[Image Source](https://chaindebrief.com/wp-content/uploads/2021/09/Terra-Luna-FI-1024x538.jpg)

Today we will understand more about one of the smart contract platforms that has stood out the most and that has a very interesting objective: to expand the adoption of cryptocurrencies through a global payment system, with fast and low-cost transactions and that has as Essential Algorithmic Stablecoins Tools. It is about the Terra that we are going to talk today.

Terra is a blockchain that runs within the Cosmos ecosystem (ATOM) and uses the Tendermint Cosmos SDK: the Cosmos development kit, as well as the Delegated-Proof-of-Stake (DPoS) consensus mechanism.

Terra's development began in January 2018 and its mainnet was officially launched in April 2019.

It was created by Daniel Shin and Do Kwon and the company TerraForm Labs, from South Korea, with the objective of building an independent digital financial system, to allow greater efficiency in electronic transactions, in a competitive format with large banks and fintechs, to drive the adoption of cryptocurrencies.

Terra's main goal is to be the programmable money of the internet, through stablecoins, which provide the capabilities of fiat currencies with the efficiency and censorship resistance of cryptocurrencies.

Tokens in the Earth ecosystem are represented by two types of tokens: a family of stablecoins and the native $LUNA token, of the Tera blockchain.

The Terra blockchain is secured through the Delegated Proof of Stake consensus algorithm, in which $LUNA token holders stake their tokens to validate transactions, receiving rewards proportional to the amount of $LUNAs staked. Token holders can also delegate the validation of transactions on their behalf, sharing the generated revenue.

### $LUNA TOKEN

Terra's native token is $LUNA, and it is an essential tool for the functioning of the Terra platform's tokenomics. It works as a governance and staking token and is also used to pay network fees.

However, its main function is to be used as a price stabilization instrument for stablecoins issued on this blockchain, through the burn and mint mechanism. To use and stake $LUNA, it is necessary to download and install the Terra Station wallet, which is the official application for storing the tokens of this network.

Thus, along with stablecoins, $LUNA acts as the foundation of the Terra blockchain.

#### STABLECOIN TERRAUSD (UST)

Terra resembles smart contract blockchains like Ethereum in that it allows the creation of decentralized applications based on smart contracts.

However, what sets it apart from other projects is the stablecoin UST (TerraUSD). Let's understand its importance. One of the main pain points for the crypto world has been the challenge of creating a stable currency to enable mass adoption of DApps.

Even today, the most popular stablecoins are Tether and USDC, which are pegged to the US dollar.

Some say that they have characteristics of centralization, because in both there is a central entity, which is responsible for their parity and stability. In the case of algorithmic stablecoins, such as UST, the backing is in other cryptocurrencies, which, among other advantages, makes it difficult to confiscate or block the assets that help maintain their parity.

##### HOW DOES $UST WORK?

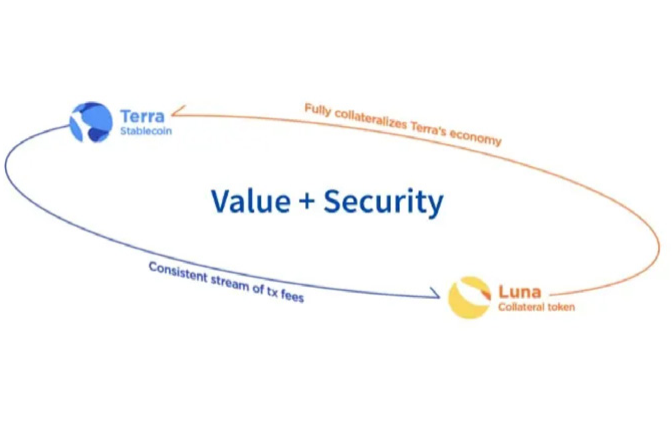

What makes $UST different is that for the issuance of this stablecoin and price stabilization, there is the use of a mechanism called burning and issuing tokens. In it, for the creation and stability of $UST to occur, there is burning or creation of $LUNA tokens in circulation.

It works like this: when the supply of UST increases, the supply of LUNA decreases (example LUNA is burned) and when the supply of UST decreases, the supply of LUNA increases (example LUNA is created). The ratio for the burn and create engine is 1 UST to 1 US of LUNA. This provides constant rebalancing of assets (LUNA) and liabilities ($UST).

<div class=pull-right>

</div>

<div class=pull-left>

$UST is the most used stable in this ecosystem. However, other stablecoins are already issued on Earth, linked to the most diverse fiat currencies. Ex: Canadian dollar, euro, South Korean won, Mongolian tugrik and 17 more options.

Thus, along with stablecoins, $LUNA acts as essential instruments for the Terra blockchain.

</div>

<hr>

UST maintains its parity with the dollar through an algorithmic rebalancing, where creating 1 UST requires 1 US$ in $LUNA to be burned. That is, for the creation of new $USTs, an equivalent amount of $LUNA must be burned, which has a direct effect on the supply and price of the asset.

<div class=pull-left>

</div>

<div class=puçç-right>

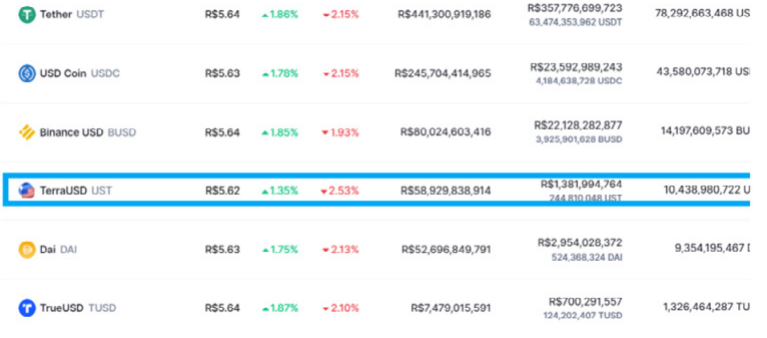

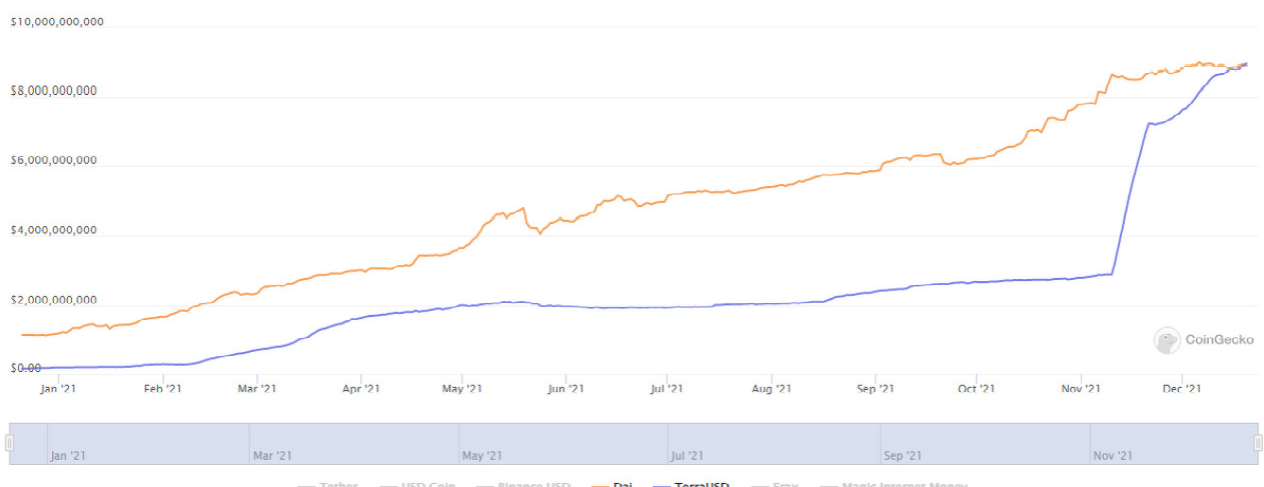

TerraUSD (UST) has surpassed the MakerDAO protocol’s DAI and is now the largest decentralized stablecoin and the fourth largest stablecoin on the market.

UST's market capitalization is over US$58 billion.

</div>

<hr>

Stablecoins are often used in DeFi applications and have gained increasing adoption.

UST has gained popularity and is slowly gaining ground. This has been happening very consistently.

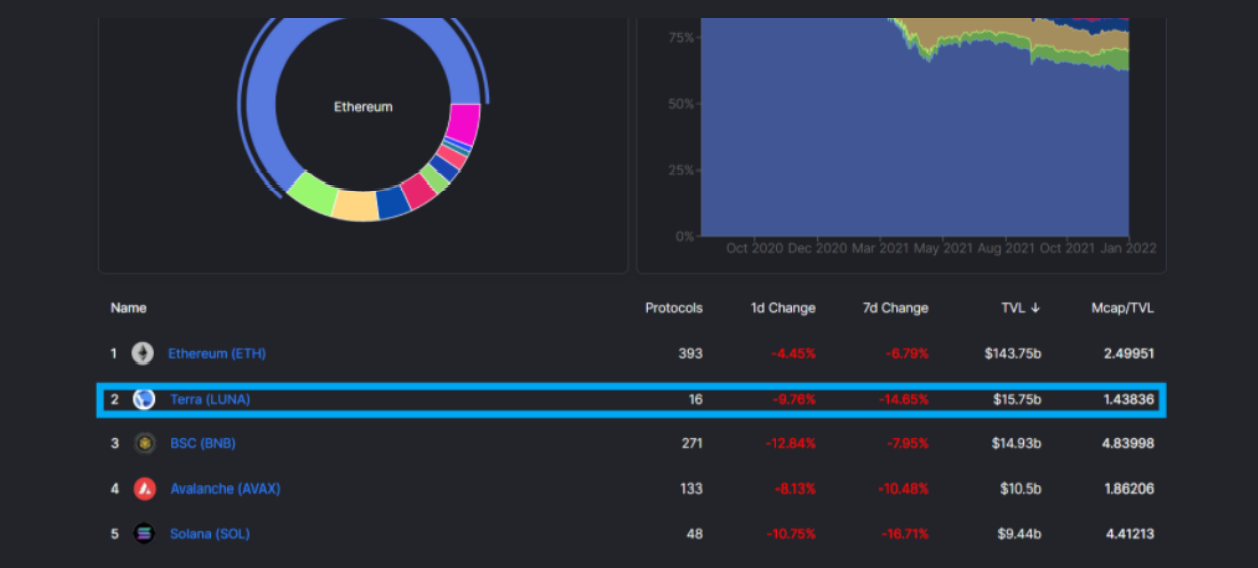

Something that has caught the attention of the crypto community in recent months is that Terra has overtaken BSC (Binance Smart Chain) in terms of TVL (Total Value Locked).

Today, more than $15 billion in total value is locked up on Earth, making it the second largest network behind Ethereum.

Another fact that draws attention is that Terra reached this level with only 16 protocols. With the exception of Solana, the other platforms have between 100 and 400 protocols.

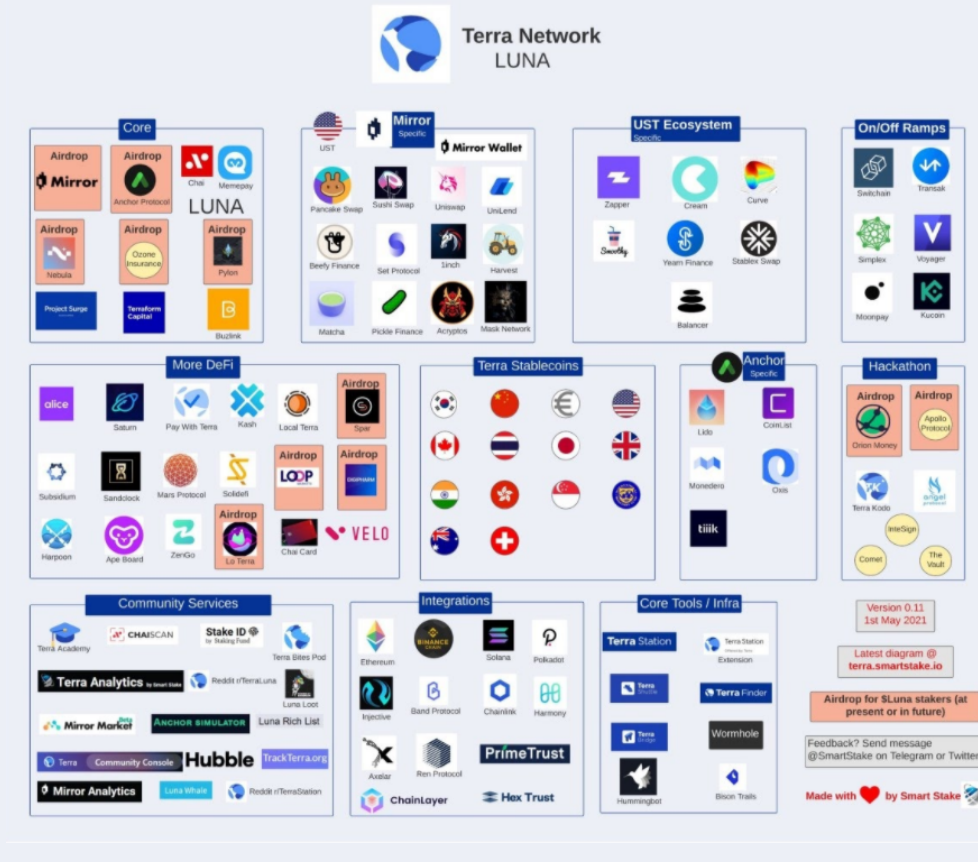

### TERRA ECOSYSTEM

One of the clearest signs of ecosystem adoption is the rapid expansion of its list of partners and projects launched. At image we can see that it is an ecosystem that comes

gaining body.

<hr>

Recently, Terra underwent a major update, Columbus-5, whose main feature was the implementation of the mechanism to burn LUNA transaction fees, which previously went to the community treasury.

After this update, Terra also became interoperable with other blockchains such as Solana and Polkadot, making its ecosystem of DeFi protocols more accessible to users, who can now move UST between the other chains.

The Terra ecosystem has some interesting DeFi DApps and

that are gaining adoption.

**The most important are Mirror and Anchor.**

### MIRROR PROTOCOL

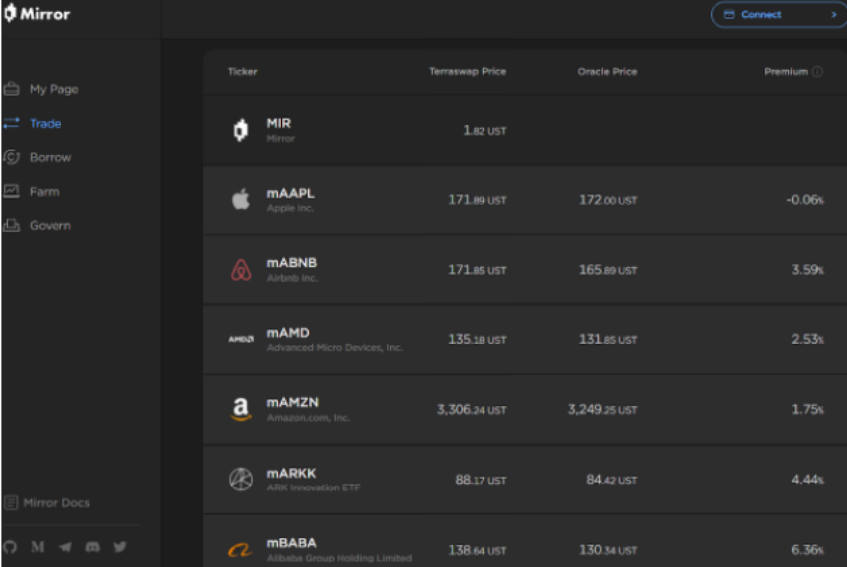

<div class=pull-left>

Launched in December 2020, Mirror is a protocol for issuing synthetic assets, which represent real-world assets such as

stocks, ETFs or other cryptocurrencies.

They are known as the mAssets.

To use Mirror, simply provide UST as collateral for the mission, for example, synthetic shares of Apple, Tesla or GameStop. Prices are provided through the use of oracles.

</div>

<div class=pull-right>

</div>

<hr>

### ANCHOR PROTOCOL

<div class=pull-left>

Another protocol built on Terra, which calls itself the “Gold Standard for Passive Income on the Blockchain”. This protocol allows users to deposit UST and receive a steady annual income of 20% per annum. In addition, it also allows instant deposits and withdrawals and loans.

</div>

<div class=pull-right>

</div>

<hr>

### BUSINESS PARTNERSHIPS

Terra recently raised, through Terraform Labs - the holding behind Terra, US$ 150 million from major investors,

such as Arrington Capital, BlockTower Capital, Delphi Digital, Lightspeed Ventures, Pantera Capital and SkyVision Capital, to increase their

DeFi ecosystem.

In addition, Terra has established a number of partnerships with payment platforms, especially in the Asia-Pacific region. In July 2019, it announced a partnership with Chai, a company that raised $60 million in a round led by Hanhwa and SoftBank Ventures Asia.

Chai is a mobile payment app from South Korea, where in-app purchases on e-commerce platforms are processed through the Terra blockchain. $6 million was raised.

Additionally, Terra is backed by the Terra Alliance, a group of 15 e-commerce giants in Asia, which collectively process $25 billion in transaction volume annually and have over 45 million users.

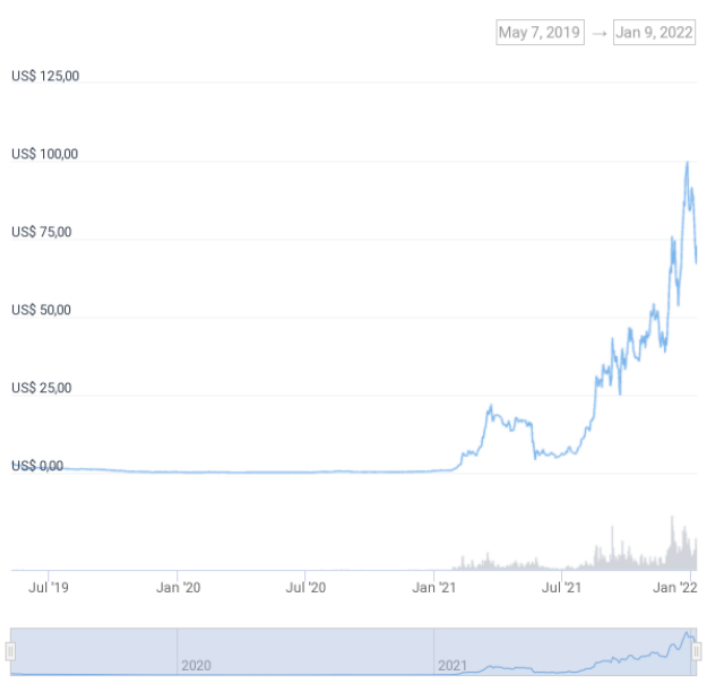

### PRICE

<div class=pull-right>

</div>

The current markecapt of the LUNA token is $26 billion, which places it among the top nine marketcaps in the market, ahead of Polkadot and Avalanche.

The token started the year 2021 worth less than $1, and came to appreciate more than 10,000% a few months later, reaching an all-time high of $103.

Among the reasons for the price increase is the expansion of the ecosystem and the addition of a synthetic form of Ether (ETH) to the Anchor protocol, which offers Ether staking rewards in the Terra ecosystem.

We can also credit the appreciation to the protocol's tokenomics format, which controls the stock of circulating LUNA and UST coins and consequently makes LUNA more scarce. On terra.smartstake.io you can see the amount of LUNA burned and the change in its supply.

Although still comparatively small, the Earth's ecosystem is gradually growing.

However, one point that is important to pay attention to is that LUNA sustains the entire ecosystem of Earth. Therefore, the attractiveness of LUNA as an investment is centrally dependent on the growth of the Terra ecosystem.

Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@cryptosimplify/terra-luna)

hiveblocks

hiveblocks