___

***

___

# Unrest within the Eurozone has an effect on the Fed

___

***

___

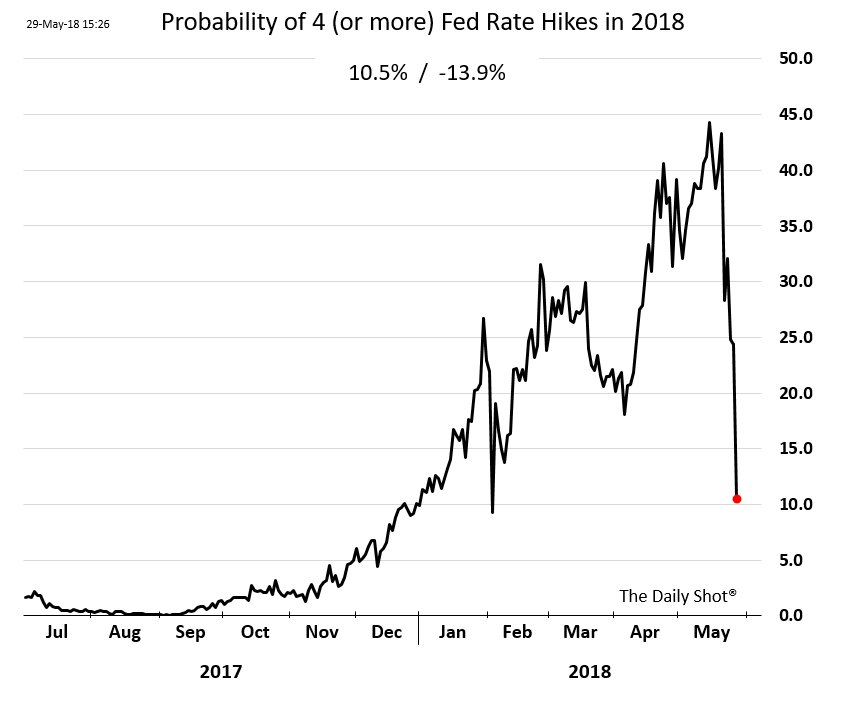

- Less than two weeks ago, there was a lot of discussion about the number of interest rate hikes that the Fed would implement in 2018. For example, the probability of 4 rate hikes was less than 40% less than two weeks ago. Today, that chance is only 10%. What has changed in the meantime?

- There will certainly be investors who wonder why the unrest within the Eurozone has an effect on the American central bank. After all, does the Fed have nothing to do with the Eurozone? That is true, but due to the increased interconnectedness between the countries, a possible crisis in Europe also has an effect on the American economy. That is why the Fed takes this into account when making the decision whether or not to raise the interest.

## Chance of 4 rate hikes this year is quite small

___

***

___

___

***

___

- The graph above, taken from The Daily Shot, shows us how quickly the tide can turn on the trading floor. The political instability within the European borders has therefore ensured that the chance of a total of four Fed rate increases this year is relatively small (according to the investors).

- So, when making your investment choices, you must take into account not only the political situation within the relevant national borders, but also the political situation outside.

hiveblocks

hiveblocks