The success of the world economy has only been successful due to finance. The Governments in each countries have been able to use finance to run the country effectively, providing the basic needs of life such as security, infrastructures, good roads, wonderful standard of living, access to good health services, shelter, clothing, food et-cetera.

The finance is managed by the Central Bank, which aid its production, storage as well as distributions to other commercial banks, which are directly accessible to all citizens. With the commercial banks, citizens have access to transact in their respective banks without stress.

Since the Government own Central Bank that oversees and manages the affairs of all commercial banks, it implies that all banks are indirectly owned by the Government, thus describing a centralized system. Through the Central Bank, the government gives instruction on what is expected from the commercial banks. No wonder bank charges in form of interest on money borrowed is always outrageous compared to the interest paid out to saving accounts.

For example: Mr. Smith is a business tycoon who is need of some urgent amount of money to clear his shipment from the port. He approached his bank for a loan for this purpose but to his amazement, the paperwork involved is too much. Aside the outrageous interests been charged, he has to provide collateral as well as sureties. With all these measures, certainly he won't be able to get the needed money to clear his shipment within two days else he face the risk of losing his shipment.

This is just one out of many other scenarios within the financial system. Thus there is a need for a change. The need to move from a centralized system to a decntralized platform. The need for a reduced/minima interest rate, if not been removed totally.

Decentralized Credit Chain (DCC)

To stop the monopolized power in the current traditional financial institutions such as the banks, DCC introduces a decentralised platform - The Blockchain.

Therefore, the Distributed Credit Chain (DCC) is a platform built on blockchain technology, which aims to curb the main problems of the financial sector and wants to be the first "public distributed banking blockchain" in the world. Although this may seem impossible and big to achieve, the team plans to create a decentralized ecosystem to enable competition among financial service providers.

DCC mode of operation will be a total opposite of what is obtainable in the banking sectors. To create more awareness and activeness in the ecosystem, DCC users and participants on the ecosystem will be given incentives as rewards. With the incentives given, it will arouse the interest of the users to invite friends and families to the DCC ecosystem, which inturn will boost the rate at which DCC will be adopted in the community and in reality.

DCC PLATFORM

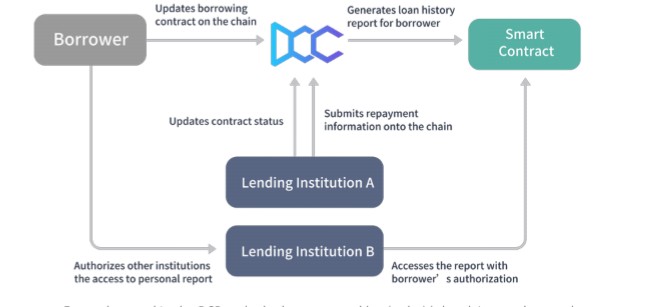

The DCC platform acts as a support for information security and in this platform it will not be necessary for a depository or an intermediary or middleman to carry out any activities as it is a decentralized platform, which also helps users (borrowers) in the community to determine their preferred lenders in the ecosystem since there are no intermediaries involved. This creates a space for lenders and borrowers to reach an agreement without being disturbed, interrupted or monitored. Because the system is decentralized, the interest rate used in the distributed credit chain depends on the demand and supply within the platform.

Decentralized Credit Chain Solution

DCC will solve problems in the current financial instutition through the following processes:

1. Authentication

2. Competence, and Reducing Data Use Cost.

3. Fashioning “Data Marketplace”

4. Anti-Fraud Risk Regulator

5. Positive Data Feedback

6. Outmoded Credit Trades.

7. Credit Quandary effected by Centralized Service.

8. Centralized Credit Provision.

9. Protecting Privacy Reasonably.

10. Abolishing Data Controls.

11. Refining Data.

FEATURES OF DCC

1. Reformation of credit cost.

2. Cross boarder credit credentials.

3. Virtual asset lending.

4. Chain data are used to maintain the lending process. This is possible as a result of the blockchain-enabled lending process.

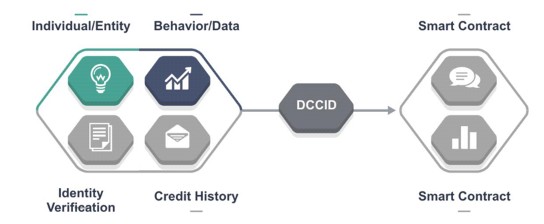

5. DCC features a decentralized account system known as Distributed Credit Chain ID (DCCID). DCCID ensures that credit history is stored in the smart contract. DCCID can be created by users on the platform either online or offline. It is generated via a Public-Private key pair. The digital signature technology is used tl protect DCCID.

6. Distributed Identification Verification (DIV) aids to prevent alteration of data and also permits data service institutions to provide clients with quality data services.

TOKEN & TOKENSALE DETAILS

DCC token is embedded on the Ethereum blockchain and will serve as the only acceptable means of payment on the platform. It will as well be used to pay oit incentives and rewards to all hardworking participants on the platform.

Ticker: DCC

Token Type: ERC-20

Token Price: 1 DCC = $0.05

Platform: Ethereum (ETH)

Total Supply:10,000,000,000 DCC

Restricted Areas: USA & China

Whitelist: YES

THE TEAM

CONCLUSION

With DCC in place, the monopoly enjoyed by the giant financial institutions will be reduced drasticay, if not totally stopped. DCC platform also allows consumption installments, which is based on agreements between dealers.

For More Information about the Project, kindly visit any of the links below:

Website: http://dcc.finance/

Whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf

Twitter: https://twitter.com/DccOfficial2018/

Facebook: https://www.facebook.com/Distributed-Credit-Chain-425721787866299/

Telegram: https://t.me/DccOfficial

Medium: https://medium.com/@dcc.finance2018

Reddit: https://www.reddit.com/r/dccofficial/

Github: https://github.com/DistributedBanking/DCC

Bitcointalk Bounty Thread: https://bitcointalk.org/index.php?topic=4185316.0

Writer: Phlaser

Email: investmentforthewise@gmail.com

BitcoinTalk URL: https://bitcointalk.org/index.php?action=profile;u=1236826

hiveblocks

hiveblocks