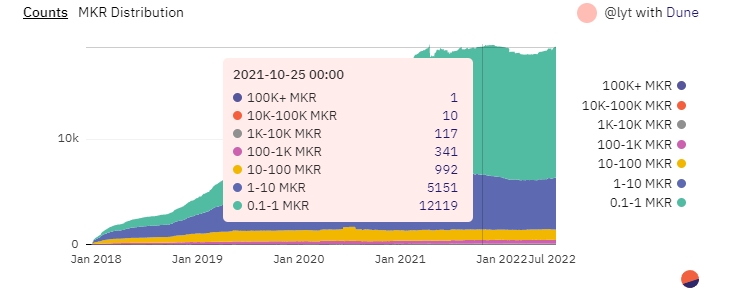

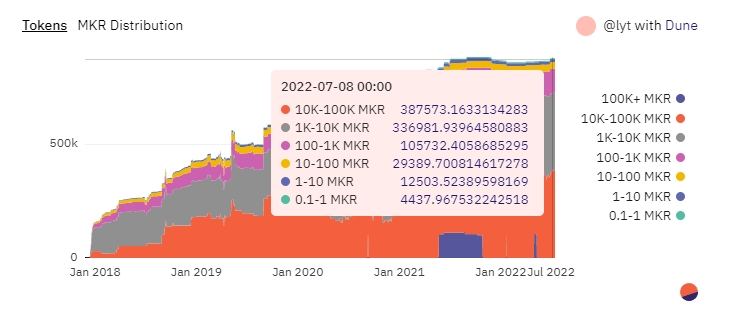

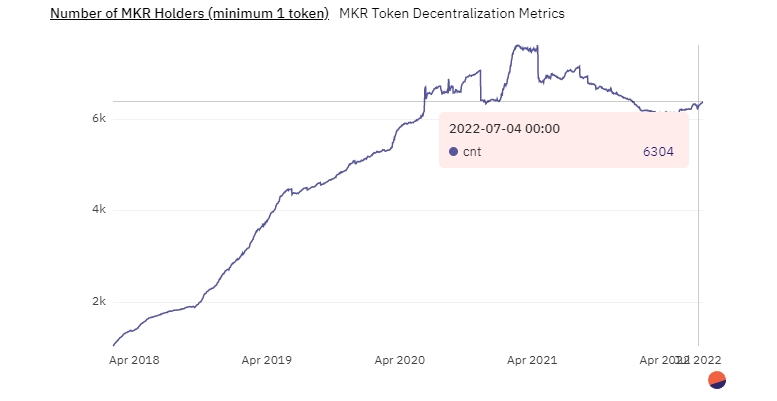

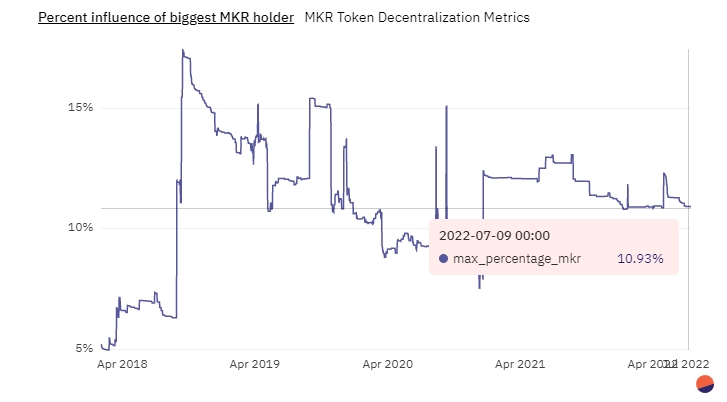

<div class="text-justify"> <div class="text-center"> ---  <sup>[src](https://d.ibtimes.co.uk/en/full/1670517/maker.jpg)</sup> --- </div> <div class="text-justify"> This happens to be one of the recently discussed topics, though not so openly about MakerDAO, but more about how the [crypto](https://leofinance.io/@leoglossary/cryptocurrency) space has taken a beating with centralized structures tearing down. And so today, we’re going to attempt a conclusion on if MakerDAO is indeed centralized or [decentralized](https://leofinance.io/@leoglossary/leoglossary-decentralization) in fact. <div class="text-center"> --- #### What is MakerDAO? --- </div> <div class="text-justify"> [MakerDAO](https://makerdao.com/en/) is said to be a [decentralized autonomous organization(DAO)](https://leofinance.io/@leoglossary/leoglossary-decentralized-autonomous-organization-dao), powered by maker [token](https://leofinance.io/@leoglossary/leoglossary-token) holders. Maker creates and issues DAI [stablecoin](https://leofinance.io/@leoglossary/leoglossary-stablecoin) on the [Ethereum](https://leofinance.io/@crypto-guides/what-is-ethereum-eth) blockchain. Recently, we’ve bodied a couple of conversations about MakerDAO as a result of the crash of Luna, and its [algorithm](https://leofinance.io/@leoglossary/leoglossary-algorithm) stablecoin. This raised concerns as to how truly safe the ecosystem is. Citing [stablecoin](https://leofinance.io/@leoglossary/leoglossary-stablecoin) issuers to be a threat, causing [fear, uncertainty, and doubt (FUD)](https://leofinance.io/@leoglossary/leoglossary-fear-uncertainty-doubt-fud). That said, the need to properly understand the inner workings of an ecosystem is crucial, and one of the best ways to do that is by looking deep into the [blockchain](https://leofinance.io/@leoglossary/blockchain)! <div class="text-center"> --- ---  --- --- #### First, we look at the supply --- </div> <div class="text-justify"> Numbers matter a lot when dealing with [cryptocurrency](https://leofinance.io/@leoglossary/cryptocurrency), and so the first thing to look at would be the supply, how widely spread the [token](https://leofinance.io/@leoglossary/leoglossary-token) supply is, determines how much centralized the ecosystem is or not. Being a token-governed [economy](https://leofinance.io/@leoglossary/leoglossary-economy), a whole lot of things rely on the [token](https://leofinance.io/@leoglossary/leoglossary-token) and so, that marks the importance. The chart above displays data in a container, what that means is that it is being grouped, like a basket of [assets](https://leofinance.io/@leoglossary/leoglossary-asset) showing the [volume](https://leofinance.io/@leoglossary/leoglossary-volume) contained. Specifically, this shows the number of addresses holding [tokens](https://leofinance.io/@leoglossary/leoglossary-token) of different sizes. So far, the number 0.1-1 dominates the equation, but does that really make a difference? I'd say no, but let's look at the next chart. <div class="text-center"> --- ---  --- --- #### "Emphasis on numbers" --- </div> <div class="text-justify"> Looking deeper makes the picture a bit clearer, as I would say that the first chart may have been a bit misleading if one doesn't pay attention to numbers. The container of addresses holding 0.1-1 Maker displays just about 4,437 [tokens](https://leofinance.io/@leoglossary/leoglossary-token). This is clearly a small figure on the wide metrics, the influence cannot be spotted on the [volume](https://leofinance.io/@leoglossary/leoglossary-volume) chart. We have to consider the price while compiling this. 1 Maker token Is worth over $900, which means, it's an expensive bet for any small pockets to dream of influence. This helps us know what we are dealing with. If you look at the dominant container, you'd realize where addresses with millions in Maker tokens are. <div class="text-center"> --- #### how does this contribute to centralization? --- </div> <div class="text-justify"> We've always looked at top address holdings to justify projects with [decentralized](https://leofinance.io/@leoglossary/leoglossary-decentralization) metrics or centralized if that's the case. That said, considering that the MakerDAO ecosystem is based on vote ruling, we have to understand how much [governance](https://leofinance.io/@leoglossary/leoglossary-decentralized-governance) influence these big entities have. <div class="text-center"> --- ---  --- --- #### Governance --- </div> <div class="text-justify"> As aforementioned, to lay **"emphasis on numbers"**, which is why we have to understand first, what's important to fully attain the influence of top accounts. This would be the number of voters! Just as in any system, not every member votes, but there is always a way to determine the number of potential voters. with the chart above, a lot of small accounts are eliminated from the equation due to certain things like "**[gas fees](https://leofinance.io/@leoglossary/leoglossary-transaction-fee)"** MakerDAO is based on the [Ethereum](https://leofinance.io/@crypto-guides/what-is-ethereum-eth) network, which happens to be the largest chain on a scale of Dapps therein, but the biggest setback on [Ethereum](https://leofinance.io/@crypto-guides/what-is-ethereum-eth) is the [cost](https://leofinance.io/@leoglossary/leoglossary-cost) of transactions. As such, when you eliminate tiny accounts (That's addresses holding less than 1 Maker based on this chart) that will obviously not be interested in voting, you have 6,304 as of July 4th, 2022. I would expect this number to be way lower as many investors within the 10 Maker [tokens](https://leofinance.io/@leoglossary/leoglossary-token) mark may still abstain from voting and focus more on using that value to grow their holdings. The numbers begin to shrink even more and you eventually have smaller circles of votes flowing in. <div class="text-center"> ---  --- </div> <div class="text-justify"> The biggest marker holder has an influence of approximately 11%, is that bad? you decide, but it would be interesting to note that on a scale of 20% influence, [3 accounts control this](https://dune.com/stratfi/mkr-token-decentralization-and-distribution-metrics), see chart below <div class="text-center"> --- --- ### how about 50%? --- --- </div> <div class="text-justify"> [21 addresses control 50%](https://dune.com/stratfi/mkr-token-decentralization-and-distribution-metrics) of the [governance](https://leofinance.io/@leoglossary/leoglossary-decentralized-governance) influence, this isn't particularly a good share considering that there are over 6,000 addresses identified to be potential voters. <div class="text-center"> --- #### Why does all of this matter? --- </div> <div class="text-justify"> When dealing with a [token](https://leofinance.io/@leoglossary/leoglossary-token)-based [economy](https://leofinance.io/@leoglossary/leoglossary-economy), whereas [governance](https://leofinance.io/@leoglossary/leoglossary-decentralized-governance) is a thing, the harder it is for a small circle to influence this, the better! Some may argue that 21 is a lot, but I really don't see how fair a share it is compared to 6,000. The one purpose for this review is Maker's recent moves in real-world [investments](https://leofinance.io/@leoglossary/leoglossary-investment), which raised concerns. We have that the protocol [voted](https://vote.makerdao.com/polling/QmXedMr8#vote-breakdown) to invest 500 million DAI into U.S. treasury bills and corporate bonds in an attempt to generate [yield](https://leofinance.io/@leoglossary/leoglossary-yield) while diversifying its holdings, the protocol [voted](https://vote.makerdao.com/polling/QmajCtnG#vote-breakdown) to include the French multinational investment [bank](https://leofinance.io/@leoglossary/leoglossary-bank) in its list of Real World [Assets](https://leofinance.io/@leoglossary/leoglossary-asset) (RWA). Maker also [voted](https://vote.makerdao.com/polling/QmUVKBfr#vote-breakdown) to loan $100 million in DAI to Huntingdon Valley [Bank](https://leofinance.io/@leoglossary/leoglossary-bank). All of this calls for an alarm about how are these transactions being managed? With the involvement of [off-chain](https://leofinance.io/@leoglossary/leoglossary-off-chain) [collaterals](https://leofinance.io/@leoglossary/leoglossary-collateral), what are the measures taken to avoid [asset](https://leofinance.io/@leoglossary/leoglossary-asset) centralization? Notwithstanding the cases, judging from this review, not many of the metrics put MakerDAO in a position of true [decentralization](https://leofinance.io/@leoglossary/leoglossary-decentralization), but that's just my take, now you can have yours, do leave a comment below if you made it this far. <div class="text-center"> --- *This content is primarily meant for educational purposes, SEO and so, not any form of financial advice.* <sup>All charts are obtained from [here](https://dune.com/stratfi/mkr-token-decentralization-and-distribution-metrics)</sup> </div> Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@malopie/is-makerdao-centralized)

| author | malopie |

|---|---|

| permlink | is-makerdao-centralized |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["makerdao","neoxian","ctp","deepdives","pob","palnet","broadhive","cent","leofinance"],"canonical_url":"https://leofinance.io/@malopie/is-makerdao-centralized","links":["https://d.ibtimes.co.uk/en/full/1670517/maker.jpg","https://leofinance.io/@leoglossary/cryptocurrency","https://leofinance.io/@leoglossary/leoglossary-decentralization","https://makerdao.com/en/","https://leofinance.io/@leoglossary/leoglossary-decentralized-autonomous-organization-dao","https://leofinance.io/@leoglossary/leoglossary-token","https://leofinance.io/@leoglossary/leoglossary-stablecoin","https://leofinance.io/@crypto-guides/what-is-ethereum-eth","https://leofinance.io/@leoglossary/leoglossary-algorithm","https://leofinance.io/@leoglossary/leoglossary-fear-uncertainty-doubt-fud","https://leofinance.io/@leoglossary/blockchain","https://leofinance.io/@leoglossary/leoglossary-economy","https://leofinance.io/@leoglossary/leoglossary-asset","https://leofinance.io/@leoglossary/leoglossary-volume","https://leofinance.io/@leoglossary/leoglossary-decentralized-governance","https://leofinance.io/@leoglossary/leoglossary-transaction-fee","https://leofinance.io/@leoglossary/leoglossary-cost","https://dune.com/stratfi/mkr-token-decentralization-and-distribution-metrics","https://leofinance.io/@leoglossary/leoglossary-investment","https://vote.makerdao.com/polling/QmXedMr8#vote-breakdown","https://leofinance.io/@leoglossary/leoglossary-yield","https://vote.makerdao.com/polling/QmajCtnG#vote-breakdown","https://leofinance.io/@leoglossary/leoglossary-bank","https://vote.makerdao.com/polling/QmUVKBfr#vote-breakdown","https://leofinance.io/@leoglossary/leoglossary-off-chain","https://leofinance.io/@leoglossary/leoglossary-collateral"],"image":["https://d.ibtimes.co.uk/en/full/1670517/maker.jpg","https://images.hive.blog/DQmWKpmtGi8P6d4vp2FjcCpxA7upVQeHhd4tmDNmY2FrnUo/Maker%20basket%201.jpg","https://images.hive.blog/DQmSyKrPFZc88xoDvf3fXjV4WZZ8s2Yu92Xww7gUAxQVkDe/Maker%20basket%202.jpg","https://images.hive.blog/DQmVtWidZZ9rshYw2odhT2wXXUFpBwPpth3cVhqSss6x8uM/Maker%20Number%20of%20potential%20voters.jpg","https://images.hive.blog/DQmfMDx7F5z3kqaotNQxNxQoqRb6PuSXuZo2TaMoECnkLPS/Maker%20top%201%20holder%20influence.jpg"]} |

| created | 2022-07-15 17:30:27 |

| last_update | 2022-07-15 17:30:27 |

| depth | 0 |

| children | 0 |

| last_payout | 2022-07-22 17:30:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.237 HBD |

| curator_payout_value | 0.175 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 9,884 |

| author_reputation | 49,826,091,245,255 |

| root_title | "Is MakerDAO centralized?" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 114,887,904 |

| net_rshares | 776,958,806,529 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| qubes | 0 | 40,029,647,660 | 25% | ||

| cranium | 0 | 6,721,708,251 | 25% | ||

| steps | 0 | 86,837,032,041 | 29% | ||

| guurg | 0 | 60,919,165,739 | 21% | ||

| prettysnake | 0 | 765,944,140 | 100% | ||

| dobroman | 0 | 1,269,898,944 | 100% | ||

| koment | 0 | 617,835,700 | 100% | ||

| komentator | 0 | 506,815,928 | 100% | ||

| anadolu | 0 | 229,956,902,704 | 25% | ||

| baycan | 0 | 1,798,848,924 | 12.5% | ||

| coinmeria | 0 | 702,018,187 | 35% | ||

| andruto | 0 | 901,107,165 | 100% | ||

| goldbuyer | 0 | 101,532,511,151 | 60% | ||

| ozeryilmaz | 0 | 516,278,989 | 50% | ||

| bagasadi | 0 | 1,067,269,178 | 100% | ||

| setik-001 | 0 | 758,147,778 | 100% | ||

| cloudblade | 0 | 1,808,123,128 | 100% | ||

| tinyhousecryptos | 0 | 496,597,720 | 5% | ||

| cranum | 0 | 804,082,941 | 100% | ||

| craniuma | 0 | 818,428,301 | 100% | ||

| kran1 | 0 | 619,590,201 | 100% | ||

| kran2 | 0 | 622,079,184 | 100% | ||

| kran3 | 0 | 605,536,251 | 100% | ||

| kran4 | 0 | 751,674,933 | 100% | ||

| kran5 | 0 | 751,704,055 | 100% | ||

| kran6 | 0 | 765,750,669 | 100% | ||

| kran8 | 0 | 757,540,251 | 100% | ||

| kran9 | 0 | 757,575,263 | 100% | ||

| kran10 | 0 | 619,394,005 | 100% | ||

| craniums1 | 0 | 6,633,341,780 | 100% | ||

| crabank | 0 | 5,786,377,089 | 100% | ||

| kran11 | 0 | 564,949,431 | 100% | ||

| kran12 | 0 | 568,018,867 | 100% | ||

| kran13 | 0 | 564,121,526 | 100% | ||

| kran14 | 0 | 567,000,650 | 100% | ||

| kran15 | 0 | 564,850,894 | 100% | ||

| kran16 | 0 | 566,336,637 | 100% | ||

| kran19 | 0 | 573,327,537 | 100% | ||

| kran20 | 0 | 533,821,617 | 100% | ||

| kran21 | 0 | 564,240,416 | 100% | ||

| kran22 | 0 | 561,984,079 | 100% | ||

| kran23 | 0 | 561,967,604 | 100% | ||

| kran24 | 0 | 560,892,510 | 100% | ||

| kran25 | 0 | 564,961,812 | 100% | ||

| mehmethesap | 0 | 830,659,411 | 25% | ||

| drax.leo | 0 | 2,564,363,874 | 10% | ||

| cranium.leo | 0 | 615,898,289 | 100% | ||

| maylenasland | 0 | 1,048,663,700 | 12.5% | ||

| teknon | 0 | 15,558,301,002 | 100% | ||

| nfter | 0 | 7,530,258,747 | 100% | ||

| untzuntzuntz | 0 | 10,283,061,007 | 75% | ||

| artpromo | 0 | 912,898,136 | 100% | ||

| kran26 | 0 | 614,963,021 | 100% | ||

| kran27 | 0 | 614,460,749 | 100% | ||

| kran28 | 0 | 610,749,517 | 100% | ||

| kran29 | 0 | 614,331,056 | 100% | ||

| kran32 | 0 | 752,375,024 | 100% | ||

| kran33 | 0 | 752,364,286 | 100% | ||

| kran35 | 0 | 754,654,914 | 100% | ||

| kran39 | 0 | 752,344,341 | 100% | ||

| kran40 | 0 | 752,300,881 | 100% | ||

| kran41 | 0 | 752,288,314 | 100% | ||

| kran42 | 0 | 752,206,068 | 100% | ||

| kran44 | 0 | 752,301,581 | 100% | ||

| kran45 | 0 | 614,699,263 | 100% | ||

| kran47 | 0 | 752,136,717 | 100% | ||

| kran50 | 0 | 752,218,325 | 100% | ||

| kran51 | 0 | 752,220,955 | 100% | ||

| kran52 | 0 | 752,221,550 | 100% | ||

| kran53 | 0 | 752,201,705 | 100% | ||

| kran54 | 0 | 614,730,551 | 100% | ||

| kran55 | 0 | 752,882,284 | 100% | ||

| kran57 | 0 | 752,257,772 | 100% | ||

| kran58 | 0 | 752,258,164 | 100% | ||

| kran60 | 0 | 752,264,500 | 100% | ||

| kran61 | 0 | 752,276,879 | 100% | ||

| kran62 | 0 | 752,277,594 | 100% | ||

| kran63 | 0 | 752,297,565 | 100% | ||

| miloshi | 0 | 592,246,874 | 100% | ||

| kran66 | 0 | 659,351,603 | 100% | ||

| kran67 | 0 | 659,235,218 | 100% | ||

| kran68 | 0 | 659,240,676 | 100% | ||

| kran70 | 0 | 659,262,832 | 100% | ||

| kran71 | 0 | 659,187,085 | 100% | ||

| kran73 | 0 | 659,186,497 | 100% | ||

| kran74 | 0 | 580,046,209 | 100% | ||

| kran75 | 0 | 659,187,090 | 100% | ||

| kran76 | 0 | 659,170,636 | 100% | ||

| kran77 | 0 | 659,181,236 | 100% | ||

| kran78 | 0 | 659,172,829 | 100% | ||

| kran79 | 0 | 659,181,973 | 100% | ||

| kran80 | 0 | 659,197,549 | 100% | ||

| kran82 | 0 | 659,196,097 | 100% | ||

| kran83 | 0 | 659,156,266 | 100% | ||

| kran85 | 0 | 659,176,902 | 100% | ||

| kran86 | 0 | 659,246,637 | 100% | ||

| kran89 | 0 | 659,262,054 | 100% | ||

| kran91 | 0 | 659,231,915 | 100% | ||

| kran92 | 0 | 659,223,185 | 100% | ||

| kran93 | 0 | 659,229,638 | 100% | ||

| kran94 | 0 | 659,226,688 | 100% | ||

| kran95 | 0 | 659,242,574 | 100% | ||

| kran97 | 0 | 659,239,435 | 100% | ||

| kran99 | 0 | 659,168,133 | 100% | ||

| kran100 | 0 | 537,492,221 | 100% | ||

| kran101 | 0 | 535,168,111 | 100% | ||

| kran102 | 0 | 535,196,632 | 100% | ||

| kran103 | 0 | 537,954,778 | 100% | ||

| kran104 | 0 | 537,463,772 | 100% | ||

| kran105 | 0 | 534,104,926 | 100% | ||

| kran106 | 0 | 538,053,795 | 100% | ||

| kran108 | 0 | 538,015,510 | 100% | ||

| kran109 | 0 | 537,890,466 | 100% | ||

| kran110 | 0 | 537,432,286 | 100% | ||

| kran111 | 0 | 537,999,426 | 100% | ||

| kran112 | 0 | 537,498,982 | 100% | ||

| kran113 | 0 | 537,946,995 | 100% | ||

| kran115 | 0 | 538,016,892 | 100% | ||

| kran116 | 0 | 537,494,462 | 100% | ||

| kran117 | 0 | 538,012,609 | 100% | ||

| kran118 | 0 | 537,993,987 | 100% | ||

| kran119 | 0 | 537,500,083 | 100% | ||

| kran120 | 0 | 537,486,821 | 100% | ||

| kran121 | 0 | 537,335,452 | 100% | ||

| kran122 | 0 | 537,984,171 | 100% | ||

| kran123 | 0 | 537,973,109 | 100% | ||

| kran124 | 0 | 535,140,986 | 100% | ||

| kran125 | 0 | 537,967,565 | 100% | ||

| kran126 | 0 | 537,337,131 | 100% | ||

| kran127 | 0 | 537,967,910 | 100% | ||

| kran128 | 0 | 537,995,183 | 100% | ||

| kran129 | 0 | 538,002,954 | 100% | ||

| kran130 | 0 | 538,010,478 | 100% | ||

| kran131 | 0 | 537,995,179 | 100% | ||

| kran132 | 0 | 537,983,893 | 100% | ||

| kran133 | 0 | 537,984,570 | 100% | ||

| kran136 | 0 | 537,967,617 | 100% | ||

| kran137 | 0 | 537,954,260 | 100% | ||

| kran138 | 0 | 537,435,421 | 100% | ||

| kran140 | 0 | 537,986,385 | 100% | ||

| kran141 | 0 | 537,362,378 | 100% | ||

| kran142 | 0 | 537,959,906 | 100% | ||

| kran143 | 0 | 535,154,988 | 100% | ||

| kran144 | 0 | 537,946,879 | 100% | ||

| kran145 | 0 | 537,395,645 | 100% | ||

| kran146 | 0 | 537,914,319 | 100% | ||

| kran147 | 0 | 537,917,086 | 100% | ||

| kran148 | 0 | 535,125,806 | 100% | ||

| kran150 | 0 | 537,909,520 | 100% | ||

| kran151 | 0 | 506,857,094 | 100% | ||

| kran152 | 0 | 506,829,273 | 100% | ||

| kran153 | 0 | 506,783,618 | 100% | ||

| kran154 | 0 | 506,869,330 | 100% | ||

| kran155 | 0 | 506,929,229 | 100% | ||

| kran157 | 0 | 506,860,406 | 100% | ||

| kran158 | 0 | 506,839,130 | 100% | ||

| kran159 | 0 | 506,843,993 | 100% | ||

| kran160 | 0 | 506,901,217 | 100% | ||

| kran161 | 0 | 509,998,559 | 100% | ||

| kran162 | 0 | 506,824,309 | 100% | ||

| kran163 | 0 | 506,871,326 | 100% | ||

| kran164 | 0 | 506,852,108 | 100% | ||

| kran165 | 0 | 510,016,257 | 100% | ||

| kran166 | 0 | 506,858,609 | 100% | ||

| kran167 | 0 | 506,904,795 | 100% | ||

| kran168 | 0 | 506,934,661 | 100% | ||

| kran170 | 0 | 506,845,669 | 100% | ||

| kran171 | 0 | 616,610,017 | 100% | ||

| kran172 | 0 | 617,216,551 | 100% | ||

| kran173 | 0 | 617,222,543 | 100% | ||

| kran174 | 0 | 617,254,909 | 100% | ||

| kran175 | 0 | 616,638,697 | 100% | ||

| kran176 | 0 | 617,240,473 | 100% | ||

| kran177 | 0 | 614,186,247 | 100% | ||

| kran178 | 0 | 617,256,640 | 100% | ||

| kran179 | 0 | 617,229,786 | 100% | ||

| kran180 | 0 | 616,699,718 | 100% | ||

| kran181 | 0 | 617,217,231 | 100% | ||

| kran182 | 0 | 616,746,329 | 100% | ||

| kran183 | 0 | 616,684,330 | 100% | ||

| kran184 | 0 | 613,059,873 | 100% | ||

| kran185 | 0 | 617,245,908 | 100% | ||

| kran186 | 0 | 616,662,620 | 100% | ||

| kran187 | 0 | 616,753,292 | 100% | ||

| kran188 | 0 | 617,249,281 | 100% | ||

| kran189 | 0 | 617,238,811 | 100% | ||

| kran190 | 0 | 616,715,995 | 100% | ||

| kran191 | 0 | 616,674,851 | 100% | ||

| kran192 | 0 | 617,269,921 | 100% | ||

| kran193 | 0 | 617,273,201 | 100% | ||

| kran194 | 0 | 616,740,024 | 100% | ||

| kran195 | 0 | 617,247,788 | 100% | ||

| kran196 | 0 | 616,728,360 | 100% | ||

| kran197 | 0 | 617,295,331 | 100% | ||

| kran198 | 0 | 617,273,122 | 100% | ||

| kran199 | 0 | 616,763,330 | 100% | ||

| kran200 | 0 | 617,282,857 | 100% | ||

| kran201 | 0 | 617,171,842 | 100% | ||

| kran202 | 0 | 614,122,183 | 100% | ||

| kran203 | 0 | 617,146,783 | 100% | ||

| kran204 | 0 | 612,933,855 | 100% | ||

| kran205 | 0 | 616,613,808 | 100% | ||

| kran206 | 0 | 617,131,764 | 100% | ||

| kran207 | 0 | 617,071,466 | 100% | ||

| kran208 | 0 | 616,568,840 | 100% | ||

| kran209 | 0 | 617,151,420 | 100% | ||

| kran210 | 0 | 616,494,698 | 100% | ||

| kran211 | 0 | 617,098,072 | 100% | ||

| kran212 | 0 | 614,101,335 | 100% | ||

| kran213 | 0 | 617,136,732 | 100% | ||

| kran214 | 0 | 617,151,113 | 100% | ||

| kran215 | 0 | 616,540,765 | 100% | ||

| kran216 | 0 | 617,095,259 | 100% | ||

| kran217 | 0 | 617,124,665 | 100% | ||

| kran218 | 0 | 612,936,186 | 100% | ||

| kran219 | 0 | 616,557,067 | 100% | ||

| kran220 | 0 | 616,608,286 | 100% | ||

| kran221 | 0 | 617,118,919 | 100% | ||

| kran223 | 0 | 617,111,886 | 100% | ||

| kran224 | 0 | 617,093,565 | 100% | ||

| kran225 | 0 | 617,138,698 | 100% | ||

| kran226 | 0 | 617,097,820 | 100% | ||

| kran227 | 0 | 617,137,174 | 100% | ||

| kran229 | 0 | 616,572,657 | 100% | ||

| kran230 | 0 | 617,066,350 | 100% | ||

| kran231 | 0 | 616,673,341 | 100% | ||

| kran232 | 0 | 617,191,949 | 100% | ||

| kran233 | 0 | 616,665,541 | 100% | ||

| kran235 | 0 | 617,178,411 | 100% | ||

| kran236 | 0 | 617,178,044 | 100% | ||

| kran237 | 0 | 617,172,386 | 100% | ||

| kran238 | 0 | 617,161,827 | 100% | ||

| kran239 | 0 | 617,170,443 | 100% | ||

| kran240 | 0 | 617,167,454 | 100% | ||

| kran241 | 0 | 616,646,239 | 100% | ||

| kran242 | 0 | 617,162,911 | 100% | ||

| kran244 | 0 | 617,145,605 | 100% | ||

| kran245 | 0 | 617,144,975 | 100% | ||

| kran246 | 0 | 614,160,546 | 100% | ||

| kran247 | 0 | 617,125,186 | 100% | ||

| kran248 | 0 | 616,618,943 | 100% | ||

| kran249 | 0 | 617,126,505 | 100% | ||

| kran250 | 0 | 617,119,824 | 100% | ||

| kran252 | 0 | 616,611,885 | 100% | ||

| kran253 | 0 | 617,106,223 | 100% | ||

| kran254 | 0 | 617,117,765 | 100% | ||

| kran255 | 0 | 616,612,623 | 100% | ||

| kran257 | 0 | 616,590,968 | 100% | ||

| kran258 | 0 | 617,162,591 | 100% | ||

| kran260 | 0 | 617,148,764 | 100% | ||

| kran261 | 0 | 613,909,477 | 100% | ||

| kran263 | 0 | 617,138,361 | 100% | ||

| kran264 | 0 | 616,536,391 | 100% | ||

| kran265 | 0 | 617,150,492 | 100% | ||

| kran266 | 0 | 617,155,923 | 100% | ||

| kran267 | 0 | 614,115,974 | 100% | ||

| kran268 | 0 | 616,632,154 | 100% | ||

| kran269 | 0 | 612,944,037 | 100% | ||

| kran271 | 0 | 617,176,621 | 100% | ||

| kran272 | 0 | 616,554,737 | 100% | ||

| kran273 | 0 | 616,584,974 | 100% | ||

| kran274 | 0 | 616,590,374 | 100% | ||

| kran275 | 0 | 617,125,642 | 100% | ||

| kran276 | 0 | 617,116,812 | 100% | ||

| kran277 | 0 | 616,500,145 | 100% | ||

| kran278 | 0 | 616,581,251 | 100% | ||

| kran279 | 0 | 616,557,827 | 100% | ||

| kran280 | 0 | 614,277,634 | 100% | ||

| kran281 | 0 | 617,090,550 | 100% | ||

| kran282 | 0 | 616,615,603 | 100% | ||

| kran283 | 0 | 614,094,507 | 100% | ||

| kran284 | 0 | 617,080,531 | 100% | ||

| kran285 | 0 | 612,885,939 | 100% | ||

| kran286 | 0 | 617,096,313 | 100% | ||

| kran287 | 0 | 616,560,005 | 100% | ||

| kran288 | 0 | 617,071,076 | 100% | ||

| kran289 | 0 | 616,528,930 | 100% | ||

| kran290 | 0 | 617,100,960 | 100% | ||

| kran291 | 0 | 616,558,176 | 100% | ||

| kran292 | 0 | 617,093,355 | 100% | ||

| kran293 | 0 | 617,070,206 | 100% | ||

| kran294 | 0 | 616,538,974 | 100% | ||

| kran296 | 0 | 617,066,080 | 100% | ||

| kran297 | 0 | 617,150,472 | 100% | ||

| kran298 | 0 | 617,103,402 | 100% | ||

| kran299 | 0 | 617,098,484 | 100% | ||

| kran300 | 0 | 616,686,160 | 100% | ||

| kran301 | 0 | 616,624,003 | 100% | ||

| kran302 | 0 | 616,698,007 | 100% | ||

| kran320 | 0 | 755,215,178 | 100% | ||

| kran321 | 0 | 754,957,505 | 100% | ||

| kran322 | 0 | 754,969,158 | 100% | ||

| kran323 | 0 | 754,945,286 | 100% | ||

| kran327 | 0 | 754,957,307 | 100% | ||

| kran328 | 0 | 754,936,175 | 100% | ||

| kran329 | 0 | 754,943,096 | 100% | ||

| kran330 | 0 | 754,934,068 | 100% | ||

| kran331 | 0 | 754,936,115 | 100% | ||

| kran332 | 0 | 754,956,256 | 100% | ||

| soska69 | 0 | 592,296,206 | 100% | ||

| triks | 0 | 591,584,320 | 100% | ||

| staiken | 0 | 591,694,628 | 100% | ||

| krakenost | 0 | 504,087,172 | 100% | ||

| gariborn | 0 | 504,174,938 | 100% | ||

| musteruy | 0 | 591,606,576 | 100% | ||

| grigoryu | 0 | 504,163,476 | 100% | ||

| daewing | 0 | 591,721,494 | 100% | ||

| fractions | 0 | 504,151,900 | 100% | ||

| trauders | 0 | 591,568,926 | 100% | ||

| veroniuk | 0 | 591,661,699 | 100% | ||

| genadium | 0 | 504,178,761 | 100% | ||

| chiken-1 | 0 | 504,120,475 | 100% | ||

| darksshadol | 0 | 591,719,858 | 100% | ||

| kiritochan | 0 | 504,146,835 | 100% | ||

| tigermand | 0 | 591,579,044 | 100% | ||

| gnidas | 0 | 504,173,909 | 100% | ||

| nasera | 0 | 591,626,654 | 100% | ||

| tygos | 0 | 591,715,941 | 100% | ||

| nastues | 0 | 591,599,611 | 100% | ||

| centtoken | 0 | 5,423,954,395 | 25% | ||

| life-shturm | 0 | 1,843,363,083 | 100% | ||

| kizunasport | 0 | 2,583,285,201 | 100% |

hiveblocks

hiveblocks