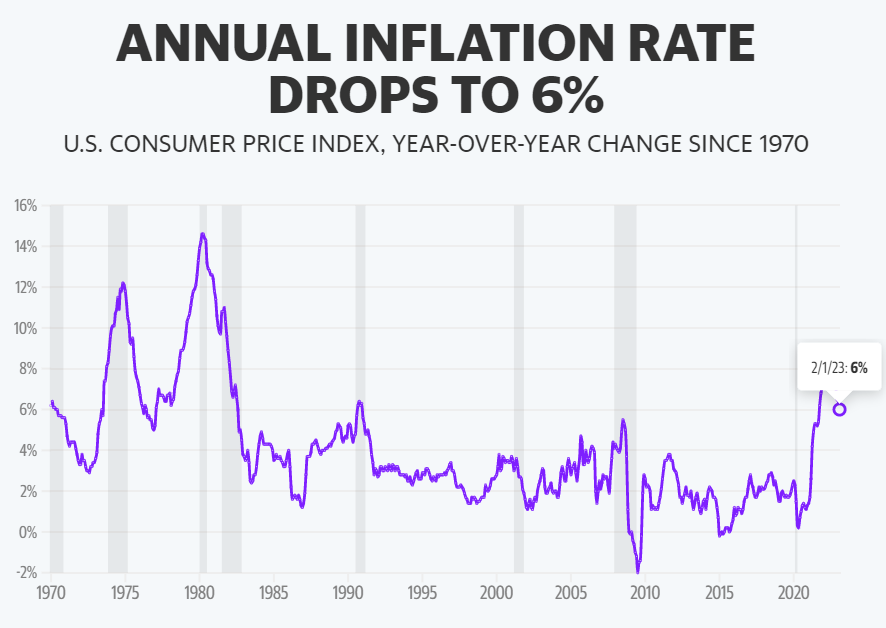

.jpg) All HIVIANS out there must be happy that BTC is pumping hard and looking to reach the next leg up at 30K at the time of writing this post. While the BTC is pumping alongside other crypto assets, the stock market, especially bank stocks, are also pumping on today’s CPI data. ### CPI - February 2023 The CPI data came out as expected for February at 6% in the US. The market looks to be satisfied with the core CPI numbers. It means that the quantitative tightening that was implemented for the last 12 months is finally coming to fruition. That could also mean that the Fed will look to be more relaxed (hopefully) with interest rate hikes and may revert the course.  But, that is not the only variable at play when it comes to raising interest rates. There is another story in the form of the Silicon Valley Bank (SVB) collapse that may impact the Fed’s decision on interest rate hikes. ### SVB Collapse Saga The collapse of SVB, the second-largest bank failure in U.S. history, sent shockwaves through the global financial system and raised questions about the stability of regional banks. SVB was a California-based bank that specialized in serving tech startups, venture capitalists, and cryptocurrency firms. It had over $200 billion in assets and more than 30,000 clients worldwide. It was also one of the few banks that had received regulatory approval to offer banking services to crypto companies. ### What happened? Well, the panicked customers drove in asking for their deposits. The crypto twitter was abuzz with bank insolvency after the bank decided to sell their long term bond holdings to swap them with short term holdings to make sure they have hedge against the rising interest rates. Customers did not like that as there were many other rumors about cyber attacks and SVB facing lawsuits over anti-money laundering practices. The bank’s investment in crypto was another reason for their exposure to high risk loans and investments. As the crypto market tanked so was the bank’s investment. > All these factors initiated a massive run on the bank as billions of dollars were taken out in a day. On March 10, 2023, SVB announced that it had suffered a net loss of $12 billion for the fourth quarter of 2020 and that it was unable to meet its capital requirements. The next day, the Federal Deposit Insurance Corporation (FDIC) seized SVB and sold its assets to Silvergate Capital, another crypto-friendly bank that also collapsed shortly after. The depositors fled from the market and the banking system as a whole was seen cracking. This has not happened since the great recession of 2008. The USDC, a stable coin issued by Circle, depegged and that sent a shockwave in the crypto market as well. The coin is back to the peg thanks to the confirmation that their money from SVB will be back in their account. The U.S. government intervened to contain the crisis and restore confidence. The Government departments issued a joint statement on March 12, 2023, announcing that they would guarantee all deposits at SVB and Signature Bank up to $250,000 per account holder. ### What does it mean for interest rates? The SVB fiasco has implications for interest rates in both the short term and the long term. In the short term, interest rates may rise as banks face higher funding costs due to lower deposits and higher risk premiums. In the long term, interest rates may be affected by the policy response of the Federal Reserve and other central banks. The Fed may have to reconsider its plans to raise interest rates gradually in 2023 to support economic recovery and inflation targets. This new CPI data has now added another wrinkle to the inflation and Quantitative Tightening story. On the contrary, the Fed may also have to expand its quantitative easing program or provide emergency liquidity facilities to stabilize the financial system. While speculating the pause in interest rates, the Fed may also flip and decide to stick to tightening and continue raising rates. The SVB fiasco could be termed as a bad investment not to reflect a broader weakness in the economy. ### Bond Yield Rates and Mortgage Rates One group of analysts are also predicting that the fixed term mortgage rates will go down which will then boost the real estate market due the SVB fiasco. The 5-year bond rate has dropped like a bird in the wake of capital fleeing for the safe asset. Mortgage rates are tied to the bond rate and if this situation solidifies then the mortgage rate will come down. Having said that the bond yield is rising again this afternoon in the market which means traders are predicting that the interest rate hikes may resume.  There are so many variables at play here. The SVB fiasco has changed the narrative of the banking system and their stability. We will wait and see what the ramifications are. The Fed and the central banks across the world will need to justify their decision to increase the interest rate for sure if they decide to remain hawkish. [https://ca.investing.com/rates-bonds/canada-5-year-bond-yield](https://ca.investing.com/rates-bonds/canada-5-year-bond-yield) [https://ca.finance.yahoo.com/news/traders-once-again-betting-fed-134158889.html](https://ca.finance.yahoo.com/news/traders-once-again-betting-fed-134158889.html) Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@rmsadkri/the-svb-fiasco-and-the-potential-impact-on-rising-interest-rates)

| author | rmsadkri |

|---|---|

| permlink | the-svb-fiasco-and-the-potential-impact-on-rising-interest-rates |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["bankrun","crypto","mortgage","feds","policy","economy","realestate","canada","leofinance"],"canonical_url":"https://leofinance.io/@rmsadkri/the-svb-fiasco-and-the-potential-impact-on-rising-interest-rates","links":["https://ca.investing.com/rates-bonds/canada-5-year-bond-yield","https://ca.finance.yahoo.com/news/traders-once-again-betting-fed-134158889.html"],"image":["https://images.hive.blog/DQmVKHVkdTNygSuBWNhDXi669M8rq8dxyFYpWMJffp3nZSP/NO%20RATE%20HIKES%20(2).jpg","https://images.hive.blog/DQmQu3vpRxiVgFLUPVGAnxzM8jYxvJGyroNQwtr1LmeUe2N/image.png","https://images.hive.blog/DQmV9kFc3zrYPsHBsBHy4Um5nbJrhaWhVtTvFswKjqh1w98/5%20year%20bond.png"]} |

| created | 2023-03-14 20:07:27 |

| last_update | 2023-03-14 20:07:27 |

| depth | 0 |

| children | 4 |

| last_payout | 2023-03-21 20:07:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 8.237 HBD |

| curator_payout_value | 8.209 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 5,777 |

| author_reputation | 130,037,546,229,053 |

| root_title | "The SVB Fiasco and the Potential Impact on Rising Interest Rates" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 121,629,497 |

| net_rshares | 29,160,743,418,475 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| kevinwong | 0 | 43,563,758,446 | 5.5% | ||

| jeffjagoe | 0 | 6,956,596,871 | 0.66% | ||

| arconite | 0 | 1,199,725,324 | 2.75% | ||

| rufans | 0 | 23,818,075,605 | 50% | ||

| virtualgrowth | 0 | 8,736,058,053 | 19% | ||

| uwelang | 0 | 3,441,558,556 | 8.8% | ||

| funnyman | 0 | 6,258,805,756 | 25% | ||

| stefanialexis | 0 | 904,262,889 | 22% | ||

| tarazkp | 0 | 1,657,395,952,984 | 25% | ||

| bitrocker2020 | 0 | 142,445,872,520 | 11% | ||

| arrliinn | 0 | 6,035,480,428 | 4.4% | ||

| bitcoinflood | 0 | 744,470,025,367 | 26% | ||

| ew-and-patterns | 0 | 561,526,443 | 10% | ||

| gniksivart | 0 | 47,182,960,936 | 10% | ||

| forexbrokr | 0 | 13,107,844,592 | 50% | ||

| paasz | 0 | 5,601,645,137 | 100% | ||

| toofasteddie | 0 | 125,568,505,740 | 29% | ||

| runicar | 0 | 3,659,175,572 | 50% | ||

| thauerbyi | 0 | 3,961,138,889 | 19.8% | ||

| jeanlucsr | 0 | 2,544,061,139 | 4.4% | ||

| pardeepkumar | 0 | 1,511,109,711 | 50% | ||

| pele23 | 0 | 320,790,953,730 | 49% | ||

| niallon11 | 0 | 73,015,109,449 | 4.4% | ||

| raj808 | 0 | 57,037,578,382 | 100% | ||

| roleerob | 0 | 103,133,995,958 | 11% | ||

| plantstoplanks | 0 | 64,344,423,172 | 14% | ||

| minloulou | 0 | 762,939,638 | 11% | ||

| dagger212 | 0 | 662,246,831,637 | 60% | ||

| divinekids | 0 | 709,776,178 | 4.4% | ||

| thetimetravelerz | 0 | 4,868,767,517 | 11% | ||

| khaleelkazi | 0 | 41,483,980,755 | 22% | ||

| caladan | 0 | 3,960,108,826 | 21.78% | ||

| mrhill | 0 | 20,840,244,474 | 70% | ||

| senorcoconut | 0 | 2,877,519,640 | 5.5% | ||

| vintherinvest | 0 | 577,855,038 | 11% | ||

| ocupation | 0 | 4,808,361,350 | 50% | ||

| joannewong | 0 | 995,807,057 | 11% | ||

| enjoyinglife | 0 | 20,841,158,935 | 50% | ||

| vempromundo | 0 | 2,726,112,615 | 11% | ||

| purefood | 0 | 2,144,875,041 | 22% | ||

| elektr1ker | 0 | 1,108,159,605 | 25% | ||

| mindtrap | 0 | 732,965,079 | 50% | ||

| runningproject | 0 | 33,924,862,410 | 70% | ||

| organduo | 0 | 8,568,638,582 | 22% | ||

| amico | 0 | 6,324,212,310 | 23.1% | ||

| gadrian | 0 | 51,763,161,948 | 8.8% | ||

| zaxan | 0 | 1,026,546,818 | 11% | ||

| steemxp | 0 | 636,687,286 | 11% | ||

| marenontherun | 0 | 8,161,965,341 | 35% | ||

| shortsegments | 0 | 882,231,803 | 1.1% | ||

| gallerani | 0 | 1,380,551,818 | 22% | ||

| ireenchew | 0 | 9,382,354,436 | 15.4% | ||

| raiseup | 0 | 96,718,756,730 | 22% | ||

| dlike | 0 | 56,318,822,208 | 22% | ||

| steemaction | 0 | 142,702,189,356 | 22% | ||

| cwow2 | 0 | 4,895,739,064 | 2% | ||

| coriolis | 0 | 4,269,368,903 | 11% | ||

| anonsteve | 0 | 10,231,899,692 | 22% | ||

| flyingbolt | 0 | 1,679,797,327 | 22% | ||

| pervitin | 0 | 3,424,026,886 | 11% | ||

| megavest | 0 | 63,347,713,855 | 22% | ||

| shauner | 0 | 3,055,255,038 | 11% | ||

| travelwritemoney | 0 | 9,751,746,994 | 22% | ||

| leo.voter | 0 | 23,977,215,031,062 | 22% | ||

| leo.curator | 0 | 850,890,898 | 17.6% | ||

| leo.bank | 0 | 572,488,242 | 22% | ||

| babytarazkp | 0 | 5,715,772,045 | 50% | ||

| asteroids | 0 | 3,188,845,448 | 22% | ||

| pouchon.tribes | 0 | 9,529,883,821 | 16.5% | ||

| emeka4 | 0 | 4,877,517,785 | 11% | ||

| coinlogic.online | 0 | 2,319,780,128 | 11% | ||

| chloem | 0 | 4,105,510,220 | 22% | ||

| leotrail | 0 | 818,667,554 | 22% | ||

| antiretroviral | 0 | 1,608,080,167 | 11% | ||

| sacrosanct | 0 | 6,762,956,107 | 15% | ||

| onestop | 0 | 908,556,366 | 11% | ||

| vxn666 | 0 | 2,562,456,852 | 11% | ||

| hivebuzz | 0 | 9,199,583,735 | 2% | ||

| leofinance | 0 | 41,296,343,805 | 22% | ||

| x9ed1732b | 0 | 1,468,503,067 | 19.8% | ||

| zuly63 | 0 | 581,717,136 | 17.6% | ||

| beehivetrader | 0 | 1,506,869,751 | 11% | ||

| subhari | 0 | 3,795,658,307 | 100% | ||

| jelly13 | 0 | 1,793,910,045 | 21.25% | ||

| w-t-fi | 0 | 1,693,350,920 | 100% | ||

| cmplxty.leo | 0 | 422,234,120 | 45% | ||

| eddie-earner | 0 | 2,404,037,129 | 11% | ||

| wrapped-leo | 0 | 3,344,753,240 | 22% | ||

| reonarudo | 0 | 1,559,163,244 | 11% | ||

| netaterra.leo | 0 | 644,336,402 | 19.8% | ||

| leo.tokens | 0 | 2,020,858,962 | 22% | ||

| erikahskitchen | 0 | 6,284,913,624 | 50% | ||

| rondonshneezy | 0 | 1,548,714,245 | 11% | ||

| v10r8 | 0 | 532,532,916 | 22% | ||

| brando28 | 0 | 4,142,008,963 | 50% | ||

| onemoretea | 0 | 486,773,683 | 22% | ||

| solymi | 0 | 6,386,932,421 | 6.6% | ||

| bananass | 0 | 533,880,997 | 14.3% | ||

| elongate | 0 | 745,616,679 | 22% | ||

| amongus | 0 | 898,795,012 | 22% | ||

| elgatoshawua | 0 | 2,902,613,985 | 11% | ||

| b-leo | 0 | 3,884,751,685 | 22% | ||

| creodas | 0 | 564,896,369 | 16.5% | ||

| impurgent | 0 | 640,879,630 | 40% | ||

| princessbusayo | 0 | 1,237,392,739 | 4.4% | ||

| brume7 | 0 | 557,460,963 | 11% | ||

| robmojo.leo | 0 | 597,553,633 | 17.6% | ||

| steentijd | 0 | 3,136,425,334 | 11% | ||

| crypto-guides | 0 | 9,603,200,970 | 100% | ||

| bella76 | 0 | 522,151,109 | 11% | ||

| bokica80 | 0 | 974,146,696 | 11% | ||

| tiyumtaba | 0 | 577,516,954 | 11% | ||

| sovstar | 0 | 513,550,599 | 11% | ||

| tanzil2024 | 0 | 2,658,379,237 | 5% | ||

| cervantes420 | 0 | 3,000,858,801 | 22% | ||

| cugel | 0 | 5,958,104,167 | 11% | ||

| kushyzee | 0 | 759,500,493 | 11% | ||

| njker | 0 | 847,624,009 | 22% | ||

| scrubs24 | 0 | 7,988,633,512 | 16.5% | ||

| trasto | 0 | 1,213,290,962 | 11% | ||

| mcsherriff | 0 | 4,388,761,396 | 21.78% | ||

| zeclipse | 0 | 611,663,080 | 22% | ||

| saboin.leo | 0 | 159,773,494 | 26% | ||

| femcy-willcy | 0 | 801,490,880 | 11% | ||

| gwajnberg | 0 | 1,976,108,524 | 15.4% | ||

| grabapack | 0 | 5,990,457,359 | 11% | ||

| alex2alex | 0 | 538,732,175 | 2.2% | ||

| henrietta27 | 0 | 589,113,266 | 11% | ||

| p-leo | 0 | 3,344,781,328 | 22% | ||

| khaltok | 0 | 1,984,443,699 | 22% | ||

| abouttodie | 0 | 1,065,635,060 | 25% | ||

| xleo.voter | 0 | -81,090,767 | -22% | ||

| p-hive | 0 | 3,651,532,315 | 22% | ||

| thoth442 | 0 | 809,880,338 | 11% | ||

| bnb-hive | 0 | 205,526,669,043 | 22% | ||

| micheal87 | 0 | 1,103,681,506 | 22% | ||

| specific-leo | 0 | 759,147,695 | 22% | ||

| cubdaily | 0 | 4,761,276,550 | 22% | ||

| olujose6 | 0 | 562,767,660 | 15% | ||

| sammyhive | 0 | 705,067,250 | 22% | ||

| mhizsmiler.leo | 0 | 980,975,045 | 22% | ||

| depressed.leo | 0 | 667,500,795 | 22% |

Congratulations @rmsadkri! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s) <table><tr><td><img src="https://images.hive.blog/60x70/http://hivebuzz.me/@rmsadkri/upvotes.png?202303141954"></td><td>You distributed more than 35000 upvotes.<br>Your next target is to reach 36000 upvotes.</td></tr> </table> <sub>_You can view your badges on [your board](https://hivebuzz.me/@rmsadkri) and compare yourself to others in the [Ranking](https://hivebuzz.me/ranking)_</sub> <sub>_If you no longer want to receive notifications, reply to this comment with the word_ `STOP`</sub> To support your work, I also upvoted your post! **Check out our last posts:** <table><tr><td><a href="/hive-122221/@hivebuzz/lpud-202303"><img src="https://images.hive.blog/64x128/https://i.imgur.com/pVZi2Md.png"></a></td><td><a href="/hive-122221/@hivebuzz/lpud-202303">LEO Power Up Day - March 15, 2023</a></td></tr><tr><td><a href="/hive-195772/@hivebuzz/afri-tunes"><img src="https://images.hive.blog/64x128/https://i.imgur.com/yngJQKY.png"></a></td><td><a href="/hive-195772/@hivebuzz/afri-tunes">HiveBuzz rewards participants in the Afri-Tunes Anniversary event</a></td></tr><tr><td><a href="/hivebuzz/@hivebuzz/call-for-support"><img src="https://images.hive.blog/64x128/https://i.imgur.com/xu0J1kD.png"></a></td><td><a href="/hivebuzz/@hivebuzz/call-for-support">Keep Hive Buzzing - Support our proposal!</a></td></tr><tr><td><a href="/hive-139531/@hivebuzz/proposal-2324"><img src="https://images.hive.blog/64x128/https://i.imgur.com/RNIZ1N6.png"></a></td><td><a href="/hive-139531/@hivebuzz/proposal-2324">The Hive Gamification Proposal</a></td></tr></table> ###### Support the HiveBuzz project. [Vote](https://hivesigner.com/sign/update_proposal_votes?proposal_ids=%5B%22248%22%5D&approve=true) for [our proposal](https://peakd.com/me/proposals/248)!

| author | hivebuzz |

|---|---|

| permlink | notify-rmsadkri-20230314t202824 |

| category | hive-167922 |

| json_metadata | {"image":["http://hivebuzz.me/notify.t6.png"]} |

| created | 2023-03-14 20:28:24 |

| last_update | 2023-03-14 20:28:24 |

| depth | 1 |

| children | 0 |

| last_payout | 2023-03-21 20:28:24 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 1,897 |

| author_reputation | 367,710,464,985,266 |

| root_title | "The SVB Fiasco and the Potential Impact on Rising Interest Rates" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 121,629,938 |

| net_rshares | 0 |

https://leofinance.io/threads/@rmsadkri/re-leothreads-2wr8ug8jr <sub> The rewards earned on this comment will go directly to the people ( rmsadkri ) sharing the post on LeoThreads,LikeTu,dBuzz.</sub>

| author | poshthreads | ||||||

|---|---|---|---|---|---|---|---|

| permlink | re-rmsadkri-the-svb-fiasco-and-the-potential-impact-on-rising--1575 | ||||||

| category | hive-167922 | ||||||

| json_metadata | "{"app":"Poshtoken 0.0.2","payoutToUser":["rmsadkri"]}" | ||||||

| created | 2023-03-14 20:10:45 | ||||||

| last_update | 2023-03-14 20:10:45 | ||||||

| depth | 1 | ||||||

| children | 0 | ||||||

| last_payout | 2023-03-21 20:10:45 | ||||||

| cashout_time | 1969-12-31 23:59:59 | ||||||

| total_payout_value | 0.000 HBD | ||||||

| curator_payout_value | 0.000 HBD | ||||||

| pending_payout_value | 0.000 HBD | ||||||

| promoted | 0.000 HBD | ||||||

| body_length | 200 | ||||||

| author_reputation | 415,441,639,265,100 | ||||||

| root_title | "The SVB Fiasco and the Potential Impact on Rising Interest Rates" | ||||||

| beneficiaries |

| ||||||

| max_accepted_payout | 1,000,000.000 HBD | ||||||

| percent_hbd | 0 | ||||||

| post_id | 121,629,560 | ||||||

| net_rshares | 0 |

https://twitter.com/1613166637544345601/status/1635735982644363287 <sub> The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.</sub>

| author | poshtoken | ||||||

|---|---|---|---|---|---|---|---|

| permlink | re-rmsadkri-the-svb-fiasco-and-the-potential-impact-on-rising--157562042 | ||||||

| category | hive-167922 | ||||||

| json_metadata | "{"app":"Poshtoken 0.0.1","payoutToUser":[]}" | ||||||

| created | 2023-03-14 20:13:54 | ||||||

| last_update | 2023-03-14 20:13:54 | ||||||

| depth | 1 | ||||||

| children | 0 | ||||||

| last_payout | 2023-03-21 20:13:54 | ||||||

| cashout_time | 1969-12-31 23:59:59 | ||||||

| total_payout_value | 0.000 HBD | ||||||

| curator_payout_value | 0.000 HBD | ||||||

| pending_payout_value | 0.000 HBD | ||||||

| promoted | 0.000 HBD | ||||||

| body_length | 254 | ||||||

| author_reputation | 3,936,746,791,208,197 | ||||||

| root_title | "The SVB Fiasco and the Potential Impact on Rising Interest Rates" | ||||||

| beneficiaries |

| ||||||

| max_accepted_payout | 1,000,000.000 HBD | ||||||

| percent_hbd | 0 | ||||||

| post_id | 121,629,613 | ||||||

| net_rshares | 0 |

Thank you for holding virtualgrowth [token](https://he.dtools.dev/richlist/VG). You have been included in today's [post](https://leofinance.io/@virtualgrowth/virtualgrowth-token-post-sharing-of-top-holders-rich-list-315). <CENTER>  </CENTER> Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@virtualgrowth/re-rmsadkri-3rd1yc)

| author | virtualgrowth |

|---|---|

| permlink | re-rmsadkri-3rd1yc |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["leofinance"],"canonical_url":"https://leofinance.io/@virtualgrowth/re-rmsadkri-3rd1yc","links":["https://he.dtools.dev/richlist/VG","https://leofinance.io/@virtualgrowth/virtualgrowth-token-post-sharing-of-top-holders-rich-list-315"],"image":["https://images.hive.blog/p/5CEvyaAfMXebL91APztQueFjHWDSQJuxtAXtcmk528PvA3cYRRTWGM7p79a7pSKhPKkRSHHwAVxzPzXj3"]} |

| created | 2023-03-16 03:51:48 |

| last_update | 2023-03-16 03:51:48 |

| depth | 1 |

| children | 0 |

| last_payout | 2023-03-23 03:51:48 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 462 |

| author_reputation | 188,573,637,868,037 |

| root_title | "The SVB Fiasco and the Potential Impact on Rising Interest Rates" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 121,667,457 |

| net_rshares | 0 |

hiveblocks

hiveblocks