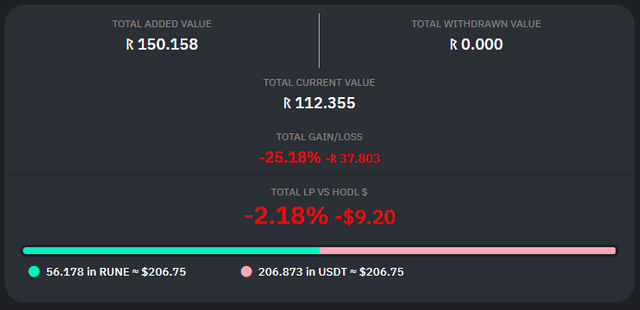

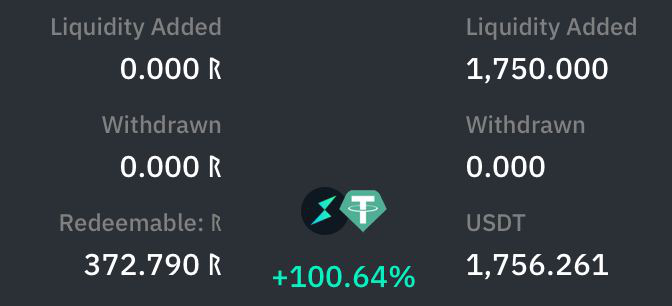

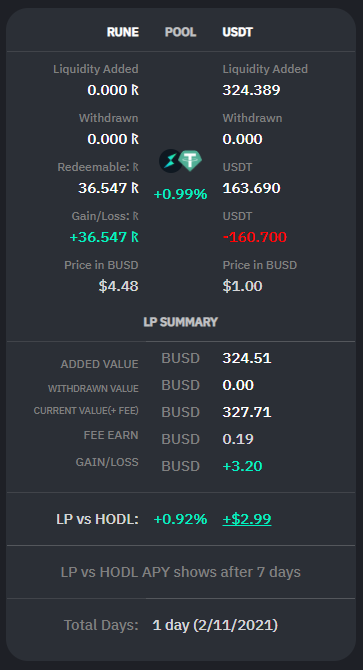

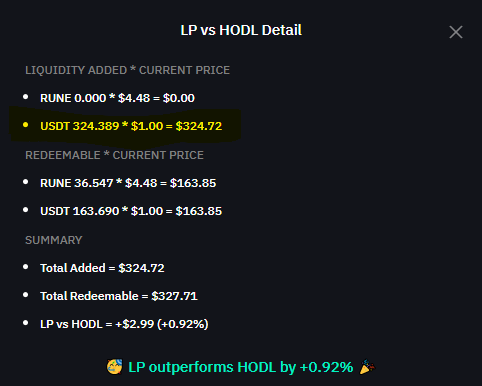

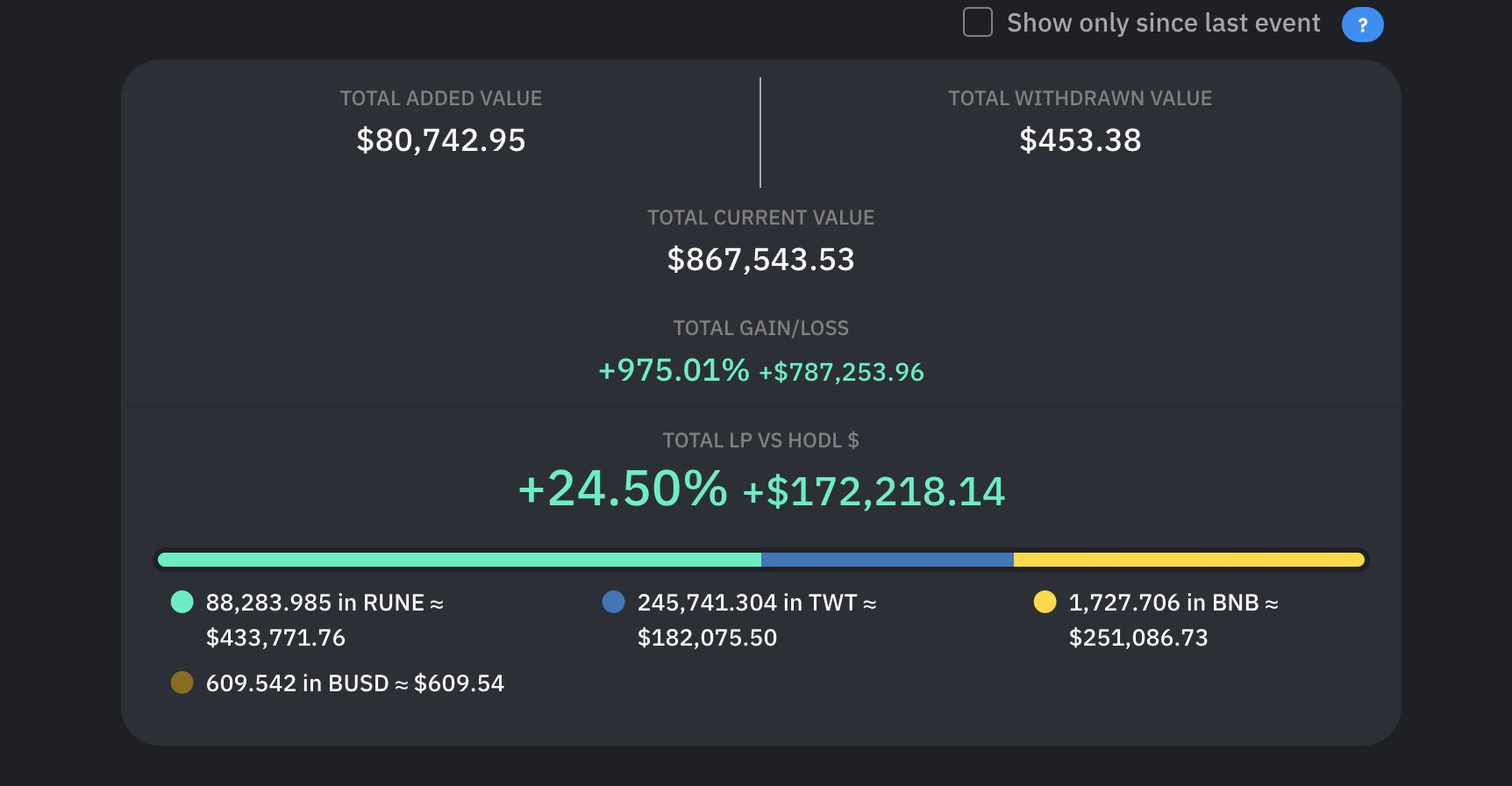

This morning I have opened up a position in the RUNE/USDT LP on Bepswap. Up until the last few days, I never imagined I would pool RUNE with USDT, fearing much Impermanent Loss. However, my thinking has shifted significantly and in this post, I'll detail why. <center> https://cdn.pixabay.com/photo/2019/03/17/08/28/rethinking-4060503_960_720.jpg </center> <center> <sub> Image Source: [Pixabay](https://pixabay.com/photos/rethinking-think-thoughts-thinking-4060503/) </sub> </center> # Learning from others. Many interested in how Thorchain LP's have been performing may have seen [this post](https://leofinance.io/@bagofincome/usdt-rune-pool-on-chaosnet-day-15-losing-some-precious-rune) by @bagofincome, and subsequent post by a Thorchain community member on Twitter, [Acrobatica](https://twitter.com/flyacro). In it, the BOI showed his stats in a USDT pool, and how much IL he was suffering. This kind of reinforced in my mind that RUNE/USDT was not a pool I wanted to be in. However, the advice given was sound, and made sense. I'd highly recommend reviewing [this tweet thread](https://twitter.com/flyacro/status/1355830014281846785) before adding to a RUNE LP. Here is how the BOI's pool position looked at the time, measured in RUNE, with this image sourced from BagofIncomes post linked above: <center>  </center> I'd be fascinated to hear back from @bagofincome as to if he made any changes to the LP position, and how it has performed since that post. # Asymmetric pooling. One great feature of Bepswap, that may be unfamiliar to people who's main LP experience is Uniswap, is Asymmetric pooling. What that means is that the UI allows you to add to a pool only the non-RUNE asset, and the pool will balance it out, effectively selling half of the asset for RUNE. This is a great facility for people that want to earn from their bags, but don't have the matching RUNE in their wallet. Any price slippage depends on the size of the stake relative to the pool depth. The other benefit to this is that it changes the unit of measurement for Impermanent Loss, which changes the psychology of the LP investment. If BOI didn't put his RUNE into the pool in equal measure with USDT, but pooled that same total value asynchronously, his "LP versus HODL" metric would show positive. Same dollar value of assets put in ($293.70) but measured as all USDT instead of half RUNE half USDT. The same USD value added, the same USD value when he took these snapshots, but a massively different "LP versus HODL" performance. Most IL is an illusion, depending on what assets you put in. # The lightbulb moment. The biggest thing that has changed my mind on a USDT pool is [this tweet](https://twitter.com/thorchain_org/status/1359308498509570048) shared by the [Thorchain](https://twitter.com/thorchain_org) account on twitter <center>  </center> In this screenshot, obviously from someone that has Asymmetrically added to the pool with all USDT, you can see that they have made back all their initial USDT investment, plus gained a bunch of "free" RUNE. Now, I dare say that this person would have pooled early in the life of this pool (a few months I think from memory) when the pool was incentivized a bit. But even so, the have, in a low risk way, doubled their money, or another way of looking at it is they have earned a whole bunch of RUNE by providing USDT liquidity. Important to keep in mind that if this person had pooled assets 50/50 (half RUNE half USDT) they would be showing a significant IL. The same USD value in, the same USD value at this point (100% gain) but an IL. IL is an illusion, it is FUD. Sometimes its real, but often it is just down to the unit of measurement. # What have I done? I freed up some funds from other places, and transferred them to my Ledger in Bep2 version. I then added them Asymmetric to the USDT/RUNE pool. <center>  </center> <center> And here is the breakdown of the "LP versus HODL" numbers: </center> <center>  </center> I'm looking to build up the position a bit, and will keep you posted. As you can see, I'm already in the green, with RUNE having moved up a bit in the few hours since I opened the position. As I have stated before, "LP versus HODL" would be negative in this metric if I had swapped half of the Tether into RUNE, and pooled it symmetrically. LP versus HODL is FUD. I hope you find this post helpful. The moral of the story is that if you already have RUNE, I'd look for a highly co-related asset to pool with. Or don't pool. Or set a target price before opening your long term pool position, once multichain launches fully (@khaleelkazi). If you want to get in, don't buy RUNE, just add your "non-RUNE' asset to the pool, and watch what happens. All of this is based on an assumption of mine that RUNE will outperform most other assets in the medium term. I could be wrong in that assumption. DYOR, Not financial advice. Thanks for reading, JK. P.S. I'll leave you with a screenshot, also shared by Thorchain, of the pool position of someone that has been in the RUNE/TWT pool (Trustwallet's token) since the early days. This is not relevant to the above discussion on Asymmetric staking, but it does show what can happen to an LP position in two assets that both perform well. Enjoy some LP porn if you will: <center>  </center> <center> Source: [This tweet thread from Thorchain](https://twitter.com/thorchain_org/status/1359457906882535425) </center> Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@jk6276/asynchronous-liquidity-pooling-on-thorchain)

| author | jk6276 |

|---|---|

| permlink | asynchronous-liquidity-pooling-on-thorchain |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","thorchain","rune","defi","liquiditypool","lp","usdt","leofinance"],"canonical_url":"https://leofinance.io/@jk6276/asynchronous-liquidity-pooling-on-thorchain","links":["https://pixabay.com/photos/rethinking-think-thoughts-thinking-4060503/","https://leofinance.io/@bagofincome/usdt-rune-pool-on-chaosnet-day-15-losing-some-precious-rune","https://twitter.com/flyacro","https://twitter.com/flyacro/status/1355830014281846785","https://twitter.com/thorchain_org/status/1359308498509570048","https://twitter.com/thorchain_org","https://twitter.com/thorchain_org/status/1359457906882535425","https://leofinance.io/@jk6276/asynchronous-liquidity-pooling-on-thorchain"],"image":["https://cdn.pixabay.com/photo/2019/03/17/08/28/rethinking-4060503_960_720.jpg","https://images.hive.blog/DQmPPigP8s2f36mkmwGgLgWoDiugnWaRaFxNdvZBdmG1xxm/image.png","https://images.hive.blog/DQmbWgUQi5CPYi6bhShSx7773dofm1emB3rubAE18E6Hppr/image.png","https://images.hive.blog/DQmWxXksX41wxHDvC8bfXLeAoygYjWxwFMqdcB8NtzsTZjY/rune%20usdt%2011feb.png","https://images.hive.blog/DQmWtQcFmw24YFe86FdNsApn6roMsWTzMmerzoRznvAreTH/usdt%20rune%20il%2011feb.png","https://images.hive.blog/DQmQzDLw4TXbntQByg1H5MR6XFqW35s8ZcyyKtcdscUQDzL/image.png"]} |

| created | 2021-02-11 00:09:18 |

| last_update | 2021-02-11 20:08:51 |

| depth | 0 |

| children | 19 |

| last_payout | 2021-02-18 00:09:18 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 7.825 HBD |

| curator_payout_value | 7.098 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 6,140 |

| author_reputation | 187,739,667,125,031 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,815,447 |

| net_rshares | 31,901,958,475,553 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| ash | 0 | 717,102,706,921 | 100% | ||

| mangou007 | 0 | 200,679,126 | 7.43% | ||

| ssjsasha | 0 | 528,391,977,316 | 100% | ||

| renovatio | 0 | 1,754,441,531 | 50% | ||

| krystle | 0 | 25,659,905,021 | 20% | ||

| deanliu | 0 | 1,743,384,854,711 | 50% | ||

| alz190 | 0 | 581,897,569 | 15% | ||

| bert0 | 0 | 9,938,160,995 | 7.43% | ||

| themonetaryfew | 0 | 1,760,819,886 | 100% | ||

| uwelang | 0 | 180,241,709,462 | 20% | ||

| r0nd0n | 0 | 28,743,918,085 | 35% | ||

| dylanhobalart | 0 | 187,059,778,144 | 68% | ||

| gamer00 | 0 | 56,932,090,499 | 5% | ||

| ahmadmanga | 0 | 1,950,673,660 | 14% | ||

| steemitboard | 0 | 10,942,774,968 | 3% | ||

| ambyr00 | 0 | 1,049,673,662 | 0.75% | ||

| dickturpin | 0 | 3,404,338,526 | 10% | ||

| tbnfl4sun | 0 | 15,505,138,592 | 50% | ||

| thatsweeneyguy | 0 | 2,207,384,940 | 10% | ||

| gamersclassified | 0 | 12,374,983,218 | 7.5% | ||

| iansart | 0 | 150,408,166,148 | 100% | ||

| papadimos | 0 | 5,061,206,781 | 40% | ||

| mikepedro | 0 | 1,734,482,142 | 25% | ||

| gohba.handcrafts | 0 | 6,407,249,003 | 7% | ||

| urs | 0 | 30,663,948,599 | 50% | ||

| scooter77 | 0 | 1,495,815,419 | 25% | ||

| stortebeker | 0 | 79,779,251,632 | 66% | ||

| artsygoddess | 0 | 581,743,660 | 3% | ||

| bearone | 0 | 48,913,282,677 | 15% | ||

| teamaustralia | 0 | 10,336,293,247 | 50% | ||

| centerlink | 0 | 227,971,625,409 | 50% | ||

| liuke96player | 0 | 19,602,885,624 | 100% | ||

| forexbrokr | 0 | 29,780,809,214 | 100% | ||

| paasz | 0 | 68,232,540,953 | 100% | ||

| adambarratt | 0 | 4,143,415,770 | 30% | ||

| hope-on-fire | 0 | 216,378,659,624 | 26% | ||

| shebe | 0 | 12,806,692,373 | 100% | ||

| khalil319 | 0 | 1,282,707,921 | 34.5% | ||

| onethousandwords | 0 | 828,327,489 | 25% | ||

| shanibeer | 0 | 326,683,714,592 | 25% | ||

| chrisdavidphoto | 0 | 8,658,148,133 | 15% | ||

| rehan12 | 0 | 9,650,438,756 | 5% | ||

| marketinggeek | 0 | 540,754,341 | 20% | ||

| mrsquiggle | 0 | 65,978,933,493 | 33% | ||

| bahagia-arbi | 0 | 2,174,708,722 | 10% | ||

| webcoop | 0 | 3,328,031,420 | 25% | ||

| saltiberra | 0 | 1,158,881,149 | 10% | ||

| holbein81 | 0 | 6,939,322,135 | 30% | ||

| voxmonkey | 0 | 615,299,326 | 100% | ||

| masterwu | 0 | 1,709,161,157 | 15% | ||

| roleerob | 0 | 42,823,802,099 | 10% | ||

| yabapmatt | 0 | 2,912,508,699,540 | 100% | ||

| rodent | 0 | 5,548,323,291 | 27% | ||

| khaleelkazi | 0 | 86,763,532,977 | 69% | ||

| flamingirl | 0 | 1,975,921,936 | 7.43% | ||

| mrhill | 0 | 19,534,339,075 | 100% | ||

| new-world-steem | 0 | 31,999,037,740 | 23% | ||

| thevillan | 0 | 1,533,647,714 | 2.5% | ||

| dashroom | 0 | 1,532,575,270 | 80% | ||

| not-a-bird | 0 | 4,498,398,960 | 20% | ||

| sgt-dan | 0 | 175,569,592,883 | 100% | ||

| tpkidkai | 0 | 10,564,501,473 | 15% | ||

| cryptwo | 0 | 5,160,155,229 | 45% | ||

| funtraveller | 0 | 5,166,374,348 | 99% | ||

| funt33 | 0 | 693,764,428 | 100% | ||

| steembasicincome | 0 | 748,695,667,522 | 100% | ||

| conradsuperb | 0 | 1,241,231,102 | 20% | ||

| jordan.white306 | 0 | 556,376,835 | 25% | ||

| hetty-rowan | 0 | 45,004,375,544 | 100% | ||

| not-a-gamer | 0 | 526,887,704 | 40% | ||

| bengy | 0 | 1,812,085,319 | 1.5% | ||

| tryskele | 0 | 3,686,568,577 | 4% | ||

| bec-on-the-block | 0 | 1,383,980,077 | 25% | ||

| steemboat-steve | 0 | 931,269,438 | 50% | ||

| terrylovejoy | 0 | 8,562,511,656 | 20% | ||

| trincowski | 0 | 98,397,325,401 | 20% | ||

| investprosper | 0 | 859,861,556 | 50% | ||

| letshodl | 0 | 601,727,904 | 100% | ||

| penderis | 0 | 89,950,018,114 | 100% | ||

| anikys3reasure | 0 | 3,380,616,098 | 50% | ||

| thebluewin | 0 | 9,956,221,086 | 100% | ||

| auminda | 0 | 2,921,467,432 | 100% | ||

| positiveninja | 0 | 8,207,594,617 | 25% | ||

| jonmylestan | 0 | 6,201,483,825 | 100% | ||

| evlachsblog | 0 | 6,628,467,306 | 25% | ||

| scottshots | 0 | 3,260,053,438 | 4% | ||

| vcclothing | 0 | 30,091,423,999 | 40% | ||

| sapphic | 0 | 4,940,797,489 | 25% | ||

| supersoju | 0 | 17,488,156,606 | 10% | ||

| sbi2 | 0 | 422,946,309,387 | 100% | ||

| bobaphet | 0 | 4,787,709,205 | 10% | ||

| melbourneswest | 0 | 43,937,924,902 | 50% | ||

| terrybogan | 0 | 3,421,275,713 | 15% | ||

| gadrian | 0 | 10,745,674,474 | 7% | ||

| cryptoslicex | 0 | 666,375,105 | 25% | ||

| gogreenbuddy | 0 | 65,835,504,985 | 10% | ||

| jersteemit | 0 | 649,395,295 | 30% | ||

| rollandthomas | 0 | 2,145,933,827 | 2% | ||

| tresor | 0 | 11,945,851,557 | 7.43% | ||

| jadnven | 0 | 2,538,735,014 | 100% | ||

| trumpman2 | 0 | 4,314,108,564 | 40% | ||

| lifeofryan | 0 | 4,163,954,601 | 25% | ||

| sbi3 | 0 | 279,962,329,760 | 100% | ||

| sbi4 | 0 | 181,009,206,939 | 100% | ||

| tronsformer | 0 | 947,223,757 | 35% | ||

| nateaguila | 0 | 312,483,440,441 | 8% | ||

| oldmans | 0 | 8,859,033,815 | 7% | ||

| niouton | 0 | 5,407,314,397 | 20% | ||

| sbi5 | 0 | 156,780,792,086 | 100% | ||

| cryptocopy | 0 | 9,899,532,165 | 100% | ||

| cryptojiang | 0 | 1,310,139,445 | 50% | ||

| sbi6 | 0 | 142,823,757,041 | 100% | ||

| deividluchi | 0 | 1,150,044,961 | 25% | ||

| adeljose | 0 | 578,575,413 | 100% | ||

| vegemitekid | 0 | 8,894,872,784 | 10% | ||

| gohalber | 0 | 5,471,732,041 | 40% | ||

| sbi7 | 0 | 140,184,763,402 | 100% | ||

| luppers | 0 | 976,260,927 | 1.36% | ||

| triptolemus | 0 | 972,728,210 | 69% | ||

| voxmortis | 0 | 871,056,642 | 0.5% | ||

| dcooperation | 0 | 7,418,429,332 | 5% | ||

| shepherd-stories | 0 | 1,637,985,949 | 100% | ||

| crypto.charity | 0 | 569,559,476 | 50% | ||

| oakshieldholding | 0 | 670,547,892 | 30% | ||

| alokkumar121 | 0 | 3,255,208,874 | 1% | ||

| canna-collective | 0 | 1,922,059,151 | 6% | ||

| sbi8 | 0 | 135,025,994,035 | 100% | ||

| sbi9 | 0 | 70,982,981,567 | 100% | ||

| luueetang | 0 | 1,327,802,528 | 100% | ||

| memeteca | 0 | 982,705,001 | 7.43% | ||

| alphaccino.art | 0 | 18,657,599,816 | 25% | ||

| michealb | 0 | 160,177,010,018 | 100% | ||

| sbi10 | 0 | 47,061,815,441 | 100% | ||

| apofis | 0 | 1,031,234,301 | 100% | ||

| incinboost | 0 | 25,161,929,246 | 36.19% | ||

| smokingfit | 0 | 4,976,922,681 | 100% | ||

| khan.dayyanz | 0 | 917,182,979 | 5% | ||

| coriolis | 0 | 10,559,104,973 | 100% | ||

| crowdwitness | 0 | 2,529,036,350 | 5% | ||

| tulwave | 0 | 621,825,588 | 10% | ||

| landshutbrauhaus | 0 | 2,680,152,093 | 100% | ||

| ava77 | 0 | 10,781,950,908 | 100% | ||

| hashkings | 0 | 4,237,769,120 | 3% | ||

| engrsayful | 0 | 10,664,354,037 | 12% | ||

| d-company | 0 | 8,850,948,401 | 100% | ||

| krunkypuram | 0 | 597,412,613 | 100% | ||

| megavest | 0 | 3,712,514,514 | 20% | ||

| gadrian-sp | 0 | 1,439,292,205 | 7% | ||

| leedsunited | 0 | 5,726,492,167 | 100% | ||

| haxxdump | 0 | 114,529,345 | 10% | ||

| mitty | 0 | 2,915,984,846 | 20% | ||

| travelwritemoney | 0 | 4,799,517,363 | 20% | ||

| dalz1 | 0 | 1,271,351,868 | 100% | ||

| hamza-sheikh | 0 | 157,070,905 | 100% | ||

| tiffin | 0 | 1,051,572,964 | 20% | ||

| reggaesteem | 0 | 10,497,988,012 | 85% | ||

| leovoter | 0 | 822,807,764 | 35% | ||

| leo.voter | 0 | 17,601,655,526,137 | 20% | ||

| leo.curator | 0 | 2,333,018,374 | 55.2% | ||

| onealfa.leo | 0 | 460,485,440 | 2.73% | ||

| sports.central | 0 | 1,981,499,031 | 33% | ||

| no-advice | 0 | 2,979,655,187 | 100% | ||

| vxc.leo | 0 | 112,647,416 | 30% | ||

| bala-leo | 0 | 658,268,652 | 20% | ||

| good.game | 0 | 14,884,040,666 | 100% | ||

| learn.leo | 0 | 1,126,985,687 | 69% | ||

| babytarazkp | 0 | 2,290,901,729 | 40% | ||

| arctis | 0 | 975,564,507 | 67.62% | ||

| taskmaster4450le | 0 | 65,861,126,380 | 30% | ||

| eloi | 0 | 995,947,664 | 68.31% | ||

| refinement | 0 | 1,052,886,815 | 69% | ||

| furtherance | 0 | 1,018,106,603 | 68.31% | ||

| revise.leo | 0 | 4,977,452,798 | 100% | ||

| sbi-tokens | 0 | 7,069,731,340 | 35.19% | ||

| logiczombie | 0 | 198,338,610,210 | 27.77% | ||

| bastionpm | 0 | 646,385,989 | 20% | ||

| mk-leo-token | 0 | 182,946,018 | 100% | ||

| vipservice | 0 | 45,439,743,270 | 6% | ||

| astraeas | 0 | 708,319,232 | 69% | ||

| akpofure | 0 | 1,055,518,866 | 69% | ||

| chloem | 0 | 846,892,725 | 69% | ||

| leotrail | 0 | 1,922,252,562 | 69% | ||

| tonimontana.leo | 0 | 759,843,573 | 50% | ||

| oelgniksivart | 0 | 1,393,784,917 | 40% | ||

| javb | 0 | 867,460,447 | 12% | ||

| snoochieboochies | 0 | 6,562,694,934 | 10% | ||

| autowin | 0 | 1,037,840,463 | 69% | ||

| meosleos | 0 | 1,039,600,290 | 68.31% | ||

| hatta.jahm | 0 | 678,935,800 | 85% | ||

| tariqul.bibm | 0 | 3,691,460,634 | 20% | ||

| rehan.blog | 0 | 1,054,904,081 | 51% | ||

| onestop | 0 | 3,039,839,110 | 10% | ||

| xxxxxxxxxxxxxxxx | 0 | 8,495,222,116 | 100% | ||

| vxn666 | 0 | 1,143,790,118 | 100% | ||

| leofinance | 0 | 20,697,983,001 | 20% | ||

| beewolf | 0 | 95,958,081 | 45% | ||

| reggaejahm | 0 | 392,126,872,785 | 100% | ||

| creators-voter | 0 | 0 | 2.04% | ||

| bnk | 0 | 9,583,274,155 | 7.43% | ||

| babalor | 0 | 2,121,526,309 | 100% | ||

| globalcurrencies | 0 | 15,308,024,308 | 15% | ||

| localgrower | 0 | 4,933,513,468 | 6% | ||

| rmsadkri | 0 | 15,364,457,486 | 31% | ||

| actioncats | 0 | 7,711,671,256 | 12% | ||

| nautilus-up | 0 | 1,476,765,674,986 | 20% | ||

| beehivetrader | 0 | 3,041,312,010 | 10% | ||

| deadswitch | 0 | 1,076,157,521 | 30% | ||

| vtol79 | 0 | 492,228,681 | 100% | ||

| leoneil.leo | 0 | 33,504,560 | 20% | ||

| corporateay | 0 | 1,254,938,187 | 100% | ||

| bepresent | 0 | 959,512,403 | 100% | ||

| jobar | 0 | 1,102,537,249 | 69% | ||

| kaef | 0 | 1,588,366,145 | 100% | ||

| resiliencia.leo | 0 | 2,743,506,693 | 100% | ||

| gcomplex | 0 | 1,475,620,912 | 100% | ||

| baluthor | 0 | 672,448,157 | 69% | ||

| hanez | 0 | 1,223,198,523 | 69% | ||

| minebb | 0 | 986,708,118 | 66.93% | ||

| plasticsoul | 0 | 1,032,788,171 | 69% | ||

| scrpt | 0 | 1,497,498,880 | 100% | ||

| gungunkrishu.leo | 0 | 2,914,438,899 | 100% | ||

| tin.aung.soe | 0 | 17,943,850,195 | 36% | ||

| druma | 0 | 1,051,032,501 | 69% | ||

| ropehold | 0 | 989,455,239 | 69% | ||

| fitlet | 0 | 744,412,487 | 69% | ||

| tokenx | 0 | 1,295,332,183 | 100% | ||

| strk | 0 | 968,263,129 | 69% | ||

| hemerit | 0 | 1,027,249,024 | 69% | ||

| midtrain | 0 | 1,007,614,042 | 69% | ||

| starle | 0 | 994,637,388 | 69% | ||

| thorc | 0 | 979,119,427 | 69% | ||

| basechain | 0 | 976,272,181 | 69% | ||

| flowc | 0 | 980,604,703 | 69% | ||

| psgood | 0 | 1,082,650,426 | 69% | ||

| tv-d | 0 | 977,209,719 | 69% | ||

| supersla | 0 | 971,235,336 | 69% | ||

| alorian | 0 | 979,919,391 | 69% | ||

| slat | 0 | 959,752,873 | 69% | ||

| protoleo | 0 | 1,433,987,398 | 100% | ||

| muski | 0 | 1,383,566,869 | 100% | ||

| netaterra.leo | 0 | 2,846,143,264 | 100% | ||

| twrk | 0 | 1,495,281,871 | 100% | ||

| nathen007.leo | 0 | 0 | 100% | ||

| eth2 | 0 | 1,483,037,149 | 100% | ||

| lbi-token | 0 | 105,942,138,180 | 30% | ||

| tslap | 0 | 1,517,552,946 | 100% | ||

| hodol | 0 | 950,512,050 | 69% | ||

| banko | 0 | 34,632,639,887 | 25% | ||

| theco | 0 | 1,489,135,937 | 100% | ||

| academialibertad | 0 | 3,451,695,702 | 100% | ||

| emrebeyler.leo | 0 | 1,508,824,731 | 100% | ||

| hochismin | 0 | 1,490,047,232 | 100% | ||

| finleo | 0 | 1,445,743,547 | 100% | ||

| givup | 0 | 1,032,896,763 | 69% | ||

| etheru | 0 | 1,043,643,712 | 69% | ||

| bynd | 0 | 1,548,318,942 | 100% | ||

| elong | 0 | 1,031,665,116 | 69% | ||

| logroll | 0 | 1,056,695,799 | 69% | ||

| outperform | 0 | 1,045,179,305 | 69% | ||

| perfi | 0 | 1,031,975,644 | 69% | ||

| foreo | 0 | 1,544,770,574 | 100% | ||

| capsule | 0 | 1,046,220,930 | 69% | ||

| sn8 | 0 | 1,039,755,785 | 69% | ||

| fundament | 0 | 1,039,536,255 | 69% | ||

| ikaro | 0 | 4,839,393,828 | 100% | ||

| index-a | 0 | 1,036,192,171 | 69% | ||

| myvest | 0 | 315,656,592 | 100% | ||

| kropak | 0 | 1,017,488,112 | 69% | ||

| bitbi | 0 | 1,028,041,366 | 69% | ||

| feelfor | 0 | 1,028,419,811 | 69% | ||

| shurbertum | 0 | 87,859,910 | 20% | ||

| mercador | 0 | 1,030,747,267 | 69% | ||

| companyx | 0 | 1,043,556,705 | 69% | ||

| crypto619 | 0 | 1,118,481,065 | 100% | ||

| hallogen | 0 | 1,039,252,565 | 69% | ||

| hodldays | 0 | 1,544,914,090 | 100% | ||

| mandawanda | 0 | 1,041,139,368 | 69% | ||

| portfoliomargin | 0 | 1,042,933,224 | 69% | ||

| fremo | 0 | 1,031,776,473 | 69% | ||

| deliveries | 0 | 1,529,016,690 | 100% | ||

| jackedup | 0 | 981,395,750 | 66.93% | ||

| tierbtc | 0 | 1,539,486,489 | 100% | ||

| mephistophenes | 0 | 931,191,779 | 100% | ||

| dannychain | 0 | 848,032,290 | 10% | ||

| cancu | 0 | 709,264,006 | 34.5% | ||

| hypnochain | 0 | 71,482,509 | 10% | ||

| compoundin | 0 | 1,535,026,191 | 100% | ||

| frankjr | 0 | 1,035,742,825 | 69% | ||

| waiting8 | 0 | 1,560,860,774 | 100% | ||

| starked | 0 | 1,010,284,524 | 69% | ||

| mk2 | 0 | 1,593,396,218 | 100% | ||

| ghostdrive | 0 | 1,590,225,888 | 100% | ||

| thatbull | 0 | 1,037,913,955 | 69% | ||

| heimdalla | 0 | 993,000,518 | 67.62% | ||

| pitchleo | 0 | 1,035,111,612 | 69% | ||

| hollywoodz | 0 | 1,028,806,539 | 69% | ||

| zbh1 | 0 | 1,035,625,591 | 68.31% | ||

| blockhire | 0 | 1,031,308,724 | 69% | ||

| f82 | 0 | 1,034,596,418 | 69% | ||

| natureway | 0 | 1,048,080,204 | 69% | ||

| knowhere | 0 | 1,032,460,742 | 69% | ||

| gamor | 0 | 1,025,366,252 | 69% | ||

| dvision | 0 | 1,026,632,687 | 69% | ||

| quantumant | 0 | 1,036,214,636 | 69% | ||

| cvlwar | 0 | 1,027,919,340 | 69% | ||

| sanctum | 0 | 1,036,009,513 | 69% | ||

| challa | 0 | 1,011,741,615 | 69% | ||

| apeople | 0 | 1,035,356,775 | 69% | ||

| quantumblank | 0 | 1,054,574,919 | 69% | ||

| endgames | 0 | 1,175,097,443 | 69% | ||

| justbuild | 0 | 1,049,025,100 | 69% | ||

| realleader | 0 | 1,098,468,158 | 69% | ||

| gohodl | 0 | 1,089,015,294 | 69% | ||

| leverup | 0 | 1,660,796,703 | 100% | ||

| vikter74 | 0 | 287,087,753 | 100% | ||

| justcapital | 0 | 1,107,575,692 | 69% | ||

| reflecting | 0 | 1,179,114,978 | 69% | ||

| buildhedge | 0 | 1,905,387,453 | 100% | ||

| valchain | 0 | 408,301,375 | 100% |

THORChain has a bright future in my opinion. Don't get discouraged by some red numbers, LP is not a short term strategy usually :) Recently posted about my rune LP stats if you want to check them out Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@ash/re-jk6276-4d4csm)

| author | ash |

|---|---|

| permlink | re-jk6276-4d4csm |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@ash/re-jk6276-4d4csm"} |

| created | 2021-02-12 16:55:33 |

| last_update | 2021-02-12 16:55:33 |

| depth | 1 |

| children | 1 |

| last_payout | 2021-02-19 16:55:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 288 |

| author_reputation | 286,803,743,324,398 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,841,827 |

| net_rshares | 333,787,399 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| jk6276 | 0 | 333,787,399 | 4% |

You are right, LP should be long term. I'm only looking short term for now, as I plan to rebuild my mix of RUNE pools completely once multichain launches. Then my time horizon changes and I look very very long term and ignore IL. I saw your post - everyone that jumped in the TWT pool has been killing it. Once I rebuild, I'll be in the major coins native pools (plus WLEO when it happens) with a 5 + year time frame. Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@jk6276/re-ash-5nmjlr)

| author | jk6276 |

|---|---|

| permlink | re-ash-5nmjlr |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@jk6276/re-ash-5nmjlr"} |

| created | 2021-02-12 20:45:21 |

| last_update | 2021-02-12 20:45:21 |

| depth | 2 |

| children | 0 |

| last_payout | 2021-02-19 20:45:21 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 513 |

| author_reputation | 187,739,667,125,031 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,845,644 |

| net_rshares | 0 |

Very interesting! Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@darkflame/re-jk6276-6eeljn)

| author | darkflame |

|---|---|

| permlink | re-jk6276-6eeljn |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@darkflame/re-jk6276-6eeljn"} |

| created | 2021-04-13 23:12:51 |

| last_update | 2021-04-13 23:12:51 |

| depth | 1 |

| children | 0 |

| last_payout | 2021-04-20 23:12:51 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 111 |

| author_reputation | 92,095,444,504,112 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 103,029,849 |

| net_rshares | 0 |

I'm sorry in advance if this is a stupid question. :) But are fees on Thorchain the same or comparable to gas fees on Ethereum?

| author | gadrian |

|---|---|

| permlink | re-jk6276-qoevzq |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-12 10:33:27 |

| last_update | 2021-02-12 10:33:27 |

| depth | 1 |

| children | 5 |

| last_payout | 2021-02-19 10:33:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 128 |

| author_reputation | 642,831,013,067,672 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,836,728 |

| net_rshares | 334,073,320 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| jk6276 | 0 | 334,073,320 | 4% |

Not a silly question at all. The fees (in terms of gas) currently on Thorchain are almost insignificant in comparison to ETH. It currently (for a few more weeks) runs on Binance chain, so you need a small amount of BNB (0.1 is plenty for numerous transactions) to interact. I believe it will be a similar situation once multichain launches, but then it will depend on which chain you are interacting with. Pooling into an ETH/RUNE pool would be more expensive than a BNB/RUNE pool as ETH fees are higher than Binance chain. Does all that make sense? Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@jk6276/re-gadrian-6op5na)

| author | jk6276 |

|---|---|

| permlink | re-gadrian-6op5na |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@jk6276/re-gadrian-6op5na"} |

| created | 2021-02-12 10:59:15 |

| last_update | 2021-02-12 10:59:15 |

| depth | 2 |

| children | 4 |

| last_payout | 2021-02-19 10:59:15 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 646 |

| author_reputation | 187,739,667,125,031 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,837,038 |

| net_rshares | 0 |

Yup, it makes sense. How about a pool like RUNE/USDT? Does it have Binance chain fees or Ethereum fees? And for DAI, if there is such a pool with RUNE, I suppose we are talking about gas fees, since it runs as a smart contract on Ethereum? Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@gadrian/re-jk6276-5gaxr4)

| author | gadrian |

|---|---|

| permlink | re-jk6276-5gaxr4 |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@gadrian/re-jk6276-5gaxr4","links":["https://leofinance.io/@gadrian/re-jk6276-5gaxr4"]} |

| created | 2021-02-12 12:37:36 |

| last_update | 2021-02-12 12:40:03 |

| depth | 3 |

| children | 3 |

| last_payout | 2021-02-19 12:37:36 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 332 |

| author_reputation | 642,831,013,067,672 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,838,019 |

| net_rshares | 0 |

I’m considering a playful attempt at this but isn’t asymmetric pooling with 100% USDT the same as buying 50% RUNE and pooling? It’s just the UI showing you 2 different metrics depending on how you entered the pool. So if RUNE goes up, your numbers will stay green when going asymmetric in this way (since your basically just buying rune with 50% of your usdt). This is how it seems to me. Maybe I’m missing something though. Not pooling has become a busy thing for me.. I need to set aside some time and just do something small to see where it takes me Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@khaleelkazi/re-jk6276-75dvua)

| author | khaleelkazi |

|---|---|

| permlink | re-jk6276-75dvua |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@khaleelkazi/re-jk6276-75dvua"} |

| created | 2021-02-16 03:46:03 |

| last_update | 2021-02-16 03:46:03 |

| depth | 1 |

| children | 1 |

| last_payout | 2021-02-23 03:46:03 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 651 |

| author_reputation | 2,582,998,310,235,749 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,898,186 |

| net_rshares | 0 |

Yes it's a mind trick more than anything, and depends on what assets you have. If you have $1000 to put in, the outcome will be the same whether you put 500/500 rune/usdt or 1000 usdt in, but the calculation will show different IL numbers. LPing with a stable is a conservative play on RUNE. The upside is less than hodling RUNE only, but the downside is lower. Fees coming into the pool (USDT pool does very well for fees) gradually increase ROI over time.

| author | jk6276 |

|---|---|

| permlink | re-khaleelkazi-qon3b4 |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-16 20:52:18 |

| last_update | 2021-02-16 20:52:18 |

| depth | 2 |

| children | 0 |

| last_payout | 2021-02-23 20:52:18 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 466 |

| author_reputation | 187,739,667,125,031 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,911,045 |

| net_rshares | 14,890,472,263 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| khaleelkazi | 0 | 14,510,829,187 | 10% | ||

| leovoter | 0 | 15,320,395 | 2.2% | ||

| onealfa.leo | 0 | 364,322,681 | 2.2% |

https://twitter.com/JunYu86396810/status/1369843944293470208

| author | poshbot |

|---|---|

| permlink | re-asynchronous-liquidity-pooling-on-thorchain-20210311t025347z |

| category | hive-167922 |

| json_metadata | "{"app": "beem/0.24.20"}" |

| created | 2021-03-11 02:53:48 |

| last_update | 2021-03-11 02:53:48 |

| depth | 1 |

| children | 0 |

| last_payout | 2021-03-18 02:53:48 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 60 |

| author_reputation | 5,554,335,374,496 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 102,299,445 |

| net_rshares | 0 |

I've just been looking into this myself. Dyou know if I can get this to work with Metamask or Trezor, I REALLY don't want to have to kick start my old ledger, I can't stand it! I think I might have just found somewhere to dump my damn crypterium bags for a while! Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@revise.leo/re-jk6276-2ued5h)

| author | revise.leo |

|---|---|

| permlink | re-jk6276-2ued5h |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@revise.leo/re-jk6276-2ued5h"} |

| created | 2021-02-13 19:53:21 |

| last_update | 2021-02-13 19:53:21 |

| depth | 1 |

| children | 2 |

| last_payout | 2021-02-20 19:53:21 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 361 |

| author_reputation | 46,990,624,125,264 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,860,158 |

| net_rshares | 0 |

Metamask - no. Trezor - I'm not certain but don't think so. Ledger - works. Trustwallet - Mobile App that's reasonably easy to use.

| author | jk6276 |

|---|---|

| permlink | re-reviseleo-qon3ea |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.01.3"} |

| created | 2021-02-16 20:54:09 |

| last_update | 2021-02-16 20:54:09 |

| depth | 2 |

| children | 1 |

| last_payout | 2021-02-23 20:54:09 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 131 |

| author_reputation | 187,739,667,125,031 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,911,074 |

| net_rshares | 476,968,857 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| revise.leo | 0 | 476,968,857 | 11% |

I'm in with Trust Wallet, downloaded it especially! Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@revise.leo/re-jk6276-24fqvx)

| author | revise.leo |

|---|---|

| permlink | re-jk6276-24fqvx |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@revise.leo/re-jk6276-24fqvx"} |

| created | 2021-02-16 23:00:18 |

| last_update | 2021-02-16 23:00:18 |

| depth | 3 |

| children | 0 |

| last_payout | 2021-02-23 23:00:18 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 147 |

| author_reputation | 46,990,624,125,264 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,913,088 |

| net_rshares | 0 |

Thanks for sharing JK. Have I got this right - if you stake in a synchronous pool, you are speculating that the trading fees and incentives (if any) you earn will be larger than the IL you will incur? Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@tradewatchblog/re-jk6276-5mfn9b)

| author | tradewatchblog |

|---|---|

| permlink | re-jk6276-5mfn9b |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@tradewatchblog/re-jk6276-5mfn9b"} |

| created | 2021-02-11 06:34:33 |

| last_update | 2021-02-11 06:34:33 |

| depth | 1 |

| children | 3 |

| last_payout | 2021-02-18 06:34:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 300 |

| author_reputation | 3,532,607,200,348 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,818,708 |

| net_rshares | 430,089,748 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| jk6276 | 0 | 430,089,748 | 5% |

Putting in Symmetrically - 50/50 of each asset - is best if you are bullish on both assets, and hope fees/incentives outweigh IL. Asymmetric works if your expect RUNE to perform better than the other asset in the pair. Essentially you are right. * Edited answer to correct my terminology. Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@jk6276/re-tradewatchblog-21fsgn)

| author | jk6276 |

|---|---|

| permlink | re-tradewatchblog-21fsgn |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@jk6276/re-tradewatchblog-21fsgn","links":["https://leofinance.io/@jk6276/re-tradewatchblog-21fsgn"]} |

| created | 2021-02-11 07:52:33 |

| last_update | 2021-02-11 20:45:54 |

| depth | 2 |

| children | 2 |

| last_payout | 2021-02-18 07:52:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 392 |

| author_reputation | 187,739,667,125,031 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,819,308 |

| net_rshares | 4,004,789,363 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tradewatchblog | 0 | 4,004,789,363 | 100% |

Thanks JK. So thinking of something like Pancake Swap, your risk boils down to potential capital losses on the assets you're staking + impermanent loss? The farm yields on LP tokens there seem almost too good to be true, far exceed risk of IL, is there any risk there you can see? From what I gather the yield just comes from CAKE inflation rather than them putting your tokens at further risk.

| author | tradewatchblog |

|---|---|

| permlink | qoe0gg |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2021-02-11 23:12:18 |

| last_update | 2021-02-11 23:12:18 |

| depth | 3 |

| children | 1 |

| last_payout | 2021-02-18 23:12:18 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 399 |

| author_reputation | 3,532,607,200,348 |

| root_title | "The benefits of Asymmetric Liquidity Pooling on Thorchain." |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 101,829,972 |

| net_rshares | 0 |

hiveblocks

hiveblocks