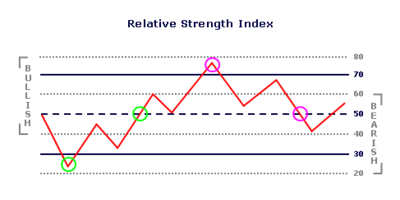

What is a Technical investigation Specialized examination is an exchanging instrument utilized to assess security's and endeavor to conjecture their future development by breaking down insights accumulated from exchanging action, for example, value development and volume. Specialized examiners concentrate on graphs of value development and different scientific apparatuses to assess a security's quality or shortcoming and estimate future value changes.  Source What are Indicators Pointers are insights used to quantify current conditions and in addition to conjecture money related or monetary patterns. Financial pointers are factual measurements used to quantify the development or withdrawal of the economy all in all or divisions inside the economy. Specialized pointers are utilized widely in specialized investigation to foresee changes in stock patterns or value designs in any exchanged resource. Diverse sort of outlines There are a couple diverse sort of diagrams. They all speak to various data so its vital to know which diagrams are usefull. Its additionally individual prefference which graph you youse. By and by I simply cherish the candles, however perhaps its distinctive for you. The distinctive outlines: Line outlines: Only demonstrate the end cost over a set period. More data Candle outlines: This demonstrates the opening and shutting cost over a set period. It likewise demonstrates what without a doubt the high and low was of a light in that period (prescribed). More information Point and figure outlines: This graphs indicates value development without demonstrating time or volume (not recommeded). More information Bar outlines: Very like candle graphs exactly what you by and by like. More information Distinctive sort of examples In the event that you know where to look you can see changed sort of paterns in outlines. These diagrams happen over and over so history continues rehashing itself. Thusly by concentrate these paterns you have an enormous preferred standpoint. These don't occur 100% of the time, since along these lines everybody would be rich. Its a greater amount of a craftsmanship then a science. The essential of examples are an inversion and continuation. An inversion is the point at which the heading of a graph changes and a continuation is the point at which it just continues going a similar course. Examples I will cover here: Head and shoulders Glass and handle Twofold tops and bottoms Triangles Holes Examples Explained  Source Head and shoulders: In head and shoulders you are searching for three crests with the center pinnacle being the most noteworthy one. The 2 different pinnacles being on a similar level and lower then the most astounding pinnacle. You associate these with a trendline along these lines you know the essential help level. Head and shoulders is an inversion graph design so you search for the breakdown.  Source Glass and handle: This is a continuation example of a bullish pattern. Afther a little respite of the of the bullish example it will backpedal up in a U shape. Attempting to clarify it as straightforward as could reasonably be expected.  Source Twofold tops and bottoms: This example is know to be simple and dependable. On the off chance that you see twice a best or base hitting a similar protection or bolster level without a breakout. This now flags an inversion of the pattern.  Source Triangles: Triangles happen exceptionally offten yet there are a pack of various triangles you can search for. I will call attention to which triangles there are. There are symmetrical triangles, rising triangles and dropping triangles. Symmetrical triangles happen when two pattern lines meet toward each other and flag just that a breakout is probably going to happen – not the heading. Rising triangles are portrayed by a level upper pattern line and a rising lower drift line and propose a breakout higher is likely, while slipping triangles have a level lower incline line and a diving upper pattern line that recommends a breakdown is probably going to happen.  Source Hole: Sometimes you see a hole in a graph. This is on account of when the market closes at a specific cost and it opens go down at another cost. Along these lines their will be a hole in the outline. As illustration it shuts a $4.00 yet opens go down at $6.00 you will have a hole. - Breakaway hole: This happens when a pattern is beginning to frame. - Runaway hole: This occurs amidst a pattern. - Exhaustion hole: This occurs toward the finish of a pattern. Distinctive sort of pointers I as of now clarified what a marker is prior in the article, however lets jump further into this. I will clarify my undisputed top choice markers and how to utilize them. In the event that you need to see every one of the pointers you will require around 1 or 2 months (Or more), on the grounds that their are alot. What is imperative to know is that there are driving markers they can be helpfull to anticipate where the cost is going. Additionally there are slacking markers these will enable merchants to see how solid a pattern is. Pointers MacD (Moving avergae joining uniqueness) RSI (Relative quality file) CCI (Commodity channel file) Moving Average ADI ( Average Directional Index) On the off chance that you know the shortened forms you ought to be great.  Source Macd: This marker is helpfull to know whether you are in a bullish area or in bearisch terrtory. On the off chance that you take a gander at the base of the photo above you can see a blue and a red line. In the event that the blue line is over the red line this implies its bullish domain and the a different way. So you must be vigilant for those traverse, since then a pattern may turn around.  Source RSI: This marker will enable you to decide when to offer and when to purchase. On the off chance that you take a gander at the outline above you will see lines on the 30 and 70. On the off chance that the RSI is inbetween this I don't give careful consideration to it. Just when the RSI is over 70 it demonstrates that something is truly overbought so you should offer. Also, when the RSI is underneath 30 something is truly oversold so you should purchase.  Source CCI: This marker is like the reason for the RSI. You can find in the photo beneath if the CCI drops you purchase on the off chance that it goes up you offer. You can utilize both the RSI and CCI together for comformation of the trade.If they both demonstrate a similar thing there is a superior change it will happen. Straightforward rationale.  Source ADI: With this pointer you can perceive how solid a pattern is. So if there is an uptrend and the ADI is at 50 you know this is a solid pattern and has a major change to keep that pattern going. Also, if there is an uptrend and the ADI is at 10 you know this is a frail pattern. This will most likely turn around. Conclusion I trust you took in something from this article. The conclusion is the more you find out about this the more noteworthy your progressions of profiting. This is simply to kick you off and my knowelgde. In any case, there is alot that I don't have the foggiest idea. This is on account of I am as yet learning and I would love some assistance with that. On the off chance that I committed any errors you can simply bring up out in the remarks. In the event that I didn't u can likewise call attention to out. Alot of data I got is from investopdia. So I profoundly suggest u look at that site if your inspired by this. Disclaimer: Most these photos aren't from me My own portfolio Creator :- @avinashsingh

| author | avinashsingh |

|---|---|

| permlink | specialized-examination-indicators-and-patterns-explainend-avinashsingh |

| category | technical |

| json_metadata | {"tags":["technical","indecent","patterns","information","update"],"users":["avinashsingh"],"image":["https://steemitimages.com/DQmRQquZMs3MV84jo7eEMamRBN7x6CWsfo563psXLNZtfEF/U5drLQkBBqDKu7TdtKuqhPee3ezF7NL_1680x8400.jpeg","https://steemitimages.com/DQmWvEyRvsAkpfmSZoRcodES3Sbjc7LFZcPNBzZJdVnCUAg/U5dsG9LuonyfUJkgsifyW4wnZh36XxL_1680x8400.jpeg","https://steemitimages.com/DQmTa8U3hD7aeoDpUoia1q5uPEWY8iVd7qT7rtFj2YSANHW/U5dsS1XTsHguJq7SyYZUUNMhJhcY9uc_1680x8400.jpeg","https://steemitimages.com/DQmZirtmUsaXyoU6obDVC3y4M6pBazWAjDMxtNsqAqMShBE/U5duHMniziNs6eTsjGPPTxEnnsP6R95_1680x8400.jpeg","https://steemitimages.com/DQmWwLCyJbQogNeQKKtkinRGXMLEYcqBQdnkUBMbv7a5Zia/U5drt84bcL7urJZcS4gYQVAaqTc9wUC_1680x8400.jpeg","https://steemitimages.com/DQmeyxAJWq6LEZzZjKeaTz2bghdJutN4Pf7WxS5JtapZquV/U5dsGLgxb8Kd986ouc6m3mXC9aBBMxr_1680x8400.png","https://steemitimages.com/DQmWFjpnQwfRu2ceeeeGN83qQuCtygzJ4mxGPznVAM3gdQZ/U5dsaxUKd7q7yFyxxJZ5tH8azumRtBr_1680x8400.png","https://steemitimages.com/DQmcgT9rW6aPbSGi9AAELyuxTemPCAStSpJGrE3YoM5RWfo/U5drcaT2YadLdvDT6xNwfUBJ7sRX5zr_1680x8400.png","https://steemitimages.com/DQmYp1975xZ4qWWihJDWvrBo4CVeYUDfvCpzWHV7ebC3kqg/U5dskMkShAc3kvR5htV3q8dbaUJ5Cpg_1680x8400.png","https://steemitimages.com/DQmSDaKqv1ik5MiD9M33GRQzc9RBg4a4HtgHWtt4NKstjuF/U5driR17qYyhjLNckurWZqvMfNeFFb9.gif","https://steemitimages.com/DQmWpisRXDF56mV3DgzzPUxb3R2ozseR48YVr2YKtwtrBcV/DQmWpisRXDF56mV3DgzzPUxb3R2ozseR48YVr2YKtwtrBcV.gif"],"app":"steemit/0.1","format":"markdown"} |

| created | 2018-01-29 03:00:09 |

| last_update | 2018-01-29 03:00:09 |

| depth | 0 |

| children | 0 |

| last_payout | 2018-02-05 03:00:09 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.299 HBD |

| curator_payout_value | 0.091 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 9,564 |

| author_reputation | -49,028,219,751 |

| root_title | "Specialized examination, Indicators and Patterns explainend! @avinashsingh" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 33,167,500 |

| net_rshares | 50,351,102,999 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| hr1 | 0 | 50,298,817,042 | 0.63% | ||

| bahasbebas | 0 | 52,285,957 | 100% |

hiveblocks

hiveblocks