**Introduction:**

Lending and borrowing has been the oldest tradition seen in the financial world. As the newer generation kicked in, this tradition got more popularized secure and validated with the invent of corporate banking sector. This changed the entire face of the services of the banking and financial institutions thereby creating a niche for the investors and people who could not help themselves during financial emergencies. But as correctly said corruption is a tree whose branches are of an immeasurable length spreading everywhere, even this sector fell in the hands of middlemen and brokers which eventually made the scenario more and more worse.Today it's a well-known fact that the loan marketplace is full of incidents where the giant corporate and business house have an easy way, while a common man has to literally struggle to utilize such services. The chain of intermediaries in the banking and financial services have created a vicious cycle of corruption which is exposed from time to time but yet no alternative is guaranteed.

**The Solution to the Problem!!**

TokenLend is an innovative idea which has revolutionized the borrowing and lending sector via a service platform which is based on the blockchain technology.This platform facilitates its users by removing the uncertainties that come tagged along to the small investors by helping them build a secured loan based investment portfolio that delivers a competitive, predictable and transparent solution.One of the major goal of this startup is to build a powerful and reliable ecosystem that will offer a full fund loan service to both parties involved.

TokenLend has made it safe secure and much easier by using Blockchain technology so that investors and inexperienced newbies bypasses the bureaucratic traps and traditional banking services which are complicated and exhausting. TokenLend platform reduces and deletes distances and territorial boundaries so that users can freely invest on a global scale.

This particular platform is secure because it essentially exhibits an inventory of carefully selected pre-approved secured loans available for investment purposes. TokenLend will only accept loans from credible EU lenders after background check. The presence of a legal entity as a counterparty will enable us to take the necessary measures in advance by obtaining timely information on payments made by the creditor and mitigating the risk of default.

The platform is very user friendly for the potential investors and lenders who are the actual members to use the interface. Listed below are few salient features of TokenLend:-

1) Provides with an open lending market where lenders can easily provide the financial assistance for users to invest and receive monetary help.

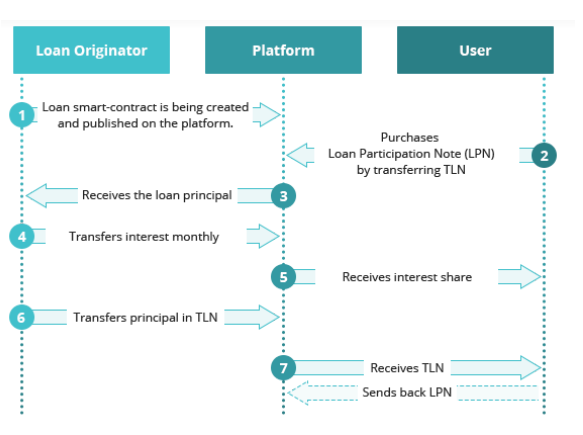

2) A Loan Participation Notes (LPN) market (i.e. "Secondary Market") where the investors or the borrowers can market continuous investments for immediate liquidity.

3) An online secured payment gateway for the users that allows financial transactions of funds from their dedicated account.

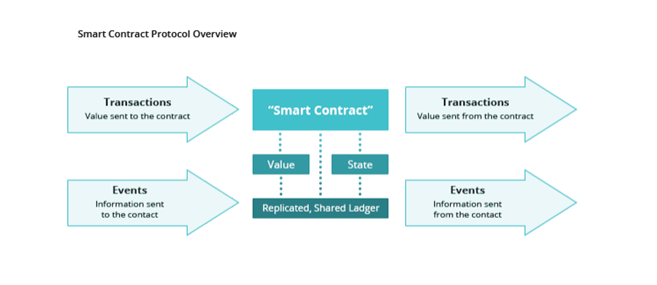

Tokenlend is a system based on blockchain technology hence it will provide a decentralized platform for all loan transactions. TokenLend also deploys a smart-contract system which will ensure the track record of all transactions performed by the user. TokenLend's team developed an intuitive web dashboard, which can provide detailed statistics, payment progress, revenue projections and other relevant information to Users.

**A Word about TLN TOKEN:**

TokenLend will release its token under the name "TLN" which can be used to invest as well as trade on other platforms, as this token has an ERC-20 base. TLN tokens are a digital representation of the right to exclusive participation in the TokenLend platform. TLN Holders have the ability to invest the desired amount of funds from their account into any of the available loans listed on the TokenLend P2P platform. The account balance on the platform will represent the number of TLN tokens stored in the Ethereum wallet of the member's TokenLend account at any time. The TLN tokens will be negotiable outside the TokenLend platform. Since they are ERC-20 tokens, they will have inherent value in exchanges.

**ICO Information:**

Tokens will be validated with the exchange rate of 1 TLN = 0.0004 ETH and 1 ETH = 2500 TLN. In total 473 466 667 TLN tokens will be created for the purpose of sale and upto 33 142 666 TLN tokens will be sold during the pre-sale.

The crowdsale date is scheduled at 6th of March 2018 which will continue for 45 days. The presale is set to cap a total of 11047 ETH and will begin on 1st of March 2018 and run for 11 days. At the end of ICO, the TLN tokens will be transferable for up to 7 days.

**Fund Allocation:**

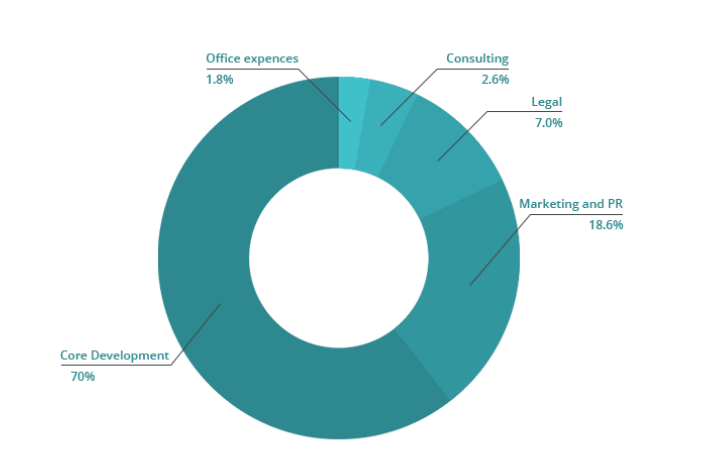

A whopping 70% of the total funds raised will be allocated to the entire development process. A decent 18.6% will go towards the external marketing and branding of the platform. The rest of the budget will be allocated to legal aspects, consulting purposes and the office expenses like Rent, utility etc.

**Concluding Remarks:**

The Blockchain technology has emerged as a boon to make the struggling financial sector secure and transparent. TokenLend with the help of this technology renders a lending platform, which is safe and robust and facilitates users with a variety of advantages and benefits that can boost their investment activities. Of the many advantages offered, an eye catching advantages of the platform is that it uses real estate as the collateral and security for the loans originated. In a nutshell, a revolution has begun in the lending economy sector which is going to change the way world looks at it.

**For More Details visit:**

**Website** : [**https://tokenlend.io/**](https://tokenlend.io/)

**Btalk ANN:** [**https://bitcointalk.org/index.php?topic=2548329**](https://bitcointalk.org/index.php?topic=2548329)

**Twitter:** [**https://twitter.com/Tokenlend\_news**](https://twitter.com/Tokenlend_news)

**Blog By: Lanirm Knayam**

**Btalk profile:** [**https://bitcointalk.org/index.php?action=profile;u=1308391**](https://bitcointalk.org/index.php?action=profile;u=1308391)

hiveblocks

hiveblocks