I have been watching these markets for a long time & have never seen such concerted collusion across the globe. There used to be daily variation & divergences across economic zones & seasons. Nowadays all of the global indexes seem to dance to the same rhythm. Call it the central bank salsa 💃🏼

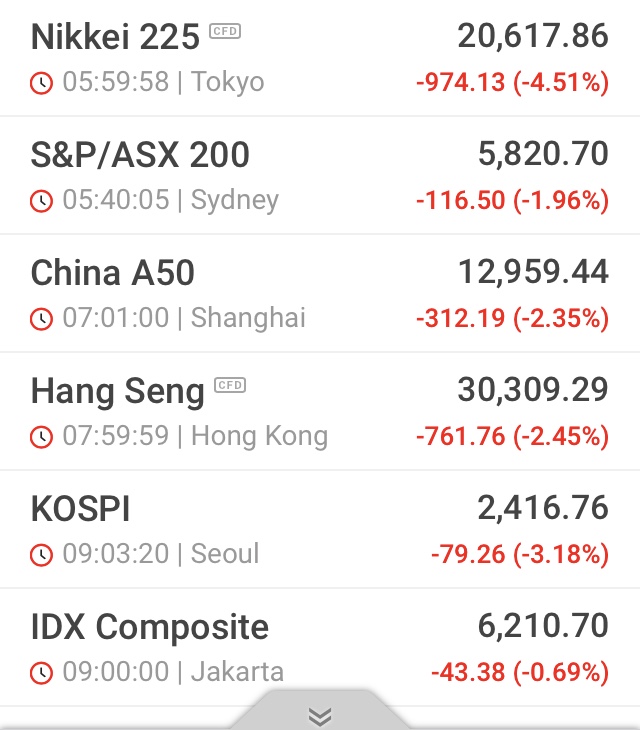

After a very rough Thursday for US equities, Friday’s trading in Asia followed the same predictable path

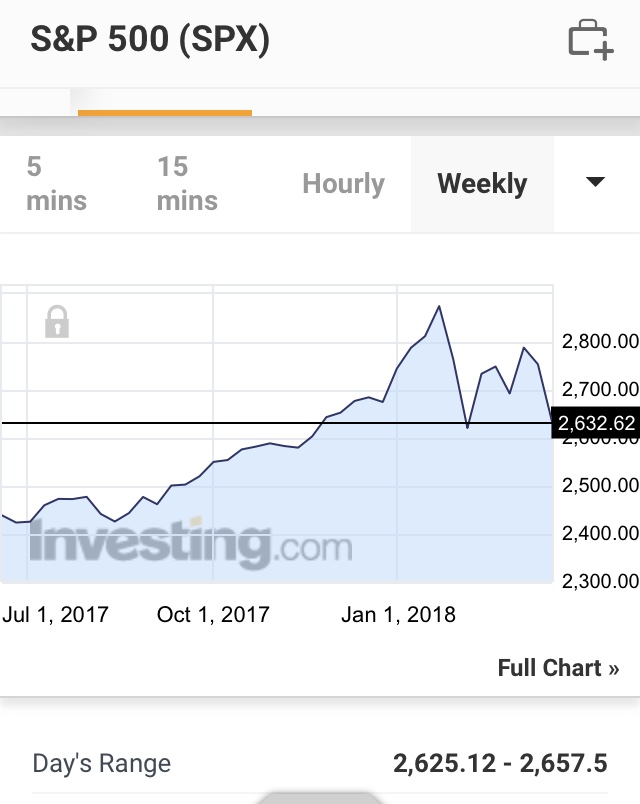

Here is a look at the S&P’s run up to the early Feb. sell off, then failing recovery, testing the February lows. A failed recovery could signal a big move to the downside at this point in the cycle.

The Dow, not surprisingly displaying the same symptoms

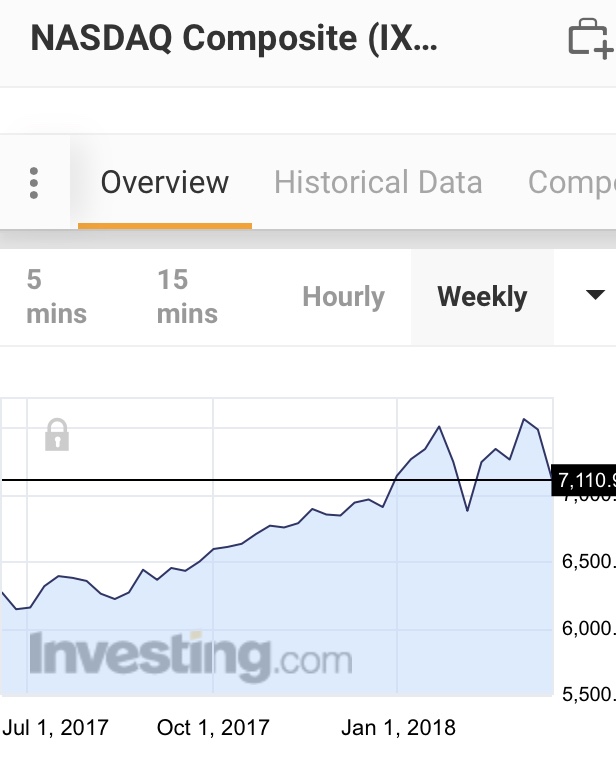

The Nasdaq has held up slightly better, but there are a lot of privacy reasons why this index may suffer more soon

Volatility spiking up again, personally been long volatility since September. Gonna go up from here, eventually....

& the dollar losing value, as are all currencies, record money printing by central banks & money created via loans by banks, does little to help the real economy but sure makes housing & food prices go sky high

& Gold, testing 1350 again...... years of failing this 1350 level. It’s as if the central banks of the world fear letting gold become trendy again. It’s a lot harder to turn populations into economic slaves on a gold standard, still doable, but harder.

We are at a critical time in the economic cycle. The mainstream shills will tell you this is all short term noise due to tariffs or some other micro reason. Study the history of these charts, go back many decades & see the cycles unfolding. Take all the bullshit commentary like the above for what it is. Charts don’t lie, look at the history & the tendency for history to repeat it itself. The debt levels across the globe are much worse than they were in 2007, the collusion among central banks is much worse than 2007. & the manipulation of system threatening assets has never been higher, I.e. bitcoin futures manipulation, much like gold & silver manipulation.

Next week will be very interesting, petroyuan for gold on 3.26 could be a big issue in the global money flows.

Are you buying the dip? Or selling the shit!

hiveblocks

hiveblocks