The editors offer for this special post a translation of the two-part article by Mark E. Jeftovic, published on his website Guerrila-capitalism.com.

Atypical character of the world of employers, Mark E. Jeftovic is the current CEO and co-creator in 1998 easyDNS provider of DNS servers and web hosting services.

In his fierce fight against the giants of the web, with which he is in direct competition, he creates his website guerilla-capitalism (literally, guerrilla capitalism) to promote the spirit of free enterprise dear to our North American colleagues. Faced with the threat of the centralization of the Internet and more generally of the economy, his goal is to make his company a model of "autonomous operational unit" and to transmit the codes to do this to anyone who would like to join him in his fight.

He gives us here a relevant analysis of the Bitcoin phenomenon and crypto-currencies in general. His statement is of course engaged (we draw your attention to this point, it is about sharing opinion and not propaganda on our part) but proves to be a bearer of interesting thoughts about crypto-currencies and the economy in general.

Similarly, although sometimes technical in detail, this analysis is a good introduction to the world of cryptocurrency for neophytes who have not yet fully understood the social and economic issues of the subject. Especially with regard to Part II of the article, to read on our site as of Friday.

We invite you to share this publication with your entourage uninitiated crypto-currencies by then :). Good reading !

"This Bitcoin story is going to end badly, it's a scam ... worse than the tulip crisis ... That said if you were a drug dealer, an assassin or a relative, you'd better manage your business in Bitcoin rather than in US Dollars. "

- Jamie Dimon: CEO of JP Morgan.

Headline of Cointelegraph: "JP Morgan guilty of money laundering and attempts to conceal the judgment of Swiss regulators. "

Given the last successive series of bullish price records of Bitcoin, his critics are working hard to build a record of accusations against him. Some call it a Ponzi scheme, fraud or scam or at least a huge speculative bubble. Curiously, many of these critics spend the rest of their time extolling the merits of "the other bubble," this bubble at all, stocks, loans, real estate, ETFs [Exchange Traded Funds, designated in French by "exchange-traded index funds" or "Index Trackers", ETF ETFs and all that follows.

It is easy to make foolish and condescending comparisons about Bitcoin, until one really takes the time to analyze the latter in depth. When I first came to Bitcoin in 2013 and did my research, I saw something different. John Galbraith spoke very well at the end of the last century, in a statement that until now has always proved correct. He wrote in his book "A Short History of Financial Euphoria":

"The world of finance is constantly cheering the perpetual reinvention of the wheel, again and again, often in a version always a little more unstable. Any financial innovation implies, in one form or another, the creation of a debt guaranteed by a greater or lesser adequacy with real assets and capital "

(Emphasis added)

If we look for historical evidence, the words of Galbraith map quite accurately all the financial bubbles ranging from the Crisis of Tulips in Holland (metaphor frequently used in attempts to discredit Bitcoin that we are about to demystify later of this article) all the way to the famous Subprime Crisis in 2008 and even more recently.

However, it remains an area where this is not applicable and it is indeed the domain of Bitcoin. Crypto-currencies, at least for the moment, do not incorporate a phenomenon of leverage and it is almost impossible to buy them on credit.

In other words, capital bubbles are largely created through leverage and there is comparatively no leverage effect in Bitcoin. In this case, and to confirm the speculative bubble hypothesis, something else must replace the leverage effect.

That being said…

The price of Bitcoin is a minor event.

I grant you, for now this is an exciting first part, especially for those who were able to acquire their tickets on time. In full writing of this article, I received the email from a long-time customer asking me "when did the profits resulting from the acceptance and then the capitalization and the ownership of Bitcoins go beyond the profits made by the easyDNS work [the company whose author is the CEO]? "

I had never considered this basic question, but quick calculations quickly revealed that even after turning a good part of it into gold (it was not my best trading operation), this crossing of curves has happened. 'last year.

But the sharp rise in price does not in itself constitute the real enthusiasm for the Bitcoin and cryptocurrency revolution. What is really exciting is the fact that the centralized, bank-controlled monopoly on the distribution of currencies themselves is coming to an end. It's over. Even if they succeed in cooperatively creating a cryptocurrency of their own and belonging to them, Greshman's law will undoubtedly be confirmed because the holders of capital will select on their own a cryptocurrency that is undeniably decentralized, where they will have the control or will have the option of control, where they will have their own private keys to store their wealth in a secure way while they use that of the governments to pay their taxes and the rest.

Regardless of the "virtual currency" developed by a state or government to appear in the near future, I suspect that it is centralized with imposed keys, private keys in remand or already by an organization third. When that happens, it should not be called crypto-currency but rather "pseudo-crypto" or "false-corner" to differentiate it.

Pointing out the mostly foolish analogies and unfounded criticisms of Bitcoin, let us first begin to seriously define what Bitcoin is not. Then in a second part we will report what Bitcoin really is and why it is different.

What Bitcoin is not

"Based on nothing"

This is a common pitfall for people who simply do not understand that crypto-currencies are based on mathematics, are without monopolies, open-source and without consensus. These people think that Bitcoins can simply be created "at will" and rely on a vacuum.

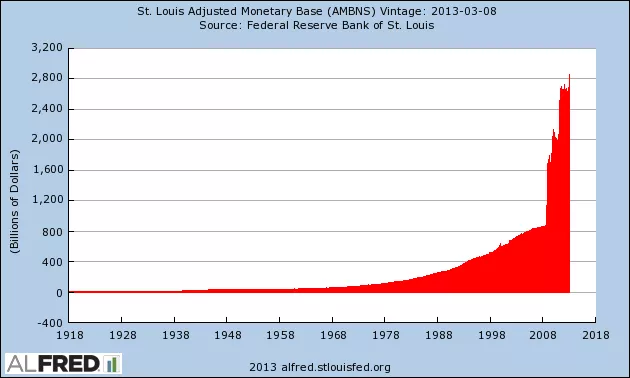

They also say this as if the world reserve currency, the US dollar, was not, literally, "nothing-based" and had not been since 1972; and as if it was not possible to print "at will", which was certainly the case and began again more beautiful

[Above, the chart of the adjustment of the monetary base of the St Louis Federal Bank. The author wants to draw attention to the evolution of the curve from 2008, post-crisis period subprime

Source: Federal Reserve Bank of St. Louis. note]

Indeed, as Galbraith says in the rest of the passage mentioned at the beginning of the article:

"This was the case in one of the oldest views of the mind: when the banks discovered that they could print notes and exchange them with borrowers by exceeding hard-money stocks [silver or gold on which were based on the currencies, which they actually had in their vaults. "

Nowadays, all fiat-currencies are really "nothing-based" and can be created or printed at will (this is what the term "fiat" actually means), and, perhaps, without the knowledge much knowledge, we are right now in a prolonged and global currency war. Each nation is racing towards the lowlands, trying to devalue their currencies against their trading partners so they can:

1. Give their export companies a competitive advantage

2. Attract stronger currencies in their capital to gain on exchange rates, and

3. Maintain their ever-increasing debts and bail them out with a devalued currency so cheaper.

This is why the purchasing power of the majority is declining despite the fact that incumbent academics and central banks constantly complain about "low inflation", and that model political spokespersons are constantly promotion of "strong" currencies.

Bitcoin is not: "Based on nothing"

What is it: The US dollar and all other fiat currencies in the world.

"Bitcoin is a Ponzi pyramid"

The idea of Bitcoin and most other cryptocurrencies as Ponzi schemes is easily discredited by the effort to understand what a Ponzi scheme really is.

As described in the book CryptoAssets (Burniske & Tartar, 2017), the principle is rather simple: the new investors pay the old ones.

It is important to understand that in a Ponzi scheme, the first investors are literally paid thanks to the funds injected by the new investors in a so-called "pyramid" logic (which differs from a logic where the subsequent investors have to pay a higher price. former investors to incite them to separate from an asset or a capital)

As long as the number of new investors, and thus the influx of funds, is increasing at a rate higher than that of the annuities received by previous investors, the Ponzi scheme thrives. When the rents exceed the influx, the system collapses.

There is no need to look very far for mechanisms that exactly fit the definition: Social security programs are all classic Ponzi schemes [although an analogy is possible with the security system French social welfare, here we are talking about the United States and Canada, editor's note]. The current demographic reality is such that the retirement of the "Baby Boom" generation - since the following generations are more limited in number, that these are more penalized by the freezing or even the fall of the wages, the rising and / or multiplying taxes, lowering purchasing power and profits from their savings - will be repressed by negative returns; This Ponzi scheme is now in its final phase.

(It must be considered that these furious headwinds facing the youngest generations can all be summed up in the expression "financial repression", it then makes sense that capital could "flee" to assets or currencies that would appear to be resistant. to these constraints)

Let's agree that the current craze for ICOs probably includes some Ponzi schemes. The book Cryptoassets describes the OneCoin as such, as well as giving advice on how to find a Ponzi in cryptocurrency. For my part, I would first have been hesitant to call the OneCoin cryptocurrency. It was not open source and did not use public blockchain.

Regarding Bitcoin or other real crypto-currencies, the first owners do not receive bitcoins from the most recent buyers. In fact, the opposite is happening. The latest arrivals must push the first to share their bitcoins. Knowing that bitcoin can not be created by mere will, it must be mined at a rate that increases over time (this year around 640,000 new bitcoins will be mined, or about 3.8% of the total available)

The demand for Bitcoins is simply well above the amount of bitcoin being mined (for reasons that will be detailed in Part II). If the price of Bitcoin were to increase dramatically (if, for example, Bitcoin suddenly became the most successful currency in the world, including capitalization) then a feedback loop would occur. New buyers would have to pay an even higher price to convince Bitcoin owners to sell.

Bitcoin is not: a Ponzi scheme

What is it: The social security system and the pension system.

Tulip Crisis or Tulipomania.

The dynamic described above is the same one that governs any bull market: buying leads to more purchases and "the fear of missing something" then comes into play. It is said that the most accurate gauges to measure the happiness of a man is closely related to the material wealth that it has compared to what his brother-in-law possesses. In a less sexist way, Alex J Pollock describes this in "Boom and Bust: Financial Cycles and Human Prosperity" as "the disturbing experience of seeing one's friends get richer"

The trick would be to have the knowledge to determine when a bull market enters financial bubble territory. One of the most popular analogies for Bitcoin is Tulipomania or Tulip Crisis: the financial bubble that happened around 1630 in Amsterdam with nothing less than tulip bulbs. Bitcoin is so often compared to Tulipomania that I decided to take a closer look at this Tulipomania to see if this comparison was valid.

What I first found is that the majority of the knowledge we have today about Tulipomania is superficial and sourced in a very subjective way, essentially stemming from Charles Mackay's Chapter on the subject in his book founder "Extraordinary Delusions and the Madness of Crowds" (1841). Here are 9 meager pages purely anecdotal, describing absurd prices paid by the Dutch, usually described as pragmatic and down to earth. Then the bubble exploded, as it is the case for all the bubbles.

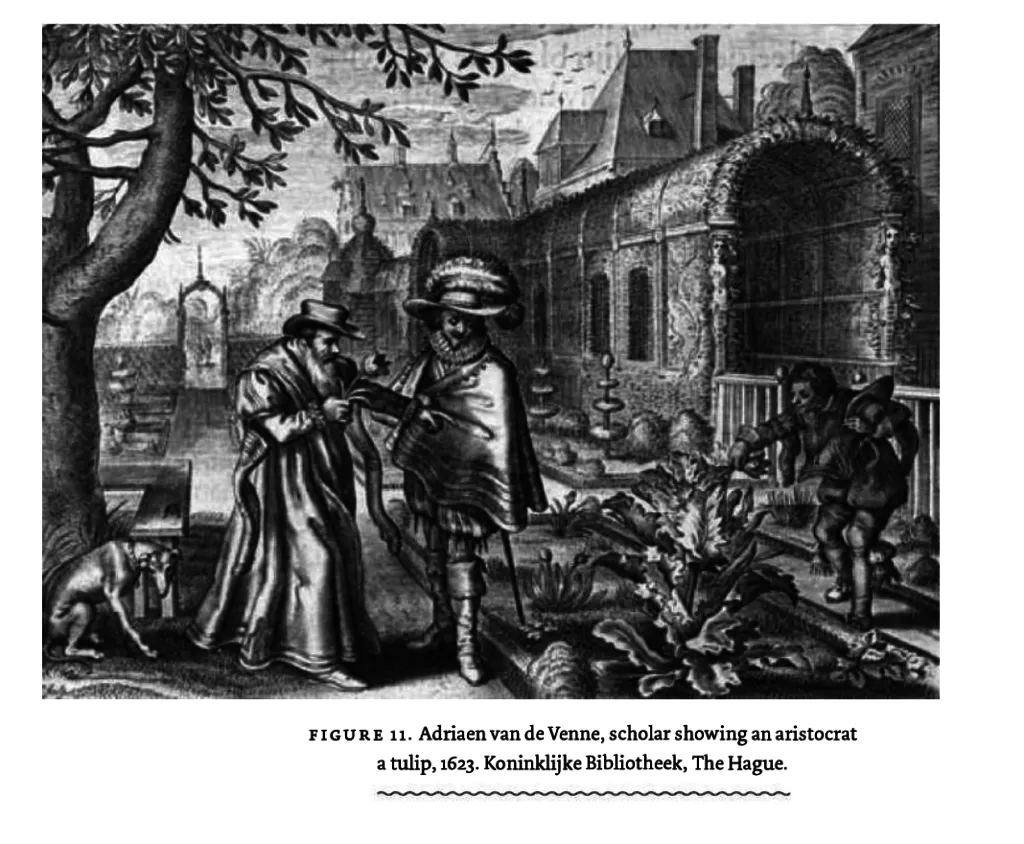

Finally, I found Anne Goldgar's book (Tulipmania: Money, Honor and Knowledge in the Dutch Golden Age), which happens to be the most in-depth investigation of the rise and fall of the tulip bulb at this time that still exists today. In this book, we learn more about the circular references that came into play to convey the history of Tulipomania to our modern day.

"If we follow these stories over the centuries, we realize how fragile their foundations are. They are in fact based on one or two elements of contemporary propaganda to Tulipomania and a prodigious amount of plagiarism. It is from this that we have our modern history of the Tulip Crisis.

She then traces the origin of the MacKay chapter:

"The main source of MacKay was Johann Beckmann, author of Beytrage zur Geschichte der Erfindungen, who, like his book A History of Inventions, Discoveries and Origins, has undergone numerous reissues in English since 1797. Beckmann was interested in speculation in his time, but his own sources were also suspicious.

He relied mainly on Abraham Munting, a botanist of the late seventeenth century. Munting's father, himself a botanist, had lost money on the tulips, but Munting, writing in the early 1670s, was not himself a reliable eyewitness. His own words, often borrowed, have two main origins: the historical narrative of the chronicler Lieuwe van Aitzema in 1669 which happens to be one of the longest contemporary works of propaganda against trade; and the book of Adriaen Roman "Samen-spraech tusschen Waermondt" (dialogue between the True-Mouth and the Good-Cupid) of 1637. Since Aitzema himself based his chronicle on the literature of pamphlets, we have a picture of Tulipomania relying almost exclusively on propaganda, as if it were a fact. "

Goldgar guides the reader in his pursuit of the effective understanding of Tulipomania going back to 1590, when there was not the shadow of a tulip in what is now called Holland, nor even in Europe. The gardens were purely functional, used to grow food and aromatic or medicinal herbs. Then, tulips and other curiosities made their appearance in the country and in Europe via merchant ships trading with the Mediterranean and the West.

The "flower garden" was born, and it was spectacular. He gave life to a whole movement of collectors, amateurs and enthusiasts who at that time could not be otherwise - were generally wealthy or well off and influential. In the years that followed, more and more people sought and then speculated on the tulip and its trade not only to profit from it, but also to claim what they perceived as an indicator of class or higher economic status.

At the risk of oversimplifying its work, let's say that the tulip trade is intertwined and becomes inseparable from art.

"The art collection seemed to go hand in hand with the tulip collection. This meant that the infatuation with the tulip was part of a much larger mentality, a mentality of curiosity, excitement and gathering connections between the seemingly disparate worlds of art and nature. She also placed the tulip in a social world where collectors strove for status and sought to present themselves as connoisseurs to each other as well as to themselves. "

The more I immersed myself in the understanding of Tulipomania, the more I could not help but think that the analogy was much more applicable to a different asset class that also benefited from an important financial bubble. not so long ago, but there is no question here of Bitcoin or crypto-currencies. To support my argument: Bitcoin was not propelled by art, beauty, or collectibility but emerged primarily as a resistance to financial repression.

There was something that was governed by uniqueness and favored by an elitist aristocratic club that until recently enjoyed a stratospheric price of the stock price: the second market for domain names . This is not the place to do a post-mortem analysis of this bubble, but suffice it to say that the distinct characteristics of domain names look more like those of tulip bulbs than Bitcoin.

Bitcoin is not: Tulipomania

What is it: The secondary market for domain names.

If Bitcoin is not a digital-fiat-currency based on nothing, neither a Ponzi nor a modern Tulipomania, then what is it? Why did he literally come out of nowhere and then become the best performing and fastest growing asset / currency in the world?

When I started writing this article I was not sure about it myself. I had to go through my library and look in History to try to find a historical background to what is happening. After going back to the origins of money exchange and the currency itself and then moving forward, I still did not have a single track to establish a convincing mental schema.

Then, one night around 2:00 am, I woke up, with the idea in mind that I was looking for the wrong place. The reflection hammered me so hard that I struggled to go back to sleep - although I wrote an improvised tweet that captures the main idea of it a few weeks ago, tweet that I am unable to find now .

I will introduce my reasoning in Part II. And in the meantime I leave you with another CEO of "mega-bank" whose position on all this is the opposite of that of Jamie Dimon. Goldman Sachs CEO Lloyd Blankfein meditates on the reasons that make it entirely possible for the currency to move from a currency-fiat to a currency based on a consensus. Really disgusting comments from a man from his position.

[you will find here the video in question, in English.]

See you on Friday 22/12/17 on @ steemi-news.org for the second part of this article.

hiveblocks

hiveblocks