As we saw in the last article, DeFi is the new movement that is attracting the attention of investors in the crypto space, having grown more than 400% since the beginning of June. Still, there are alternatives for variable decentralization. In other words, totally decentralized projects and others that are still dependent on human intervention - more centralized in a company.

**CeFi vs DeFi**

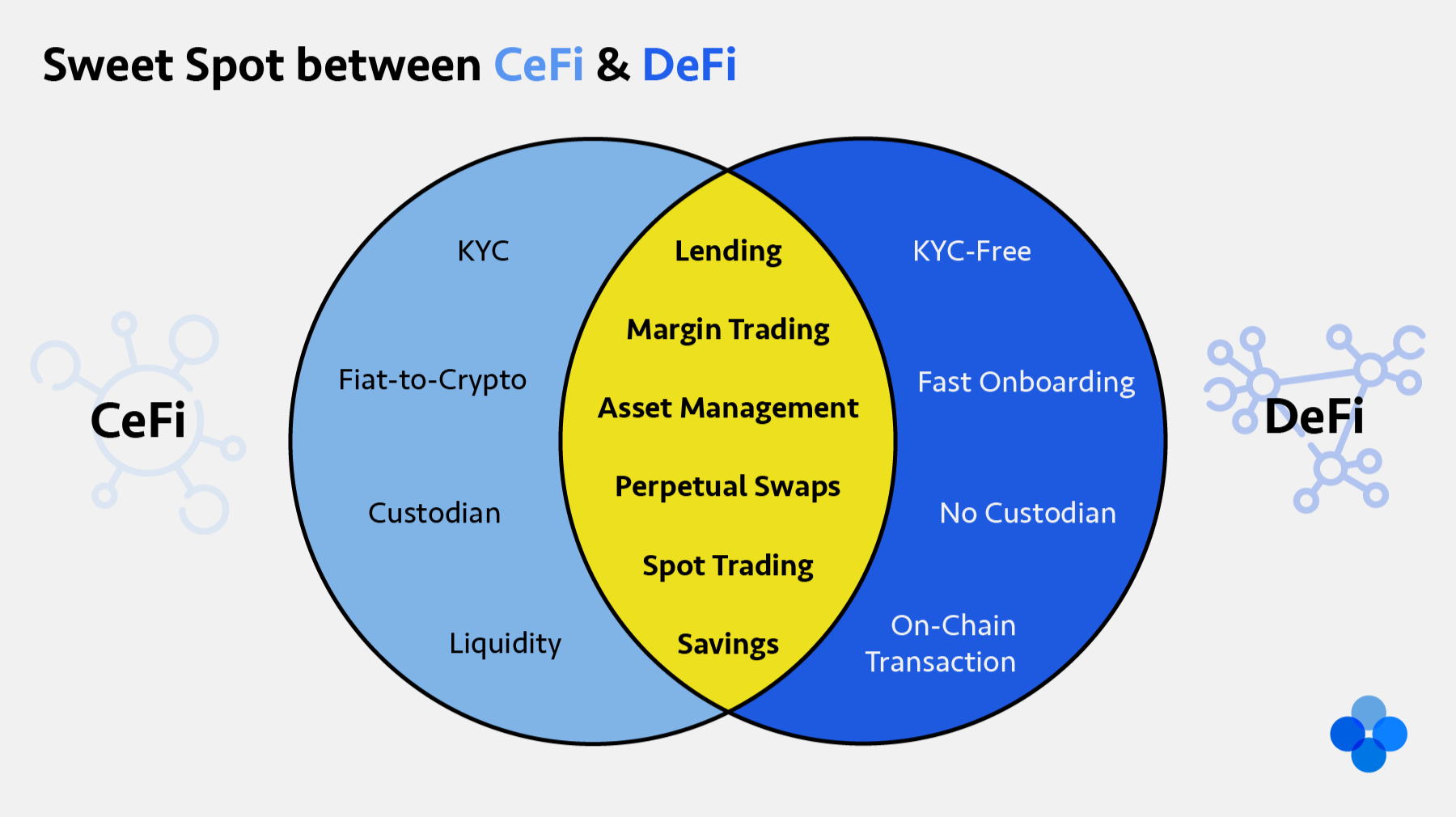

DeFi are **De**centralized **Fi**nance, while CeFi are **Ce**ntralized **Fi**nance around a company that offers financial and banking services to anyone. When using a CeFi solution we continue to trust a company, while we rely on protocol and technology when using DeFi.

**What is the CeFi value?**

The world of cryptography aims to remove the power of banking institutions that fully and without transparency control the financial resources that they put in their custody. In this new world, there are companies that propose to manage your money using the blockchain and its characteristics: transparency and shared control.

These companies and the services they offer have the potential to attract many people to the world of crypto. They can be seen as a transition solution to total control over each other's assets. The responsibilities that such control entails can make many afraid to convert to Bitcoin and other crypto. Thus, these companies offer services that use intermediate solutions in which users do not have absolute control over what they have, but are able to view and confirm the transactions that are made for their accounts. The **main advantages** of these services are:

- **Conversion of fiat currencies (euro, dollar) to crypto** - you can, for example, convert your euros or reais to bitcoins or ethers.

- **Interoperability**- you can make exchanges between several cryptography. Transactions between cryptocurrencies of different blockchains cannot be made directly. Since these institutions have large reserves of various crypto assets, they are able to support direct and instantaneous exchanges between different assets whose links between chains would take longer.

- **Customer support**- with the need to keep their customers happy, companies have to develop satisfactory customer support services to answer their doubts and questions.

However, we continue to trust our money to a company and the people who run it. This is the main risk of CeFi projects. There are others that are:

- **Custody**- your cryptography is usually under the control of that company. For purists in the crypto world, this is an affront to the principle of control over your money.

- **Provide personal data** - as these companies operate in systems that are more regulated and controlled by the state (for using fiat coins) they are obliged to register their users' personal data. Thus, your data is in the hands of third parties.

There are many companies in this business and some of them are becoming giants in the world of finance and banking. **Some examples of CeFi companies** are:

- **Kraken**- a crypto broker that allows you to make direct exchanges between cryptos or buy crypto with fiat currencies.

- **Crypto.com** - a platform that allows you to make payments using your cards, receive loans or make deposits receiving interest of up to 18%, if you use your MCO token.

- **Celsius**- a platform that allows you to receive loans with rates starting at 1% or make deposits receiving interest of up to 10%, or even more for some stablecoins (crypto with the value equivalent to a fiat currency).

**Why use DeFi?**

In the previous article we already talked more deeply about the space DeFi - Finances Decentralized. These platforms offer financial services to anyone without discrimination of any kind and without having to ask for authorization. However, here the responsibility rests entirely with the user since there is no company or entity to which they can turn. For these reasons, taking the step towards decentralized finance can seem like a Herculean task for those who are taking their first steps in the world of crypto.

Fortunately, this space is exposed to a very high rate of innovation and able to adapt to provide services that users are looking for with solutions that are increasingly easy to use.

Although this option is decentralized, we always have to allocate trust to something. In the case of DeFi, trust is placed in the protocol and the computer code that builds it.

The **main positive points** are:

- **Total control** - you master your cryptography and decide what to do with it and where you want to invest it. There are platforms that automate transactions to maximize returns according to the parameters you define.

- **Do not expose your data** - these protocols work using only blockchains and the assets that are stored there. So, you don't have to identify yourself or give your data to anyone.

We are talking about super recent technologies that have not yet been tested against hackers and other possible flaws.

The **main risks of using DeFi projects** are:

- **You are alone** - you must be very careful with the keys that give you access to the money you invested. If you lose them or someone steals them you will not be able to turn to anyone to recover them.

- **Venture investment** - these platforms are open source and have many programmers working to verify the protocols that constitute them. In addition, there are several external auditors who prove the security of the technologies. Despite this, they are new applications that have little testing time to be able to say they are safe and therefore, you should look at them as a high risk investment.

Some of the platforms where you can invest using the DeFi benefits are:

**MakerDAO**- a decentralized lending platform that generates a stablecoin.

**Compound**- a decentralized platform for receiving loans and making deposits with interest.

**Uniswap**- a decentralized broker where you can buy and sell crypto.

Like all new technologies, both DeFi and CeFi are susceptible to improvements that have to be developed and implemented. They are extremely recent protocols and technologies and therefore they may still have flaws that can be exploited by hackers. Since we are talking about investments, it could be your money at stake. **Therefore, it is necessary to be extremely cautious with any investments in these platforms.**

However, we can also see that each failure that is taken advantage of and each improvement that is implemented will cause these new banking services to be improved and become more robust. As highly profitable returns become more secure, faster transactions and infrastructure for a more open financial world will continue to attract more investors. **Moving towards fulfilling its purpose of breaking with the dominance of traditional banking institutions and giving back to ordinary people control over their savings and personal assets.**

hiveblocks

hiveblocks