades-proposal/820/16)! > > It’s impossible to design any proof-of-work which depends on burning electricity which wouldn’t be [orders-of-magnitude more efficient in a customized circuit](https://github.com/ifdefelse/ProgPOW#review-of-existing-pow-algorithms) (c.f. [also](https://github.com/ifdefelse/ProgPOW/issues/24#issuecomment-497487354) and [also](https://github.com/ifdefelse/ProgPOW/issues/9)), unless someone can discover a way to make “proof-of-storage” work wherein the best an ASIC can do it rely on commodity memory power consumption. In 2013, I proposed “proof-of-storage” in discussions at bitcointalk.org and unfortunately I wasn’t able to figure out how to make it work. As [I explained](https://bitcointalk.org/index.php?topic=1361602.msg15546448#msg15546448) to @**tromp** in 2016, an ASIC most definitely can be made that is more efficient than consumer NVMe or DRAM. A consumer memory or storage device is not power optimized, because it has to trade-off many different use case patterns. When the use case is narrowed by a specific proof-of-work algorithm, then there are further optimizations that can be made. > nyzo https://fx-c.com/cryptocurrencies-that-will-change-the-world/#NYZO This is just a variation of proof-of-stake. Same bad smell. Unless something is burned during mining the new tokens, then the token has no value. Tokens that were supposedly sold for fiat or BTC when the stake was created, is unprovable (e.g. ICOs do not tell you that they buy their ICO from themselves) and (even if initial supply was distributed with proof-of-work) there’s no [ongoing marginal cost of production in order to](https://steemit.com/bitcoin/@anonymint/ps6tdj) maintain the valuation. Read what was written about proof-of-stake (which [I refer to as](https://medium.com/@shelby_78386/agreed-the-competition-now-is-for-who-will-create-the-medium-of-exchange-cryptocurrency-b666efb279d9) proof-of-nothing) [here](https://medium.com/@hamoun.gh/i-finally-had-a-chance-to-carefully-read-your-article-f0b3dfc38060) and [here](https://steemit.com/trading/@anonymint/re-anonymint-re-anonymint-re-anonymint-most-important-bitcoin-chart-ever-20190513t224433919z). > Note: None of these were written by the coins developers or team members nyzo developer is anon Most people who are writing about crypto don’t have the requisite knowledge to analyse it correctly. > I hope you can join their discord to talk with the developers of above projects. They are active on discord. They seem to possibly be good developers, although Java sucks and anyone coding in Java immediately is cast into doubt by me (being I am expert on programming language design). But they appear to lack requisite depth in economics and other technological research. They’re probably better off partnering with someone who is more expert, though the problem is these young guys (these days, unlike in my generation when we appreciated apprenticeship) typically don’t want to admit that they need to do that and unwilling to make the necessary sacrifices for that. C’est la vie. --- I wrote [a follow-up reply](https://medium.com/@shelby_78386/im-sorry-they-can-t-defeat-asics-6ad2c7ca677f) on Medium: > I’m sorry their Snowblossom design can’t resist ASICs. I edited my comment you replied to and added: > >> In short, it’s impossible to design any proof-of-work which depends on burning electricity which wouldn’t be orders-of-magnitude more efficient in a customized circuit, unless someone can discover a way to make “proof-of-storage” work wherein the best an ASIC can do it rely on commodity memory power consumption. In 2013, I proposed “proof-of-storage” in discussions at `bitcointalk.org` and unfortunately I wasn’t able to figure out how to make it work. > > I don’t have enough free time to attempt to teach the readers electrical engineering, game theory, and economics. They’ll learn the hard way, as the Monero developers and community also did. > > I warned @**fluffypony** and the Monero community, so they banned me from their Github. Now [they see I was correct](https://steemit.com/bitcoin/@anonymint/ps6tdj). > > --- > > The creators of Nyzo are lying, disingenuous, or not very astute. And I presume they’re astute, so it’s probably the former. Nyzo is a proof-of-stake system. The only distinction being that the stake resource is the set of all IPv4 addresses, instead of tokens. It will suffer from all the game theoretic and economics problems of proof-of-stake. To be blunt, another worthless nonsense PoS design. Please don’t waste more of my time by insisting there must be some chance that they've done something worthwhile and unique, which I then I have to expend more time to refute so that naive readers aren’t swayed by the FOMO hope. > > I provided to you my opinion already on Steemit. I complimented them by writing that they appear to be reasonably good developers, although the use of Java is a red flag for me. But they ostensibly lack the requisite expertise in research, game theory, economics, etc. to be designing new consensus technologies. I have no interest in joining their Discord and try to convince Millennials that they should be more circumspect. They’re making money doing what they think values themselves highly. I should stand aside and let them take money from technologically-ignorant, greater fools. I have more important things to do. In the end, true valuations will be assigned. And they won’t be up there in the top echelon. And wrote [another](https://medium.com/@shelby_78386/premine-and-icos-arent-the-only-way-to-take-money-from-greater-fools-by-launching-a-proof-of-work-e591652ebfbe): >> 1. you assume the creator of snowblossom may , 'take money from fool' which isn't fact. it has not premine no ico, and creator is already pretty well off in the past. > > Premine and ICOs aren’t the only way to take money from greater fools by launching a proof-of-work cryptocurrency. > > Here are some other ways: > > 1. Mine it heavily before it becomes well known, thus amassing a considerable share of the initial supply. Given you have pointed our that [FireDuck was the creator of Satoshi Dice](https://en.bitcoin.it/wiki/Satoshi_Dice#History), he presumably has access to a lot of capital to mine a nascent, recently launched altcoin before it’s on the radar of many people. > > 2. Secretly develop a better hardware configuration and/or algorithm for the mining than the client and hardware presumed to be run by everyone else. > > 3. Use developer pronouncements to influence price moves, front running shorting and going long on exchanges. Which also has the risk that it ostensibly violates securities regulations in many countries can potentially cause them to get in legal trouble. > >> 2. you assume that if asic can be made, than it's not good design. > > That is not what I wrote. I was refuting the official claim that an ASIC is unlikely to be “price effective”. > >> fact, even in this article the snow creator did not say something more efficient can't be made > > In fact, he claimed it was unlikely. > >> Asic can be made for bitcoin too in the long term, but bitcoin did not die from it. > > I didn’t claim ASICs would cause Snowblossom based altcoins to die. I claimed that the author was making a bogus claim, and the Snowblossom doesn’t have the claimed uniqueness (i.e. not ASIC resist). If greater fools know it’s not any more unique than other 1000s of copycat, shitcoins in that respect, they might be more hesitant to doubt the hints the creators are making about a 5% chance of world domination. > >> what he said is it’s harder than my question is :even if asic can be made , economically, is anyone motivated to do that? > > ASICs are built when the cryptocurrency becomes valuable enough, as was the case for Monero. > >> because when the snowfields doubled in size., people may need to build new asics again that is double the size…. and the cost doubled. suppose someone is doing it at scale profitablly (Idoubt, but not impossible maybe,) , > > That is what the Monero community thought and [they learned it will not stop the ASIC development](https://steemit.com/bitcoin/@anonymint/ps6tdj). > >> does it still save more energy than bitcoin? > > This is an incoherent question. And wrote [another](https://medium.com/@shelby_78386/yes-i-edited-my-initial-comment-on-their-blog-3114d56a2e30): >> but will asic be able to do random assess on bulk data more cost effective than consumer ssd/nvme? > > Yes an ASIC will be orders-of-magnitude more power consumption efficient. I edited my initial comment on their blog. You should re-read it. I provided more technological detail. > >> Plus nvme ssd that’s more than 1TB, is super expensive, > > Irrelevant. Electric power consumption is all that matters in proof-of-work, especially more so with memory devices which are not improving as fast Moore’s law. And wrote [another](https://medium.com/@shelby_78386/the-claim-appears-to-be-written-on-their-official-medium-account-48f65ff3cc1c): >> the article was written by a community member, so you can’t just say nyzo developer lied, he didn’t even say anything > > [The claim (which I assert is bogus) appears to be written on their official Medium account](https://medium.com/@nyzoco/the-nyzo-mesh-time-and-diversity-as-a-currency-85c676631516). > >> About nyzo , it doesnt’ really matter what one person says what it is, even if he ‘s someone famous or know/writes a lot. > > If you’re not valuing my effort to analyze it, then please do not go on my Steem again and loudly ask me to come analyze something. Either you respect and value my contribution or you don’t. If you have some substantive technological rebuttal then make it. Btw, this butthurt, irrational stuff is why I have stopped responding to most Millennials. And I’m not famous, just diligent in my research and effort. > > It does matter what one person says if they’re correct. Because those who follow incorrect information end up losers. If I’m incorrect, then someone knowledgeable needs to point out why I am. Also as you know I put some additional technological elaboration on my Steemit reply to you. > >> I think it’s much more secure than traditional proof of work altcoins, and POS coins. > > Irrelevant. Do you have a technological rebuttal?

| author | anonymint |

|---|---|

| permlink | ps9btb |

| category | bitcoin |