<center></center>

With MoneyToken, there is no reason to sell your BTC when you need cash or a stable currency. MoneyToken provides loans supported by crypto, MTC stablecoin and a decentralized exchange service.

The problem has been clear for some time - spending current crypto assets prevents cryptocurrency holders from gaining future growth in asset values, holders who buy low requirements to sustain their investment to profit from high sales.

This is where MoneyToken steps in. The MoneyToken platform allows you to borrow liquid funds instantly, based on the current value of your cryptocurrency asset ownership. You take out a loan, secured by a more volatile asset such as Bitcoin or Ethereum - and in return you receive an agreed loan amount in a stable currency. And after paying off the loan, you receive all your collateral back, even if the collateral has increased in value several times.

In this way, you can obtain liquid funds for immediate needs, and keep your crypto position, all at the same time.

**Vision**

At this stage of market development, they see that the cryptocurrency assets have acquired the characteristics of various financial instruments. We can divide cryptocurrency with their quality and algorithm, into investment assets and means of payment.

Investment assets are volatile and attractive for the long term, made to make a difference between exchange rates or earn other types of income, such as from stock proof algorithms, interest rates, and so forth.

Cryptocurrency payments are made to support exchange rate stability - they are usually embedded with their own set of mechanisms, unique algorithms to regulate mining constraints or the release of new coins.

**Lending Model**

The MoneyToken Lending Model uses fluctuating crypto-assets as collateral for loans given in fiat or stablecoin currency.

The list of advantages of this model is compared to traditional banking schemes or pawnshops :

- Auto loan confirmation in seconds or minutes.

- There is no requirement for credit assessment or asset verification.

Customers manage their own lending conditions within the boundaries of the provisions of the platform.

- An option to store collateral in some cryptocurrency assets to stabilize general fluctuations of collateral and lower upward pressure on interest rates.

- Transparency of operations during the transfer and storage of a security deposit.

- Transparency of collateral evaluation and fluctuations in value from time to time for both parties.

**Who is the platform for ?**

- Miners

Avoid cash flow problems or invest in more equipment, without losing the macro cryptocurrency already mined.

- Traders and investors

Maintain your investment portfolio of cryptocurrency and use leverage to make further investments or improve your ICO liquidity symbol.

- ICO

Quick access to cash, without all red tape, for short-term businesses need a token symbol of money

- Exchange

Meet the need for extra cash while hedging exchange risks and utilizing your crypto assets

**Platform Technical Description**

- MoneyToken will use a smart contract based on Ethereum to secure the terms of the agreement.

- The collateral fund will be kept in a protected multi-signature wallet and requires 3/4 signature to access. One signature is owned by the borrower at any time, owned by the lender, third and fourth owned by the MoneyToken arbitration service.

- Multichain and contract deals will be available in the future, making MoneyToken a fully decentralized platform

**Collateral Currency**

- At the time of platform launch, Bitcoin and Ethereum will be accepted as collateral, these are the two crypto currencies with the largest market capitalization.

- Dash, Litecoin, and other popular cryptocurrencies included in the top 10 uppercase letters will be added as cryptocurrency backup in the third release platform.

- Adding token sales Another popular token that has gained enough confidence in the market and backed by a successful product, will be considered a future guarantee currency.

**MoneyToken Exchange**

- At the MoneyToken exchange service, users will be able to purchase and exchange cryptocurrency assets, as well as fiat funds.

- MoneyToken exchange will be used for automation collateral liquidation in cases of collateral currencies price drop.

**Initial money Token**

- Up to 60% discount on the platform fees for Customer membership

- Become a lender

- Participate in the decentralized decision-making system.

**Get cash anytime and anywhere**

- Card balance in USD

- Fast and easy loan cash-in

- Repay your loan

**Token Info**

Name : MoneyToken

Token : IMT

Platform : Ethereum

Type : ERC20

Price in ICO : 0.01 USD

Private sale : 40%

Presale : 25-30%

Token sale : Up to 20%

Tokens for sale : 10,120,000

**Bounty Allocation**

- Signature Campaign : 45%

- Blog/Media Campaign : 20%

- Twitter Campaign : 12,5%

- Facebook Campaign : 12,5%

- Translation Campaign : 10%

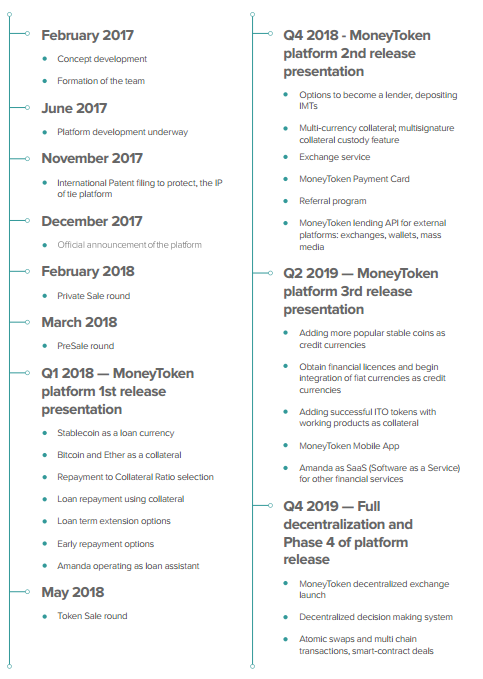

<center>**RoadMap**</center>

<center></center>

**For more information, visit the link below :**

Website : https://moneytoken.com/

Whitepaper : https://moneytoken.com/doc/MoneyTokenWP_ENG.pdf

Bounty : https://bitcointalk.org/index.php?topic=3407082.0

Abstract : https://moneytoken.com/doc/Abstract.pdf

Telegram : https://t.me/moneytoken

Medium : https://medium.com/@moneytoken

Twitter : https://twitter.com/MoneyToken

Youtube : https://www.youtube.com/channel/UCz9r7r5BSoq4eE6guMa7P-w

**Author :**

Username : chong_ali

Profile Link : https://bitcointalk.org/index.php?action=profile;u=1360386

0x89095edc877ed4ed7d201c9c76edb68baa187e2b

hiveblocks

hiveblocks