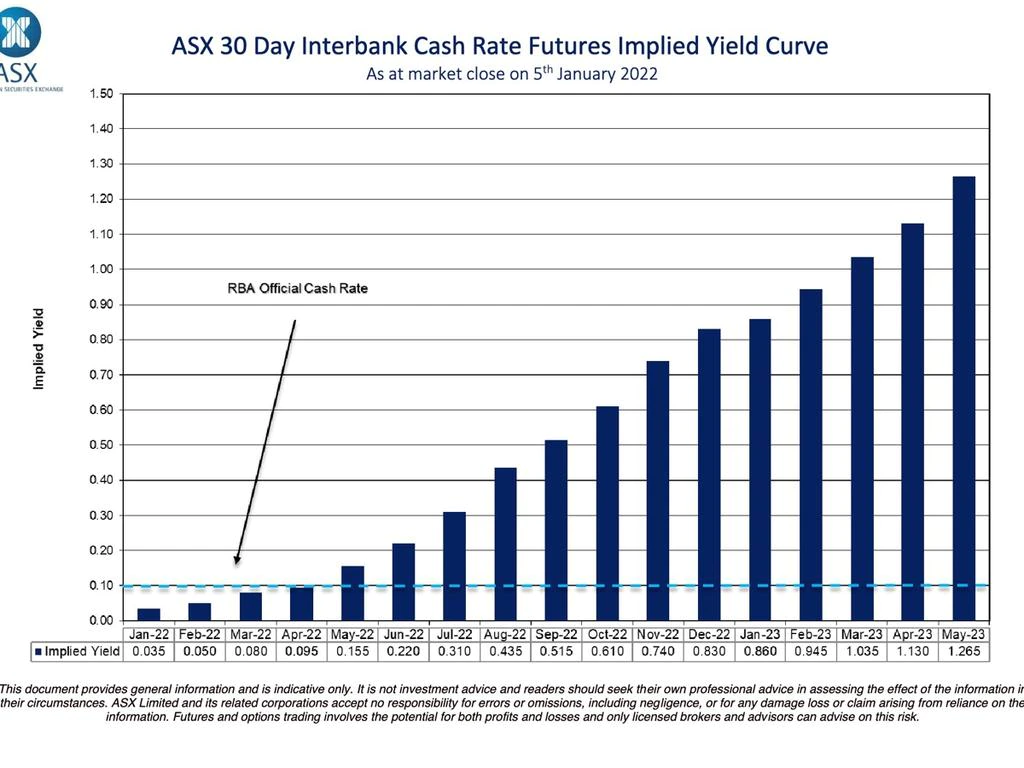

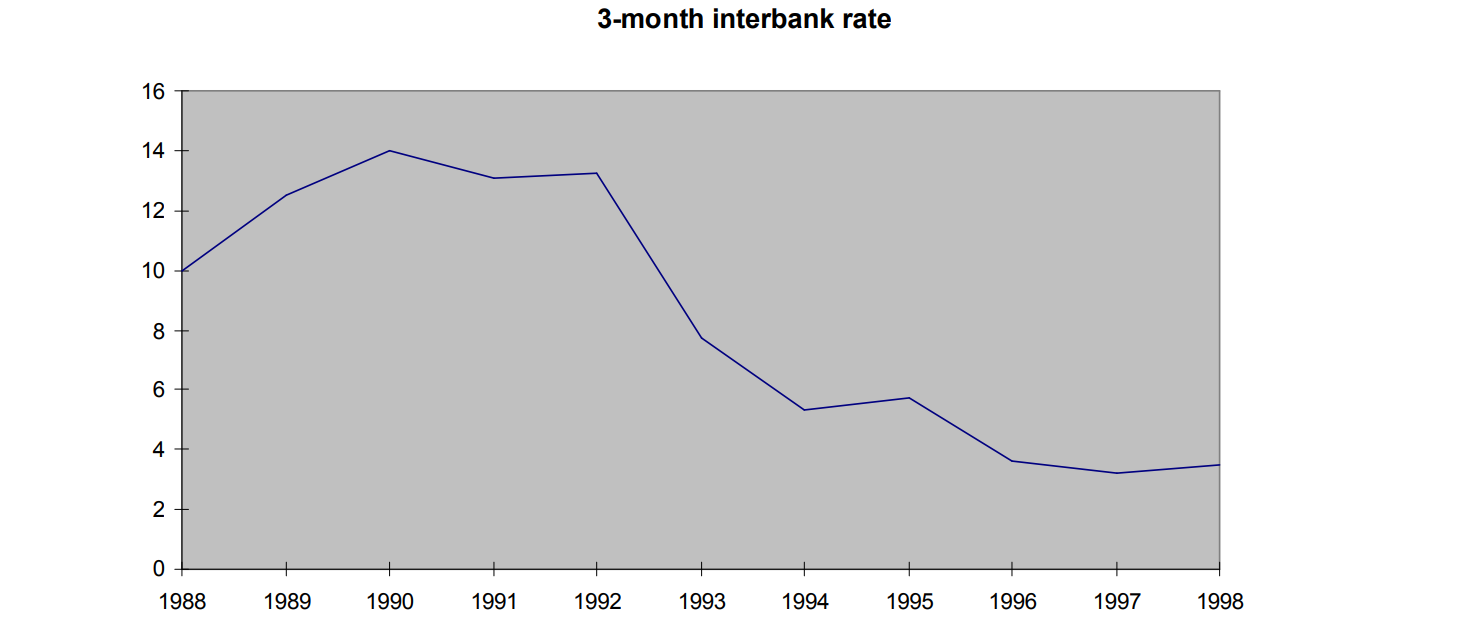

<div class="text-justify">  I found this chart interesting - it is the Australian Stock Exchange (ASX) market expectation of the interest rates based on the trade of futures. While the Reserve Bank of Australia (RBA) has said that they aren't expecting to raise interest rates until some time in 2023, the market seems not to trust them and expect 3 rate hikes this year alone, as the market is expecting about an 0.8% increase and the RBA normally increases in 0.25 percentage points at a time.  Which will be correct will be interesting to see, but the head of the RBA didn't actually say they wouldn't raise them, they said they wouldn't raise them if the inflation rate didn't increase outside of their 2-3% band, but if the US is anything to go by (and the US market impacts all markets), they ended 2021 with a 6.8% inflation rate, so what are the chances of the Australia rate staying below 3%? >“The Reserve Bank Board will not increase the cash rate until actual inflation is sustainably in the 2–3 per cent target range,” - *RBA Governor Philip Lowe* Chances? *I'd say pretty slim.* Why I find this interesting is that they have said that they won't *repeatedly* over the last year and I suspect they might actually stick to their word to save face, but that is just going to make matters worse, by kicking the can down the street - at least for the next few months. 2022 is an *election year* in Australia and no government is going to want to go into an election after encouraging homebuyers into spending to the outer limit of what they can afford into an extremely inflated housing market and then, forcing interest rate hikes onto them so they can no longer pay the mortgage. *That'd be silly.* The election is in April, so May for the first increase? The question is going to be, who is reading *the future* the best, the market traders or the average Australian? The market is expecting rate increases, but is the average Australian paying attention to this chart or, are they paying attention to the words of the RBA stating no interest rate increases this year? Now, even if the interest rates don't happen this year, but the economic conditions call for them, this means that next year, the RBA will raise them and then double down in order to claw back the postponements from 2022. This means that regardless, mortgage payers are going to be in for a world of hurt and, the housing market bubble is going to burst on the higher cost of borrowing. This means that those who have the high-end loans and are stretched tight, are likely to sell as early as they can in order to cover and recover their deposit the best they can, collapsing the market like a house of cards. This isn't my area at all, but I am glad that I insisted on collaring the house loan we took, as while it is more expensive per month, it effectively caps the interest rates at a *far lower* level if interest rates do start moving rapidly. In some way, it is a little bit of piece of mind and I made the call because the interest rates are the lowest they have ever really been, so there is only one way for them to go. Worst case scenario (personally) is if the interest rates stay very low for the next ten (nine now) years, meaning that I am overpaying for the loan, but at money "this cheap" that isn't too much of an issue.  >Most people can't even afford to pay their mortgage at the 1998 "low". The issue would be if instead of the lowest rates in history, interests were to return to the 4,6 or 8 percent range that were in the mid 90s, or in Finland, the 14% in 89-93. During that period of high interest rates in Finland, house prices fell by *50%* rapidly. In Australia in 1990, the interest rates peaked around 17.5% - which is *credit card level rates,* and I don't think you would want to have a 1.3 million dollar loan on a home where you were stress-tested at 4-6% for and, still have 25 years left to pay. Australians who are old enough might remember Paul Keating saying, "The recession we had to have". If you want to read a little about it, here is a [Wiki article](https://en.wikipedia.org/wiki/Early_1990s_recession_in_Australia) Will the *policy makers* get it right this time? Well, in the past have they? If you read that article the measures taken were pretty grim and I remember the struggle my parents had during those years, and the years of recovery as things "improved". Economic policy these days is largely irrelevant for the economy in many ways, as the economic conditions that the mechanisms have been designed to control, are no longer the same kind of animal. A lot of the policy has been designed a hundred years ago and at that time, there was not the globalized conglomerates, nor the myriad investment vehicles that there are today - it is far more complex than it was, but without anything other tool than a hammer in hand, everything gets treated as a nail. And at the end of the day, it is the average person who gets bent over and nailed hard. I don't think it matters where a person lives in the world, economic conditions for most are going to deteriorate and become untenable to maintain current levels of lifestyle - and most aren't exactly "living it up" out there. At least, not on their own dime. Housing debt is up, consumer debt is up and eventually, the chips will be called in. What happens when the chip bowl is empty? It is going to be an interesting few years ahead, as the excesses of the last couple years will come home to roost and I suspect that again, it will be labelled as conditions "we had to have" in order to keep us safe from Corona. But, it will be a scapegoat excuse that covers a period of extreme wealth transfer from poor to rich and then as the markets fall and the poor lose even more, those who have made all of those gains so far, will *buy the fucking dip* - because they can. Taraz [ Gen1: Hive ] </div> Posted Using [LeoFinance <sup>Beta</sup>](https://leofinance.io/@tarazkp/the-back-of-the-wave)

| author | tarazkp |

|---|---|

| permlink | the-back-of-the-wave |

| category | hive-167922 |

| json_metadata | {"app":"leofinance/0.2","format":"markdown","tags":["economics","finance","investing","economy","business","rehab","thoughts","mindset","australia","life","leofinance"],"canonical_url":"https://leofinance.io/@tarazkp/the-back-of-the-wave","links":["https://en.wikipedia.org/wiki/Early_1990s_recession_in_Australia"],"image":["https://images.hive.blog/DQmYdJ9qdWGmyPK3fnBxMJQ7v6KNzUaX43tEET8TDrRDKX9/image.png","https://files.peakd.com/file/peakd-hive/tarazkp/Eos6dpCQN4tuNGhFUeBKgkVthwJUEk9Dx2pRoDt7nc7MFoE67jAhFi4wGPArXz1rFcC.png","https://images.hive.blog/DQmRGKycVzNxWB3hYCtkKPnqunkUdGya4sChgB1ceHDH7JJ/image.png"]} |

| created | 2022-01-08 22:44:27 |

| last_update | 2022-01-08 22:44:27 |

| depth | 0 |

| children | 28 |

| last_payout | 2022-01-15 22:44:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 83.358 HBD |

| curator_payout_value | 83.141 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 6,333 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,295,347 |

| net_rshares | 96,189,884,042,860 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| nanzo-scoop | 0 | 4,519,827,401 | 50% | ||

| mummyimperfect | 0 | 59,393,585,995 | 50% | ||

| leprechaun | 0 | 875,159,231 | 40% | ||

| ak2020 | 0 | 23,632,763,612 | 50% | ||

| emily-cook | 0 | 1,639,363,487 | 50% | ||

| meesterboom | 0 | 2,372,307,237,243 | 100% | ||

| arcange | 0 | 175,380,406,367 | 2% | ||

| alz190 | 0 | 681,457,157 | 17% | ||

| raphaelle | 0 | 1,401,964,676 | 2% | ||

| sazbird | 0 | 10,770,138,825 | 100% | ||

| shanghaipreneur | 0 | 67,521,943,334 | 50% | ||

| wisbeech | 0 | 9,436,178,678 | 100% | ||

| mattclarke | 0 | 848,749,854,107 | 100% | ||

| englishtchrivy | 0 | 68,777,052,856 | 100% | ||

| daveks | 0 | 723,517,969,804 | 12% | ||

| penguinpablo | 0 | 303,969,775,026 | 12% | ||

| uwelang | 0 | 43,073,515,290 | 4% | ||

| kommienezuspadt | 0 | 3,955,946,248,252 | 100% | ||

| abh12345 | 0 | 1,699,846,285,925 | 75% | ||

| boxcarblue | 0 | 304,327,810,316 | 100% | ||

| t-bot | 0 | 964,602,778 | 50% | ||

| moretea | 0 | 515,392,420 | 10% | ||

| mafeeva | 0 | 71,899,422,669 | 50% | ||

| walterjay | 0 | 5,247,790,219 | 0.35% | ||

| ryivhnn | 0 | 161,903,130,158 | 61% | ||

| steemitboard | 0 | 8,424,048,835 | 2% | ||

| justinashby | 0 | 11,316,828,155 | 100% | ||

| trafalgar | 0 | 15,386,639,276,485 | 39% | ||

| preparedwombat | 0 | 464,466,611,464 | 42% | ||

| elevator09 | 0 | 5,777,667,727 | 100% | ||

| raindrop | 0 | 254,319,210,066 | 39% | ||

| thatsweeneyguy | 0 | 704,510,196 | 100% | ||

| eliel | 0 | 11,573,237,750 | 5% | ||

| drag33 | 0 | 3,355,744,410 | 100% | ||

| sumatranate | 0 | 505,282,609,016 | 100% | ||

| trumpikas | 0 | 34,391,058,562 | 80% | ||

| varunpinto | 0 | 6,376,858,555 | 100% | ||

| bammbuss | 0 | 1,398,304,045 | 96.7% | ||

| bitcoinflood | 0 | 517,672,758,262 | 25.2% | ||

| alphacore | 0 | 5,962,847,667 | 2.42% | ||

| galenkp | 0 | 2,623,331,663,726 | 100% | ||

| sam99 | 0 | 26,884,154,350 | 18% | ||

| teamaustralia | 0 | 8,042,807,951 | 45% | ||

| dandesign86 | 0 | 182,875,845,208 | 100% | ||

| tezmel | 0 | 87,756,697,544 | 100% | ||

| jayna | 0 | 79,590,223,015 | 15% | ||

| ew-and-patterns | 0 | 57,365,435,193 | 20% | ||

| joeyarnoldvn | 0 | 9,028,226,489 | 24.21% | ||

| taliakerch | 0 | 74,266,412,195 | 87.5% | ||

| forexbrokr | 0 | 14,376,837,659 | 20% | ||

| mcoinz79 | 0 | 17,286,458,072 | 6% | ||

| bluemist | 0 | 18,183,937,121 | 9% | ||

| captainquack22 | 0 | 6,812,912,713 | 19% | ||

| dante31 | 0 | 739,610,802 | 5% | ||

| lenasveganliving | 0 | 2,820,888,882 | 4.5% | ||

| bluemoon | 0 | 41,660,210,579 | 20% | ||

| appreciator | 0 | 30,644,291,097,273 | 9% | ||

| steemik | 0 | 814,787,345,520 | 100% | ||

| thauerbyi | 0 | 1,465,814,038 | 9% | ||

| jasonbu | 0 | 54,065,187,718 | 56.25% | ||

| leveragetrading | 0 | 148,786,915,060 | 25% | ||

| santigs | 0 | 38,439,569,745 | 100% | ||

| joalvarez | 0 | 53,618,691,464 | 55% | ||

| bashadow | 0 | 104,603,032,688 | 25% | ||

| raffy | 0 | 3,078,609,370 | 100% | ||

| artonmysleeve | 0 | 581,089,363 | 6% | ||

| celestal | 0 | 449,563,954,695 | 100% | ||

| tomiscurious | 0 | 48,844,075,868 | 11% | ||

| roleerob | 0 | 21,167,015,684 | 5% | ||

| simplifylife | 0 | 109,483,473,129 | 50% | ||

| fatman | 0 | 7,688,059,191 | 2% | ||

| espoem | 0 | 15,576,557,502 | 5% | ||

| ghazanfar.ali | 0 | 75,242,694,897 | 100% | ||

| rodent | 0 | 6,433,234,785 | 30.6% | ||

| martusamak | 0 | 887,001,931 | 100% | ||

| borgheseglass | 0 | 5,796,795,250 | 100% | ||

| daisyphotography | 0 | 11,017,359,760 | 100% | ||

| investegg | 0 | 40,297,286,371 | 1% | ||

| keepcalmandread | 0 | 3,284,833,431 | 100% | ||

| fknmayhem | 0 | 8,564,006,853 | 85% | ||

| vintherinvest | 0 | 9,581,072,841 | 5% | ||

| suzn.poudel | 0 | 7,707,875,073 | 100% | ||

| citizensmith | 0 | 54,612,392,649 | 100% | ||

| mytechtrail | 0 | 58,143,457,264 | 15% | ||

| traf | 0 | 1,381,367,249,430 | 39% | ||

| b00m | 0 | 20,969,007,867 | 100% | ||

| afril | 0 | 1,141,621,927 | 100% | ||

| cryptonized | 0 | 17,526,308,942 | 12% | ||

| crookshanks | 0 | 1,085,750,057 | 100% | ||

| fourfourfun | 0 | 1,513,486,784 | 5.5% | ||

| gorc | 0 | 4,329,035,650 | 61% | ||

| pixietrix | 0 | 3,124,708,295 | 61% | ||

| shadowlioncub | 0 | 3,410,710,055 | 61% | ||

| aussieninja | 0 | 98,980,683,483 | 100% | ||

| abitcoinskeptic | 0 | 1,949,613,661 | 50% | ||

| jongolson | 0 | 1,184,120,719,835 | 50% | ||

| intrepidphotos | 0 | 3,683,601,660,289 | 100% | ||

| tryskele | 0 | 3,903,837,234 | 15% | ||

| edicted | 0 | 5,474,503,703,921 | 100% | ||

| mciszczon | 0 | 108,162,394,993 | 100% | ||

| rbm | 0 | 2,632,279,701 | 50% | ||

| philnewton | 0 | 1,373,232,521 | 18.75% | ||

| fieryfootprints | 0 | 18,895,177,231 | 40% | ||

| tobias-g | 0 | 4,217,269,982 | 56.25% | ||

| bet1x2 | 0 | 505,711,894 | 100% | ||

| bigtom13 | 0 | 296,753,618,570 | 50% | ||

| annabellenoelle | 0 | 5,249,382,567 | 100% | ||

| nakary | 0 | 3,203,284,388 | 100% | ||

| bozz | 0 | 185,876,109,952 | 20% | ||

| cst90 | 0 | 134,682,097,860 | 100% | ||

| videoaddiction | 0 | 21,165,150,085 | 100% | ||

| g4fun | 0 | 11,206,422,868 | 25% | ||

| jasonwaterfalls | 0 | 746,237,885 | 100% | ||

| jglake | 0 | 5,484,413,915 | 20% | ||

| slwzl | 0 | 44,304,694,609 | 100% | ||

| zemiatin | 0 | 716,306,589 | 50% | ||

| outlinez | 0 | 6,125,220,473 | 4.5% | ||

| onepercentbetter | 0 | 15,004,375,687 | 12% | ||

| manniman | 0 | 61,837,908,282 | 11% | ||

| hlezama | 0 | 84,010,539,275 | 100% | ||

| mariuszkarowski | 0 | 1,366,547,818 | 10% | ||

| ablaze | 0 | 37,650,903,302 | 100% | ||

| blainjones | 0 | 42,554,663,459 | 15% | ||

| gadrian | 0 | 5,933,417,718 | 4% | ||

| silwanyx | 0 | 613,157,030 | 10% | ||

| inciter | 0 | 5,361,171,719 | 9% | ||

| kgakakillerg | 0 | 1,447,375,058 | 0.9% | ||

| julialee66 | 0 | 27,406,706 | 5% | ||

| break-out-trader | 0 | 9,906,674,489 | 10% | ||

| popyhq | 0 | 2,614,850,681 | 70% | ||

| superlao | 0 | 25,980,125,611 | 100% | ||

| stevenwood | 0 | 133,872,170,171 | 100% | ||

| curatorcat | 0 | 71,448,025,340 | 100% | ||

| cryptoandcoffee | 0 | 421,160,813,012 | 25% | ||

| luminaryhmo | 0 | 3,178,119,251 | 100% | ||

| merlion | 0 | 578,751,158 | 12% | ||

| sagesigma | 0 | 73,983,756,915 | 20% | ||

| elmundodexao | 0 | 1,081,676,063 | 4.5% | ||

| marblely | 0 | 8,047,434,665 | 9% | ||

| gaottantacinque | 0 | 175,221,816 | 100% | ||

| abacam | 0 | 840,399,214 | 100% | ||

| abcor | 0 | 3,347,820,629 | 100% | ||

| karamyog | 0 | 415,359,132,729 | 100% | ||

| shortsegments | 0 | 94,451,644,681 | 50% | ||

| nazomimatute1998 | 0 | 167,923,484 | 100% | ||

| gallerani | 0 | 601,440,970 | 10% | ||

| rilo | 0 | 442,113,963 | 5% | ||

| aboost | 0 | 507,273,132 | 100% | ||

| bkt | 0 | 505,362,451 | 100% | ||

| thebigsweed | 0 | 139,896,598,193 | 100% | ||

| luciannagy | 0 | 4,996,782,111 | 30% | ||

| smartvote | 0 | 46,752,933,803 | 2.2% | ||

| jk6276 | 0 | 26,320,451,880 | 50% | ||

| gasaeightyfive | 0 | 306,680,027 | 100% | ||

| xcore | 0 | 505,200,052 | 100% | ||

| jokinmenipieleen | 0 | 3,850,216,560 | 100% | ||

| bagpuss | 0 | 8,306,890,298 | 100% | ||

| tipsybosphorus | 0 | 3,004,163,301 | 50% | ||

| pboulet | 0 | 585,946,787 | 0.7% | ||

| marcocasario | 0 | 136,580,044,224 | 100% | ||

| cribbio | 0 | 516,847,067 | 100% | ||

| ecoinstats | 0 | 85,025,572,510 | 34% | ||

| nowserving | 0 | 8,146,376,856 | 100% | ||

| harpreetjanda | 0 | 576,545,328 | 2% | ||

| sbi9 | 0 | 67,886,647,403 | 65.69% | ||

| priyanarc | 0 | 20,788,549,235 | 30% | ||

| perzeus | 0 | 2,986,922,475 | 100% | ||

| theopinion | 0 | 3,520,999,578 | 100% | ||

| manoldonchev | 0 | 300,036,068,494 | 100% | ||

| banat | 0 | 1,851,025,248 | 10% | ||

| svirus | 0 | 16,745,067,956 | 100% | ||

| misterengagement | 0 | 3,944,433,439 | 67.5% | ||

| khan.dayyanz | 0 | 5,721,193,164 | 5% | ||

| blind-spot | 0 | 12,596,842,816 | 50% | ||

| primeradue | 0 | 846,779,887 | 4.5% | ||

| lestrange | 0 | 55,887,616,661 | 100% | ||

| mrsbozz | 0 | 11,623,087,280 | 50% | ||

| flyingbolt | 0 | 732,471,165 | 10% | ||

| scoopstakes | 0 | 13,879,530,852 | 50% | ||

| nanzo-snaps | 0 | 9,195,912,267 | 50% | ||

| holdonla | 0 | 134,014,798,600 | 100% | ||

| hungrybear | 0 | 509,604,571 | 12% | ||

| thelogicaldude | 0 | 4,865,775,720 | 5% | ||

| src3 | 0 | 9,261,548,792 | 12.5% | ||

| edian | 0 | 1,538,674,645 | 10% | ||

| jamys | 0 | 507,406,087 | 100% | ||

| d-company | 0 | 54,130,818,976 | 100% | ||

| crazydaisy | 0 | 571,745,262 | 100% | ||

| eliptic | 0 | 539,392,143 | 100% | ||

| qaap | 0 | 532,119,436 | 100% | ||

| vakum | 0 | 529,536,067 | 100% | ||

| megavest | 0 | 20,906,280,767 | 10% | ||

| deeanndmathews | 0 | 743,317,133 | 1.75% | ||

| bastter | 0 | 1,579,688,829 | 25% | ||

| agmoore2 | 0 | 4,177,068,659 | 100% | ||

| ctrpch | 0 | 633,899,318 | 10% | ||

| leighscotford | 0 | 575,407,674 | 0.9% | ||

| travelwritemoney | 0 | 1,094,303,539 | 10% | ||

| sanjatea | 0 | 613,309,461 | 10% | ||

| xyz004 | 0 | 47,846,093,142 | 25% | ||

| theoctoberwind | 0 | 4,232,522,922 | 100% | ||

| kgswallet | 0 | 1,346,192,524 | 20% | ||

| nichemarket | 0 | 1,967,227,019 | 100% | ||

| abh12345.leo | 0 | 2,739,143,796 | 100% | ||

| mindtrap-leo | 0 | 772,206,381 | 34% | ||

| leo.voter | 0 | 7,179,059,268,431 | 10% | ||

| ejmh | 0 | 646,323,145 | 34% | ||

| bearjohn | 0 | 909,520,076 | 50% | ||

| myfreshes | 0 | 5,341,643,035 | 7.2% | ||

| coffeea.token | 0 | 6,302,063,096 | 100% | ||

| babytarazkp | 0 | 11,441,941,665 | 100% | ||

| driedfruit | 0 | 905,456,370 | 100% | ||

| agro-dron | 0 | 902,076,732 | 10% | ||

| xgerard | 0 | 59,104,302,524 | 100% | ||

| acguitar1 | 0 | 14,426,205,673 | 100% | ||

| taskmaster4450le | 0 | 550,152,555,159 | 34% | ||

| maddogmike | 0 | 1,541,173,945 | 1.75% | ||

| logiczombie | 0 | -1,589,333,078 | -1% | ||

| liaminit1 | 0 | 7,581,648,819 | 90% | ||

| elianaicgomes | 0 | 6,929,877,024 | 7.5% | ||

| bruleo | 0 | 728,400,331 | 100% | ||

| zeesh | 0 | 2,147,917,155 | 4.5% | ||

| coinlogic.online | 0 | 3,867,581,719 | 5% | ||

| khalneox | 0 | 1,334,936,984 | 100% | ||

| alexcocopro | 0 | 317,880,820 | 100% | ||

| lnakuma | 0 | 11,051,280,325 | 34% | ||

| sumatranate.leo | 0 | 5,639,238,624 | 100% | ||

| galenkp.aus | 0 | 1,200,109,912 | 100% | ||

| khalpal | 0 | 1,990,493,042 | 100% | ||

| hjmarseille | 0 | 3,362,081,840 | 100% | ||

| onestop | 0 | 1,636,405,515 | 5% | ||

| photosnap | 0 | 12,374,689,751 | 25% | ||

| savageduels | 0 | 513,306,606 | 100% | ||

| marblesz | 0 | 582,786,960 | 9% | ||

| bilpcoinbpc | 0 | 1,129,655,129 | 5% | ||

| sportal | 0 | 821,518,479 | 10% | ||

| grad.best | 0 | 804,132,443 | 10% | ||

| julesquirin | 0 | 1,066,013,071 | 7.8% | ||

| leofinance | 0 | 72,884,321,326 | 10% | ||

| laruche | 0 | 30,263,830,204 | 0.7% | ||

| master-lamps | 0 | 17,970,737,422 | 100% | ||

| softworld | 0 | 274,773,133,195 | 100% | ||

| hivelist | 0 | 5,375,327,580 | 1.75% | ||

| zuly63 | 0 | 808,177,240 | 8% | ||

| pcojines | 0 | 8,287,435,306 | 100% | ||

| rmsadkri | 0 | 32,675,293,189 | 45% | ||

| actioncats | 0 | 9,307,155,731 | 7% | ||

| hivehustlers | 0 | 8,985,445,889 | 3.5% | ||

| discoveringarni | 0 | 38,036,616,836 | 15% | ||

| beehivetrader | 0 | 934,199,712 | 5% | ||

| iamyohann | 0 | 3,413,959,760 | 15% | ||

| ileart | 0 | 25,946,524,875 | 90% | ||

| olaunlimited | 0 | 24,794,430,637 | 17.55% | ||

| w-t-fi | 0 | 1,443,091,183 | 100% | ||

| hive-108278 | 0 | 648,421,449 | 37.5% | ||

| camplife | 0 | 690,263,587 | 100% | ||

| whoaretheyph | 0 | 5,068,535,794 | 15% | ||

| debri | 0 | 1,134,927,534 | 100% | ||

| rituraz17 | 0 | 4,753,155,451 | 65% | ||

| aabcent | 0 | 127,302,188,005 | 100% | ||

| cmplxty.leo | 0 | 180,106,194 | 50% | ||

| idea-make-rich | 0 | 76,116,269,734 | 100% | ||

| jontv | 0 | 7,340,009,292 | 100% | ||

| borbolet | 0 | 6,339,813,667 | 30% | ||

| eddie-earner | 0 | 1,310,911,737 | 34% | ||

| noalys | 0 | 584,700,292 | 4.5% | ||

| borniet | 0 | 4,979,843,140 | 50% | ||

| rdfield | 0 | 1,983,882,702 | 100% | ||

| lowlightart | 0 | 1,200,484,173 | 40% | ||

| kattycrochet | 0 | 1,609,579,008 | 4.5% | ||

| officialhisha | 0 | 150,968,522 | 100% | ||

| dalz.shorts | 0 | 1,246,816,447 | 40% | ||

| gungunkrishu.leo | 0 | 2,289,101,460 | 100% | ||

| drax.leo | 0 | 1,758,097,006 | 10% | ||

| torrey.leo | 0 | 605,183,349 | 100% | ||

| psicologiaexpres | 0 | 7,883,175,429 | 30% | ||

| he-index | 0 | 3,979,740,594 | 15% | ||

| lbi-token | 0 | 92,456,758,990 | 34% | ||

| sharkleo | 0 | 712,545,820 | 10% | ||

| blockbroccoli | 0 | 1,134,054,799 | 60.75% | ||

| leo.tokens | 0 | 907,441,192 | 10% | ||

| adamada.leo | 0 | 869,813,193 | 100% | ||

| potpourry | 0 | 1,141,762,286 | 30% | ||

| trumpikasleo | 0 | 615,649,171 | 100% | ||

| badbitch | 0 | 18,064,697,177 | 100% | ||

| cielitorojo | 0 | 7,073,736,534 | 5% | ||

| trostparadox | 0 | 7,240,216,932,977 | 79.88% | ||

| zeusfrench01 | 0 | 7,053,516 | 49% | ||

| iikrypticsii | 0 | 44,296,166,839 | 70% | ||

| instytutfi | 0 | 1,791,587,974 | 100% | ||

| sofs-su | 0 | 33,067,490,980 | 32.5% | ||

| meowcurator | 0 | 914,430,467 | 70% | ||

| kriszrokk | 0 | 4,198,151,737 | 100% | ||

| vid.observer | 0 | 747,432,251 | 10% | ||

| natepowers | 0 | 25,551,730,232 | 100% | ||

| cbridges573 | 0 | 5,483,590,389 | 15% | ||

| elgatoshawua | 0 | 2,101,167,620 | 5% | ||

| xyba | 0 | 37,295,590,265 | 80% | ||

| star.leo | 0 | 1,013,128,000 | 34% | ||

| cowboyphylosophy | 0 | 6,388,600,592 | 100% | ||

| nyxlabs | 0 | 577,477,082 | 3.05% | ||

| cryptololo | 0 | 1,066,910,752 | 9% | ||

| astrocreator | 0 | 38,174,295,719 | 100% | ||

| broadhive-org | 0 | 753,155,370 | 5% | ||

| impurgent | 0 | 678,569,827 | 40% | ||

| meesterleo | 0 | 1,721,934,731 | 100% | ||

| superxsymbiote | 0 | 420,010,908 | 100% | ||

| stdd | 0 | 7,512,960,057 | 100% | ||

| zwhammer | 0 | 505,771,495 | 25% | ||

| hive.friends | 0 | 720,516,465 | 91.35% | ||

| makulit | 0 | 23,081,238,839 | 15% | ||

| holovision.cash | 0 | 1,547,015,863 | 100% | ||

| rabbitv | 0 | 5,166,183,823 | 100% | ||

| scooter77.pob | 0 | 1,731,285,471 | 100% | ||

| chrysanthemum | 0 | 31,954,365,021 | 100% | ||

| panmonagas | 0 | 863,335,643 | 9% | ||

| bulldog1205 | 0 | 19,805,886,613 | 25% | ||

| robmojo.leo | 0 | 569,354,411 | 17% | ||

| revise.pob | 0 | 1,237,401,265 | 100% | ||

| aprasad2325 | 0 | 1,671,544,980 | 4.5% | ||

| xyba.pob | 0 | 981,353,828 | 80% | ||

| solominer.leo | 0 | 767,835,659 | 100% | ||

| hunterblaze | 0 | 532,401,160 | 100% | ||

| jocieprosza.leo | 0 | 1,341,215,924 | 34% | ||

| trostparadox.pob | 0 | 3,078,163,530 | 80% | ||

| cryptoccshow | 0 | 3,955,480,213 | 25% | ||

| steveparma | 0 | 4,464,979,610 | 90% | ||

| nbogda | 0 | 5,630,438,657 | 100% | ||

| sketchygamerguy | 0 | 4,894,782,821 | 33% | ||

| cugel | 0 | 1,607,278,461 | 5% | ||

| rzc24-nftbbg | 0 | 1,543,121,738 | 100% | ||

| szpb | 0 | 1,524,807,784 | 100% | ||

| barizon | 0 | 1,278,925,715 | 100% | ||

| jkp.nisha | 0 | 2,720,276,786 | 100% | ||

| js3 | 0 | 187,476,132 | 100% | ||

| ratu-hive | 0 | 3,578,594,651 | 100% | ||

| carmary | 0 | 717,508,407 | 100% | ||

| abeerhunter | 0 | 3,843,544,718 | 22.9% | ||

| leoalpha | 0 | 978,614,074 | 50% | ||

| onybreak | 0 | 0 | 100% | ||

| beautifulwreck | 0 | 41,402,022,177 | 50% | ||

| saboin.leo | 0 | 54,615,618 | 14% | ||

| indignantgerald | 0 | 259,127,877 | 100% | ||

| drwall | 0 | 134,697,706 | 100% |

I've been keeping a close eye on this as well, as we'll be looking to go back to Australia at some point over the next 10 years... and I'm so curious to how China will affect the Australian Real Estate market. In regards to the purchasing of Iron Ore and Chinese citizens buying houses. With Chinese developers almost being in free-fall at the moment, will that mean that the Chinese people with multiple properties each lose huge on their net-worth and/or will it force the Chinese people to buy up Australian properties because they don't trust that their own assets will retain value? And then the final question I always have... just how much higher can property prices go in Australia? They're already well beyond what you could possibly consider making back in rent...

| author | aussieninja |

|---|---|

| permlink | re-tarazkp-r5f50l |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 01:19:33 |

| last_update | 2022-01-09 01:19:33 |

| depth | 1 |

| children | 2 |

| last_payout | 2022-01-16 01:19:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.150 HBD |

| curator_payout_value | 0.150 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 781 |

| author_reputation | 116,118,088,893,118 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,297,973 |

| net_rshares | 174,438,331,464 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 174,438,331,464 | 5% |

What might be interesting is that Chinese property buyers may have to sell in Australia (and other places) to cover their debts in China. With the drive of the Chinese government to keep wealth in China though, many will look to escape too, but can they? I think that buying property in Australia at the moment is crazy....

| author | tarazkp |

|---|---|

| permlink | re-aussieninja-r5fknt |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 06:57:30 |

| last_update | 2022-01-09 06:57:30 |

| depth | 2 |

| children | 1 |

| last_payout | 2022-01-16 06:57:30 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.100 HBD |

| curator_payout_value | 0.100 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 324 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,305,868 |

| net_rshares | 118,633,870,122 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| aussieninja | 0 | 118,633,870,122 | 100% |

Yeah, we literally can't afford any property in Australia anytime soon... but my partner is keeping a close eye on property around family. The prices are straight up bonkers. Australia avoided the GFC in 08, and I feel like it's time for recession has to come sooner rather than later. We kinda need the price reset right? Great point about covering Chinese debt and if Chinese citizens can move their wealth into Australian property... I guess we'll see.

| author | aussieninja |

|---|---|

| permlink | re-tarazkp-r5get9 |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 17:48:48 |

| last_update | 2022-01-09 17:48:48 |

| depth | 3 |

| children | 0 |

| last_payout | 2022-01-16 17:48:48 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 459 |

| author_reputation | 116,118,088,893,118 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,320,292 |

| net_rshares | 0 |

In Russia, the interest rate on deposits has already been set at 8%, however, due to high inflation, which in reality reaches 30% instead of 4% budgeted, people prefer to invest in goods, home renovations and their own health, but not in banks ...

| author | bammbuss |

|---|---|

| permlink | re-tarazkp-202219t122247617z |

| category | hive-167922 |

| json_metadata | {"tags":["economics","finance","investing","economy","business","rehab","thoughts","mindset","australia","life","leofinance"],"app":"ecency/3.0.20-vision","format":"markdown+html"} |

| created | 2022-01-09 07:22:57 |

| last_update | 2022-01-09 07:22:57 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-01-16 07:22:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.149 HBD |

| curator_payout_value | 0.148 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 247 |

| author_reputation | 21,915,846,838,025 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,306,970 |

| net_rshares | 175,622,249,341 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 174,836,880,380 | 5% | ||

| dickturpin | 0 | 785,368,961 | 2.5% |

The banks here offer such a low rate that it is essentially nothing. Having money in the bank will cost about 4-5% a year in inflation....

| author | tarazkp |

|---|---|

| permlink | re-bammbuss-r5fmj8 |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 07:37:57 |

| last_update | 2022-01-09 07:37:57 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-01-16 07:37:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 138 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,307,267 |

| net_rshares | 0 |

The only way Australian rates will not go up after the election is if the people reelect enough of the current people. If a new party wins, or more opposition people win, then one month after, like you predict, the rates will go up, and the out going party will be to blame for overspending. I do not know how the Australian Government or elections are set up, but most elected governments have at least two different sides. Their versions of Republicans and Democrats.

| author | bashadow |

|---|---|

| permlink | re-tarazkp-r5fh8x |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 05:43:48 |

| last_update | 2022-01-09 05:43:48 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-01-16 05:43:48 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.148 HBD |

| curator_payout_value | 0.147 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 471 |

| author_reputation | 100,388,692,638,882 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,303,093 |

| net_rshares | 175,124,636,372 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 174,339,904,397 | 5% | ||

| dickturpin | 0 | 784,731,975 | 2.5% |

I suspect that even if they do reelect, the "promises" will go unfulfilled, *like normal.* It has happened many times before - but once in, the governments have 3 years (election cycle) to try and affect opinion. But yes, the outgoing party will take the blame and then 6 months later, the new party will be blamed for not turning it around fast enough - politics is useless... >Their versions of Republicans and Democrats. It is similar in Australia, though there is a fair bit more diversity. In Finland, there is even more party diversity. Pretty much, all governments are coalitions.

| author | tarazkp |

|---|---|

| permlink | re-bashadow-r5fkss |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 07:00:27 |

| last_update | 2022-01-09 07:00:27 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-01-16 07:00:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.084 HBD |

| curator_payout_value | 0.084 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 593 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,305,922 |

| net_rshares | 99,408,003,296 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| bashadow | 0 | 99,408,003,296 | 25% |

today I got my first upvote from Appreciator. I have no idea why I got it but I definitely can't complain. 😜

| author | fieryfootprints |

|---|---|

| permlink | r5fr22 |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-01-09 09:15:39 |

| last_update | 2022-01-09 09:16:09 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-01-16 09:15:39 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.150 HBD |

| curator_payout_value | 0.150 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 108 |

| author_reputation | 267,259,213,823,826 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,308,983 |

| net_rshares | 175,669,871,620 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 175,669,871,620 | 5% |

I got one today too. My first too perhaps.

| author | tarazkp |

|---|---|

| permlink | r5ftad |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-01-09 10:03:45 |

| last_update | 2022-01-09 10:03:45 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-01-16 10:03:45 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 42 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 0 |

| post_id | 109,309,824 |

| net_rshares | 0 |

Although we took a modest home loan for our place I worry for my friends and others who borrowed right at there limit. Some struggle to make the minimum monthly payment as is let alone once the interest rate swings

| author | growingoutofdebt |

|---|---|

| permlink | re-tarazkp-2022111t22616700z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922","economics","finance","investing","economy","business","rehab","thoughts","mindset","australia","life","leofinance"],"app":"ecency/3.0.23-mobile","format":"markdown+html"} |

| created | 2022-01-11 12:06:18 |

| last_update | 2022-01-11 12:06:18 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-01-18 12:06:18 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.149 HBD |

| curator_payout_value | 0.148 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 214 |

| author_reputation | 45,497,739,998 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,376,747 |

| net_rshares | 176,334,610,245 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 176,334,610,245 | 5% |

>Some struggle to make the minimum monthly payment as is let alone once the interest rate swings Makes you wonder about the "stress testing" doesn't it? I assume that the testing is done as if the people do not have any other life.

| author | tarazkp |

|---|---|

| permlink | r5jsl9 |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-01-11 13:39:09 |

| last_update | 2022-01-11 13:39:09 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-01-18 13:39:09 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 233 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,378,750 |

| net_rshares | 0 |

Congratulations @tarazkp! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s): <table><tr><td><img src="https://images.hive.blog/60x70/http://hivebuzz.me/@tarazkp/replies.png?202201091028"></td><td>You got more than 74000 replies.<br>Your next target is to reach 74500 replies.</td></tr> </table> <sub>_You can view your badges on [your board](https://hivebuzz.me/@tarazkp) and compare yourself to others in the [Ranking](https://hivebuzz.me/ranking)_</sub> <sub>_If you no longer want to receive notifications, reply to this comment with the word_ `STOP`</sub> **Check out the last post from @hivebuzz:** <table><tr><td><a href="/hivebuzz/@hivebuzz/pum-202201-8"><img src="https://images.hive.blog/64x128/https://i.imgur.com/4rgjfmA.png"></a></td><td><a href="/hivebuzz/@hivebuzz/pum-202201-8">Hive Power Up Month - Feedback from Day 7</a></td></tr></table>

| author | hivebuzz |

|---|---|

| permlink | notify-tarazkp-20220109t104108 |

| category | hive-167922 |

| json_metadata | {"image":["http://hivebuzz.me/notify.t6.png"]} |

| created | 2022-01-09 10:41:09 |

| last_update | 2022-01-09 10:41:09 |

| depth | 1 |

| children | 0 |

| last_payout | 2022-01-16 10:41:09 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 920 |

| author_reputation | 369,856,187,103,402 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,310,497 |

| net_rshares | 0 |

Guess "they" must have found some way to prop up the house of cards a bit longer or done something else or I'm just not smart enough to figure out how that ends well for anyone.

| author | ryivhnn |

|---|---|

| permlink | re-tarazkp-r5fvdh |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 10:48:54 |

| last_update | 2022-01-09 10:48:54 |

| depth | 1 |

| children | 3 |

| last_payout | 2022-01-16 10:48:54 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.152 HBD |

| curator_payout_value | 0.152 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 177 |

| author_reputation | 211,299,523,552,170 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,310,620 |

| net_rshares | 177,224,241,593 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 177,224,241,593 | 5% |

Definitely doesn't end well, unless you bought low, sold high and are now ready to buy the coming dip.

| author | tarazkp |

|---|---|

| permlink | r5fwe2 |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-01-09 11:10:48 |

| last_update | 2022-01-09 11:10:48 |

| depth | 2 |

| children | 2 |

| last_payout | 2022-01-16 11:10:48 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 102 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 0 |

| post_id | 109,310,978 |

| net_rshares | 0 |

So what happens when there's no one left to sell or rent to (because they've all been priced out)?

| author | ryivhnn |

|---|---|

| permlink | re-tarazkp-r5g4og |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 14:09:54 |

| last_update | 2022-01-09 14:09:54 |

| depth | 3 |

| children | 1 |

| last_payout | 2022-01-16 14:09:54 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 98 |

| author_reputation | 211,299,523,552,170 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,314,609 |

| net_rshares | 0 |

Thx for your perspective, I'm observing also for several years now, but nobody could convince me yet why real estate as investment could be a better fit for me than crypto

| author | sciencevienna |

|---|---|

| permlink | re-tarazkp-202219t01958693z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922","economics","finance","investing","economy","business","rehab","thoughts","mindset","australia","life","leofinance"],"app":"ecency/3.0.23-mobile","format":"markdown+html"} |

| created | 2022-01-08 23:19:57 |

| last_update | 2022-01-08 23:19:57 |

| depth | 1 |

| children | 3 |

| last_payout | 2022-01-15 23:19:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.335 HBD |

| curator_payout_value | 0.333 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 171 |

| author_reputation | 12,575,502,307,147 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,296,021 |

| net_rshares | 386,653,566,807 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| mattclarke | 0 | 167,211,874,315 | 20% | ||

| tarazkp | 0 | 219,441,692,492 | 6% | ||

| ochoap | 0 | 0 | 100% |

>but nobody could convince me yet why real estate as investment could be a better fit for me than crypto Especially at the current prices in many places. I get the "security" of it, but that isn't going to matter, unless it is owned outright. However, I am glad we got the place we have when we did (almost two years ago and before pandemic effects), as I don't think I would have the confidence to go in now. Crypto is going to see some pretty major moves this year I think - especially in the NFT and game regions, which will effectively give the usecase to them as a real estate alternative. Will be interesting :)

| author | tarazkp |

|---|---|

| permlink | r5ezmw |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-01-08 23:23:21 |

| last_update | 2022-01-08 23:23:21 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-01-15 23:23:21 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.058 HBD |

| curator_payout_value | 0.057 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 620 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,296,063 |

| net_rshares | 67,041,739,102 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| sciencevienna | 0 | 67,041,739,102 | 100% |

By the way - Happy New Year mate :)

| author | tarazkp |

|---|---|

| permlink | r5eznh |

| category | hive-167922 |

| json_metadata | {"app":"hiveblog/0.1"} |

| created | 2022-01-08 23:23:42 |

| last_update | 2022-01-08 23:23:42 |

| depth | 2 |

| children | 1 |

| last_payout | 2022-01-15 23:23:42 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.056 HBD |

| curator_payout_value | 0.056 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 35 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,296,069 |

| net_rshares | 65,705,430,812 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| sciencevienna | 0 | 65,705,430,812 | 100% |

Same to you may the crypto wings bring us to sunnier climes 😊

| author | sciencevienna |

|---|---|

| permlink | re-tarazkp-202219t0270127z |

| category | hive-167922 |

| json_metadata | {"tags":["ecency"],"app":"ecency/3.0.23-mobile","format":"markdown+html"} |

| created | 2022-01-08 23:26:57 |

| last_update | 2022-01-08 23:26:57 |

| depth | 3 |

| children | 0 |

| last_payout | 2022-01-15 23:26:57 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 61 |

| author_reputation | 12,575,502,307,147 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,296,104 |

| net_rshares | 0 |

> But, it will be a scapegoat excuse that covers a period of extreme wealth transfer from poor to rich and then as the markets fall and the poor lose even more, those who have made all of those gains so far, will buy the fucking dip - because they can. You have been writing a lot about the ongoing and sadly accelerated wealth transfer problem. I agree this is a really huge problem for humanity, but i don’t see anything what can stop or even reverse it. If the trends will be the same for the upcoming years, soon a few will have almost everything. I’m curious if you see any chance of a turningpoint of this trend, or just narrating the inevitable?

| author | szpb |

|---|---|

| permlink | re-tarazkp-202219t81729557z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922","economics","finance","investing","economy","business","rehab","thoughts","mindset","australia","life","leofinance"],"app":"ecency/3.0.23-mobile","format":"markdown+html"} |

| created | 2022-01-09 07:17:30 |

| last_update | 2022-01-09 07:17:30 |

| depth | 1 |

| children | 3 |

| last_payout | 2022-01-16 07:17:30 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.149 HBD |

| curator_payout_value | 0.148 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 653 |

| author_reputation | 1,050,417,806,577 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,306,670 |

| net_rshares | 175,775,276,030 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 174,989,621,649 | 5% | ||

| dickturpin | 0 | 785,654,381 | 2.5% | ||

| ochoap | 0 | 0 | 100% |

There is little hope using the current centralized economy to make a difference. However, through a decentralized economy combined with crypto, there can be a redefinition of what has value and therefore, what is required to build wealth. For example, Splinterlands is part of this redefinition now, with cards starting to act like real estate and factories, assets that can be owned to generate income, but in order for them to have value, people have to decide they have value, not a centralized authority.

| author | tarazkp |

|---|---|

| permlink | re-szpb-r5fmhu |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 07:37:06 |

| last_update | 2022-01-09 07:37:06 |

| depth | 2 |

| children | 2 |

| last_payout | 2022-01-16 07:37:06 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 509 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,307,261 |

| net_rshares | 1,479,905,434 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| szpb | 0 | 1,479,905,434 | 100% |

Splinterland cards have dropped a lot in value lately. I hope we are at the bottom line, but checkin daily i’m not so sure. I still believe in it, but its harder day to day. Well your stake is much higher, therefor your dedication gives some hope :)

| author | szpb |

|---|---|

| permlink | re-tarazkp-202219t104354447z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"ecency/3.0.23-mobile","format":"markdown+html"} |

| created | 2022-01-09 09:43:54 |

| last_update | 2022-01-09 09:43:54 |

| depth | 3 |

| children | 1 |

| last_payout | 2022-01-16 09:43:54 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 249 |

| author_reputation | 1,050,417,806,577 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,309,443 |

| net_rshares | 0 |

Here in the states, inflation is rising at the highest pace in over 40 years. The first thing that the Federal Reserve already started doing was the tapering of its bond-buying program, and they are looking to continue to do so at an even greater pace. We are in for at least three rate hikes in 2022, and possibly more if inflation can't be brought under control. By the end of 2021, the consumer price index had risen to 6.8% At the beginning of the rise in inflation, our government was telling us that it was transitory, a few months later they decided to spill the real beans. It's always best to prepare for the worst.

| author | thebigsweed |

|---|---|

| permlink | re-tarazkp-r5f0wj |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-08 23:50:42 |

| last_update | 2022-01-08 23:50:42 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-01-15 23:50:42 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.152 HBD |

| curator_payout_value | 0.150 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 654 |

| author_reputation | 243,012,746,643,403 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,296,479 |

| net_rshares | 175,570,275,864 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 174,785,205,549 | 5% | ||

| dickturpin | 0 | 785,070,315 | 2.5% | ||

| ochoap | 0 | 0 | 100% |

I don't see inflation dropping too fast, even when the supply glut is cleared. It is going to have a major impact on all kinds of markets globally and, if the past is anything to go by, it isn't going to be handled well, with the wealth gap expanding even further. A year ago, they were saying how inflation is a great thing and those who fear it are "stuck in the past" :D

| author | tarazkp |

|---|---|

| permlink | re-thebigsweed-r5fkip |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 06:54:27 |

| last_update | 2022-01-09 06:54:27 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-01-16 06:54:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.148 HBD |

| curator_payout_value | 0.148 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 375 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,305,647 |

| net_rshares | 174,280,459,484 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| thebigsweed | 0 | 174,280,459,484 | 100% |

I think that the existing goverment won't increase the rates until the election to win. It is like that almost for all governmemts. However, the FED is going to increase the rates at least three times in 2022. Therefore, the other reserve banks won't have any other options.

| author | videoaddiction |

|---|---|

| permlink | re-tarazkp-202219t25731744z |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922","economics","finance","investing","economy","business","rehab","thoughts","mindset","australia","life","leofinance"],"app":"ecency/3.0.23-mobile","format":"markdown+html"} |

| created | 2022-01-08 23:57:33 |

| last_update | 2022-01-08 23:57:33 |

| depth | 1 |

| children | 1 |

| last_payout | 2022-01-15 23:57:33 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.150 HBD |

| curator_payout_value | 0.150 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 274 |

| author_reputation | 166,832,250,701,297 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,296,619 |

| net_rshares | 175,396,351,076 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| tarazkp | 0 | 174,611,681,745 | 5% | ||

| dickturpin | 0 | 784,669,331 | 2.5% |

The increases are coming and I reckon they will be felt sooner rather than later. Funnily, I was reading an article in the news posted an hour ago that pretty much echoes what I am saying here :)

| author | tarazkp |

|---|---|

| permlink | re-videoaddiction-r5fkkg |

| category | hive-167922 |

| json_metadata | {"tags":["hive-167922"],"app":"peakd/2021.09.1"} |

| created | 2022-01-09 06:55:27 |

| last_update | 2022-01-09 06:55:27 |

| depth | 2 |

| children | 0 |

| last_payout | 2022-01-16 06:55:27 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 0.000 HBD |

| curator_payout_value | 0.000 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 197 |

| author_reputation | 5,914,430,605,209,043 |

| root_title | "The Back of the Wave" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 109,305,688 |

| net_rshares | 0 |

hiveblocks

hiveblocks