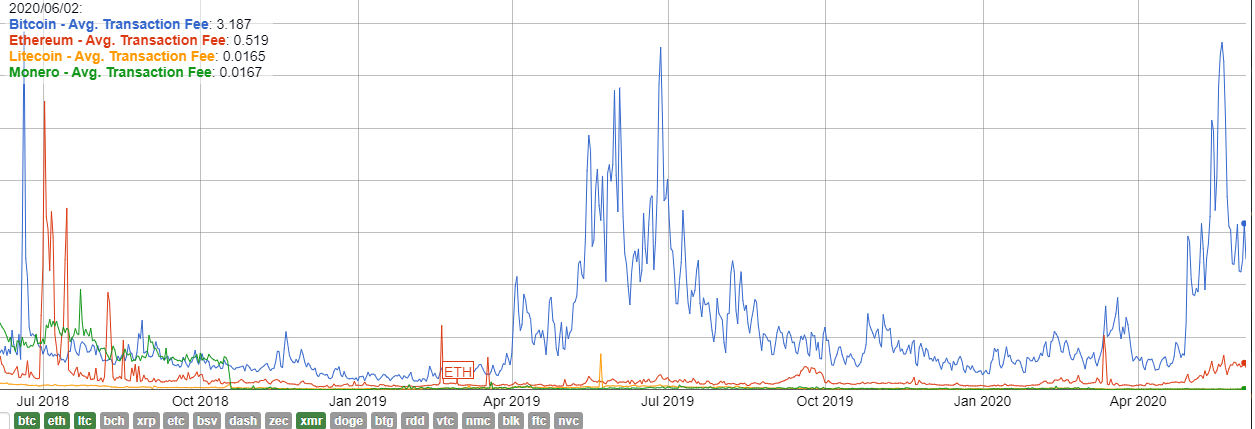

<center> </center> <center> </center> https://bitinfocharts.com/comparison/transactionfees-btc-eth-ltc-xmr.html The more I look at this chart the more I just can't get over it. # Moving Bitcoin around is expensive! And it's only going to get more expensive, likely astronomically so. Remember at the end of 2017 when Bitcoin spiked to $50 transaction fees? How high will fees spike during the next bubble? # $100? $200? $500? $1000? My guess is somewhere between $500-$1000 for a single Bitcoin transaction. Let that sink in for a bit. # Think that's ridiculous? A lot of people are predicting a new bubble of Bitcoin up to $280k per coin, myself included. If that was the case, how could Bitcoin fees not hit these ridiculously high targets? If it was $50 per transaction at $20k isn't the logical assumption a linear progression of $500 fees at $200k? It will be that this point that many will realize that Bitcoin does not exist for the common man; it exists for the super rich. We were just lucky enough to be here first before all the banks, governments, and corporations ~~wanted~~ needed a piece of the action. Bitcoin is the original chain with the highest security and the most inefficient redundancies that boost said security. Anyone who wants to use it will have to pay a steep price, and pay they will, because it will be totally worth it for them. A $1000 fee on a transaction of a few million dollars is not a big deal, especially when the entire banking system is going belly-up and hyperinflating. ----- ### We also have to assume that Coinbase will be forced to stop offering free Bitcoin transactions. That's just the name of the game; they will no long be able to afford that luxury. ----- # LN I have absolutely zero faith that the Lightning Network will solve this scaling issue. A second-layer solution is effectively just a new chain. Why would anyone use this new chain, that has so many problems, when they can just overflow to another chain with better security like Litecoin. When atomic-swaps become commonplace, this dynamic will become even more obvious. ----- # And what about Hive? What are our transaction fees looking like these days? Still zero? Hm... ---- #### [Trickle-down theory actually works with crypto!](https://peakd.com/economy/@edicted/my-cup-runneth-over-trickle-down-theory) I wrote this post at the end of 2018, and it is still valid. You know what isn't valid? All those references to the Dot Com bubble! Do we remember that? Everyone was talking about crypto like it was the Dot Com fiasco for the entire year that Bitcoin was crashing in 2018. Who's talking about Dot Com now? No one. Stupid irrelevant comparison, and ***NO ONE*** admits that they were totally wrong in making that comparison after the fact even though no one is making that reference anymore and they so vehemently did before. <center> </center> ## [Ridiculous Dot Com Bubble Comparison](https://peakd.com/bubble/@edicted/ridiculous-dot-com-bubble-comparison) Comparing crypto to Dot Com was, and always has been, a fool's errand. Seriously I wonder if they will try to pull that shit again on the next bubble. That would be even dumber because they were already proven wrong. Yet, I fully expect it to happen regardless. # Bitcoin With it's four-year halving cycles, Bitcoin is creating floods of value in cycles almost like the Nile River in ancient Egypt. The Bitcoin River floods and everyone gains. It's the year-long famine afterward that you have to worry about. # Litecoin I'm always flip-flopping back and forth with Litecoin wondering if it's a valid project. Once again I've flipped back to a pro-Litecoin stance. It's the second oldest crypto ever. It uses a different hashing algorithm (huge deal). And the transaction fees are dirt cheap. I transferred Litecoin around the other day for a tenth of a penny, and that was double the price I needed to pay (simply wanted it to be guaranteed on the next block). Not only that, but Litecoin's second halving was last August. We've almost had a full year of liquidity drain on the market. When the supply runs out, we'll know, that's for damn sure. # Ethereum This is the second safest asset to invest in, as it is the second highest project by market cap with the second-most liquidity. Ethereum sets itself apart greatly from both Bitcoin and Litecoin with the smart-contract and DeFi niche. It's not going anywhere. [There is no such thing as an Ethereum Killer!](https://peakd.com/ethereum/@edicted/there-is-no-ethereum-killer) # Hive Not as sure of a thing as these other projects I've listed, but still my favorite one (obviously). Where else can you find a social network presence so intimately connected to a blockchain? "Get paid to _____" will certainly be our motto going forward, and as the world goes to shit and people out there get more and more desperate for any form of income, Hive will be sitting pretty. # Bitcoin forks (BCH, BSV, Bitcoin Diamond) In my mind, these forks are doomed to fail. They all use the SHA-256 algorithm so their entire security is compromised. Any big miner from the Bitcoin network can attack and double-spend them into the dirt. With the ability to rent hashpower, this is even more relevant. # Conclusion No one project can do it all. Everyone tries to project competition onto this space, but there is no competition. All of these projects are collaborative and open-source. They all have their own niche. As the Bitcoin Flood begins we will see the cycle complete once again. It's been a long four years, and I'm glad to see so many people here have stuck it out and stayed the course. Our patience will be rewarded.

| author | edicted |

|---|---|

| permlink | inevitable-overflow-on-the-horizon-revisiting-trickle-down-theory |

| category | bitcoin |

| json_metadata | "{"app":"peakd/2020.05.5","format":"markdown","description":"Granddaddy Bitcoin is going to flood the entire market with value. ","tags":["bitcoin","fees","trickle-down","litecoin","ethereum"],"users":["edicted"],"links":["https://bitinfocharts.com/comparison/transactionfees-btc-eth-ltc-xmr.html","/economy/@edicted/my-cup-runneth-over-trickle-down-theory","/bubble/@edicted/ridiculous-dot-com-bubble-comparison","/ethereum/@edicted/there-is-no-ethereum-killer"],"image":["https://files.peakd.com/file/peakd-hive/edicted/Xfkh0gxp-trickle20down20cup20glass-overflow.jpg","https://files.peakd.com/file/peakd-hive/edicted/CquAyqB3-t1.png","https://files.peakd.com/file/peakd-hive/edicted/Juviuqfi-mark20twain20easier20to20fool-trick.jpg"]}" |

| created | 2020-06-04 20:29:24 |

| last_update | 2020-06-04 20:29:24 |

| depth | 0 |

| children | 19 |

| last_payout | 2020-06-11 20:29:24 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 5.856 HBD |

| curator_payout_value | 5.179 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 6,094 |

| author_reputation | 3,487,919,500,077,472 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,776,248 |

| net_rshares | 24,890,457,888,163 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| team | 0 | 62,148,665,771 | 10% | ||

| kingscrown | 0 | 416,955,259,259 | 5% | ||

| hitmeasap | 0 | 24,804,029,516 | 50% | ||

| livingfree | 0 | 154,532,554,527 | 1% | ||

| jrcornel | 0 | 7,157,741,121,839 | 100% | ||

| scaredycatguide | 0 | 15,500,910,993 | 50% | ||

| kiddarko | 0 | 3,141,335,196 | 2.5% | ||

| borran | 0 | 507,705,052,983 | 75% | ||

| netaterra | 0 | 447,769,001,325 | 20% | ||

| dadview | 0 | 637,419,202 | 1.5% | ||

| riseofth | 0 | 211,630,805,598 | 70% | ||

| justyy | 0 | 21,680,659,751 | 2.5% | ||

| greer184 | 0 | 9,460,178,871 | 25% | ||

| dylanhobalart | 0 | 20,499,956,723 | 21% | ||

| rishi556 | 0 | 8,183,360,670 | 100% | ||

| mitchelljaworski | 0 | 17,472,075,546 | 100% | ||

| created | 0 | 179,150,688,824 | 1% | ||

| builderofcastles | 0 | 20,848,418,039 | 25% | ||

| adventureevryday | 0 | 2,582,057,398 | 5% | ||

| master-set | 0 | 353,185,533,735 | 100% | ||

| ripperone | 0 | 1,054,765,099,757 | 19% | ||

| sn0n | 0 | 179,148,074,610 | 100% | ||

| buzzbeergeek | 0 | 797,535,480 | 5% | ||

| markkujantunen | 0 | 111,292,977,963 | 100% | ||

| preparedwombat | 0 | 592,187,472,758 | 100% | ||

| detlev | 0 | 18,673,535,324 | 1.5% | ||

| trumpman | 0 | 1,760,202,576,607 | 50% | ||

| mdosev | 0 | 760,876,186 | 2.5% | ||

| xyzashu | 0 | 855,393,997 | 50% | ||

| slickhustler007 | 0 | 3,543,511,426 | 100% | ||

| crypto-futurist | 0 | 2,004,550,660 | 70% | ||

| santigs | 0 | 6,776,718,187 | 25% | ||

| pele23 | 0 | 30,257,454,529 | 12% | ||

| paullifefit | 0 | 1,564,271,993 | 75% | ||

| blokz | 0 | 18,170,582,415 | 100% | ||

| circleoffriends | 0 | 1,049,861,260 | 100% | ||

| revisesociology | 0 | 303,670,142,368 | 25% | ||

| decentropia | 0 | 11,742,467,376 | 70% | ||

| superbing | 0 | 4,012,905,899 | 90% | ||

| tobetada | 0 | 236,975,787,683 | 20% | ||

| zoidsoft | 0 | 75,584,174,572 | 100% | ||

| mrhill | 0 | 22,341,070,589 | 100% | ||

| diverse | 0 | 51,863,570,839 | 100% | ||

| mtl1979 | 0 | 543,955,762 | 50% | ||

| zekepickleman | 0 | 58,656,873,464 | 100% | ||

| dashroom | 0 | 1,440,578,630 | 40% | ||

| not-a-bird | 0 | 2,197,225,968 | 10% | ||

| aussieninja | 0 | 101,557,881,236 | 100% | ||

| adityajainxds | 0 | 18,220,681,953 | 50% | ||

| fun2learn | 0 | 4,894,988,769 | 2% | ||

| edicted | 0 | 1,674,804,024,512 | 100% | ||

| culgin | 0 | 37,293,853,073 | 30% | ||

| holger80 | 0 | 1,927,946,634,651 | 50% | ||

| moeenali | 0 | 1,554,003,317 | 1% | ||

| mysearchisover | 0 | 112,222,810,332 | 100% | ||

| idkpdx | 0 | 135,323,267 | 2.5% | ||

| teutonium | 0 | 11,500,281,351 | 25% | ||

| angelinafx | 0 | 324,996,467 | 6% | ||

| rollandthomas | 0 | 872,405,290 | 2% | ||

| practicalthought | 0 | 144,768,707,284 | 100% | ||

| quochuy | 0 | 161,962,431,597 | 14.73% | ||

| morellys2004 | 0 | 71,463,865,331 | 100% | ||

| fw206 | 0 | 1,364,306,265,357 | 100% | ||

| hatoto | 0 | 135,751,171,423 | 50% | ||

| mrshev | 0 | 680,372,785 | 30% | ||

| solarwarrior | 0 | 1,719,007,152,531 | 100% | ||

| digital.mine | 0 | 70,299,519,426 | 0.3% | ||

| moneybaby | 0 | 787,192,116 | 2.5% | ||

| nailyourhome | 0 | 529,334,462 | 3.3% | ||

| nutritree | 0 | 28,119,266,294 | 100% | ||

| steemmedia.org | 0 | 778,387,189 | 50% | ||

| partitura | 0 | 860,128,082,682 | 50% | ||

| steem-oracle | 0 | 736,082,304 | 15% | ||

| fullnodeupdate | 0 | 10,700,118,557 | 50% | ||

| bengiles | 0 | 338,925,566,708 | 100% | ||

| frot | 0 | 516,411,780,044 | 50% | ||

| oakshieldholding | 0 | 129,300,733 | 80% | ||

| thisnewgirl | 0 | 3,417,146,151 | 100% | ||

| thrasher666 | 0 | 1,622,648,869 | 60% | ||

| dein-problem | 0 | -16,452,497 | -0.5% | ||

| autobodhi | 0 | 8,745,482,434 | 100% | ||

| xxxxxxxxxx | 0 | 647,674,661,453 | 5% | ||

| bluesniper | 0 | 18,758,612,888 | 100% | ||

| lallo | 0 | 12,650,747,745 | 66% | ||

| farm-mom | 0 | 88,482,602,598 | 100% | ||

| limka | 0 | 22,533,215 | 100% | ||

| giftgiver | 0 | 118,289,821,642 | 100% | ||

| dtrade | 0 | 735,015,803 | 30% | ||

| mitty | 0 | 6,041,306,242 | 100% | ||

| dalz1 | 0 | 1,235,545,977 | 100% | ||

| steem-key | 0 | 1,302,785,013 | 100% | ||

| abh12345.leo | 0 | 1,391,981,125 | 80% | ||

| mindtrap-leo | 0 | 1,620,076,454 | 40% | ||

| bearjohn | 0 | 1,072,640,195 | 100% | ||

| mktmaker | 0 | 800,347,127 | 97% | ||

| babytarazkp | 0 | 5,181,341,172 | 85% | ||

| arctis | 0 | 587,512,897 | 50% | ||

| revise.leo | 0 | 656,952,051 | 50% | ||

| tomhall.leo | 0 | 493,458,936 | 100% | ||

| tonimontana.leo | 0 | 1,854,621,433 | 50% | ||

| therealyme | 0 | 1,443,781,138 | 20% | ||

| crimianales | 0 | 2,158,447,630 | 49.95% | ||

| steem.ens | 0 | 861,272,234 | 50% | ||

| gmlrecordz | 0 | 887,919,099 | 9.5% | ||

| ldelegations | 0 | 1,230,504,730 | 100% | ||

| davidlionfish | 0 | 51,021,316,356 | 100% | ||

| dalz4 | 0 | 637,392,389 | 50% | ||

| drew0 | 0 | 2,695,185,301 | 20% | ||

| chromebook | 0 | 347,667,383 | 80% | ||

| ericandryan | 0 | 935,595,184 | 70% | ||

| softworld | 0 | 358,099,768,252 | 25% | ||

| hextech | 0 | 3,250,274,475 | 100% | ||

| ninnu | 0 | 1,537,836,104 | 25% | ||

| hivehustlers | 0 | 36,053,266,646 | 50% | ||

| raven.icu | 0 | 3,155,459,210 | 100% |

If btc goes to 280k that is around 30x Do you think other coins will 30x? I think several in the top 100 now may just do this or better. Especially those with dapps. Coins below 500 probably don't have a chance and are mostly small funds or dead projects that held on. Maybe we will see new coins, but I hope we see less stupid money into random new tokens that pretend they will solve problems.

| author | abitcoinskeptic |

|---|---|

| permlink | re-edicted-qbf88k |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-04 21:41:12 |

| last_update | 2020-06-04 21:41:12 |

| depth | 1 |

| children | 7 |

| last_payout | 2020-06-11 21:41:12 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.017 HBD |

| curator_payout_value | 0.017 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 399 |

| author_reputation | 335,387,091,612,941 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,777,183 |

| net_rshares | 131,388,436,224 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| edicted | 0 | 131,388,436,224 | 8% |

> but I hope we see less stupid money into random new tokens that pretend they will solve problems. This will inherently not be the case. Crypto is super complicated and valuable. It will be basically impossible for investors to tell the difference between the valid and invalid projects. Everyone is going to be suffering from unit bias, thinking they've been priced out of the bigger markets. Everyone is going to want their own x1000 story. This is going to happen over and over again before people wise up, and that has no chance of happening until crypto is fully mainstream and beyond.

| author | edicted |

|---|---|

| permlink | re-abitcoinskeptic-qbfldo |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-05 02:25:03 |

| last_update | 2020-06-05 02:25:03 |

| depth | 2 |

| children | 6 |

| last_payout | 2020-06-12 02:25:03 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 601 |

| author_reputation | 3,487,919,500,077,472 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,780,566 |

| net_rshares | 0 |

Well those of us in it during the alt drought will be better able to smell scams. I'll take the gamble on a few weird alt coins, but all the coins I'm planning to stock up on already exist. I don't need 1000x. If I put in 100$ in 100 alts maybe I could hit that..but it's moronic like buying 1 million lotto tickets. If I get 3x on btc I'll be happy. I have a few others I'm hoping for more of a 10x.

| author | abitcoinskeptic |

|---|---|

| permlink | re-edicted-qbfm1b |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-05 02:39:15 |

| last_update | 2020-06-05 02:39:15 |

| depth | 3 |

| children | 5 |

| last_payout | 2020-06-12 02:39:15 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.015 HBD |

| curator_payout_value | 0.015 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 402 |

| author_reputation | 335,387,091,612,941 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,780,749 |

| net_rshares | 115,913,276,649 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| edicted | 0 | 115,913,276,649 | 7% |

I prefer ETH to move *wealth* around. Much cheaper. You know what's dirty cheap and fast? Dogecoin...

| author | acesontop |

|---|---|

| permlink | qbfd6q |

| category | bitcoin |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2020-06-04 23:28:03 |

| last_update | 2020-06-04 23:28:03 |

| depth | 1 |

| children | 1 |

| last_payout | 2020-06-11 23:28:03 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 102 |

| author_reputation | 1,956,268,749,582,342 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,778,500 |

| net_rshares | 0 |

A lot of people mention Dogecoin but I've never used it. I have wanted to look into Digibyte for the same reason. I feel like Dogecoin and Digibyte are the tin and copper to Bitcoin & Litecoin's gold and silver.

| author | edicted |

|---|---|

| permlink | re-acesontop-qbflua |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-05 02:35:00 |

| last_update | 2020-06-05 02:35:00 |

| depth | 2 |

| children | 0 |

| last_payout | 2020-06-12 02:35:00 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 216 |

| author_reputation | 3,487,919,500,077,472 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,780,691 |

| net_rshares | 0 |

I see Bitcoin as the anchor and the other projects are extensions of Bitcoin, what BTC can't do well we now have multiple experiments to find the best solution to that problem, let's say smart contracts for example. Once the market settles on one and we push it to its most efficient, capital will flow to the next problem and so we take the value sitting in BTC and push it out into new improvements for the entire sector, It all seems fragmented now, but it will come together in some weird way eventually, I believe

| author | chekohler |

|---|---|

| permlink | re-edicted-qgcq11 |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.08.3"} |

| created | 2020-09-08 18:00:39 |

| last_update | 2020-09-08 18:00:39 |

| depth | 1 |

| children | 0 |

| last_payout | 2020-09-15 18:00:39 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.012 HBD |

| curator_payout_value | 0.012 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 520 |

| author_reputation | 524,332,427,393,665 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 99,521,767 |

| net_rshares | 141,522,985,657 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| edicted | 0 | 141,522,985,657 | 5% |

Thanks for the info, you've got me thinking for sure. I am one who's stuck around, hoping for a big payday, but those fees, man hard to swallow. As far as #hive, I truly hope it catches on and more users buzz our way, I think for it to be truly successful, more users are key.

| author | farm-mom |

|---|---|

| permlink | qbff4q |

| category | bitcoin |

| json_metadata | {"tags":["hive"],"app":"hiveblog/0.1"} |

| created | 2020-06-05 00:10:03 |

| last_update | 2020-06-05 00:10:03 |

| depth | 1 |

| children | 0 |

| last_payout | 2020-06-12 00:10:03 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.014 HBD |

| curator_payout_value | 0.015 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 276 |

| author_reputation | 229,068,554,632,361 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,779,014 |

| net_rshares | 114,808,422,695 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| edicted | 0 | 114,808,422,695 | 7% |

Those massive transaction fees will make the contents of a lot of Bitcoin addresses worthless dust for all practical purposes, at least during the peak. I wonder how that should be factored into the valuation of Bitcoin as a whole.

| author | markkujantunen |

|---|---|

| permlink | re-edicted-qbf925 |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-04 21:58:51 |

| last_update | 2020-06-04 21:58:51 |

| depth | 1 |

| children | 2 |

| last_payout | 2020-06-11 21:58:51 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.017 HBD |

| curator_payout_value | 0.017 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 231 |

| author_reputation | 624,829,749,092,114 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,777,395 |

| net_rshares | 131,196,689,112 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| edicted | 0 | 131,196,689,112 | 8% |

Honestly I think the issue is over rated. Most BTC transaction fees are based on btc% and not dollars. If the fee remains at 0.0005 btc but the usd value is 1000$ Ill be so amazingly rich if I manage a single transaction I won't care. I use Hive way more much, but BTC has made me so much more money for literally doing nothing other than buy low sell high.

| author | abitcoinskeptic |

|---|---|

| permlink | re-markkujantunen-qbflpb |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-05 02:32:03 |

| last_update | 2020-06-05 02:32:03 |

| depth | 2 |

| children | 0 |

| last_payout | 2020-06-12 02:32:03 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 357 |

| author_reputation | 335,387,091,612,941 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,780,650 |

| net_rshares | 0 |

How do you figure? If Bitcoin goes x30 and fees go x30... all the ratios are the same. There also has to be some different mindsets to it that might make it not linear. We saw how people acted when Bitcoin had $50 fees. I have to imagine that the way people act around $500 would be even more intense. Just the thought of "wasting" $500 will make a lot of users not want to transfer their Bitcoin (even if it's $50,000 to the exchanges and that's only a 1% fee). It would be fully possible to imagine Bitcoin spiking from low liquidity just because the fees are so high and the exchanges run out of supply. This of course would send the price and fees of Bitcoin even higher, ironically. Then everyone who held feels like they got rewarded for holding and even more people want to hold... it could get crazy.

| author | edicted |

|---|---|

| permlink | re-markkujantunen-qbfm0v |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-05 02:38:57 |

| last_update | 2020-06-05 02:38:57 |

| depth | 2 |

| children | 0 |

| last_payout | 2020-06-12 02:38:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 818 |

| author_reputation | 3,487,919,500,077,472 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,780,744 |

| net_rshares | 0 |

For BTC the greatest concern is scaleability.

| author | master-set |

|---|---|

| permlink | re-edicted-qbgqjc |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-05 17:14:00 |

| last_update | 2020-06-05 17:14:00 |

| depth | 1 |

| children | 1 |

| last_payout | 2020-06-12 17:14:00 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 46 |

| author_reputation | 29,898,183,809,227 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,789,942 |

| net_rshares | -394,008,410,953 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| freebornangel | 0 | -10,394,235,837 | -33% | ||

| master-set | 0 | 365,251,721,080 | 100% | ||

| stempede | 0 | -25,956,919,261 | -33% | ||

| edicted | 0 | 128,453,198,686 | 7% | ||

| antisocialist | 0 | -99,280,511,717 | -33% | ||

| enforcer48 | 0 | -226,622,367,116 | -33% | ||

| onebtcofhive | 0 | -525,459,296,788 | -33% |

Is that a concern? I'd say it's a feature at this point, not a bug.

| author | edicted |

|---|---|

| permlink | re-master-set-qbgtpi |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-05 18:22:33 |

| last_update | 2020-06-05 18:22:33 |

| depth | 2 |

| children | 0 |

| last_payout | 2020-06-12 18:22:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.051 HBD |

| curator_payout_value | 0.052 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 69 |

| author_reputation | 3,487,919,500,077,472 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,791,113 |

| net_rshares | 372,746,595,812 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| master-set | 0 | 372,746,595,812 | 100% |

> And the transaction fees are dirt cheap. The four times I invested back at the beginning of my Steem life I used Litecoin from Coinbase. The fees for Bitcoin would have eaten up my investment, and Litecoin was cheaper than Ethereum. I wondered then why so many were still saying Bitcoin was the gateway to crypto when for the masses it wasn't economically feasible. I remember when I first started hearing of trickle down economics. Maybe on paper that looks good, but in reality in most cases those at the top keep most of it and piss on the rest beneath them. You see this in practice with all the bailouts those welfare republicans like giving to their rich masters. They hoard as much of it as they can despite the (wink wink) talk that it's to benefit the common person. I'm really hopeful that Hive can leave much of the crypto world behind. It has a practical use for the average person who uses several aspects of the use elsewhere daily. It will come down to a few things. One thing I see talked of a lot is the need for a middleman to handle the complexities of wallet management. Most people aren't going to want to participate in what I call James Bond maneuvers to log in and out. The other thing I see is going to be the need for an easy buy in/cash out. Having to jump through so many KYC hoops is ridiculous. More ridiculous when you see most of the exchanges playing KYC games and pretending they 18th ID/selfie isn't good enough while they deny you access to your funds for yet another month. Shit is mad ridiculous and has been the main reason I haven't invested more than I have. The whole selfie thing is top notch ridiculous. I don't need a selfie to online bank or shop, why is one necessary to buy crypto? Damn, wasn't planning on ranting, lol. I agree Bitcoin isn't something that the masses will flock to. I used to think it might be Ethereum, but not so sure now. The average person has no use for Ethereum either.

| author | practicalthought |

|---|---|

| permlink | qbf6yl |

| category | bitcoin |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2020-06-04 21:13:33 |

| last_update | 2020-06-04 21:13:33 |

| depth | 1 |

| children | 1 |

| last_payout | 2020-06-11 21:13:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.014 HBD |

| curator_payout_value | 0.015 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 1,950 |

| author_reputation | 49,876,004,966,704 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,776,837 |

| net_rshares | 114,730,961,020 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| edicted | 0 | 114,730,961,020 | 7% |

The big difference between Trickle-Down economics in the legacy economy is that the right-wing purposefully funnels money into the hands of the rich. It's fully a partisan issue pushed by the right side of the spectrum. With Crypto... the concept of Trickle-Down doesn't involve any governance whatsoever. All this value is being created out of thin air and being splashed everywhere without anyone's permission or say-so. Ethereum is really good to transfer value on at the moment, but it has really fast blocks, making it more prone to attack. Also it's making an awkward swap to POS. In the long run, Ethereum's main use case will be smart-contracts. It makes logical sense that these big smart contracts will clog up the network and make transfers more expensive than say Litecoin. Also, like I said, Litecoin has theoretically better security because they have 150 second blocks vs 15 sec on ETH. This makes LTC 10 times more expensive to attack and double-spend on than ETH, assuming equivalent hashpower.

| author | edicted |

|---|---|

| permlink | re-practicalthought-qbfmi5 |

| category | bitcoin |

| json_metadata | {"tags":["bitcoin"],"app":"peakd/2020.05.5"} |

| created | 2020-06-05 02:49:21 |

| last_update | 2020-06-05 02:49:21 |

| depth | 2 |

| children | 0 |

| last_payout | 2020-06-12 02:49:21 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.020 HBD |

| curator_payout_value | 0.020 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 1,022 |

| author_reputation | 3,487,919,500,077,472 |

| root_title | "Inevitable Overflow on the Horizon: Revisiting Trickle-Down Theory" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 97,780,858 |

| net_rshares | 153,189,476,583 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| practicalthought | 0 | 153,189,476,583 | 100% |

hiveblocks

hiveblocks