### **Welcome to this month's ETF Investment Update**

Guest author: @hoosie

> **What is SPI?**

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, on ~~STEEM~~ HIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% every year from weekly dividends. We raised $13k from issuing SPI tokens which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens, accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Hardcapped to roughly 94,000, no more can be minted or issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

> SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We do not FOMO or chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Follow @spinvest for weekly holdings and earnings reports.

### Introduction

I invest in stock markets through Exchange Traded Funds (ETFs) and Share Funds via Fidelity UK. My investment strategy is for long term gain (5+ years), and I tend to DCA in when I can (but I wouldn't bet my mortgage on it or put my family at financial risk). I invest in ETFs and funds as I like spreading my investment across a basket of shares, as opposed to trying to pick individual shares, which would be too risky for me. I tend to stick to solid funds within the US, UK and Europe, and have a liking for tech funds. I do not day-trade, or look for short term flips. Please take that into account, and always do your own research!

### What's Happening This Month

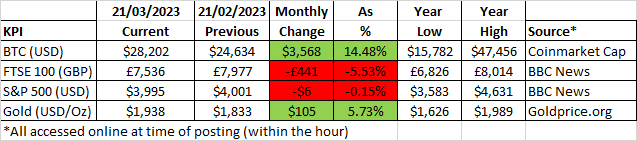

**Monthly KPIs**

I use a number of Key Performance Indicators to help me gauge how the overall markets are performing and it also helps me to try to understand where money is moving.

[Figures correct as of 21/03/23 - article posted late due to technical reasons]

Looking at the monthly change columns:

- BTC and Gold have both had a decent increase, and particularly BTC at 14.48%. Reading on Yahoo finance today, I saw suggestions that people are putting money in BTC (digital gold) and gold because of the bank scare - they'd rather not have their cash in a bank at this point in time,

- The FTSE100 (a key index for UK shares) has dropped 5.53% over the month, with UK banking shares taking a hammering in the last few weeks,

- The S&P 500 (a key index for US shares) is still quite low generally, and hasnt moved much in the last 4 weeks.

From my perspective I dont really think the dust has settled from the bank collapses and it could mean turbulence for a number of weeks to come. Will BTC and Gold keep on going - especially if people think their money is safer there ? From a share investment perspective it leaves me perplexed. Maybe dropping some money into the banking sector now is a potential opportunity, because the shares are at a low price - but what if more banks go under ? A number of key central banks have moved to shore things up, so hopefully thats unlikely.

So my thoughts on share fund investment are:

- A bank sector fund could be interesting, but for example, if the UK markets have only lost 5% overall and were near the top anyway - is that a great investment ?,

- US shares still havent grown much over the month, and its certainly where I think there is more growth to be had, so I'd be inclined to focus more there.

[Credit: Nasdaq 5 year index price from BBC News website on 21/03/23]

The 5 year price of the NASDAQ (a US tech share Index with the likes of Apple and Microsoft) paints a similar picture to that of the S&P 500. It hit its highs back in Nov 2021, and since has taken a battering. It may be starting to flatten out where it currently is, and I feel it could be a good time to DCA back in.

**Recent Trade activity**

I dont have any spare funds at the moment, nor have I had any decent dividends come in over the last month, so I'm not going to sink any cash into a fund this month. Also I'm keen to see where the dust settles with the recent bank scares so I think leaving it for this month is not a bad idea.

For info, I put some money into POGTU (Polar Capital Funds PLC - Polar Capital Global Technology Fund I Income) last month when I was writing this article. I paid £54.52 per share. Today they are at £56.61 - so I'm happy with that.

**Monthly Fund Focus**

Each month I'll review one of the funds I use (or am considering using) and take a look at its key features and its performance. In my post last month, I said the following in the summary:

> If I get some spare time over the coming month, I'm going to look for a new fund to consider that has lower fees, but has nice cash dividend payouts.

Well, I had some time earlier tonight, and considering I like the look of the NSADAQ, I've found a fund that I'm interested in:

**- Schroder US Equity Income Maximiser fund ([SCUZI](https://www.fidelity.co.uk/factsheet-data/factsheet/GB00BYP24Z16-schroder-us-equity-income-maximisr-z-inc/key-statistics)).**

> The Fund aims to provide income by investing in equity and equity related securities of large US companies. The Fund aims to deliver an income of 5% per year but this is not guaranteed and could change depending on market conditions. The Fund invests at least 80% of its assets in a passively managed portfolio of the top 500 listed US companies by market capitalisation.

*Credit - Fidelity.co.uk website - accessed on 21/03/23*

Key Features:

- The fund is actively managed by Schroder Unit Trusts Limited, in the UK,

- Current price at 21/03/23 (GBP) £0.6106, 12 month low £0.59, 12 month high £0.69 - so its not that far off its 12 month low,

- Its an income fund, so it pays out dividends to the holder, and its dividends are paid quarterly at an annual equivalent rate of 4.92% (this is a historic yield figure),

- It has a lowish fee of 0.49%. I think they have deliberately tried to sneak it just under the 0.50% mark ! Which I dont think is too bad for an actively managed fund,

- The fund is growth and income focused, and has investments across 467 stocks

- The fund's money is invested nearly entirely in the US (98.81%) of which 98.26% is in stocks,

- Check out the list below for the top 10 holdings - those are fantastic US companies that have a great track record from both a dividend and shareprice perspective !

*Credit - Fidelity.co.uk website - accessed on 21/03/23*

*Credit - Fidelity.co.uk website - accessed on 21/03/23*

The 5 year growth chart shows consistent performance up to the end of 2021, where it then stagnates, but actually does not show the drop we see in the NASDAQ. As per usual, I've left Fidelity's disclaimer in place at the bottom of the image - this is so true !!!!!

So there is quite a lot I like about this fund. I'm going to keep an eye on it, and drop some money into it at some point soon as I think it has potential - plus I like the quarterly dividends and the lowish fees.

**Round-up**

So thats my update for the month. Will more banks go to the wall, and as such will gold and BTC keep on climbing ? My guess is that BTC will, but it will be a gradual climb - but I'm no expert. As usual I do in general feel comfortable enough to DCA in with spare sums of cash when I have them (although am giving this month a miss), as I believe over the longer term (1+ years) the markets will recover.

And I'm glad I had a look around for another new fund - I like the look of SCUZI !

If you have any advice to share or tips for funds, I'd love to hear about them - and feel free to leave feedback on the post - I'd love to know what you think !!!

All the best @hoosie

Have you checked out the newest token from @SPinvest - XV ????:

- XV TOKENS will sell for 10 weeks at 1 HIVE each,

- SPinvest takes all the HIVE from sales and converts it into a basket of 15 cryptos ranked in the top 50,

- SPinvest holds the cryptos in offline wallets (possibly earning an APY with some),

- Every 6 months, the basket is rebalanced,

- In June 2025, SPinvest converts the crypto basket back into HIVE and buys back XV tokens from investors.

[Check out XV here !!!](https://leofinance.io/@spinvest/spinvest-newest-token-release-coming-soon-xv)

*Want to know more about SPI tokens and investments ? Check out the latest posts [here](https://hive.blog/@spinvest/posts).*

*Want to know more about the Saturday Savers Club ? Check out the latest posts [here](https://hive.blog/@eddie-earner/posts).*

Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@spinvest/saving-for-retirement-stock-market-exchange-traded-funds-or-march-2023)

hiveblocks

hiveblocks