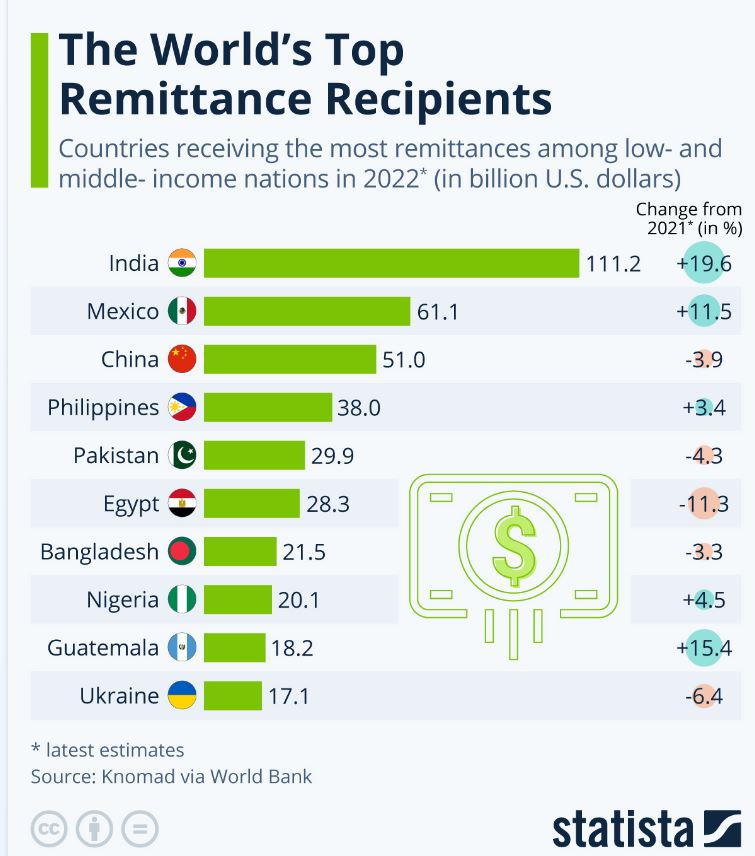

Since the dawn of the Bitcoin era, the cryptocurrency has been touted as a solution to reduce high remittance costs for those who left their countries to work and earn better wages abroad. Remittances have been [estimated at almost $650 billion in 2022](https://www.statista.com/chart/20166/top-10-remittance-receiving-countries/) with India, the top receiving country, receiving more than $110 billion alone.

<sup>[source](https://www.statista.com/chart/20166/top-10-remittance-receiving-countries/)</sup>

More than 15 years after Bitcoin started, and despite a continous rise in awareness and usage, [a recent IMF report](https://www.imf.org/en/Blogs/Articles/2024/01/03/how-training-and-advice-can-speed-cross-border-payments-and-cut-costs) puts the global average cost of sending $200 abroad at $12.50, or 6.25%, more than double the UN Sustainable Development Goal of 3% (target for 2030). If Bitcoin really was such a clear-cut solution, it can be argued that the incentives would have been strong to prefer it to other channels.

<sup>[source](https://www.imf.org/en/Blogs/Articles/2024/01/03/how-training-and-advice-can-speed-cross-border-payments-and-cut-costs)</sup>

According to [a recent study by PYMNTS and Stellar Development Foundation](https://www.pymnts.com/news/cross-border-commerce/cross-border-payments/2021/new-data-25-percent-united-states-cross-border-remittance-senders-use-cryptocurrency/), almost a quarter of people sending money abroad from the US use cryptocurrencies to do so, although it is unclear what percentage of the total amount of remittances that represents.

Some Bitcoin proponents continue to imply that greater adoption of Bitcoin as a vector for cross-border remittances would lead to reduced costs.

<sup>The original LinkedIn post in French claims that Bitcoin would be appropriate to lower the cost of sending small sums of money across borders</sup>

If I am persuaded that continuing to increase awareness about Bitcoin - which leads in turn to **increased awareness about crypto** - would help indeed people get more of their hard-earned money to reach the loved ones back home, I wanted to look closer at the claim that _"Bitcoin is appropriate in such situations"_ (high fees for remittances of modest sums of money).

### Bitcoin is seldom **earned**

The title of this section is an euphemism (I am trying to preempt the potential wrath of the Bitcoin Maxis). Truth is, wages are paid in _fiat_, not in Bitcoin. People working abroad are overwhelmingly paid in _fiat_ currency, most often dollars. Moreover, Bitcoin can only be earned with a significant capital outlay (forking out for a mining rig), which many people can barely afford.

Bitcoin needs to be **bought**. Foreign workers would need to first find a secure way to buy Bitcoin, i.e. **convert their dollars** (often paid in cash) into Bitcoin. **Exchanging** dollars (whether of the electronic sort held with a bank, or cold hard cash) for Bitcoin require a relatively high level of skill and entails not only risks but also **significant fees**. I refer to these as **"on-ramp costs"**. On-ramp costs are not faced when remitting money directly as _fiat_ and should be added to the total cost of using Bitcoin (or most other cryptocurrencies) for sending "labor wages" across borders.

Ideally, to escape those fees, one would want to have his **compensation paid directly in cryptocurrency** and thus avoid the conversion cost. That happens sometimes, but it's anecdotical at this point. To be paid in crypto, you'd need to work in "Cryptonia", a virtual dream land whose currency is crypto. Think "[Bitcoinia](https://www.economist.com/free-exchange/2013/04/11/inside-the-bitcoin-economy)" for Bitcoin.

Hive is a tiny ecosystem that cannot currently support many wage earners, but it offers a glimpse into what an ideal system could look like. I compared it with a (very small) [land, **Hiveland**](https://peakd.com/hive/@sorin.cristescu/bitcoin-and-hive-todays-heet). Back in Steem days, I was similarly talking about [**Steemland**](https://peakd.com/blockchain/@sorin.cristescu/revisiting-steemland-a-fairer-and-more-transparent-art-market-as-a-new-export). These are places where (still few) people **can [work with their "brow"](https://steemit.com/steemit/@sorin.cristescu/help-yourself-steemit-for-dummies) and no capital outlay** (aside from a decent smartphone and a data plan, or a computer and an internet connection) **and earn** a (currently very small) wage in STEEM/HIVE and SBD/HBD, which they can **remit directly, with no "conversion to crypto" fees**.

### Sending Bitcoin incurs transaction fees

Proponents of using Bitcoin for remittances like to extoll the difference in transaction fees between classical money transmitters such as Moneygram or Western Union and Bitcoin. Not to mention that Bitcoin is also significantly faster than the former.

In the LinkedIn post above (in French), the author says sending $200 would cost the sender $1,05 in transaction fees _"at the time of this writing"_. This points to one of Bitcoin's weaknesses: **the transaction fees are difficult to predict** and **can go much higher than $1,05**. Finding the right trade-off between the fee paid and the speed of the transfer require considerable skill. Not only that, but lately, due to new innovations in the Bitcoin ecosystem (BRC-20 tokens, Taproot Assets, Ordinals and soon, Runes) we've seen a clear move toward more activity. More activity generates more demand for including transactions in blocks. Block space is a limited resource. This tends to lead over time to higher median transaction fees. We are still far below the $12.5 for $200 of classical channels, but I want to underscore again that **transaction fees are just one part of the total cost structure, next to "on-ramp costs" and "off-ramp costs"**.

<sup>Median fee for [block 839166 was $3.19](https://mempool.space/fr/block/0000000000000000000123bddb33d095f73a26c69fb6fb472ba63229000cf925)</sup>

Even if transaction fees are not the bigger contributor to the overall cost of sending money as crypto rather than using traditional money transmitters, ideally one would want a cryptocurrency where **transaction fees are $0 (zero).**

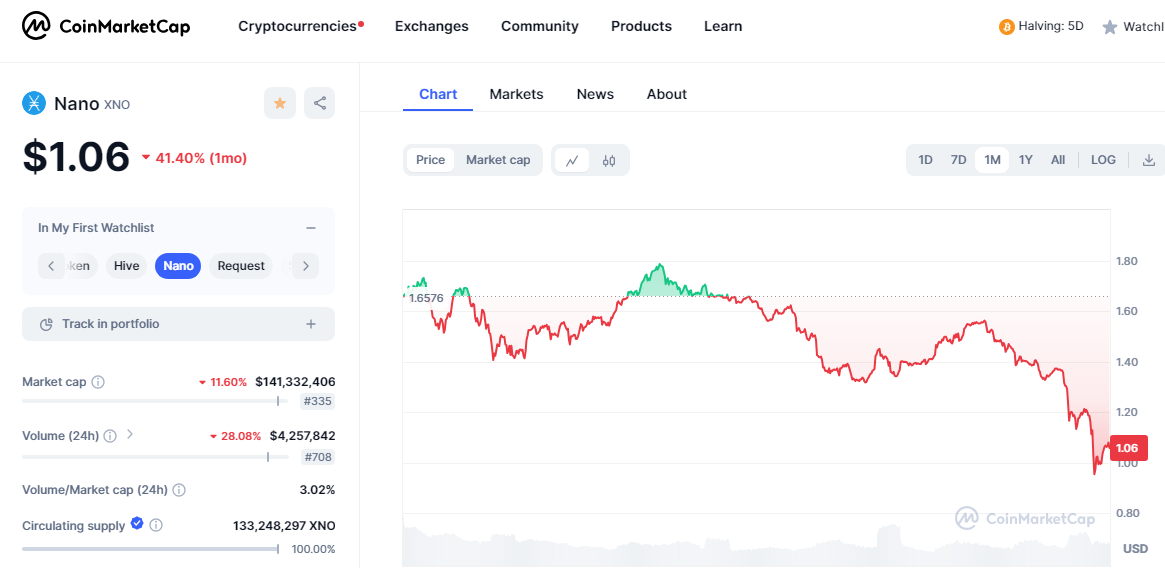

Among the first ones to offer this service was Nano (previously RaiBlocks), which also displayed an impressive software architecture. Let's say it here, as an "unpopular opinion": RaiBlocks' software design was in many ways superior to Bitcoin's. Yet in a replay of the eternal battle between [Betamax and VHS](https://en.wikipedia.org/wiki/Videotape_format_war), Bitcoin, the technically less sophisticated product (initially, this is not true anymore) thrived while the re-baptised Nano slipped into oblivion and is now lower in the [CMC rankings](https://coinmarketcap.com) than Hive.

<sup>[source](https://coinmarketcap.com/currencies/nano/)</sup>

Which brings us to Steem and Hive, which both also offer **free transactions**. Anyone can **send 600 HIVE** (a bit more than **$200** _at the time of writing_) that they would have **earned** by **[blogging](https://ecency.com)**, or **[vlogging](https://3speak.tv/)**, or **[playing games](https://splinterlands.com)**, or **[providing liquidity for 2nd layer tokens](https://tribaldex.com/dieselpools/)**, or **[trading NFTs](https://nftshowroom.com/)**, at the other end of the world **for free**. Much faster than Bitcoin too (not that the difference between Bitcoin's roughly **30 minutes** and Hive's **3 seconds** is "material" in such a situation).

### Bitcoin can seldom be spent

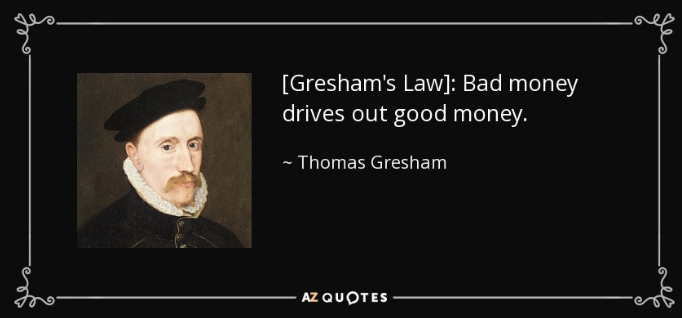

Despite the consistent efforts of the Bitcoin's enthusiasts, outside from El Salvador, and perhaps Lugano in Switzerland, there are **preciously few places where Bitcoin can be spent** directly for everyday's needs. That is mostly because Bitcoin is structurally a poor "medium of exchange". Strong deflationary mechanics make it a **very good "store of value"** and, as Sir Thomas Gresham might have put it, "good money" - too good, in fact, for its own sake.

<sup>[source](https://www.azquotes.com/quote/605676)</sup>

With its built-in inflationary mechanics, **_fiat_ money drives out Bitcoin from commercial transactions** whenever no specific pressure is applied to force people to spend their Bitcoin. Therefore, because spending is almost exclusively in _fiat_, the recipients of remitted Bitcoin would need to **convert back** their Bitcoin into the local currency (or possibly dollars). This reconversion incurs **yet more fees**, besides hassle and risk. I refer to these additional costs as **"off-ramp" costs** and they should also be added to the total cost of using Bitcoin for remittances. Few Bitcoin proponents include these costs when debating the topic.

The off-ramp costs could be avoided if merchants began accepting payment in cryptocurrencies. Ideally, for a crypto to take hold as a **"medium of exchange"**, it would need not only **low friction** (zero or extremely low transaction fees, lower than those of VISA and MasterCard) but also a balanced but **inflationary emission rate**.

Moreover, outside of an imaginary Bitcoinia where goods and services would be priced in Bitcoin, **the volatility of Bitcoin** (with respect to the dollar or other fiat currencies) is also seriously hampering its usefulness for remittances. Indeed an immigrant worker might earn dollars, convert them to a certain amount of Bitcoin and send the latter, but by the time his family would be able to actually "cash out" into spendable _fiat_, the Bitcoin value might well have suffered a dip. The recipient family would thus end up with significantly less dollars than what their remote parent had sent them. The risk of such an event is a serious obstacle to the spread of Bitcoin as a means for remittances.

The historical **volatility of Bitcoin** over the past year was **35,2%**, whereas over the same period **HIVE displayed a much lower volatility of only 12,3%**.

But even 12% is quite high for most people. This is where **stablecoins** have a compelling value proposition. The Hive blockchain has an additional feature: it sports **a native stablecoin, HBD** which can also be earned similarly to HIVE. HBD is also slightly inflationary. HBD can be exchanged to HIVE and back on chain, on the "[internal market](https://wallet.hive.blog/market)" for free, with zero transaction fees. It can also be [swapped with no fees](https://hivehub.dev/market). Smart contracts that do an internal conversion exist too. They decrease the risk from HIVE volatility but they have a 5% fee and only settle after 3.5 days, so I cannot recommend them.

As stablecoins go, **HBD** performs rather poorly in terms of stability, but its historical **volatility** over the past year was **only 3,8%**, more than three times less than HIVE's and more than nine times below that of Bitcoin.

### Conclusion

Bitcoin has started a revolution that will have a profound impact on our societies. But **it cannot solve alone all the issues of the traditional financial system**. Here, I specifically challenge the claim that _people sending money cross border back to their families would benefit by switching from traditional money transmitters such as Western Union and MoneyGram to Bitcoin_. The main argument backing that claim is that Bitcoin's transaction fees are significantly lower (and also that it is faster).

However, those supporting such claim conveniently ignore that people sending money back to their families **do not earn Bitcoin**. If they want to send Bitcoin, they have first to buy it, a process which is complex and costly (**"on-ramp costs"**).

They also ignore that Bitcoin's **transaction fees**, while generally lower than those of Western Union, are not negligible, and moreover are hard to predict.

They especially ignore the fact that the recipients cannot generally spend Bitcoin but instead need to sell it for _fiat_ (whether the local currency or, again, dollars). This process is impacted by Bitcoin's **volatility** and incurs costs (**"off-ramp costs"**).

For the "crypto rails" to offer a compelling alternative to the classical money transmitters, the cryptocurrency vehicle needs to be designed differently.

The **ideal cryptocurrency for remittances** can be **earned through labor alone**, with little to no capital outlay, so the **"on-ramp costs" are as close to zero as possible**. It should also be transferrable incurring **zero fees** (and possibly faster than Bitcoin). It should keep its value in the process (**low volatility** or, better still, **stablecoin**). And should be **spendable with no fees** so the merchants have an **incentive to accept payments** denominated in it over physical cash (which is costly to manage) or credit cards (which carry significant fees).

Inspired by Bitcoin, a great many cryptocurrencies have been created and are today in circulation. Together, they constitute **"the cryptoverse"**. A few cryptocurrencies from the cryptoverse display some or all of those ideal characteristics for remittances, at least to a certain extent. Those would therefore be better suited to challenge the traditional financial system in this respect. I have mentioned here Nano, Steem, Hive and its associated stablecoin, HBD. They might not be "better than Bitcoin" overall, and would certainly not be in existence today if not for Bitcoin. But through their design, their features complement and **strengthen the overall value proposition of crypto** as a revolution challenging the traditional financial system.

As I wrote in a previous article, [The Exit Machine](https://peakd.com/bitcoin/@sorin.cristescu/the-exit-machine), to bring about the improvements everyone hopes it will, **"Bitcoin needs the cryptoverse"**.

hiveblocks

hiveblocks