According to the Global Findex report ,two billion people around the world do not have access to financial services, and especially access to credit. Existing banking infrastructure is expensive and consequentially, banking conglomerates typically make their services unavailable to the poorest populations or those living in remote areas.

This is a particular problem in emerging economies. The problem of access to credit can be reduced to three factors:

(1)The high cost of capital

(2) Information asymmetry

(3)The high cost of banking infrastructure.

Also, when compared to developed countries, under-developed countries have a lower credit offering ratio and a higher interest rate spread, making credit more expensive and savings less remu- nerative. This is particularly a problem in Latin America and the Caribbean. A combination of the banking sector’s market power, systemic inefficiencies, default risks, lack of liquidity, ex- change rate volatility, complexity of banking operations, and tax regulation contributes to an unfavourable scenario for consumers who ultimately experience high implicit and explicit fees.

CONCEPT :

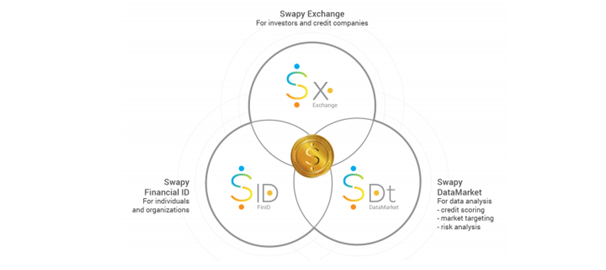

As a solution to the above problems, Swapy is building a decentralized protocol with a suite of three integrated applications aiming to provide Universal Access to Credit.

These applications are:

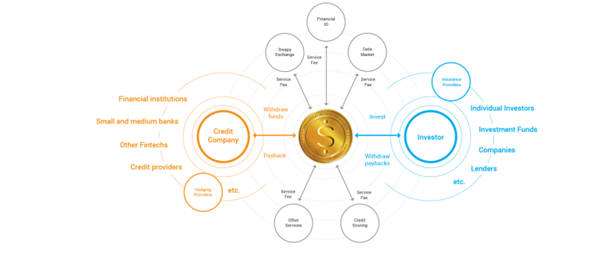

(1) The Swapy Exchange, which aims to connect smart money to emerging economies. It will introduce international investors from countries where the interest rates are comparatively low to credit companies in countries where the interest rates are comparatively high, providing better returns to the investors and lower cost capital for the credit companies;

(2) Swapy Financial ID, which aims to empower people, giving them a financial identity that has the purpose to be valid anywhere in the world;

(3) Swapy Data Market, which aims to transform users’ financial data into self-determined value through a token-based system.

Swapy Network aims to connect the various participants within the financial industry:

(i) borrowers

(ii) creditors

(iii) insurers

(iv) data producers

(v) data consumers

With Swapy Network, individuals and/or companies are able to offer or consume services and collaborate within the ecosystem to decrease the prices of financial services, all the while being more inclusive of new entrants in the financial industry. The fees to operate in Swapy Network will be charged in Swapy cryptographic tokens (SWAPY). This way, token holders will have access rights to use the Swapy Network, benefiting from and contributing to it, and receiving tokens in exchange

This suite of decentralized applications will allow the individuals to hold their own data and to choose how many tokens they receive in exchange for it, and when, and with whom they want to share. The Swapy Data Market also aims to reduce the entrance barriers for new participants since huge pools of data will no longer be exclusive to large corporations, and instead will present an opportunity for the new entrants. The Swapy Company envision a world of efficient credit markets, with no barriers to entry for new players, where consumers have the power and reap the benefits of Universal Access to Credit.

WORKING

Few steps to be taken by SWAPY Network will be

1. To facilitate offers of credit in order to lower the costs of capital.

2. To eliminate information asymmetry between participants through a commonly shared and updated data network.

3. To provide better data so that credit companies can make better lending decisions and offer lower rates to good clients.

4.To encourages lower cost capital and better information which can reduce entrance barriers for new companies.

One of the most important components will be the SWAPY token

The Swapy Token (SWAPY) is a ERC2012 token and the basic unit of value in the Swapy Network. One unit will have 18 decimal points, which means that the lowest value one can hold is 0.000000000000000001 SWAPY. The Swapy Token is a utility token and it will be used to:

(a) pay for the individual’s information

(b) pay for services in Swapy Network (such as credit scoring)

(c) be used as collateral when requesting loans, as soon as these features become available through the decentralized applications that are being developed by the Swapy team.

The Swapy team expect that Swapy Network achieves sustainability and promote a virtuous cycle surrounding the issuance of a new cryptocurrency, promoting benefits to the peers in the Swapy Network.

In addition to the protocol, the Swapy team is building three decentralized open-source applications that Swapy Tokens can be used in: (1) Swapy Financial ID

(2) Swapy Exchange

(3) Swapy Data Market

Also new entrants can offer products and services on the Swapy Network and get paid in Swapy tokens. The Swapy Token is proposed to be used to pay for decentralized services, data, and realtime insights in the Swapy Network. That way, all players (individuals, investors, credit companies and service providers) who join the network are incentivized to add value and contribute to the ongoing success of the community in order to see the establishment of a sustainable and selfmanaged network of participant. This is termed as circular economy

TECHNICAL ARCHITECTURE:

It consists of the following four components

• Self-Sovereign Identity

• B2B Fundraising

• Data Sharing

• Data Ingestion

• Insights Consumption

ROADMAP

FOR 2019

• 1st quarter: Swapy Exchange, Swapy Financial ID and Swapy Data Market operating on main net;

• 2nd quarter: Increasing the transparency of Swapy Exchange fundraising by enabling the lenders to disclose the pre-approved loans they are raising money for1;

• 3rd quarter: Integration of Swapy Financial ID, Swapy Data Market and Swapy Exchange to the Swapy Network second layer;

• 4th quarter: Release of a test network for the Swapy Network second layer (Proof-of-Stake or Permissioned);

FOR 2020

• 1st quarter: Auditing Swapy second layer; Performance testing; Security testing; Testing Homomorphic Cryptography and Encrypted Data Mining;

• 2nd quarter: Providing insights from data using the Swapy Network second layer; Library to ingest insights from Swapy Network decentralized parallel processing infrastructure (test net);

• 3rd quarter: Adding insights feature to Swapy Data Market; BI area to analyze insights from the anonymous crowd;

• 4th quarter: Library of standard algorithms; Second Layer Beta release (main net)

FOR 2021

• Providing your own algorithm/model;

• Consuming algorithms from other users in the network;

• Creating data mining flows composed by the combination of multiple algorithms;

• Profiling tool to estimate the cost in time and in SWAPY to execute the parallel tasks;

FOR 2022

• Stable releases of the three proposed DApps, protocol, and decentralized infrastructure.

• Providing Universal Access to Credit by empowering the unbanked through decentralization.

ABOUT TEAM

• Edmilson Rodrigues, CEO & Co-Founder: Graduated in Business Administration at UFPE. Project Management course at Harvard. Innovation course at Stanford and Draper University. Former Google employee and serial entrepreneur.

• T´ulio Braga, CTO & Co-Founder: Master student in Computer Science (UFMG). Graduated in Computer Engineering (CEFET-MG). Exchange student at The College of New Jersey. Innovation course at Stanford University. Ethereum-BH meetup organizer

• . • Plinio Braga, Lead Designer & Co-Founder: Graduated in Design at Universidade Federal de Minas Gerais, UFMG. Studied Design at Karelia University of Applied Sciences, Finland. Graduated as Electronics Technician at CEFET-MG.

• Bruna Fiori, COO: Economist and Post Graduation in Controllership, also serves as Counselor of the Regional Council of Economy. She was a substitute professor of Economics at the Federal

• University of Pernambuco (UFPE) for 2 years. 12 years of experience in retail, business management and financial consulting.

• Brunno Neves, CFO: Bachelor in Economic Sciences (PUC-SP), freelance trader, multitask entrepreneur and fintech enthusiast. Former Facebook employee. He has experience working in the financial market.

VERDICT:

Swapy Network seems like a company with a good perspective of future. Their administrators seem experienced and their plan is solid. Because of this, they look like somewhat of a solid investment. The investor of this project are Tim Draper and Don Tapscott which highlights the fact that they believe in Swapy Network and it might be a good investment idea.

The negative point is that there is no investment for service; it’s only for the money.

TOKEN METRICS

Token :SWAPY

PreICO Price

Presale: (0.55, 0.57, 0.60) USD - 3 tiers of 5Mi USD each

1 SWAPY = 0.61 - 0.65 USD

Bonus:Available

Bounty:Available

Platform:Ethereum

Accepting:ETH

Minimum investment:1 USD

Soft cap:5,000,000 USD

Hard cap:30,000,000 USD

Country:Cayman Islands

Whitelist/KYC:KYC & Whitelist

Restricted areas:USA, China, Brazil

LINKS:

Twitter: https://twitter.com/swapynetwork

Telegram : https://t.me/SwapyNetworkChat

Facebook : https://www.facebook.com/swapynow

Linked in : https://www.linkedin.com/company-beta/10619437/

hiveblocks

hiveblocks