Good question.

You're right in the sense that this 15% the project is paying to delegators is in some way ''our cost to attract capital'' But the numbers shown through hivestats are wrong (because of how the blockchain works), let me explain a bit better.

Curation rewards start to be credited 7 days after the Hive power delegation is under control of empo.voter this basically means there's a effective delay which is very noticeable the first week but starts diluting rapidly.

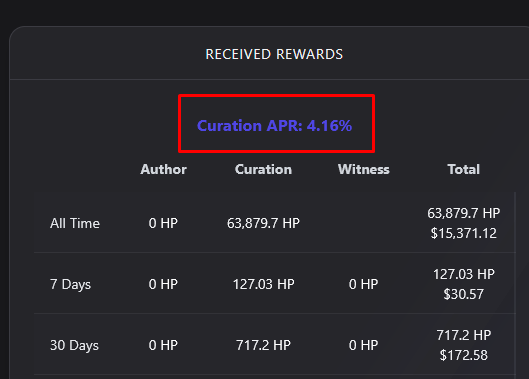

As shown in Hivestats, curation APR for the last 30 days is (as shown) a 4,16% APR.

But this number isn't accounting for the Hive Power which has been delegated in the last 7 day window (simply because it didn't had time yet to produce anything).

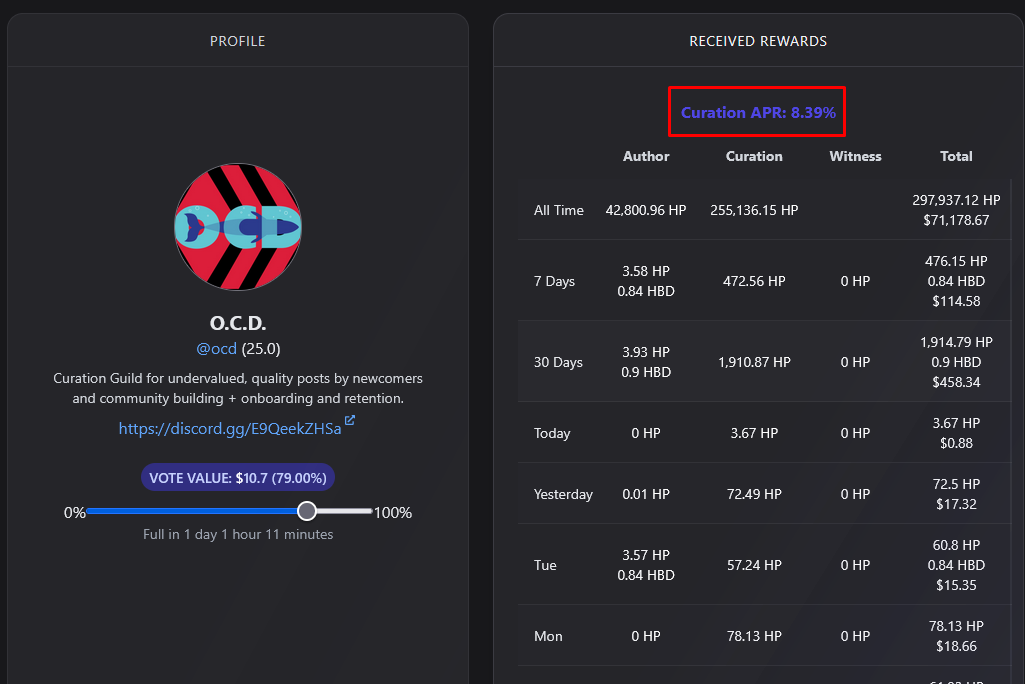

But empo.voter is simply vote trailing other curators, like for example @ocd or blocktrades. Both of these accounts have a curation APR above 8%; there's absolutely no reason our 'real' apr is lower than that.

This means, as you said that ''our cost'' is around ~1970 HIVE/month.

But since our 'real' APR is a bit more closer than 8%, then our income for this HIVE is ~1066 HIVE/month (and not 715).

Then our 'real' deficit is **~904 HIVE/month**, which is still 'some' but a bit less than 1250

> is this "cost of capital acquisition" (a deficit of ~1,250 HIVE/month from this operation) factored into the project's strategy?

Given the current configuration, PWR is a synthetic “short” in HIVE. And here comes a bit of personal opinion and beef.

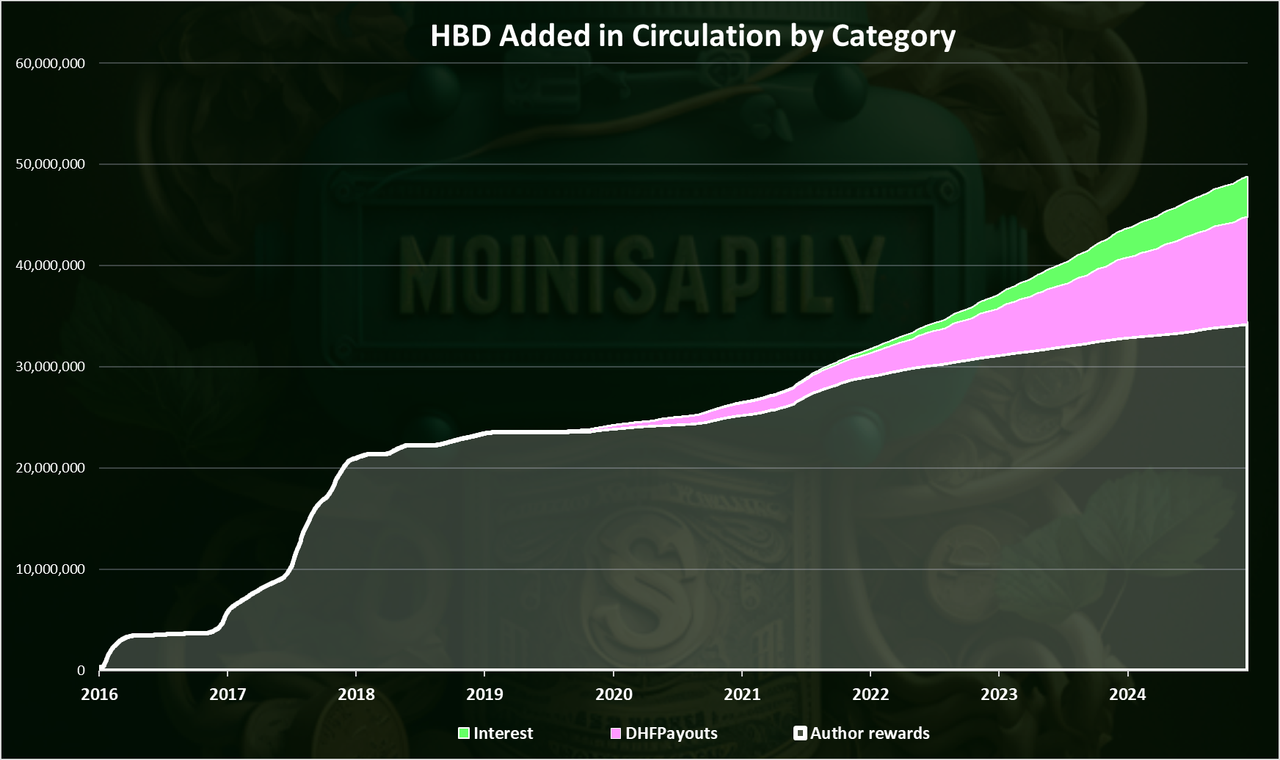

As long as HIVE as a ecosystem doesn't fix it's house chores, will keep lagging among other competitors. If we add to this a structural inflation rate of 6% (although decreasing) and the wasteful use of DHF funds, this inflation rate is currently 8%.

I believe PWR is more than positioned to yield +8% /year. (If not, well, I should be wrapping this up and moving onto other things).

All of this together makes HIVE as a coin behave like a somewhat 'stable' asset half of the time... while it slowly bleeds on itself the other half.

Well, it behaves like this... until it doesnt.

I like this distribution system since it requires someone to be long-term commited with HIVE (13 week lock) plus it's being released very slowly. 15% (or whatever the number) can be seen like a lot, but.

- It's distributed daily (so not much volatility at once).

- It still requires the delegator/holder to sell.

In other words, as long as the delegator/holder doesn't sell, it gives me time to profit on his 'free loan'. And it's only a matter of time since I'm back again into accumulating yielding assets (which will make this deficit nonexistent or positive), like for example HBD on a bear market.

I've probably strayed from the initial question, but I think all this reasoning adds value to the overall scheme of how things work with PWR and how I structure them in my not always tidy little head.

Pd. I still have to think about ur OTC offer.

hiveblocks

hiveblocks