Everyone is talking about bitcoin, and it's not just television talking heads and the Winklevoss twins. Now in the closing days of 2017, the news is all about a 70-year old bitcoin investing grandma from Las Vegas who monitored her investment while playing poker. That's the reality of bitcoin: it has managed to percolate from the servers of computer geeks to holiday conversations and senior citizens' portfolios in the heart of America.

.jpg)

Interest Rises as Bitcoin Price Rockets Higher

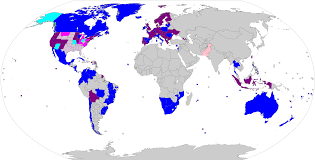

Now we have six years of traffic data to track reader interest in the cryptocurrency, and with more than 27 million unique visitors to our site every month, the data set is fairly substantial. For most of those years, traffic to our bitcoin pages was small compared to traditional investments, and it was located mostly in New York and California. This year, however, as bitcoin cruised past one price milestone after another, so did reader interest, which grew more than 200% year-over-year from January to November 2017.

Bitcoin Interest Growth by State 2016-2017

itcoin Value: More Than Money

One thing is clear: bitcoin has burst the bounds of Silicon Alley and Silicon Valley for two likely reasons: First, because the technology is complex and potentially revolutionary, (hashes, nonces, mining and blockchain) even financially sophisticated readers needs to educate themselves on what it actually is. It's different from any other asset class or financial concept that has existed till now.

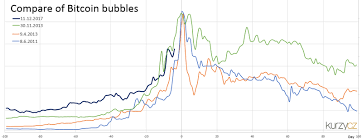

The exponential growth of bitcoin's price is another reason bitcoin has gone mainstream. A lot of people are interested in how and where they can invest in bitcoins, and brokers are scrambling to be first in the space to offer bitcoin-based investments to ordinary consumers, sometimes by offering ETFs or recently created bitcoin futures.

Bitcoin-mania may wane as fast as it surged. The cryptocurrency has proven to be capable of wild price swings, and other virtual currencies are gaining ground. But for now, bitcoin is still 21st century gold.

nvesting in cryptocurrencies and other Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author does not own cryptocurrency..jpg).png)

hiveblocks

hiveblocks