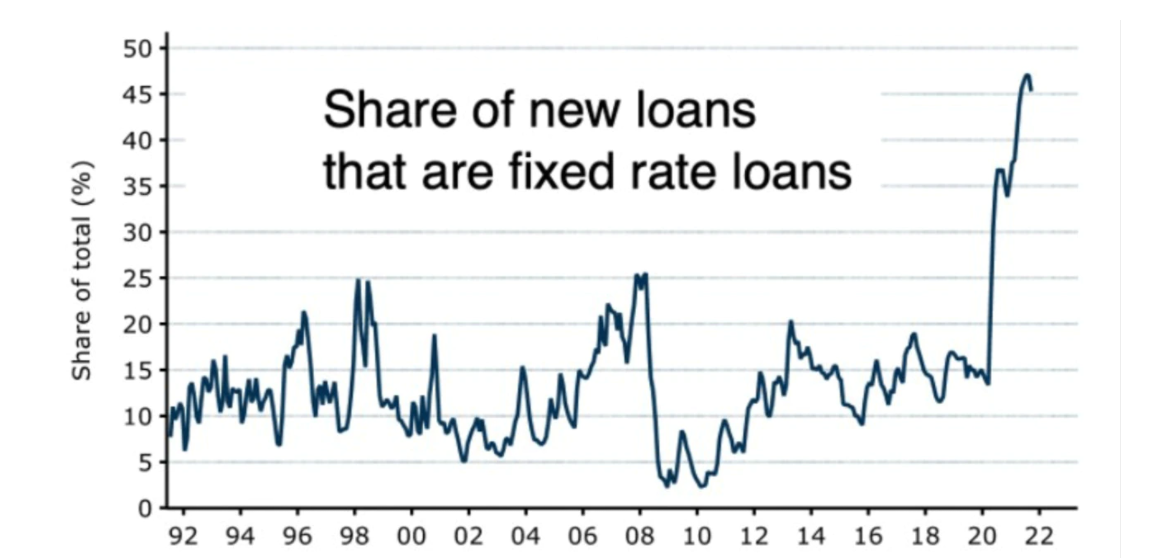

<div class="text-justify"> While the prices of housing in Finland hasn't seen the extreme rises of Australia, there are still concerns about what is going to happen to mortgage repayments as interest rates rise over the coming two years to combat inflation. In Australia, the expectation *was* that rates wouldn't rise until 2023 at the earliest, but that was always going to be a load of crap, at least for anyone who believes that printing incredibly high amounts of money will lead to inflation.  What is going to be interesting is that over the last couple years in Australia, for the first time in a long time, there have been a far greater percentage of fixed rate home loans, which is due to the incredibly low rates on offer, and of course the growing size of the loan amounts. However, the terms for the fixed rate before returning to a variable is only a couple years for most, and that means that once the rates do shift back (with a lot ending in December 2023), they are going to be hit with multiple interest rate rises at the same time.  This is going to be a bit of a shock to the system for many, with the expectation that on a 400K and at an interest rate of about 4.5%, this is likely to add another 500 dollars a month *on top* of the mortgage amount today.  However, this is not a very good indicator of the amount to expect to pay, as according to the Australian Bureau of Statistics (ABS), toward the end of 2021, the average mortgage in Australia was 550K, 30% higher - which means it is more likely to be $700 additional per month to find or, 8000 dollars extra. And in the Sydney area where the median house price is over a million dollars now and requires a 20% deposit, there are going to be many people with +800K mortgages, that can expect a rise of $1200 dollars more a month or around $15,000 more. In a country where the average salary is around 80-90K a year, that is a massive amount *extra* to find. On top of this, the increase in interest rates will likely be followed with a fall in house prices, with some estimates indicating up to a 30% drop in value. This is because higher rates means less people are able to afford loans, dropping demand until a new floor equilibrium is found. Long-term this isn't too bad for mortgage holders, *unless needing to sell* because the mortgage repayment level is now untenable. But, there is more to it than just dealing with mortgage costs, as the reason that the rates will rise is due to the inflation rate, which means that the cost of everything is going up, with a lot of "necessities" like fuel prices (Australia is a large country and the distances needed to cover often require owning a car at a practical level) are increasing above the inflation rate, especially on the back of looming war between Russia and Ukraine. But, many costs have increased also, with *healthy food* seeing increases of over 20% in the last year alone in some cases. This means that not only will the average mortgage holder have to find additional income to cover rate rises, they will also have to find it to cover other life expenses and in combination, this is going to be difficult. Perhaps where the opportunity lays for some is for those who didn't FOMO into the housing market in Australia over the last two years and instead used their income as an investment mechanism to generate wealth beyond the inflation rate and more. It is possible that once the housing markets do crash, they will be able to reallocate their wealth from near-liquid into physical assets at the bottom of the real estate market, buying up other's broken dreams. It might seem like a morbid way to look at it, but often this is the case in many markets that are on the way down in the cycle, as people sell because they *must,* not because they *want* to. Economics seems cruel in many ways, because behind all of the numbers, there are real people and their lives at stake. However, this is just the way it works and unfortunately, there is unlikely to ever be an economy that is always going to be win-win across the board, unless there is a perfect AI system that can perfectly implement the perfect communist economy - but that isn't going to happen, as this isn't Star Trek. So, that leaves us to largely fend for ourselves in regards to our own wellbeing and while we all make the best decisions we can in the moment, the truth is that all decisions are going to be on a spectrum of outcomes based on many factors. Buying a house in the last two years might have been the smartest financial move they will ever make, for another person buying the house next door, it might be their biggest regret. What determines the difference is going to depend on many aspects, but in general the ability to manage the debt *long-term* and under less than ideal conditions is going to be the main factor. A lot of people have overextended and exposed themselves to a high debt burden in order to get their "dream home", pushing their loan to the outer limit, even though interest rates are at the lowest they have ever been. This means, they can only really go up and with a loan of 25+ years, the chances of that happening are very high. A couple of percent will make an incredibly large difference to many families out there and unfortunately, some of those dreams are going to turn nightmarish. For mortgage holders, the next couple years are going to probably be rough, so if you expect that you are going to need more to cover the future, it is best to start preparing as best as possible now. How to prepare is determined by personal conditions, but it is likely going to take more than belt-tightening for many, so look for additional income streams as well. A year or two from now, it might get pretty turbulent in the home, so having a few extra months of costs put away, might be enough to make the difference between bankruptcy and seeing it through to the other side. I hope everyone makes it, but that is unlikely. Taraz [ Gen1: Hive ] </div> Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@tarazkp/overextended-and-ready-to-rise)

| author | tarazkp |

|---|---|

| permlink | overextended-and-ready-to-rise |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["real-estate","economics","investing","mindset","economy","community","business","thoughts","rehab","life","future","leofinance"],"canonical_url":"https://leofinance.io/@tarazkp/overextended-and-ready-to-rise","image":["https://files.peakd.com/file/peakd-hive/tarazkp/23wqg5KPbMNcAAgQqV9jxTArgqMA8g9Ny9Dp6MjgskxQnjNbVzndyADLBsjZsbnjqeM2H.png","https://files.peakd.com/file/peakd-hive/tarazkp/23uFwDcUJpBnVSVB86oxK6dyBr3yR4wBQvcnrps2ZDXHSsLtigQgoDwciY2LibiPvQ5kq.png","https://files.peakd.com/file/peakd-hive/tarazkp/23tmhMSQKiCZogUUntidcW5uohc7gaEe4vyXVxzwUt9H64EXg7BGFF2SgPMAnmoQopLxm.png"]} |

| created | 2022-02-19 18:18:00 |

| last_update | 2022-02-19 18:18:00 |

| depth | 0 |

| children | 14 |

| last_payout | 2022-02-26 18:18:00 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 23.199 HBD |

| curator_payout_value | 23.089 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 6,535 |

| author_reputation | 5,831,886,281,081,239 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,622,817 |

| net_rshares | 43,455,592,468,477 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| nanzo-scoop | 0 | 4,684,100,207 | 50% | ||

| acidyo | 0 | 8,585,612,837,678 | 80% | ||

| mummyimperfect | 0 | 61,614,024,095 | 50% | ||

| ak2020 | 0 | 24,512,012,832 | 50% | ||

| mammasitta | 0 | 1,179,186,293 | 0.3% | ||

| emily-cook | 0 | 1,688,373,798 | 50% | ||

| meesterboom | 0 | 2,490,783,386,958 | 100% | ||

| arcange | 0 | 659,530,486,654 | 5% | ||

| raphaelle | 0 | 6,094,091,108 | 5% | ||

| sazbird | 0 | 10,994,087,086 | 100% | ||

| kryptik | 0 | 10,571,179,984 | 100% | ||

| shanghaipreneur | 0 | 41,457,841,009 | 50% | ||

| wisbeech | 0 | 9,762,753,186 | 100% | ||

| themanualbot | 0 | 535,888,801 | 20% | ||

| uwelang | 0 | 29,582,827,451 | 4% | ||

| doitvoluntarily | 0 | 38,249,777,563 | 100% | ||

| abh12345 | 0 | 2,134,240,861,021 | 75% | ||

| t-bot | 0 | 995,108,173 | 50% | ||

| shawnlauzon | 0 | 49,679,189,056 | 50% | ||

| mafeeva | 0 | 74,588,895,419 | 50% | ||

| walterjay | 0 | 9,998,987,971 | 0.87% | ||

| ryivhnn | 0 | 180,730,810,320 | 61% | ||

| steemitboard | 0 | 17,650,954,303 | 3% | ||

| justinashby | 0 | 6,947,069,799 | 100% | ||

| pouchon | 0 | 95,952,478,297 | 3.5% | ||

| ganjafarmer | 0 | 623,761,819 | 0.87% | ||

| preparedwombat | 0 | 1,167,630,752,506 | 100% | ||

| freebornsociety | 0 | 744,319,771 | 6.2% | ||

| dickturpin | 0 | 4,402,314,966 | 15% | ||

| lizanomadsoul | 0 | 1,135,540,699 | 2% | ||

| thatsweeneyguy | 0 | 735,907,840 | 100% | ||

| l337m45732 | 0 | 641,055,830 | 2% | ||

| enjoywithtroy | 0 | 116,268,678,924 | 50% | ||

| jhelbich | 0 | 146,907,595,332 | 82% | ||

| tamaralovelace | 0 | 93,542,533,474 | 100% | ||

| cyclope | 0 | 81,747,211,014 | 88% | ||

| sumatranate | 0 | 496,545,155,451 | 100% | ||

| fredrikaa | 0 | 1,455,849,810,011 | 100% | ||

| trumpikas | 0 | 12,268,269,238 | 80% | ||

| varunpinto | 0 | 5,573,468,361 | 100% | ||

| tonyz | 0 | 106,698,371,704 | 68% | ||

| galenkp | 0 | 3,102,396,394,555 | 100% | ||

| teamaustralia | 0 | 8,076,786,746 | 45% | ||

| evolved08gsr | 0 | 7,409,353,565 | 50% | ||

| jayna | 0 | 71,094,435,205 | 15% | ||

| ew-and-patterns | 0 | 58,148,287,162 | 20% | ||

| joeyarnoldvn | 0 | 9,052,087,930 | 24.21% | ||

| papilloncharity | 0 | 1,480,581,286,334 | 80.1% | ||

| summertooth | 0 | 1,099,867,038 | 49.5% | ||

| dante31 | 0 | 685,911,302 | 5% | ||

| goldkey | 0 | 387,825,265,196 | 51% | ||

| macchiata | 0 | 461,783,554,961 | 100% | ||

| vikisecrets | 0 | 523,985,959,430 | 30% | ||

| thauerbyi | 0 | 1,523,189,220 | 9% | ||

| jasonbu | 0 | 46,569,592,508 | 56.25% | ||

| bashadow | 0 | 111,293,469,227 | 25% | ||

| bahagia-arbi | 0 | 510,360,849 | 10% | ||

| roleerob | 0 | 20,777,879,207 | 5% | ||

| simplifylife | 0 | 104,346,566,402 | 50% | ||

| espoem | 0 | 15,626,109,856 | 5% | ||

| ghazanfar.ali | 0 | 19,836,023,448 | 100% | ||

| gringo211985 | 0 | 5,561,535,629 | 100% | ||

| borgheseglass | 0 | 6,426,985,829 | 100% | ||

| daisyphotography | 0 | 11,691,958,593 | 100% | ||

| planetauto | 0 | 94,759,756,545 | 100% | ||

| fknmayhem | 0 | 8,582,049,845 | 85% | ||

| diverse | 0 | 206,715,701,440 | 100% | ||

| dashroom | 0 | 1,688,040,091 | 80% | ||

| vintherinvest | 0 | 8,568,561,552 | 5% | ||

| not-a-bird | 0 | 5,055,716,984 | 20% | ||

| citizensmith | 0 | 35,460,728,991 | 100% | ||

| mytechtrail | 0 | 61,069,837,861 | 15% | ||

| leopard0505 | 0 | 2,003,566,842 | 100% | ||

| b00m | 0 | 13,125,073,446 | 100% | ||

| gorc | 0 | 4,796,753,084 | 61% | ||

| pixietrix | 0 | 3,487,097,251 | 61% | ||

| shadowlioncub | 0 | 3,797,094,132 | 61% | ||

| abitcoinskeptic | 0 | 4,336,719,653 | 50% | ||

| jongolson | 0 | 904,342,738,672 | 50% | ||

| not-a-gamer | 0 | 528,571,515 | 40% | ||

| intrepidphotos | 0 | 3,844,979,438,309 | 100% | ||

| tryskele | 0 | 3,963,017,904 | 15% | ||

| socialmediaseo | 0 | 929,781,921 | 50% | ||

| leslierevales | 0 | 4,451,789,088 | 40.05% | ||

| mciszczon | 0 | 103,309,515,801 | 100% | ||

| manncpt | 0 | 1,960,428,146 | 2% | ||

| rbm | 0 | 2,708,024,348 | 50% | ||

| philnewton | 0 | 1,584,992,309 | 18.75% | ||

| fieryfootprints | 0 | 19,940,247,226 | 40% | ||

| tobias-g | 0 | 5,759,522,043 | 56.25% | ||

| jazzhero | 0 | 6,982,106,632 | 40% | ||

| ericburgoyne | 0 | 32,613,994,626 | 50% | ||

| bigtom13 | 0 | 302,417,375,846 | 50% | ||

| nakary | 0 | 2,488,313,625 | 100% | ||

| bozz | 0 | 185,549,923,886 | 20% | ||

| cst90 | 0 | 144,755,234,310 | 100% | ||

| videoaddiction | 0 | 21,467,145,194 | 100% | ||

| g4fun | 0 | 11,244,351,521 | 25% | ||

| jasonwaterfalls | 0 | 745,679,719 | 100% | ||

| jglake | 0 | 5,450,452,176 | 20% | ||

| didutza | 0 | 798,332,952 | 50% | ||

| zemiatin | 0 | 677,908,440 | 50% | ||

| adamada | 0 | 299,388,221,370 | 40% | ||

| ghua | 0 | 1,326,721,477 | 100% | ||

| obsesija | 0 | 1,600,425,044 | 5% | ||

| blainjones | 0 | 10,840,283,712 | 15% | ||

| sd974201 | 0 | 1,292,985,656 | 3% | ||

| gadrian | 0 | 11,248,410,848 | 4% | ||

| springlining | 0 | 38,731,274,292 | 100% | ||

| achimmertens | 0 | 7,811,469,266 | 2.5% | ||

| kgakakillerg | 0 | 17,072,917,428 | 10% | ||

| break-out-trader | 0 | 8,286,605,031 | 10% | ||

| kendallron | 0 | 958,225,203 | 40% | ||

| globalschool | 0 | 932,346,159 | 1% | ||

| trumpman2 | 0 | 14,958,632,081 | 99% | ||

| superlao | 0 | 48,111,330,604 | 100% | ||

| pepitagold | 0 | 30,693,479,517 | 73.8% | ||

| worldwildflora | 0 | 777,221,260 | 40% | ||

| cryptoandcoffee | 0 | 472,837,068,185 | 25% | ||

| luminaryhmo | 0 | 2,391,550,894 | 100% | ||

| gaottantacinque | 0 | 245,073,718 | 100% | ||

| abacam | 0 | 810,594,521 | 100% | ||

| abcor | 0 | 4,221,395,284 | 100% | ||

| shortsegments | 0 | 95,585,061,382 | 50% | ||

| gallerani | 0 | 595,981,075 | 10% | ||

| bestofph | 0 | 7,754,466,887 | 40% | ||

| luciannagy | 0 | 17,013,880,519 | 30% | ||

| jk6276 | 0 | 93,871,326,104 | 50% | ||

| gasaeightyfive | 0 | 355,375,972 | 100% | ||

| jokinmenipieleen | 0 | 3,572,087,207 | 100% | ||

| bagpuss | 0 | 8,527,860,721 | 100% | ||

| tipsybosphorus | 0 | 3,032,541,914 | 50% | ||

| pboulet | 0 | 1,704,864,324 | 1.75% | ||

| marcocasario | 0 | 145,984,019,891 | 100% | ||

| dosh | 0 | 518,730,730 | 5% | ||

| cribbio | 0 | 686,665,384 | 100% | ||

| piensocrates | 0 | 2,313,898,351 | 100% | ||

| mister-meeseeks | 0 | 35,291,809,881 | 40% | ||

| agustinaka | 0 | 44,104,005,101 | 44% | ||

| priyanarc | 0 | 16,469,430,141 | 30% | ||

| svirus | 0 | 16,608,230,778 | 100% | ||

| sbi10 | 0 | 57,948,956,563 | 77.45% | ||

| misterengagement | 0 | 4,103,279,825 | 67.5% | ||

| owasco | 0 | 105,370,773,826 | 75% | ||

| shainemata | 0 | 877,929,729 | 2.5% | ||

| blind-spot | 0 | 13,211,911,100 | 50% | ||

| mrsbozz | 0 | 11,724,565,321 | 50% | ||

| flyingbolt | 0 | 726,249,828 | 10% | ||

| scoopstakes | 0 | 14,283,642,008 | 50% | ||

| nanzo-snaps | 0 | 9,464,146,448 | 50% | ||

| dknkyz | 0 | 12,863,472,847 | 40% | ||

| thelogicaldude | 0 | 4,953,153,955 | 5% | ||

| src3 | 0 | 9,967,779,957 | 12.5% | ||

| photographercr | 0 | 30,871,020,055 | 16% | ||

| d-company | 0 | 546,580,352 | 100% | ||

| bigmoneyman | 0 | 713,895,199 | 40% | ||

| megavest | 0 | 21,660,093,495 | 10% | ||

| bastter | 0 | 1,608,255,227 | 25% | ||

| agmoore2 | 0 | 3,300,162,329 | 100% | ||

| tinyhousecryptos | 0 | 503,048,368 | 5% | ||

| ctrpch | 0 | 744,717,092 | 10% | ||

| travelwritemoney | 0 | 1,359,980,821 | 10% | ||

| xyz004 | 0 | 48,015,042,256 | 25% | ||

| nichemarket | 0 | 2,101,928,361 | 100% | ||

| abh12345.leo | 0 | 3,035,857,296 | 100% | ||

| leo.voter | 0 | 8,651,322,748,132 | 10% | ||

| bearjohn | 0 | 916,589,055 | 50% | ||

| coffeea.token | 0 | 6,256,234,237 | 100% | ||

| babytarazkp | 0 | 10,358,535,422 | 100% | ||

| maddogmike | 0 | 1,463,332,982 | 1.75% | ||

| revise.leo | 0 | 2,534,620,554 | 100% | ||

| liaminit1 | 0 | 7,667,191,257 | 90% | ||

| elianaicgomes | 0 | 7,184,490,986 | 7.5% | ||

| bruleo | 0 | 685,029,493 | 100% | ||

| coinlogic.online | 0 | 3,883,668,105 | 5% | ||

| khalneox | 0 | 1,477,546,471 | 100% | ||

| therealyme | 0 | 905,422,413,210 | 15% | ||

| oelgniksivart | 0 | 3,180,630,505 | 99% | ||

| bilpcoin.pay | 0 | 518,379,200 | 10% | ||

| sumatranate.leo | 0 | 5,270,246,177 | 100% | ||

| galenkp.aus | 0 | 1,197,524,079 | 100% | ||

| khalpal | 0 | 1,909,252,987 | 100% | ||

| gloriaolar | 0 | 6,332,101,818 | 22.5% | ||

| onestop | 0 | 1,606,121,861 | 5% | ||

| photosnap | 0 | 9,452,957,460 | 25% | ||

| theisacoin | 0 | 1,462,423,178 | 50% | ||

| monica-ene | 0 | 51,292,726,750 | 40% | ||

| hivebuzz | 0 | 5,620,260,849 | 2% | ||

| leofinance | 0 | 25,507,912,596 | 10% | ||

| laruche | 0 | 80,872,019,557 | 1.75% | ||

| hivephilippines | 0 | 105,207,107,194 | 25% | ||

| kohsamui99 | 0 | 294,644,254,614 | 100% | ||

| softworld | 0 | 156,270,605,557 | 37% | ||

| globalcurrencies | 0 | 4,126,387,063 | 100% | ||

| ppinillos | 0 | 1,378,105,043 | 100% | ||

| hivelist | 0 | 4,973,017,691 | 1.75% | ||

| zuly63 | 0 | 1,156,445,872 | 8% | ||

| pcojines | 0 | 8,533,259,582 | 100% | ||

| rmsadkri | 0 | 29,345,854,273 | 45% | ||

| ghaazi | 0 | 4,058,300,959 | 80% | ||

| actioncats | 0 | 9,489,953,124 | 7% | ||

| hivehustlers | 0 | 9,732,492,343 | 3.5% | ||

| schmidi | 0 | 598,000,749 | 1% | ||

| ileart | 0 | 23,950,928,904 | 90% | ||

| w-t-fi | 0 | 1,169,885,012 | 100% | ||

| reward.app | 0 | 45,359,388,967 | 25% | ||

| deadswitch | 0 | 4,018,215,360 | 100% | ||

| enilemor | 0 | 2,748,726,129 | 100% | ||

| camplife | 0 | 697,698,947 | 100% | ||

| rituraz17 | 0 | 4,545,948,234 | 65% | ||

| cmplxty.leo | 0 | 165,220,638 | 45% | ||

| borbolet | 0 | 8,126,889,783 | 30% | ||

| iamfarhad | 0 | 744,114,718 | 50% | ||

| curatorcat.leo | 0 | 4,516,768,291 | 100% | ||

| dknkyz.leo | 0 | 840,801,936 | 50% | ||

| rdfield | 0 | 1,934,883,078 | 100% | ||

| officialhisha | 0 | 224,558,388 | 100% | ||

| drax.leo | 0 | 1,904,823,011 | 10% | ||

| he-index | 0 | 3,973,275,567 | 15% | ||

| blockbroccoli | 0 | 1,084,935,276 | 60.75% | ||

| leo.tokens | 0 | 900,037,945 | 10% | ||

| badbitch | 0 | 32,847,249,136 | 100% | ||

| cielitorojo | 0 | 7,409,483,623 | 5% | ||

| iikrypticsii | 0 | 43,217,318,156 | 70% | ||

| instytutfi | 0 | 1,808,246,711 | 100% | ||

| meowcurator | 0 | 832,882,753 | 65% | ||

| kriszrokk | 0 | 4,333,167,236 | 100% | ||

| cbridges573 | 0 | 1,395,719,751 | 3.75% | ||

| elgatoshawua | 0 | 2,305,823,790 | 5% | ||

| cowboyphylosophy | 0 | 6,316,539,768 | 100% | ||

| kurkumita | 0 | 1,668,657,020 | 41% | ||

| nyxlabs | 0 | 598,494,545 | 3.05% | ||

| creodas | 0 | 1,064,339,088 | 30% | ||

| rendrianarma | 0 | 1,564,081,635 | 40% | ||

| cryptololo | 0 | 1,064,034,511 | 9% | ||

| broadhive-org | 0 | 1,066,631,851 | 5% | ||

| leoball | 0 | 538,220,969 | 10% | ||

| leveluplifestyle | 0 | 18,694,695,057 | 40% | ||

| auliaarma | 0 | 895,111,957 | 40% | ||

| meesterleo | 0 | 1,878,373,130 | 100% | ||

| hive.friends | 0 | 780,289,198 | 99.34% | ||

| scooter77.pob | 0 | 1,376,345,666 | 100% | ||

| chrysanthemum | 0 | 36,119,228,491 | 100% | ||

| twicejoy | 0 | 1,047,143,886 | 40% | ||

| zulfahmi0221 | 0 | 1,391,735,421 | 100% | ||

| revise.pob | 0 | 1,244,361,325 | 100% | ||

| hunterblaze | 0 | 535,803,234 | 100% | ||

| trentonlundy1 | 0 | 2,205,995,309 | 5% | ||

| cryptoccshow | 0 | 3,978,133,946 | 25% | ||

| steveparma | 0 | 4,624,261,814 | 90% | ||

| mjvdc | 0 | 1,851,923,448 | 100% | ||

| szpb | 0 | 2,084,133,410 | 100% | ||

| trasto | 0 | 635,385,906 | 40% | ||

| batistebou | 0 | 607,304,428 | 50% | ||

| thinkrdotexe | 0 | 1,777,066,432 | 49.8% | ||

| jkp.nisha | 0 | 3,194,216,339 | 100% | ||

| krazzy-kitty | 0 | 4,320,843,590 | 100% | ||

| danyst1ne | 0 | 12,335,183,436 | 100% | ||

| tokenizedsociety | 0 | 2,292,793,654 | 20% | ||

| leoalpha | 0 | 1,188,034,334 | 50% | ||

| technicalone | 0 | 1,966,583,574 | 100% | ||

| beautifulwreck | 0 | 6,313,057,459 | 50% | ||

| lordtimoty | 0 | 12,095,530,012 | 100% | ||

| financeadviser | 0 | 1,433,808,978 | 100% | ||

| saboin.leo | 0 | 61,277,658 | 14% | ||

| zuun.net | 0 | 12,550,205,603 | 30% | ||

| ladytitan | 0 | 2,924,441,137 | 100% | ||

| hivetoshi | 0 | 52,663,711,616 | 100% | ||

| khaltok | 0 | 760,906,555 | 10% | ||

| andreseloy581 | 0 | 35,084,540,472 | 100% |

We have had 2 rate hikes already this year which is absurd. Luckily the house payments are tied in with the family business/salary package so if they go up we have no worries. I can see plenty repossessions over the next 5 years as many are stretched beyond their means already. Throw in escalating prices just to live as you mentioned and many are facing a problem. Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@cryptoandcoffee/re-tarazkp-21vfhx)

| author | cryptoandcoffee |

|---|---|

| permlink | re-tarazkp-21vfhx |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["hive-167922","leofinance"],"canonical_url":"https://leofinance.io/@cryptoandcoffee/re-tarazkp-21vfhx"} |

| created | 2022-02-19 21:31:21 |

| last_update | 2022-02-19 21:31:21 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-02-26 21:31:21 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.150 HBD |

| curator_payout_value | 0.149 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 467 |

| author_reputation | 3,568,777,981,751,323 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,626,639 |

| net_rshares | 279,714,857,088 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 279,024,500,648 | 5% | ||

| dickturpin | 0 | 690,356,440 | 2.5% |

The repo companies are going to have a field day, though I wouldn't want to work for them having to take people's dreams away.

| author | tarazkp |

|---|---|

| permlink | re-cryptoandcoffee-r7kn8s |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2022.01.2"} |

| created | 2022-02-19 21:48:27 |

| last_update | 2022-02-19 21:48:27 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-02-26 21:48:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 127 |

| author_reputation | 5,831,886,281,081,239 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,626,970 |

| net_rshares | 0 |

When you have a mortgage you are a slave to the system. Thank God we own our home and not the bank.

| author | enjoywithtroy |

|---|---|

| permlink | re-tarazkp-r7kwvh |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2022.01.2"} |

| created | 2022-02-20 01:16:27 |

| last_update | 2022-02-20 01:16:27 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-02-27 01:16:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.134 HBD |

| curator_payout_value | 0.134 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 102 |

| author_reputation | 142,851,883,439,160 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,630,758 |

| net_rshares | 249,942,141,908 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 249,942,141,908 | 5% |

I wish I had started getting myself organized earlier in life...

| author | tarazkp |

|---|---|

| permlink | r7kxto |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-02-20 01:37:00 |

| last_update | 2022-02-20 01:37:00 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-02-27 01:37:00 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 64 |

| author_reputation | 5,831,886,281,081,239 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,631,049 |

| net_rshares | 0 |

Absolutely agree with you on this one. We're on the Mid North Coast of NSW. We got in before the boom, and thought we were overpaying. Our house price has gone up something like 55% in value in that time. Crazy, right? That said, we just locked in interest rates in January - 2 years at 1.99%. We're hoping like crazy for those wage increases to kick in to try and cover off any rate raises. Not sure that's amazing planning, but it's the best we've currently got! Have a fab week, you've got my upvote. Tim

| author | lordtimoty |

|---|---|

| permlink | re-tarazkp-r7lded |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2022.01.2"} |

| created | 2022-02-20 07:13:27 |

| last_update | 2022-02-20 07:13:27 |

| depth | 1 |

| children | 3 |

| last_payout | 2022-02-27 07:13:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.138 HBD |

| curator_payout_value | 0.137 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 509 |

| author_reputation | 134,706,772,473,562 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,636,381 |

| net_rshares | 253,256,541,916 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 252,566,227,092 | 5% | ||

| dickturpin | 0 | 690,314,824 | 2.5% |

Hopefully you aren't too extended and things will be fine - but, if you got in before and you have a 50% gain, it is unlikely to drop lower than break even for you, so it should be okay. I don't know about your personal conditions of course, but I might be building a few months of buffer into my savings for when the fixed rate ends, just in case - as that will cover the increases for a year or two. Also, what is the max on fixed? I took the max on the collar in Finland that my bank offered and it was 10 years.

| author | tarazkp |

|---|---|

| permlink | r7lprm |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-02-20 11:40:36 |

| last_update | 2022-02-20 11:40:36 |

| depth | 2 |

| children | 2 |

| last_payout | 2022-02-27 11:40:36 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 518 |

| author_reputation | 5,831,886,281,081,239 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,641,084 |

| net_rshares | 0 |

In Australia, the longest fixed rate period you can lock in is 5 years. We took the 2 year option on 1.99%, the five year option was 2.99%. The Reserve Bank kept their narrative, 'No increases until 2024'. Our fixed period ends in January 2024. The Reserve's narrative has changed, they will raise this year. We do have room for rates to rise, at the moment, the repayments are about 31% of my take home pay. All of my wife's pay goes into savings - I guess the fear is, a 1% increase works out to be $115 per week for us - that's a fair chunk of disposable income. We're lucky though, our mortgage is only around that $600,000 mark - from memory the average new mortgage is about $800,000 - so I guess we're in a position where we're a lot better off than a lot of people. The indebtedness of the country should stop the Reserve from raising like crazy though, the implications, and potential for negative equity. Ouch!

| author | lordtimoty |

|---|---|

| permlink | re-tarazkp-r7mj8c |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2022.01.2"} |

| created | 2022-02-20 22:17:06 |

| last_update | 2022-02-20 22:17:06 |

| depth | 3 |

| children | 1 |

| last_payout | 2022-02-27 22:17:06 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.148 HBD |

| curator_payout_value | 0.148 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 923 |

| author_reputation | 134,706,772,473,562 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,656,238 |

| net_rshares | 257,151,447,504 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 257,151,447,504 | 5% |

>the terms for the fixed rate before returning to a variable is only a couple years for most Does Australia not have *fixed* fixed rate mortgages? In the U.S., you can lock in for 15- or 30-year mortgages (those are the common ones, I once had a 25-year mortgage) and then have the option of refinancing if rates drop semi-significantly.

| author | preparedwombat |

|---|---|

| permlink | re-tarazkp-r7ke4t |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2022.01.2"} |

| created | 2022-02-19 18:31:42 |

| last_update | 2022-02-19 18:31:42 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-02-26 18:31:42 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.174 HBD |

| curator_payout_value | 0.173 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 338 |

| author_reputation | 854,451,817,212,199 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,623,163 |

| net_rshares | 326,936,055,807 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 326,096,830,279 | 6% | ||

| dickturpin | 0 | 839,225,528 | 3% |

They do, but they are typically only a couple years. The variable rate has been popular for a long time. In Finland, most go variable too. I collared the moal on ours for 10 years (the max) so it can only rise so far. This comes with an additional cost, and many people think me crazy. I am old enough to remember the early 1990s and with the rates so low now, it is a no brainer. They can only go a fraction lower, but there is a lot of potential on the rise side.

| author | tarazkp |

|---|---|

| permlink | r7keci |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-02-19 18:36:15 |

| last_update | 2022-02-19 18:36:15 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-02-26 18:36:15 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.061 HBD |

| curator_payout_value | 0.060 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 466 |

| author_reputation | 5,831,886,281,081,239 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 0 |

| post_id | 110,623,301 |

| net_rshares | 114,605,972,838 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| preparedwombat | 0 | 114,605,972,838 | 10% |

The general rule is that if interest rate rises, prices of housing goes down. However, it doesn't work like that all the time. Despite the increased interest rate, the prices of housing have constantly been rising in my country for more than one year. The rate if increasing is not sensible and can't be explained. A owner of a house increases the price, if sees anything else's price has been increased. This is a kind of self-protection against inflation. Finally, I could find a more sensible reason: The number of houses built recently has been decreased.

| author | videoaddiction |

|---|---|

| permlink | re-tarazkp-2022219t235932778z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922","real-estate","economics","investing","mindset","economy","community","business","thoughts","rehab","life","future","leofinance"],"app":"ecency/3.0.25-mobile","format":"markdown+html"} |

| created | 2022-02-19 20:59:36 |

| last_update | 2022-02-19 20:59:36 |

| depth | 1 |

| children | 3 |

| last_payout | 2022-02-26 20:59:36 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.150 HBD |

| curator_payout_value | 0.149 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 562 |

| author_reputation | 165,272,110,807,818 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,626,074 |

| net_rshares | 279,439,389,784 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 278,749,386,408 | 5% | ||

| dickturpin | 0 | 690,003,376 | 2.5% |

But there is also hyperinflation there, right? The value of the house keeps increasing with the inflation rate, but the interest rate makes it harder to get loans, meaning that building houses will go down - isn't that the case?

| author | tarazkp |

|---|---|

| permlink | re-videoaddiction-r7kn7i |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2022.01.2"} |

| created | 2022-02-19 21:47:42 |

| last_update | 2022-02-19 21:47:42 |

| depth | 2 |

| children | 2 |

| last_payout | 2022-02-26 21:47:42 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 228 |

| author_reputation | 5,831,886,281,081,239 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,626,950 |

| net_rshares | 0 |

> But there is also hyperinflation there, right? Right. > The value of the house keeps increasing with the inflation rate More than the inflation rate, and if you know the real value of houses, you can understand that it is arbitrary. I don't think that building houses would go down that much due to interest rates, but increasing costs. However, I am surprised to see people paying that money for houses. I don't know how much of price is loan, but it is obvious that people have savings.

| author | videoaddiction |

|---|---|

| permlink | re-tarazkp-2022220t11458677z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"ecency/3.0.25-mobile","format":"markdown+html"} |

| created | 2022-02-19 22:15:03 |

| last_update | 2022-02-19 22:15:03 |

| depth | 3 |

| children | 1 |

| last_payout | 2022-02-26 22:15:03 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.148 HBD |

| curator_payout_value | 0.148 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 496 |

| author_reputation | 165,272,110,807,818 |

| root_title | "Overextended and Ready to Rise" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 110,627,573 |

| net_rshares | 276,600,018,436 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 276,600,018,436 | 5% |

hiveblocks

hiveblocks