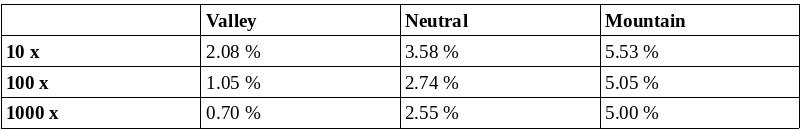

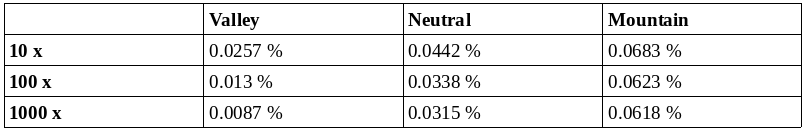

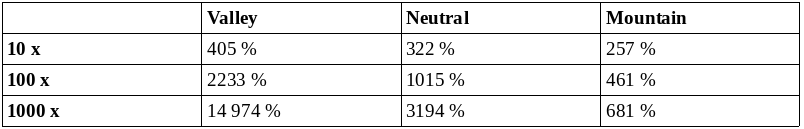

This should help you decide your parameters. A well set-up strategy will give you peace of mind and increase the likelihood of good performance. I made a few comparison matrixes to understand how range and mode affects profitability. I use a 5% increment and 10% spread. I simply look at one side. Note that the _mode_ doesn't mean what your current mode is (you can change it at any point), but how the funds are allocated into orders (with what mode you started the strategy). In reality your situation might be more complex, but this comparison should give you a baseline understanding. ## Order size at starting price Percentage of asset total  As you can see, extending the range costs almost nothing for mountain mode, but much more for valley. ## Profit of one single trade at starting price This assumes you have half your assets in base and half in quote. Profit compared to total value of assets allocated into strategy.  This shows essentially the same picture. Remember that profits compound. If you assume 1 trade per day, and price returning to starting point, you can count `<profit> ^ 365` to get yearly profit. ## Average sell price if price exceeds upper bound How many percent profit would you have made in total if the price shot right through all your orders with no fluctuation whatsoever. If starting price is 100, then the number also shows at what price on average would you have sold everything.  You might notice how much better valley mode is in this case. However, I don’t recommend planning your strategy to sell out at some point. If you expect that to happen, it might be better to place on limit order to sell the whole bag at a high price. ## What you should probably learn The idea of Staggered Orders is to profit from the fluctuation of the price at all probable prices. On average you accumulate more of both assets. To use a small range is – if not suicidal – at least stupid. The very idea is not to sell out, but to continue to benefit from fluctuations at all prices and compound the profits. You probably don’t know if it will go down 100x or up 100x, so better prepare for that scenario. It’s most likely that prices will remain close to current levels than to significantly deviate. However, the potential profit is significantly higher for higher fluctuations. So defining your parameters is a balancing act between high probablility of small profits compounding, and small probability of huge profits and less compounding. What do you expect? If you expect little volatility, use mountain mode with a big range (since extending range costs almost nothing). If you expect huge volatility, use valley mode with a big range. If you don’t know, use neutral mode with a big range (since you don’t know, and it costs only a little more). A big range will give you peace of mind, and you can focus on other things instead of obsessing about price.

| author | markopaasila |

|---|---|

| permlink | staggered-orders-comparing-range-and-mode |

| category | dexbot |

| json_metadata | {"tags":["dexbot","staggered-orders","marketmaking","trading","bitshares"],"image":["https://cdn.steemitimages.com/DQmWdMQ6n2be2nLwSDLyH1j7GTr1Ad59fbAyy9RZ7xh72wv/image.png","https://cdn.steemitimages.com/DQmeoBvaWZZMRBnKv1rpCqjmT8V4GUqTrfMnGTP8NhNDZ4P/image.png","https://cdn.steemitimages.com/DQmY9QJBq5r66PUFMhFVbgvSKws2GXVwQVfWCtKw6AMVEnp/image.png"],"app":"steemit/0.1","format":"markdown"} |

| created | 2019-01-04 11:15:48 |

| last_update | 2019-01-04 11:27:09 |

| depth | 0 |

| children | 1 |

| last_payout | 2019-01-11 11:15:48 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 4.010 HBD |

| curator_payout_value | 1.250 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 3,175 |

| author_reputation | 32,771,884,740,822 |

| root_title | "Staggered Orders - comparing range and mode" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 77,857,277 |

| net_rshares | 9,720,803,594,029 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tombstone | 0 | 8,677,228,236,922 | 33% | ||

| markopaasila | 0 | 11,675,112,852 | 100% | ||

| konelectric | 0 | 201,107,381,473 | 100% | ||

| team | 0 | 81,360,658,180 | 10% | ||

| fractalnode | 0 | 69,447,470,102 | 100% | ||

| idealist | 0 | 40,509,923,827 | 100% | ||

| cm-steem | 0 | 536,519,143,893 | 100% | ||

| jamielewis | 0 | 833,823,476 | 100% | ||

| gabev | 0 | 554,195,243 | 100% | ||

| hotbit | 0 | 0 | 100% | ||

| vvk | 0 | 19,330,503,807 | 100% | ||

| merry1990 | 0 | 490,615,124 | 100% | ||

| nikopu | 0 | 492,413,078 | 100% | ||

| shancarpe | 0 | 493,100,108 | 100% | ||

| amaratonna | 0 | 492,350,150 | 100% | ||

| ingakoral | 0 | 494,009,915 | 100% | ||

| s6476721 | 0 | 490,480,606 | 100% | ||

| luzan88 | 0 | 491,763,411 | 100% | ||

| natalliav | 0 | 491,743,373 | 100% | ||

| halford | 0 | 494,949,537 | 100% | ||

| vaisvila | 0 | 492,366,275 | 100% | ||

| klaraminasyan | 0 | 492,212,342 | 100% | ||

| miki21657 | 0 | 492,579,231 | 100% | ||

| miki20336 | 0 | 494,577,277 | 100% | ||

| boomhello | 0 | 505,451,534 | 100% | ||

| iridiumnonagon | 0 | 499,957,932 | 100% | ||

| poofwalrus | 0 | 491,437,747 | 100% | ||

| bankhayloft | 0 | 491,938,698 | 100% | ||

| pignutcraft | 0 | 499,343,730 | 100% | ||

| molly.smith | 0 | 499,364,470 | 100% | ||

| ira.timirova91 | 0 | 499,206,738 | 100% | ||

| ikalinowski | 0 | 492,067,949 | 100% | ||

| taigacabinet | 0 | 491,911,014 | 100% | ||

| pinchtedious | 0 | 494,766,093 | 100% | ||

| pursercomet | 0 | 500,047,792 | 100% | ||

| unicodedemi | 0 | 492,724,424 | 100% | ||

| widgeontasks | 0 | 491,911,505 | 100% | ||

| palmcomposed | 0 | 492,028,019 | 100% | ||

| embryofemur | 0 | 499,414,277 | 100% | ||

| rattyopera | 0 | 498,764,571 | 100% | ||

| closedolphin | 0 | 493,354,456 | 100% | ||

| danceslovak | 0 | 493,924,027 | 100% | ||

| mailrabbit | 0 | 492,596,865 | 100% | ||

| modulardrudge | 0 | 494,403,347 | 100% | ||

| boredrational | 0 | 491,593,415 | 100% | ||

| pedlarthermal | 0 | 491,375,848 | 100% | ||

| djane860 | 0 | 494,457,839 | 100% | ||

| elenatagaeva | 0 | 492,534,483 | 100% | ||

| svetamihanova | 0 | 492,387,826 | 100% | ||

| skuzmin88 | 0 | 491,721,161 | 100% | ||

| telephonewhy | 0 | 492,081,414 | 100% | ||

| exoticbaste | 0 | 492,795,997 | 100% | ||

| betweeneris | 0 | 494,139,987 | 100% | ||

| partialbullhorn | 0 | 491,825,756 | 100% | ||

| nebulabilled | 0 | 501,560,063 | 100% | ||

| wailibis | 0 | 492,891,894 | 100% | ||

| corvushilt | 0 | 492,435,334 | 100% | ||

| templateflask | 0 | 490,490,617 | 100% | ||

| casecod | 0 | 490,412,210 | 100% | ||

| kitgoody | 0 | 491,813,617 | 100% | ||

| pointsbee | 0 | 491,825,908 | 100% | ||

| quadratour | 0 | 501,146,263 | 100% | ||

| trashycalf | 0 | 495,191,049 | 100% | ||

| muffintwinning | 0 | 491,936,747 | 100% | ||

| cliveponie | 0 | 493,251,215 | 100% | ||

| brandcomment | 0 | 493,249,455 | 100% | ||

| magichive | 0 | 494,494,598 | 100% | ||

| recognizedesert | 0 | 491,922,148 | 100% | ||

| lipspin | 0 | 490,558,443 | 100% | ||

| lotgreasy | 0 | 492,413,293 | 100% | ||

| lividbouncy | 0 | 494,053,034 | 100% | ||

| rootscheese | 0 | 492,555,731 | 100% | ||

| appearford | 0 | 499,023,416 | 100% | ||

| okapitonov88 | 0 | 492,500,590 | 100% | ||

| senchiks | 0 | 501,583,375 | 100% | ||

| elianton | 0 | 494,186,125 | 100% | ||

| aleksey.kuzmin4 | 0 | 494,200,082 | 100% | ||

| buntlinelard | 0 | 501,624,496 | 100% | ||

| rigelnull | 0 | 495,191,076 | 100% | ||

| ecotypedatabase | 0 | 492,426,428 | 100% | ||

| fizzyreadymade | 0 | 495,063,764 | 100% | ||

| roadlifted | 0 | 492,630,668 | 100% | ||

| pedalgrinder | 0 | 499,429,768 | 100% | ||

| ringbiceps | 0 | 495,163,374 | 100% | ||

| phatchinson | 0 | 493,156,520 | 100% | ||

| atihonov1990 | 0 | 492,980,995 | 100% | ||

| neshferdin | 0 | 498,909,423 | 100% | ||

| etanuelch | 0 | 491,399,386 | 100% | ||

| nlazarev69 | 0 | 498,873,195 | 100% | ||

| evgeniy.pavlenko | 0 | 491,580,894 | 100% | ||

| sergeyrevutskiy | 0 | 493,129,295 | 100% | ||

| nikfrol1983 | 0 | 499,259,381 | 100% | ||

| stewem | 0 | 499,393,098 | 100% | ||

| ismirnov88 | 0 | 491,893,675 | 100% | ||

| stmpay | 0 | 5,356,595,658 | 1.64% | ||

| japanesecliff | 0 | 493,515,234 | 100% | ||

| panickysafe | 0 | 492,778,108 | 100% | ||

| lettersacrobatic | 0 | 492,719,555 | 100% | ||

| hostlerodd | 0 | 494,033,071 | 100% | ||

| wigeonpate | 0 | 495,557,028 | 100% | ||

| stopthe | 0 | 493,422,304 | 100% | ||

| anxiousupdates | 0 | 492,563,079 | 100% | ||

| turbulentsooty | 0 | 493,172,319 | 100% | ||

| obtainmelody | 0 | 493,900,565 | 100% | ||

| slacketerosion | 0 | 495,858,384 | 100% | ||

| northernsound | 0 | 491,296,430 | 100% | ||

| bigblock | 0 | 492,972,773 | 100% | ||

| lopatin.artem | 0 | 493,845,836 | 100% | ||

| yaroslavkotelok | 0 | 494,151,025 | 100% | ||

| ruslan.chernovol | 0 | 493,972,081 | 100% | ||

| ivan.maznichenko | 0 | 493,885,977 | 100% | ||

| femanbox | 0 | 501,135,725 | 100% | ||

| rublesky | 0 | 494,469,310 | 100% | ||

| brazileczo | 0 | 494,134,519 | 100% | ||

| molot.orex | 0 | 493,425,853 | 100% | ||

| charlimr | 0 | 492,528,065 | 100% | ||

| reno.logan | 0 | 494,570,957 | 100% | ||

| vladlenkonkol | 0 | 492,630,693 | 100% | ||

| kardakova | 0 | 494,492,310 | 100% | ||

| celestacrid | 0 | 491,527,452 | 100% | ||

| clailpickled | 0 | 493,244,536 | 100% | ||

| dryemigrate | 0 | 481,596,062 | 100% | ||

| crocodileevident | 0 | 492,625,112 | 100% | ||

| societiespaying | 0 | 492,873,566 | 100% | ||

| teamruffs | 0 | 492,691,783 | 100% | ||

| huglend | 0 | 493,936,534 | 100% | ||

| lockoperand | 0 | 494,101,981 | 100% | ||

| boatswainjick | 0 | 491,387,116 | 100% | ||

| kingboundless | 0 | 494,516,286 | 100% | ||

| rhowarkened | 0 | 495,576,792 | 100% | ||

| flagsencourage | 0 | 501,320,755 | 100% | ||

| behaveskaters | 0 | 493,389,222 | 100% | ||

| nickermemory | 0 | 494,925,503 | 100% | ||

| analamuck | 0 | 492,630,075 | 100% | ||

| fearfultanager | 0 | 492,899,598 | 100% | ||

| cloudhopeless | 0 | 481,799,783 | 100% | ||

| godwitresources | 0 | 494,096,465 | 100% | ||

| nestlewider | 0 | 492,564,918 | 100% | ||

| baggygruesome | 0 | 494,004,529 | 100% | ||

| haumearook | 0 | 494,111,269 | 100% | ||

| divergemagpie | 0 | 495,478,216 | 100% | ||

| hiveclamorous | 0 | 493,852,409 | 100% | ||

| charbodge | 0 | 493,725,628 | 100% | ||

| liquidisenavel | 0 | 493,836,098 | 100% | ||

| coatattach | 0 | 492,462,585 | 100% | ||

| nokeununtrium | 0 | 494,082,015 | 100% | ||

| scarceflaky | 0 | 492,615,220 | 100% | ||

| splashdrown | 0 | 493,743,552 | 100% | ||

| celestialbull | 0 | 493,225,238 | 100% | ||

| footedurgonian | 0 | 493,322,313 | 100% | ||

| mingdomnirds | 0 | 494,063,754 | 100% | ||

| mexicanrichest | 0 | 492,717,626 | 100% | ||

| possessprint | 0 | 493,817,720 | 100% | ||

| achingjavabean | 0 | 493,867,095 | 100% | ||

| revelibuges | 0 | 493,173,274 | 100% | ||

| sawgpufsing | 0 | 493,126,790 | 100% | ||

| blonohdikov | 0 | 494,035,692 | 100% | ||

| bluesniper | 0 | 4,616,515,458 | 0.32% | ||

| hozn4ukhlytriwc | 0 | 87,547,391 | 20% | ||

| redfox071 | 0 | 556,000,000 | 100% |

Congratulations @markopaasila! You received a personal award! <table><tr><td>https://steemitimages.com/70x70/http://steemitboard.com/@markopaasila/birthday3.png</td><td>Happy Birthday! - You are on the Steem blockchain for 3 years!</td></tr></table> <sub>_You can view [your badges on your Steem Board](https://steemitboard.com/@markopaasila) and compare to others on the [Steem Ranking](http://steemitboard.com/ranking/index.php?name=markopaasila)_</sub> ###### [Vote for @Steemitboard as a witness](https://v2.steemconnect.com/sign/account-witness-vote?witness=steemitboard&approve=1) to get one more award and increased upvotes!

| author | steemitboard |

|---|---|

| permlink | steemitboard-notify-markopaasila-20190425t092344000z |

| category | dexbot |

| json_metadata | {"image":["https://steemitboard.com/img/notify.png"]} |

| created | 2019-04-25 09:23:45 |

| last_update | 2019-04-25 09:23:45 |

| depth | 1 |

| children | 0 |

| last_payout | 2019-05-02 09:23:45 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 635 |

| author_reputation | 38,975,615,169,260 |

| root_title | "Staggered Orders - comparing range and mode" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 83,728,630 |

| net_rshares | 0 |

hiveblocks

hiveblocks