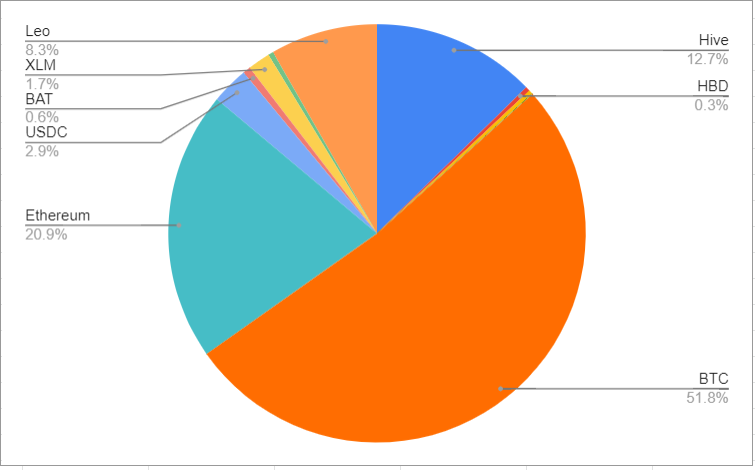

This is not financial advice and is just a vision of what I'd like to eventually grow my crypto portfolio, what it looks like currently, and what my plan is for the bear market. Don't listen to me as I've built this portfolio with a few dollars I've earned off crypto faucets and talk a big game. <h1> My Current Portfolio </h1> I'm currently happy with my portfolio right now. Obviously, along with everyone else in the space right now, I wished I had accumulated a lot more crypto in the bear market, but overall I'm happy with the percentage breakdown of what I own. <center></center> I'm shooting for Bitcoin to make up 50% - 60% of my portfolio. As it gets closer to 60% of my portfolio I'll sell some into Ethereum and some into USDC my stable coin of choice. I'm shooting for my Altcoin to make up 40% - 50% of my portfolio. If it starts to climb higher than that I'll sell some into either Bitcoin or USDC. Depending on where I think we are in the market cycle I may even be ok with a little more percentage of alts, and move into other alts that I don't have enough or any exposure in. Finally, I'd like to increase my stable coin exposure to 5% - 10% of my holdings. While I'm ok being stable coin "light" right now, I would like to continue to grow my stable coin holdings so I can start buying some dips and looking for some quick flips. <h1> Holdings During a Bear Market </h1> By the time I think we're getting close to the top I'll start focusing more on growing my stable coin investment. I'd like to slowly grow my portfolio to 50% by the time I think the market is starting to feel a little toppy. I'll do this over the course of several months to a year because no one can call the top and I'd still like to use a portion of these funds to try and flip the dips and use to earn interest on websites such as [Block Fi](https://blockfi.com/?ref=0075da2c). <center></center> The other 50% I'd like to have split evenly between Bitcoin and altcoins so 25% Bitcoin and 25% altcoins. I'd prefer to have this be at least Bitcoin and be ok with growing it as high as 40% Bitcoin and Ethereum and 10% altcoins during the duration of the bear market since Bitcoin usually holds its value the best. <h1> My Future Portfolio </h1> Obviously, with crypto, there isn't a great way to forecast which of these markets will survive and which will be consumed by other markets. For all we know Bitcoin will be the only blockchain and every other use case will be a second layer on the blockchain network. Assuming that's not the case here is what I'd like to own: *Smart Contract Platforms *Gaming/Collectibles *Currencies / Privacy *Social Platforms *Index Funds So for each of these genres, I'd like to think as they continue to grow and mature that they would make up 20% of my portfolio. I'd like to own the "top 3" in each genre and a speculative newcomer that would make the makeup look like the top 1 - 3 would be greater than 90% of the portfolio with the speculative project making up less than 10%. If there is a decent Index Fund that's easily accessible and is broken down in a similar way which I describe above I'd be ok with putting most of my funds into that, but as I think there are quite a few projects in the top 10 and especially in the top 100 that won't be around in a few years, I don't think a decent index fund can be set-up currently. <center></center> I'm really looking forward to what the gaming/collectible market will look like in a few years. I'm not investing in much right now, outside of [Splinterlands](https://splinterlands.com?ref=gniksivart) as I want to see what can stand the test of time, but I have a feeling more and more games/collectibles will continue to grow and become investible in the future. <h1> To Wrap Things Up </h1> I'm not sure how able I will be able to follow this into the future and during the bear market, but I hope to come close to this and I think it will serve me well not having to follow trades. This will set me up so that, for the most part, the only time I'm "trading" is when I'm needed to rebalance my portfolio because I'm too heavy one way or the other. Would love to know what altcoins or what markets in cryptos future you're watching and planning to invest heavily in, regardless if it's a crypto project or upcoming blockchain game, let me know in the comments down below. Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/hive-167922/@gniksivart/what-does-your-crypto-portfolio-allocation-look-like)

| author | gniksivart |

|---|---|

| permlink | what-does-your-crypto-portfolio-allocation-look-like |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["steemleo","neoxian","palnet","posh","crypto","spt","splinterlands","portfolio","investing","altcoin","leofinance"],"links":["https://blockfi.com/?ref=0075da2c","https://splinterlands.com?ref=gniksivart"],"image":["https://images.hive.blog/DQmPYHxGaP58gWyfZiCuYSTuxgDfbyPa7PeWoLpjUm7smTA/image.png","https://images.hive.blog/DQmXmihgJFTVN6tLdpZLCKKMkWpRavHhPkQM44jnnXV43jt/image.png","https://images.hive.blog/DQmXtGSpFfxW2HLDNY6UxxGWYiz7sqJwUqGjv3Sz2xjNoEV/image.png"]} |

| created | 2021-02-15 22:02:00 |

| last_update | 2021-02-15 22:02:00 |

| depth | 0 |

| children | 16 |

| last_payout | 2021-02-22 22:02:00 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 3.912 HBD |

| curator_payout_value | 3.742 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 4,810 |

| author_reputation | 74,197,147,678,652 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,894,302 |

| net_rshares | 16,786,688,339,088 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| mangou007 | 0 | 193,628,896 | 7.24% | ||

| bert0 | 0 | 9,717,509,260 | 7.24% | ||

| penguinpablo | 0 | 461,138,003,748 | 9% | ||

| uwelang | 0 | 118,070,064,540 | 13% | ||

| ahmadmanga | 0 | 842,745,605 | 9.09% | ||

| ganjafarmer | 0 | 3,516,842,988 | 5% | ||

| thatsweeneyguy | 0 | 1,451,462,523 | 6.5% | ||

| papadimos | 0 | 2,016,112,724 | 15% | ||

| kennyroy | 0 | 1,798,043,618 | 100% | ||

| trumpikas | 0 | 43,847,800,758 | 50% | ||

| alphacore | 0 | 42,424,380,119 | 4.51% | ||

| enjar | 0 | 643,050,369,879 | 80% | ||

| pennsif | 0 | 75,496,173,476 | 100% | ||

| khalil319 | 0 | 1,183,593,836 | 31% | ||

| bahagia-arbi | 0 | 1,437,217,478 | 6.5% | ||

| vlemon | 0 | 492,695,438,714 | 100% | ||

| voxmonkey | 0 | 435,123,084 | 100% | ||

| roleerob | 0 | 28,104,189,552 | 6.5% | ||

| mawit07 | 0 | 19,631,574,043 | 66.1% | ||

| dagger212 | 0 | 51,667,189,589 | 100% | ||

| sayee | 0 | 11,840,308,935 | 13% | ||

| khaleelkazi | 0 | 85,735,302,770 | 62% | ||

| flamingirl | 0 | 1,949,279,484 | 7.24% | ||

| mrhill | 0 | 23,090,532,970 | 100% | ||

| mazzle | 0 | 4,458,610,070 | 100% | ||

| elderson | 0 | 1,249,747,018 | 2.5% | ||

| steemusa | 0 | 6,302,622,123 | 10% | ||

| kevmcc | 0 | 30,759,622,629 | 30% | ||

| cryptonized | 0 | 34,834,835,896 | 9% | ||

| fourfourfun | 0 | 6,096,635,200 | 20% | ||

| aiziqi | 0 | 34,561,076,258 | 100% | ||

| steemboat-steve | 0 | 845,780,965 | 50% | ||

| icuz | 0 | 680,922,655 | 95% | ||

| thebluewin | 0 | 9,143,331,261 | 100% | ||

| organduo | 0 | 314,335,097,506 | 62% | ||

| onepercentbetter | 0 | 10,723,613,047 | 9% | ||

| ivansnz | 0 | 300,057,613,306 | 100% | ||

| gadrian | 0 | 6,881,756,725 | 4.54% | ||

| gogreenbuddy | 0 | 46,411,506,707 | 6.5% | ||

| chairmanlee | 0 | 7,062,936,805 | 6.5% | ||

| tresor | 0 | 11,654,516,122 | 7.24% | ||

| julialee66 | 0 | 8,215,302,489 | 6.5% | ||

| trumpman2 | 0 | 1,634,300,762 | 15% | ||

| mightynick | 0 | 1,696,299,852 | 6.5% | ||

| laputis | 0 | 41,176,989,668 | 62% | ||

| merlion | 0 | 3,383,096,001 | 9% | ||

| decepticons | 0 | 779,313,119 | 30% | ||

| sbi5 | 0 | 127,521,222,295 | 99.66% | ||

| thinkwise | 0 | 1,185,561,524 | 6.5% | ||

| lexilee | 0 | 10,796,553,979 | 6.5% | ||

| militaryphoto | 0 | 4,850,182,564 | 6.5% | ||

| yisunshin | 0 | 6,401,371,531 | 6.5% | ||

| rokarmy | 0 | 4,458,599,765 | 6.5% | ||

| roknavy | 0 | 655,205,757 | 3.25% | ||

| rokairforce | 0 | 27,431,333,803 | 3.25% | ||

| jk6276 | 0 | 795,103,066 | 10% | ||

| triptolemus | 0 | 969,877,981 | 62% | ||

| oakshieldholding | 0 | 321,646,320 | 15% | ||

| alokkumar121 | 0 | 2,171,011,918 | 0.65% | ||

| perfspots | 0 | 4,338,164,565 | 100% | ||

| memeteca | 0 | 955,033,382 | 7.24% | ||

| nonsowrites | 0 | 43,523,204,631 | 100% | ||

| cakemonster | 0 | 38,907,681,791 | 31% | ||

| elkaos | 0 | 1,780,497,001 | 15% | ||

| navyactifit | 0 | 3,245,287,255 | 6.5% | ||

| ctime | 0 | 260,194,870,395 | 4% | ||

| landshutbrauhaus | 0 | 2,830,426,527 | 100% | ||

| limka | 0 | 23,702,988 | 50% | ||

| hungrybear | 0 | 290,991,427 | 9% | ||

| hashkings | 0 | 2,966,131,399 | 1.95% | ||

| engrsayful | 0 | 6,177,225,408 | 7.8% | ||

| hungerstream | 0 | 1,021,954,446 | 50% | ||

| megavest | 0 | 2,364,969,262 | 13% | ||

| gadrian-sp | 0 | 937,278,948 | 4.54% | ||

| pearltwin | 0 | 5,215,527,816 | 6.5% | ||

| haxxdump | 0 | 114,436,649 | 10% | ||

| travelwritemoney | 0 | 3,259,511,972 | 13% | ||

| queengaga | 0 | 1,354,988,284 | 33% | ||

| hamza-sheikh | 0 | 188,540,868 | 100% | ||

| tiffin | 0 | 697,142,757 | 13% | ||

| mindtrap-leo | 0 | 952,390,062 | 33% | ||

| leo.voter | 0 | 11,824,302,182,135 | 13% | ||

| leo.curator | 0 | 2,176,928,943 | 49.6% | ||

| vxc.leo | 0 | 61,830,278 | 21% | ||

| bala-leo | 0 | 3,486,031,490 | 100% | ||

| good.game | 0 | 13,669,722,027 | 100% | ||

| learn.leo | 0 | 1,090,966,689 | 62% | ||

| babytarazkp | 0 | 2,824,866,417 | 40% | ||

| arctis | 0 | 953,805,870 | 60.76% | ||

| eloi | 0 | 986,624,806 | 61.38% | ||

| refinement | 0 | 1,034,190,021 | 62% | ||

| furtherance | 0 | 969,769,793 | 62% | ||

| beta500 | 0 | 51,669,579,406 | 62% | ||

| sbi-tokens | 0 | 1,318,183,295 | 7.97% | ||

| mk-leo-token | 0 | 132,491,063 | 100% | ||

| tomhall.pal | 0 | 48,596,406 | 100% | ||

| untersatz | 0 | 2,587,887,079 | 50% | ||

| astraeas | 0 | 664,396,431 | 62% | ||

| akpofure | 0 | 925,257,404 | 62% | ||

| chloem | 0 | 832,107,329 | 62% | ||

| leotrail | 0 | 1,892,799,092 | 62% | ||

| tonimontana.leo | 0 | 720,117,004 | 50% | ||

| tonimontana.neo | 0 | 77,448,326 | 5.61% | ||

| toni.spt | 0 | 0 | 1.61% | ||

| javb | 0 | 550,601,757 | 7.8% | ||

| snoochieboochies | 0 | 4,348,994,428 | 6.5% | ||

| autowin | 0 | 1,031,426,385 | 62% | ||

| meosleos | 0 | 1,026,377,340 | 61.38% | ||

| tariqul.bibm | 0 | 2,195,106,828 | 13% | ||

| toni.pal | 0 | 0 | 1.26% | ||

| zeusflatsak | 0 | 1,214,334,612 | 5% | ||

| sgerhart | 0 | 9,398,313,293 | 100% | ||

| leofinance | 0 | 20,651,462,474 | 13% | ||

| bnk | 0 | 9,355,257,434 | 7.24% | ||

| gradeon | 0 | 1,490,799,939 | 10% | ||

| teikn | 0 | 0 | 100% | ||

| hivelist | 0 | 94,380,021,698 | 10% | ||

| actioncats | 0 | 4,903,338,865 | 7.8% | ||

| beehivetrader | 0 | 2,018,564,984 | 6.5% | ||

| asa-raw | 0 | 936,479,780,480 | 25% | ||

| vtol79 | 0 | 346,383,162 | 100% | ||

| friendlymoose | 0 | 4,224,897,746 | 10% | ||

| leoneil.leo | 0 | 5,059,324 | 13% | ||

| thahodler | 0 | 4,653,868,703 | 100% | ||

| intacto | 0 | 27,023,302,906 | 2% | ||

| wxmark | 0 | 718,310,606 | 100% | ||

| curatorcat.leo | 0 | 2,310,916,970 | 100% | ||

| ztfo | 0 | 998,585,151 | 58.9% | ||

| jobar | 0 | 1,077,334,719 | 62% | ||

| kaef | 0 | 989,262,294 | 58.9% | ||

| gcomplex | 0 | 965,908,106 | 62% | ||

| baluthor | 0 | 618,342,989 | 62% | ||

| hanez | 0 | 1,204,696,613 | 62% | ||

| minebb | 0 | 972,928,598 | 60.14% | ||

| plasticsoul | 0 | 1,004,925,690 | 62% | ||

| scrpt | 0 | 986,573,829 | 62% | ||

| druma | 0 | 1,037,722,816 | 62% | ||

| ropehold | 0 | 980,425,359 | 62% | ||

| fitlet | 0 | 735,907,986 | 62% | ||

| strk | 0 | 952,200,189 | 62% | ||

| hemerit | 0 | 1,003,549,453 | 62% | ||

| midtrain | 0 | 1,021,642,544 | 62% | ||

| starle | 0 | 978,741,514 | 62% | ||

| thorc | 0 | 983,168,571 | 62% | ||

| basechain | 0 | 979,557,857 | 62% | ||

| flowc | 0 | 968,824,342 | 62% | ||

| psgood | 0 | 1,008,774,309 | 62% | ||

| tv-d | 0 | 971,597,451 | 62% | ||

| supersla | 0 | 964,945,973 | 62% | ||

| alorian | 0 | 973,573,538 | 62% | ||

| slat | 0 | 942,505,576 | 62% | ||

| protoleo | 0 | 933,497,548 | 62% | ||

| muski | 0 | 900,609,253 | 62% | ||

| netaterra.leo | 0 | 3,577,997,372 | 100% | ||

| twrk | 0 | 965,114,259 | 62% | ||

| dabalacks | 0 | 457,468,756 | 100% | ||

| eth2 | 0 | 969,724,313 | 62% | ||

| tslap | 0 | 988,563,905 | 62% | ||

| hodol | 0 | 873,377,714 | 62% | ||

| theco | 0 | 987,795,761 | 62% | ||

| muskland | 0 | 957,450,510 | 62% | ||

| hochismin | 0 | 993,134,009 | 62% | ||

| finleo | 0 | 960,266,889 | 62% | ||

| givup | 0 | 1,021,613,997 | 62% | ||

| etheru | 0 | 1,051,729,212 | 62% | ||

| bynd | 0 | 1,014,673,151 | 62% | ||

| elong | 0 | 1,020,382,745 | 62% | ||

| logroll | 0 | 1,037,958,524 | 62% | ||

| outperform | 0 | 1,025,301,614 | 62% | ||

| perfi | 0 | 1,016,996,877 | 62% | ||

| foreo | 0 | 1,000,871,370 | 62% | ||

| capsule | 0 | 1,026,375,750 | 62% | ||

| sn8 | 0 | 1,028,190,749 | 62% | ||

| fundament | 0 | 1,027,988,399 | 62% | ||

| ppp333 | 0 | 226,985,709 | 75% | ||

| ikaro | 0 | 4,132,573,781 | 100% | ||

| livingdigitally | 0 | 2,052,799,382 | 100% | ||

| camanda | 0 | 3,662,014,090 | 100% | ||

| index-a | 0 | 1,016,724,539 | 62% | ||

| myvest | 0 | 331,934,090 | 100% | ||

| kropak | 0 | 1,003,212,879 | 62% | ||

| bitbi | 0 | 1,016,601,965 | 62% | ||

| feelfor | 0 | 1,018,396,621 | 62% | ||

| mercador | 0 | 1,007,021,361 | 62% | ||

| bennetcerven | 0 | 59,810,776,031 | 100% | ||

| companyx | 0 | 1,030,406,265 | 62% | ||

| hallogen | 0 | 1,014,835,367 | 62% | ||

| hodldays | 0 | 1,003,389,680 | 61.38% | ||

| mandawanda | 0 | 1,027,238,878 | 62% | ||

| portfoliomargin | 0 | 1,029,790,769 | 62% | ||

| fremo | 0 | 1,008,026,441 | 62% | ||

| deliveries | 0 | 975,715,010 | 60.14% | ||

| jackedup | 0 | 967,923,404 | 60.14% | ||

| tierbtc | 0 | 986,420,118 | 60.76% | ||

| dannychain | 0 | 524,532,360 | 6.5% | ||

| cancu | 0 | 625,279,224 | 31% | ||

| hypnochain | 0 | 0 | 6.5% | ||

| compoundin | 0 | 997,636,909 | 61.38% | ||

| hive-163105 | 0 | 326,336,898 | 62% | ||

| frankjr | 0 | 1,016,837,570 | 62% | ||

| waiting8 | 0 | 979,761,594 | 60.14% | ||

| starked | 0 | 996,443,545 | 62% | ||

| mk2 | 0 | 973,366,532 | 58.9% | ||

| ghostdrive | 0 | 1,000,020,654 | 60.14% | ||

| thatbull | 0 | 1,029,418,283 | 62% | ||

| heimdalla | 0 | 979,621,530 | 60.76% | ||

| pitchleo | 0 | 1,015,619,888 | 62% | ||

| hollywoodz | 0 | 1,016,151,357 | 62% | ||

| zbh1 | 0 | 1,015,157,625 | 61.38% | ||

| blockhire | 0 | 1,016,135,374 | 62% | ||

| f82 | 0 | 1,028,150,480 | 62% | ||

| natureway | 0 | 1,036,979,165 | 62% | ||

| knowhere | 0 | 1,017,433,407 | 62% | ||

| gamor | 0 | 1,010,438,105 | 62% | ||

| dvision | 0 | 1,015,413,323 | 62% | ||

| quantumant | 0 | 1,025,934,302 | 62% | ||

| cvlwar | 0 | 1,016,683,396 | 62% | ||

| sanctum | 0 | 1,025,730,531 | 62% | ||

| challa | 0 | 998,364,544 | 62% | ||

| apeople | 0 | 1,024,647,871 | 62% | ||

| quantumblank | 0 | 1,037,139,647 | 62% | ||

| endgames | 0 | 1,126,824,320 | 62% | ||

| justbuild | 0 | 1,025,382,896 | 62% | ||

| realleader | 0 | 1,037,184,131 | 62% | ||

| retaliatorr | 0 | 488,592,479 | 100% | ||

| gohodl | 0 | 1,025,776,890 | 62% | ||

| leverup | 0 | 1,003,349,980 | 60.14% | ||

| badge-406715 | 0 | 0 | 6.5% | ||

| justcapital | 0 | 1,028,314,537 | 62% | ||

| reflecting | 0 | 1,033,497,563 | 62% | ||

| buildhedge | 0 | 1,022,940,616 | 61.38% | ||

| valchain | 0 | 369,364,347 | 50% | ||

| elongate | 0 | 1,060,968,517 | 62% | ||

| amongus | 0 | 1,043,828,365 | 62% | ||

| skylinebuds-leo | 0 | 1,813,809,636 | 100% | ||

| seevision | 0 | 1,055,545,500 | 60.76% | ||

| yellowstone | 0 | 1,101,365,288 | 62% | ||

| luiz12381074717 | 0 | 291,851,038 | 100% |

My investment portfolio is pretty modest... currently about 15% BTC, 20% Hive/HBD, 10% Hive 2nd Layer tokens, 30% stock market index funds, 25% rare stamps and paper collectibles. I'm a long term investor and generally avoid trying to predict where individual markets are heading, short term. As for investing in the collectibles field (that bit originally caught my eye) my advice is *"invest in something you're really INTO."* That way, if things head south, you still have the *hobby* enjoyment of sports cards, comic books, or whatever... otherwise you risk ending up with a big *"boat anchor"* you can't unload. Seen it happen in several collectibles industries when people started treating something as an *investment* rather than a *collectible.* =^..^= Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@curatorcat.leo/re-gniksivart-7bkmsd)

| author | curatorcat.leo |

|---|---|

| permlink | re-gniksivart-7bkmsd |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@curatorcat.leo/re-gniksivart-7bkmsd"} |

| created | 2021-02-16 00:59:06 |

| last_update | 2021-02-16 00:59:06 |

| depth | 1 |

| children | 1 |

| last_payout | 2021-02-23 00:59:06 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.240 HBD |

| curator_payout_value | 0.241 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 867 |

| author_reputation | 27,954,329,640,323 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,896,529 |

| net_rshares | 1,504,073,277,614 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| brettpullen | 0 | 1,504,073,277,614 | 100% |

Honestly, it would probably be Magic though I never really got into the game as a kid because it was "evil and demonic". I do still enjoy Pokemon and would like to eventually play that with my son, so you may have just convinced me, however, I think Magic is still king and from an investment, standpoint has the longest staying power of any of the card games to date.

| author | gniksivart |

|---|---|

| permlink | re-curatorcatleo-qolpey |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-16 02:54:33 |

| last_update | 2021-02-16 02:54:33 |

| depth | 2 |

| children | 0 |

| last_payout | 2021-02-23 02:54:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.230 HBD |

| curator_payout_value | 0.231 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 370 |

| author_reputation | 74,197,147,678,652 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,897,744 |

| net_rshares | 1,444,574,593,631 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| brettpullen | 0 | 1,444,574,593,631 | 100% |

I'm leaning a lot heavier into Bitcoin, probably 65%. I just feel that it will outperform pretty much everything over the long term. Most of my alt positions are to try and outperform bitcoin short term so I can buy more bitcoin. :-) That said, I do think LINK could easily 10x from here. Synthetix as well. Just depends on how long the current bull market lasts. Both of those feel like they'll survive long-term but...who knows? If everyone starts pulling their liquidity it could get ugly in a hurry. I also like the uncertainty of the Cosmos platform. It's certainly been growing but I don't think it has really received a lot of attention yet with it's Stargate coming online this month. There's definitely some hype but I think it will perform better than people expect and things could escalate quickly. I've got a couple of the small peripherals in that space so hopefully the launch goes well and the whole ecosystem picks up steam. Then I have some real flyers I'm trying to get big bags of, two being Hive and Leo. While I really don't see either one really reaching their full potential this bull cycle, I do think the communities will have staying power through the down times and their long-term potential into the next bull cycle could be massive. But, in the meantime, I'll just be stacking sats and trying to grow my stake here. Good luck with your bags! It's good to have a plan. Just stick to it. Failing to plan is planning to fail, right? :-) Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@dagger212/re-gniksivart-4wzeud)

| author | dagger212 |

|---|---|

| permlink | re-gniksivart-4wzeud |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@dagger212/re-gniksivart-4wzeud"} |

| created | 2021-02-16 08:24:45 |

| last_update | 2021-02-16 08:24:45 |

| depth | 1 |

| children | 4 |

| last_payout | 2021-02-23 08:24:45 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.238 HBD |

| curator_payout_value | 0.238 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 1,582 |

| author_reputation | 65,134,388,111,142 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,900,545 |

| net_rshares | 1,474,023,437,219 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| brettpullen | 0 | 1,474,023,437,219 | 100% |

I couldn't agree more. If you don't have a plan you're doomed to fail. At least if I have a plan I might not always succeed, but I won't always fail either. I couldn't agree more with Bitcoin having the best case currently for staying around the longes and the project I'm mainly focusing to accumulate the most of maybe along with Hive and of course Leo. Sounds like you have a solid plan. Mind if I ask what other "flyers" you're accumulating?

| author | gniksivart |

|---|---|

| permlink | re-dagger212-qomo3f |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-16 15:23:39 |

| last_update | 2021-02-16 15:23:39 |

| depth | 2 |

| children | 3 |

| last_payout | 2021-02-23 15:23:39 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 445 |

| author_reputation | 74,197,147,678,652 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,905,646 |

| net_rshares | 0 |

SOLVE is one. They're trying to reform the healthcare system by making the ***patient*** the center of his/her own little universe. Using the blockchain and SOLVE, they'll connect healthcare providers, insurance companies, and individual patients so that the patient will have complete access to all of his/her information and will have the ability to allow that information to be seen, used, and added to by whatever doctors they choose, wherever that happens to be. I haven't delved too deeply into it. It just sounded like something that really needs to be done. The inefficiencies of healthcare are so huge that I thought I'd "take a flyer" on buying some. It was only $.10 USD (and is still only $.16 right now) and it's very early but....there you have it. Plus, as I understand it, patients may be able to use their SOLVE tokens to pay for their healthcare in the future so....my logic, if I spend a couple hundred dollars now to get some, and it ends up working, maybe the token goes to $10 or more someday and I will basically have paid for my health insurance costs for years to come. :-) Like I said, a flyer. Worth checking out though... Another one is ORAI. They have an AI Oracle that could actually compete with LINK. Their mainnet goes live in about a week. Only a $40M market cap even though it's around $60. The tokenomics make that one attractive. They have not received much press so I think once they go live and people see what they can do, I think they'll have lots to announce and can create a nice space inside that market. LINK has a $12B market cap so my thinking is that if ORAI can grow to 5% of that its at least a 10x. And if it turns out their tech is as good as they think it is, then that brings in the fabled 100x everyone is looking for. Realistically, on a fully diluted basis, LINK is already at $31B mkt cap and ORAI is already $1.4b so....if these things continue to be linchpins for defi I don't think there's any reason both of them won't continue to grow exponentially as the entire market does the same. Who knows? Again, a flyer... The last one is QRL. Personally, I just like their discord channel. :-) I actually bought that one during the last run in 2017 and have just held it. To me, they seem like an extremely good "ledger" without a real use case. The tech is hopefully just a little ahead of its time and at some point, I'm kind of hoping they "merge" for lack of a better word, with some sort of idea that can put them on the map. Again, a flyer.... In the meantime, just trying to Stack Sats.... :-) Oh, yeah, and I've staked a little HEX too. The community is rabid so I thought it was worth a "flyer". I bought a little and staked it for the full 15 years. If it works, I'll have like 200,000 tokens at $10. If it doesn't, I'll be out $200. A true flyer. lol Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@dagger212/re-gniksivart-5zyucp)

| author | dagger212 |

|---|---|

| permlink | re-gniksivart-5zyucp |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@dagger212/re-gniksivart-5zyucp","links":["https://leofinance.io/@dagger212/re-gniksivart-5zyucp"]} |

| created | 2021-02-16 17:26:09 |

| last_update | 2021-02-16 17:30:12 |

| depth | 3 |

| children | 2 |

| last_payout | 2021-02-23 17:26:09 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 2,951 |

| author_reputation | 65,134,388,111,142 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,907,449 |

| net_rshares | 28,080,365 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tips.tracker | 0 | 28,080,365 | 1% |

Mostly Hive and gaming NFTs for me.

| author | enjar |

|---|---|

| permlink | re-gniksivart-qolj7s |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-16 00:40:42 |

| last_update | 2021-02-16 00:40:42 |

| depth | 1 |

| children | 1 |

| last_payout | 2021-02-23 00:40:42 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 36 |

| author_reputation | 1,190,589,903,636,777 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,896,339 |

| net_rshares | 0 |

Hive is definitely outperforming eth and btc right now

| author | gniksivart |

|---|---|

| permlink | re-enjar-qoljfv |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-16 00:45:30 |

| last_update | 2021-02-16 00:45:30 |

| depth | 2 |

| children | 0 |

| last_payout | 2021-02-23 00:45:30 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 54 |

| author_reputation | 74,197,147,678,652 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,896,398 |

| net_rshares | 0 |

Congratulations @gniksivart! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) : <table><tr><td><img src="https://images.hive.blog/60x70/http://hivebuzz.me/@gniksivart/upvotes.png?202102160904"></td><td>You distributed more than 50000 upvotes.<br>Your next target is to reach 51000 upvotes.</td></tr> </table> <sub>_You can view your badges on [your board](https://hivebuzz.me/@gniksivart) and compare yourself to others in the [Ranking](https://hivebuzz.me/ranking)_</sub> <sub>_If you no longer want to receive notifications, reply to this comment with the word_ `STOP`</sub> **Check out the last post from @hivebuzz:** <table><tr><td><a href="/hivebuzz/@hivebuzz/tour-update1"><img src="https://images.hive.blog/64x128/https://i.imgur.com/xecznXF.png"></a></td><td><a href="/hivebuzz/@hivebuzz/tour-update1">Hive Tour Update - Advanced posting</a></td></tr><tr><td><a href="/hivebuzz/@hivebuzz/valentine-2021"><img src="https://images.hive.blog/64x128/https://i.imgur.com/ye2hK66.png"></a></td><td><a href="/hivebuzz/@hivebuzz/valentine-2021">Valentine's day challenge - Give a badge to your beloved!</a></td></tr></table>

| author | hivebuzz |

|---|---|

| permlink | hivebuzz-notify-gniksivart-20210216t093357000z |

| category | hive-167922 |

| json_metadata | {"image":["http://hivebuzz.me/notify.t6.png"]} |

| created | 2021-02-16 09:33:57 |

| last_update | 2021-02-16 09:33:57 |

| depth | 1 |

| children | 0 |

| last_payout | 2021-02-23 09:33:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 1,189 |

| author_reputation | 370,782,173,802,426 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,901,238 |

| net_rshares | 0 |

Pretty much a two chain pony here! Bitcoin and HIVE/H-E tokens are what I'm looking at - earning interest on the BTC and having fun on the HIVE! There's some other things I'm dabbling with but nothing substantial - perhaps looking to get some more stablecoins and get some nice interest on Celsius for them! Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@nickyhavey/re-gniksivart-5k5xky)

| author | nickyhavey |

|---|---|

| permlink | re-gniksivart-5k5xky |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@nickyhavey/re-gniksivart-5k5xky"} |

| created | 2021-02-16 22:40:51 |

| last_update | 2021-02-16 22:40:51 |

| depth | 1 |

| children | 2 |

| last_payout | 2021-02-23 22:40:51 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 406 |

| author_reputation | 343,022,660,476,683 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,912,862 |

| net_rshares | 0 |

Yeah I love earning interest on my stable coins and Bitcon. For whatever reason I don't feel as guilty just holding them through the ups and downs. My main two focus is really BTC and HIVE with Eth as a quick 3rd, but everything else just really trying to flip for more BTC or USD.

| author | gniksivart |

|---|---|

| permlink | re-nickyhavey-qonaqz |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-16 23:33:00 |

| last_update | 2021-02-16 23:33:00 |

| depth | 2 |

| children | 1 |

| last_payout | 2021-02-23 23:33:00 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 281 |

| author_reputation | 74,197,147,678,652 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,913,470 |

| net_rshares | 0 |

Yeah you know the grandaddy BTC isn't going anywhere and with stablecoins...well, the price is more stable so more predictable! It makes things a little easier for accounting purposes too with having less coins to remember where you have them too!

| author | nickyhavey |

|---|---|

| permlink | re-gniksivart-qonc2j |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-17 00:01:30 |

| last_update | 2021-02-17 00:01:30 |

| depth | 3 |

| children | 0 |

| last_payout | 2021-02-24 00:01:30 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 247 |

| author_reputation | 343,022,660,476,683 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,913,819 |

| net_rshares | 0 |

https://twitter.com/GnikSivart/status/1361439225921552384

| author | poshbot |

|---|---|

| permlink | re-what-does-your-crypto-portfolio-allocation-look-like-20210215t221626z |

| category | hive-167922 |

| json_metadata | "{"app": "beem/0.24.20"}" |

| created | 2021-02-15 22:16:27 |

| last_update | 2021-02-15 22:16:27 |

| depth | 1 |

| children | 0 |

| last_payout | 2021-02-22 22:16:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 57 |

| author_reputation | 5,554,335,374,496 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,894,530 |

| net_rshares | 0 |

I like your portfolio as I believe this is one to benefit from crypto without stressing too much. Most of your holdings are in the 2 best assets for LT (ETH / BTC). You might try to get some crazy alts but that’s risky ! Good luck mate Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@vlemon/re-gniksivart-3thj6y)

| author | vlemon |

|---|---|

| permlink | re-gniksivart-3thj6y |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@vlemon/re-gniksivart-3thj6y"} |

| created | 2021-02-16 20:48:33 |

| last_update | 2021-02-16 20:48:33 |

| depth | 1 |

| children | 1 |

| last_payout | 2021-02-23 20:48:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 334 |

| author_reputation | 875,845,517,283,835 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,910,983 |

| net_rshares | 0 |

Yeah I'm looking getting some DeFi coins, just can't get myself to pull the trigger on projects so new. Don't mind the risk, but just want to make sure I'm buying at a "good price"

| author | gniksivart |

|---|---|

| permlink | re-vlemon-qonaor |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-16 23:31:39 |

| last_update | 2021-02-16 23:31:39 |

| depth | 2 |

| children | 0 |

| last_payout | 2021-02-23 23:31:42 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 182 |

| author_reputation | 74,197,147,678,652 |

| root_title | "What Does Your Crypto Portfolio Allocation Look Like?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,913,461 |

| net_rshares | 0 |

hiveblocks

hiveblocks