## Week #16 - April 21 Options Trades:

- 2023 "4-5-6" Social Media Options Challenge - Update

- SQ - How I trade Block's Covered call in a single week.

- April 21 Trades Summary

- Bitcoin ended weak!

- Current Trend

##### 2023 "4-5-6" Social Media Options Challenge - Update

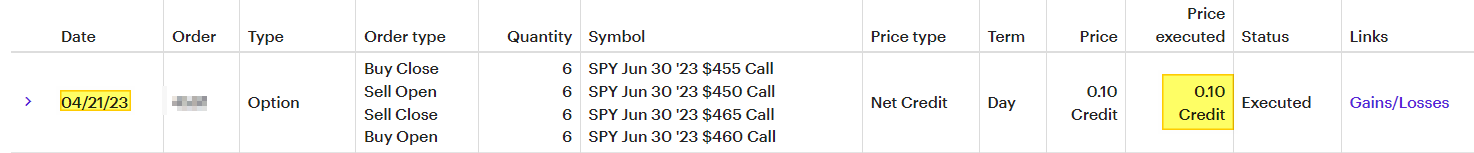

During week #16, I adjusted the "6" - June 30 Iron Condors on SPY for $0.10 Premium. This means I collected around $55 after the fees. If SP500 stays between 3800-4200 in the coming week, I will make money on my SPY position. All I need to do is let THETA DECAY happen!!

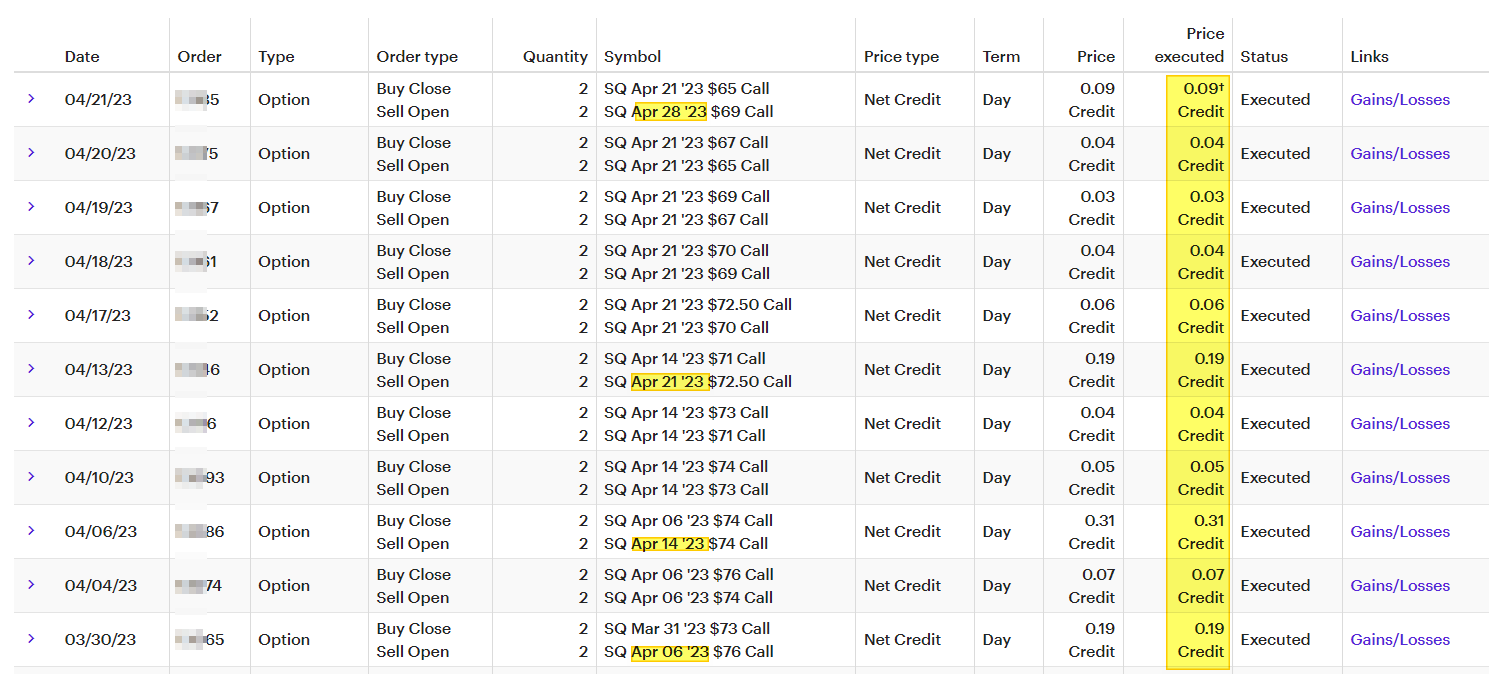

##### SQ - How I trade Block's Covered call in a single week.

I have 2 Covered calls on Block (aka Square). I start with a covered call higher than where I think it would go. Then if the stock drop, I add some risk back into the trade by LOWERING the strike price. As you can see, this week, I did it 4 times. I ended the trade on Friday and MOVED into next week (APRIL 28). Covered call at $69!! This works if the stock stay in a narrow range. If SQ moves up, I can roll the STRIKE price UP (and add more time to the option).

##### April 21 Trades Summary

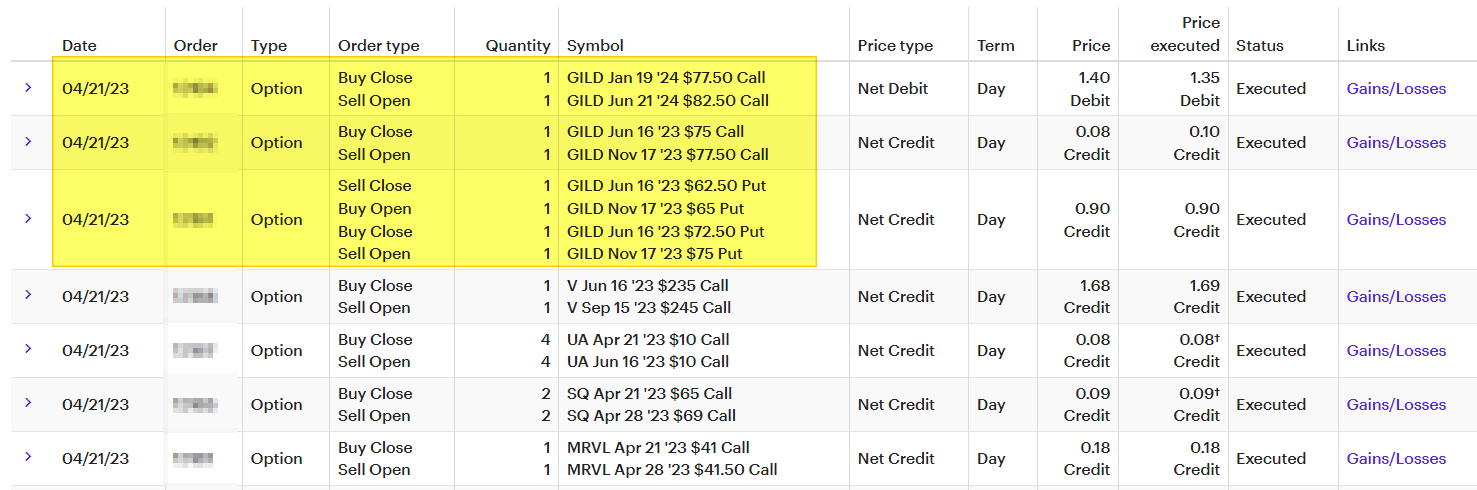

- GILD - Adjust the positions.

- Visa - Rolled a covered call up $10 in STRIKE PRICE. Collected $169 today.

- SQ - Rolled a covered call UP to $69 and Out one more Week.

- MRVL - Rolled a covered call UP to $41.50 and Out one more Week.

- UA - Waiting for UA to recover. Added more time to options.

##### Bitcoin ended weak.

Last week was good for Bitcoin/Ether. This week is not so good. Since I'm using 1 year or longer option, there isn't much I need to do. I will add more to my position as the price of BTC/ETHER drops.

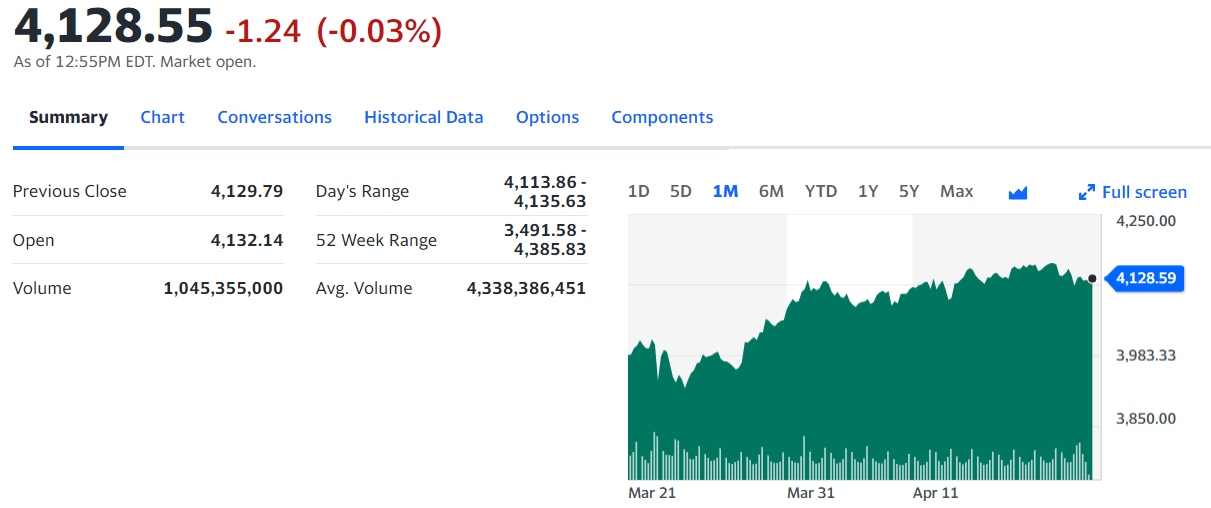

##### Current Trend

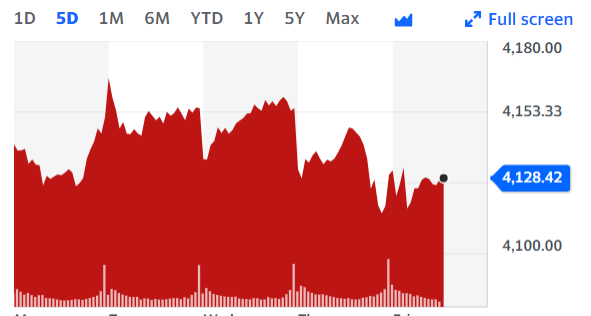

The monthly trend for S&P 500 is still upward.

This week is a RED week.

What would I LIKE? I want the markets to trade between 3700-4000 in the near-term. I think with EARNING, anything is possible!! Just make sure to hedge properly or take advantage of the market's opportunities.

My final summary will be released over the weekend.

Regards,

Solving-Chaos

Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@solving-chaos/week-16-april-21-options-trades)

hiveblocks

hiveblocks