As Bitcoin's price recently reached $5,000 for a new high price and then fell back to nearly $3,000, this month it was a natural pursuit this month.

These explosions are part of a volatile digital currency, and drops of 10, 20, even 40 percent are not so rare.

Since the start of Bitcoin, there has been a major accident, but there have been many good lessons to learn.

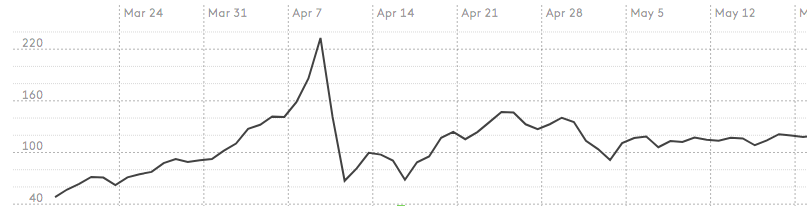

**The collapse of April 2013**

At an earlier and higher pace, the Bitcoin price dropped from $233 to $67 overnight from the night, with a massive 71% decline over the course of 12 hours. It takes seven months to recover.

This melt-back was attributed to the Bitcoin Friction Shoulders mainstream for the first time. The digital currency never exceeded $15 before 2013, but the flood of media coverage helped over $200.

It was a drastic and violent correction followed by a surge in price rises, although Mt. Gox, which was considered a catalyst.

**Famed 2013 bubble**

At the end of April, the price of Bitcoin rose to about $120 a while later, at the end of November, prices rose sharply to $1,150. However, by mid-December, the price dropped below what was less than half that, and it will remain for four years before reaching $1,000.

At the end of 2013, all bubble signs were coming, as amateur investors stormed the digital currency. This continued even more as the regulatory authorities took a positive stance, while exchanges like Coinbaz began to make the purchase process much easier.

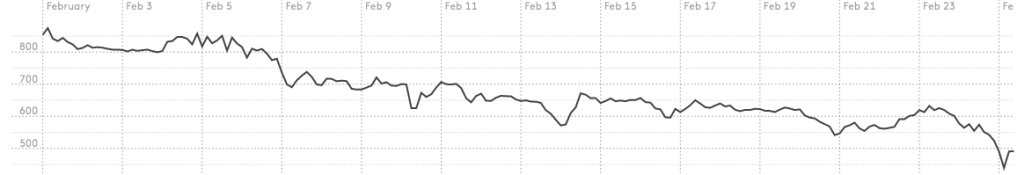

**Mt. Gox misfortune**

After the collapse of December 2013 on long highways, Mt. The Gox accident that almost fluctuated with the Bitcoin boat. Bitcoin has been growing steadily in January and February, when it suddenly dropped from nearly 50 percent from $867 to $439.

This collapse was triggered when Mt. Gox announced that he had a great deal of hacking. On 7 February, suspensions were exchanged, and later the thieves discovered 850,000 bitcoins (worth around $ 3.5 billion today).

**Summer Sale in 2017**

At the beginning of January this year, Bitcoin's price rose again to $1,000, which led to a huge rise in prices, as the digital currency added $3,000 in June. But by mid-July, it had dropped 36 percent back to $1,896.

Despite boom and increased interest, the Code was still a concern and a civil war. On August 1, a large number of people were very famous and scared several investors for the future of the coin, as users and miners searched for different solutions.

The ironic fact that such a fork rose in August as a rival in Bitcoin Cash, but it does not seem to have damaged Bitcoin for a long time.

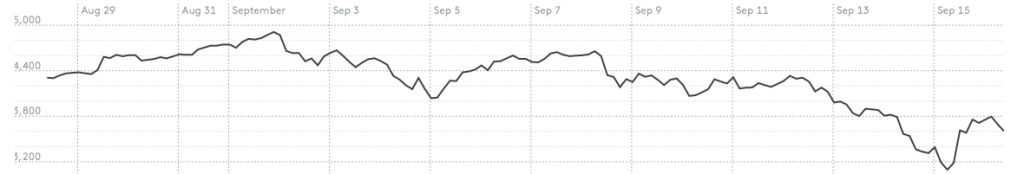

**Chinese sitter intervention**

When the forks are off and peace has been restored between the various parties, Bitcoin has once again overwhelmed its growth. It rose to about $5,000 at the beginning of September, before a mere 35 percent deepening to 37 percent, which reduced the overall Bitcoin consumption limit by over $30bn.

This decline is really one thing, and it's China. The Socialist state first hijacked the ICOs, and then went after the exchange of the digital currency, making their feelings a disturbing monetary system.

**Lesson to be learnt**

Although this is not a lesson, more lifestyles for Bitcoin, it must be clear that the digital currency is volatile.

Similarly, it can be seen that the breakdown of Bitcoin coincides with speculative collisions associated with exogenous shocks, such as large-scale hacking or government crackdowns.

However, Bitcoin always turns it back. The bouncing back process can be anywhere from a week to a couple of years, and the warning story there is long-term keeping the bypass of any stress caused by massive drops.

Late clashes have been much smaller, less susceptible and shock angles have been faster and more durable. It shows an open-ended market. To date, the cryptocurrency market is much larger and has proven to be resilient.

hiveblocks

hiveblocks