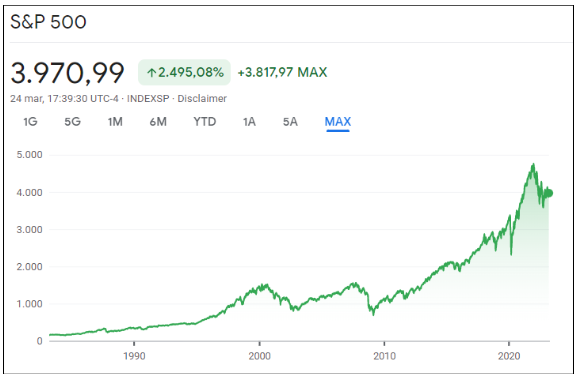

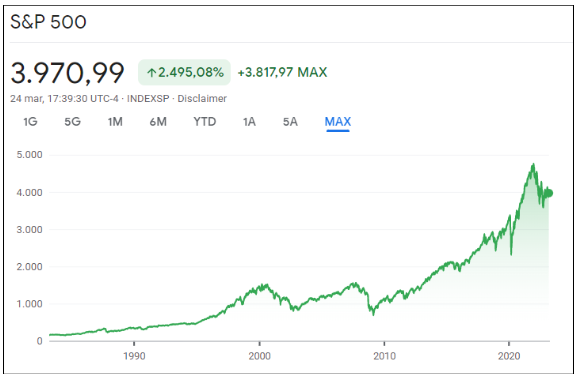

------------- Hive logo source: https://hive.io/ Central image source: Foto di <a href="https://pixabay.com/it/users/pictavio-1923348/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=5100671">Pictavio</a> da <a href="https://pixabay.com/it//?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=5100671">Pixabay</a> https://www.google.com/finance/quote/.INX:INDEXSP?sa=X&ved=2ahUKEwjBwsLUw_n9AhW4_rsIHY8NBYMQ3ecFegQIJBAg&window=MAX --------------- ***English version*** **Introduction:** I want to share with you from LeoFinance some important insights I am getting about the world of economics and finance. *Disclaimer: I am not a financial advisor, so what is written in this post is a personal opinion, not financial advice. If you want to invest, you must do so knowingly and on your own responsibility.* ***Lesson No. 3*** *How important is psychology in investing?* Some investors invest to be right at all costs and may persist in making a certain type of investment to prove to others and themselves that they were right to do so after all. However, this may lead them not to learn from their mistakes and not to gain from the investment. Then there are those who instead invest to make a profit. Perhaps it would be better to invest to gain and not to be right. One important thing to keep in mind is to avoid risk, because risk is always greater than we expect and our ability to bear risk is less than we think. **ETFs (Exchange Traded Funds)** ETFs are passive exchange-traded funds. They can be classified into two types: Generalist ETFs Specialized ETFs ***Generalist ETFs*** These are a kind of ETFs to always buy and never sell (Ex: MSCI, SP500). They can track an entire market, an entire continent, or even markets around the world. The SP500 over 100 years has given a 10% return per year.  (Source:[google finance]( )) In banks they do not think it is possible to have 2-digit returns, and they teach you that having a 4-6% return is already something more real. In Italian banks most of the time ETFs are not offered because the bank has its own funds to offer to the investor. These funds are issued by companies and are baskets of many things, including bonds, stocks, etc. The bank, on the fund it sells you, has its own costs and earnings. NB: Consider that among the funds offered by banks, 98 percent are below the SP500. The "Have control" rule in investing can translate into not relying on the bank for your investment. The "Low Costs" rule can also translate into not relying on banks. ***Specialized ETFs*** It is hard to know when they are to buy, even harder to know when they are to sell. They are sector ETFs. Some examples of specialized ETFs: XLF: The Financial Select Sector SPDR® Fund SSGA0, VGT: Vanguard Information Technology ETF SCHD: Schwab US Dividend Equity ETF™ (SCHD). Chatie Wood con ARK Invest in highly specialized ETFs and invests only in highly disruptive companies. **Question:** Did you know the difference between generalist ETFs and specialized ETFs? ---------------- ***Versione italiana*** **Introduzione:** Voglio condividere con voi di LeoFinance alcune nozioni importanti che sto ricevendo riguardo al mondo dell'economia e della finanza. *Disclaimer: Non sono un consulente finanziario, quindi ciò che è scritto in questo post è un'opinione personale, non un consiglio finanziario. Se volete investire dovete farlo consapevolmente e sotto la vostra responsabilità.* ***Lezione nr.3*** *Quanto conta la psicologia nell’investimento?* Alcuni investitori investono per avere a tutti i costi ragione e possono ostinarsi a fare un determinato tipo di investimento per dimostrare agli altri e a se stessi che alla fine avevano ragione a farlo. Questo però può portarli a non imparare dai propri errori e a non guadagnare dall’investimento. Poi c’è chi invece investe per guadagnare. Forse sarebbe meglio investire per guadagnare e non per avere ragione. Una cosa importante da tenere a mente è quella di evitare il rischio, perché il rischio è sempre maggiore di quello che ci aspettiamo e la nostra capacità di sopportare un rischio è inferiore di quello che pensiamo. **ETF (Exchange Traded Funds)** Gli ETF sono fondi passivi tradabili in borsa. Possono essere classificati in due tipi: ETF generalisti ETF specializzati ***ETF generalisti*** Sono un genere di ETF da comprare sempre e mai vendere (Es.: MSCI, SP500). Essi possono tracciare un intero mercato, un intero continente o addirittura i mercati di tutto il mondo. Lo SP500 in 100 anni ha dato un rendimento del 10% all’anno.  (Source:[google finance]( )) In banca non ritengono possibile avere dei rendimenti a 2 cifre, e ti insegnano che avere un rendimento del 4-6% sia già qualcosa di più reale. Nelle banche italiane il più delle volte gli ETF non vengono proposti perché la banca ha i suoi fondi da proporre all’investitore. Questi fondi sono emessi da delle società e sono dei panieri di tante cose, tra cui obbligazioni, azioni ecc. La banca, sul fondo che ti vende, ha i suoi costi e i suoi guadagni. NB: considerare che tra i fondi proposti dalle banche il 98% sta sotto lo SP500. La regola “Avere il controllo” negli investimenti può tradursi nel non affidarsi alla banca per il proprio investimento. Anche la regola “Costi bassi” può tradursi nel non affidarsi alle banche. ***ETF specializzati*** E’ difficile da capire quando sono da comprare, ancora più difficile da capire quando sono da vendere. Sono ETF di settore. Alcuni esempi di ETF specializzati: XLF: The Financial Select Sector SPDR® Fund SSGA0, VGT: Vanguard Information Technology ETF SCHD: Schwab US Dividend Equity ETF™ (SCHD) Chatie Wood con ARK Invest investe in ETF altamente specializzati e investe solo in aziende altamente disruptive. **Domanda:** Conoscevate la differenza tra ETF generalisti ed ETF specializzati? Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@lyra-b/lesson-no-3-the-different-types-of-etfs-exchange-traded-funds-or-lezione-n-3-i-diversi-tipi-di-etf-exchange-traded-funds)

| author | lyra-b |

|---|---|

| permlink | lesson-no-3-the-different-types-of-etfs-exchange-traded-funds-or-lezione-n-3-i-diversi-tipi-di-etf-exchange-traded-funds |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["etf","investment","money","sp500","leofinance"],"canonical_url":"https://leofinance.io/@lyra-b/lesson-no-3-the-different-types-of-etfs-exchange-traded-funds-or-lezione-n-3-i-diversi-tipi-di-etf-exchange-traded-funds","links":["https://hive.io/","https://pixabay.com/it/users/pictavio-1923348/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=5100671","https://pixabay.com/it//?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=5100671","https://www.google.com/finance/quote/.INX:INDEXSP?sa=X&ved=2ahUKEwjBwsLUw_n9AhW4_rsIHY8NBYMQ3ecFegQIJBAg&window=MAX"],"image":["https://images.hive.blog/DQmRzSCmukvmpqNSias9hze5mRnzYH6R7dwZwaFHsogEfZH/image.png","https://images.hive.blog/DQmdHKJsst6pzTEm1PxVsvCgZiwxoRUfPZCTVVP4wrs4yqz/image.png"]} |

| created | 2023-03-30 16:42:48 |

| last_update | 2023-03-30 16:42:48 |

| depth | 0 |

| children | 7 |

| last_payout | 2023-04-06 16:42:48 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 1.716 HBD |

| curator_payout_value | 1.711 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 6,439 |

| author_reputation | 8,485,919,371,858 |

| root_title | "Lesson No. 3: The different types of ETFs (Exchange Traded Funds) | Lezione N.3: I diversi tipi di ETF (Exchange Traded Funds)" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 122,113,782 |

| net_rshares | 6,238,535,976,581 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| boatymcboatface | 0 | 149,139,864,679 | 8% | ||

| kingscrown | 0 | 13,980,959,557 | 8% | ||

| theshell | 0 | 39,930,948,887 | 8% | ||

| good-karma | 0 | 73,691,622,594 | 8.2% | ||

| seckorama | 0 | 9,511,479,677 | 3% | ||

| esteemapp | 0 | 18,370,054,475 | 8.2% | ||

| drwom | 0 | 1,744,462,560 | 4.1% | ||

| tipu | 0 | 3,021,148,289,595 | 10% | ||

| esteem.app | 0 | 2,165,051,193 | 8.2% | ||

| auleo | 0 | 707,706,933 | 1.64% | ||

| atongis | 0 | 13,179,718,643 | 5% | ||

| cherryng | 0 | 888,365,706 | 1.64% | ||

| el-dee-are-es | 0 | 7,462,094,586 | 10% | ||

| longer | 0 | 812,185,697 | 2.5% | ||

| sbi8 | 0 | 45,351,863,368 | 20.94% | ||

| stefano.massari | 0 | 214,202,078,861 | 100% | ||

| marianomariano | 0 | 3,881,267,544 | 100% | ||

| mia-cc | 0 | 1,245,310,718 | 10% | ||

| kryptogames | 0 | 24,951,671,590 | 10% | ||

| camlock | 0 | 1,311,549,593 | 48% | ||

| bcm | 0 | 852,440,373 | 7.5% | ||

| ecency | 0 | 2,569,252,160,824 | 8.2% | ||

| ecency.stats | 0 | 2,661,222,993 | 8.2% | ||

| princessbusayo | 0 | 1,022,215,532 | 2.05% | ||

| will91 | 0 | 12,246,443,300 | 100% | ||

| xecency | 0 | -78,326,705 | -8.2% | ||

| xtipu | 0 | -79,625,927 | -10% | ||

| jesus-son | 0 | 2,173,429,522 | 20.8% | ||

| hikergirl | 0 | 6,809,470,213 | 100% |

**Yay!** 🤗<br>Your content has been **boosted with Ecency Points**, by @stefano.massari. <br>Use Ecency daily to boost your growth on platform! <br><br><b>Support Ecency</b><br>[Vote for new Proposal](https://hivesigner.com/sign/update-proposal-votes?proposal_ids=%5B245%5D&approve=true)<br>[Delegate HP and earn more](https://ecency.com/hive-125125/@ecency/daily-100-curation-rewards)

| author | ecency |

|---|---|

| permlink | re-2023330t20565887z |

| category | hive-167922 |

| json_metadata | {"tags":["ecency"],"app":"ecency/3.0.20-welcome","format":"markdown+html"} |

| created | 2023-03-30 20:56:06 |

| last_update | 2023-03-30 20:56:06 |

| depth | 1 |

| children | 0 |

| last_payout | 2023-04-06 20:56:06 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 385 |

| author_reputation | 549,971,524,037,747 |

| root_title | "Lesson No. 3: The different types of ETFs (Exchange Traded Funds) | Lezione N.3: I diversi tipi di ETF (Exchange Traded Funds)" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 122,121,375 |

| net_rshares | 0 |

https://twitter.com/1378276142247985152/status/1641485751949963272 <sub> The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.</sub>

| author | poshtoken | ||||||

|---|---|---|---|---|---|---|---|

| permlink | re-lyra-b-lesson-no-3-the-different-types-of-etfs-exchange-t1814044384 | ||||||

| category | hive-167922 | ||||||

| json_metadata | "{"app":"Poshtoken 0.0.1","payoutToUser":[]}" | ||||||

| created | 2023-03-30 17:01:24 | ||||||

| last_update | 2023-03-30 17:01:24 | ||||||

| depth | 1 | ||||||

| children | 0 | ||||||

| last_payout | 2023-04-06 17:01:24 | ||||||

| cashout_time | 1969-12-31 23:59:59 | ||||||

| total_payout_value | 0.000 HBD | ||||||

| curator_payout_value | 0.000 HBD | ||||||

| pending_payout_value | 0.000 HBD | ||||||

| promoted | 0.000 HBD | ||||||

| body_length | 254 | ||||||

| author_reputation | 3,941,620,445,587,309 | ||||||

| root_title | "Lesson No. 3: The different types of ETFs (Exchange Traded Funds) | Lezione N.3: I diversi tipi di ETF (Exchange Traded Funds)" | ||||||

| beneficiaries |

| ||||||

| max_accepted_payout | 1,000,000.000 HBD | ||||||

| percent_hbd | 0 | ||||||

| post_id | 122,114,231 | ||||||

| net_rshares | 0 |

@tipu curate

| author | robibasa |

|---|---|

| permlink | rscoyx |

| category | hive-167922 |

| json_metadata | {"users":["tipu"],"app":"hiveblog/0.1"} |

| created | 2023-03-30 20:30:36 |

| last_update | 2023-03-30 20:30:36 |

| depth | 1 |

| children | 2 |

| last_payout | 2023-04-06 20:30:36 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 12 |

| author_reputation | 197,934,613,400,518 |

| root_title | "Lesson No. 3: The different types of ETFs (Exchange Traded Funds) | Lezione N.3: I diversi tipi di ETF (Exchange Traded Funds)" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 122,120,454 |

| net_rshares | 0 |

Grazie per il curating 😊

| author | lyra-b |

|---|---|

| permlink | re-robibasa-2023331t132659999z |

| category | hive-167922 |

| json_metadata | {"tags":["ecency"],"app":"ecency/3.0.39-mobile","format":"markdown+html"} |

| created | 2023-03-31 11:26:57 |

| last_update | 2023-03-31 11:26:57 |

| depth | 2 |

| children | 0 |

| last_payout | 2023-04-07 11:26:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 24 |

| author_reputation | 8,485,919,371,858 |

| root_title | "Lesson No. 3: The different types of ETFs (Exchange Traded Funds) | Lezione N.3: I diversi tipi di ETF (Exchange Traded Funds)" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 122,138,010 |

| net_rshares | 0 |

<a href="https://tipu.online/hive_curator?robibasa" target="_blank">Upvoted 👌</a> (Mana: 1/41) <a href="https://peakd.com/hive/@reward.app/reward-app-quick-guide-updated" target="_blank">Liquid rewards</a>.

| author | tipu |

|---|---|

| permlink | re-rscoyx-20230330t203040z |

| category | hive-167922 |

| json_metadata | "{"app": "beem/0.24.26"}" |

| created | 2023-03-30 20:30:39 |

| last_update | 2023-03-30 20:30:39 |

| depth | 2 |

| children | 0 |

| last_payout | 2023-04-06 20:30:39 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 215 |

| author_reputation | 55,206,507,265,417 |

| root_title | "Lesson No. 3: The different types of ETFs (Exchange Traded Funds) | Lezione N.3: I diversi tipi di ETF (Exchange Traded Funds)" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 122,120,457 |

| net_rshares | 0 |

È assolutamente vero! Molti investono per aver ragione e non per guadagnare. Io ed il team con cui collaboro deve avere l’obiettivo ben fisso nella mente… che non è quello di aver ragione. !CTP

| author | stefano.massari |

|---|---|

| permlink | re-lyra-b-2023330t19348261z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922","etf","investment","money","sp500","leofinance"],"app":"ecency/3.0.39-mobile","format":"markdown+html"} |

| created | 2023-03-30 17:03:48 |

| last_update | 2023-03-30 17:03:48 |

| depth | 1 |

| children | 0 |

| last_payout | 2023-04-06 17:03:48 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 193 |

| author_reputation | 175,386,315,401,277 |

| root_title | "Lesson No. 3: The different types of ETFs (Exchange Traded Funds) | Lezione N.3: I diversi tipi di ETF (Exchange Traded Funds)" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 122,114,300 |

| net_rshares | 0 |

Interessante anche la questione del “controllo”. Investire i soldi i banca potrebbe effettuvamente tradursi nell’avere meno controllo.

| author | stefano.massari |

|---|---|

| permlink | re-lyra-b-2023330t215137584z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922","etf","investment","money","sp500","leofinance"],"app":"ecency/3.0.39-mobile","format":"markdown+html"} |

| created | 2023-03-30 19:51:39 |

| last_update | 2023-03-30 19:51:39 |

| depth | 1 |

| children | 0 |

| last_payout | 2023-04-06 19:51:39 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 135 |

| author_reputation | 175,386,315,401,277 |

| root_title | "Lesson No. 3: The different types of ETFs (Exchange Traded Funds) | Lezione N.3: I diversi tipi di ETF (Exchange Traded Funds)" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 122,119,041 |

| net_rshares | 0 |

hiveblocks

hiveblocks