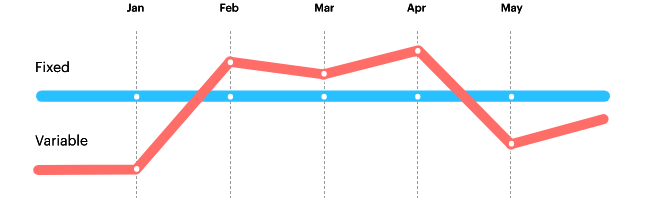

[<sup>(Source)</sup>](https://www.youtube.com/watch?v=lOB5LjLYQ-Y) #### Evening I have been a fan of fixed rate loans, ever since I started my banking interactions a few years ago. Although they look more costly on paper, Fixed rate loans are generally turn out more cost effective in long term when compared with Variable rate loans. #### My Mortgage Story Two years ago I entered a 15 years real estate agreement with a local bank, thanks to the earnings from early days of SPS airdrop. The bank offered two plans, one with low variable interest rate and other with high fixed interest rate. And I smartly, went for the high fixed rate plan. Fixed rate plan consisted of 9.5% fixed interest for the lease period, where as variable rate plan was KIBOR+2%(KIBOR= Interbank interest rate). At that time inflation genie was a bit tamed so KIBOR rates were hovering around 6%. Cut things short, I had a choice between 9.5% fixed rate lease and 8%(KIBOR+2%) variable interest rate loan. At that time going with variable rate loan seemed to be the logical choice but I went with my gut feeling and choose fixed rate plan. And I has proved to be an excellent choice so far. Domestic and geo-political woes deteriorated pretty much since then, e.g. Ukraine Russia War and ongoing China-Taiwan tensions . And now we have a all time high inflation around 35$ here and as a natural response banking interest rates soared heavily. Current KIBOR rate stands tall at 14.82%. Had I went for the easy choice of variable rate plan, I would have been paying 16.82% interest rate by now. Instead I am sitting cozy on my lease agreement paying 9.5% markup. My decision to go for fixed rate lease plan was due to the long term uncertainty surrounding economic outlook of third world country I live in and the associated geo-political factors involved. #### How to choose Between Fixed and Variable Rate Options  [<sup>(Source)</sup>](https://www.salliemae.com/student-loans/get-ready-to-borrow/choose-a-type-of-interest-rate-and-repayment-option/) **- Loan Term** The term of loan is the most important factor that determines the choice between fixed and variable rate plans, in my opinion. If you are going for a short term loan like 5 years or so, going for variable rates in the best bet as that variable rate will prove to be more cost effective and chances of large fluctuations are minimum. This is especially true for big stable economies, as despite of unfavorable circumstances they usually don't nosedive abruptly. Smaller economies are more prone to be affected by external factors like wars, famines and policy shifts; so they are always at high risk of collapsing. So if you live in a country with gigantic economy, short term loans with variable rates should be your go to choice. And if you are a resident of a country with a fragile economy, going for fixed rates is always the best choice. **- Risk Tolerance** In the end it all comes down to personal choice. If you have low tolerance for risk, go for fixed rates as it will bring you peace of mind, stability, and will be easier to manage. And if you are gambling guy, you can always go for variable rates. Remember, variable rates can also turn profitable if the underlaying base rates fall further or even remain stable.  ##### So, what factors do you consider when making a choice between fixed or variable rate loans? Do let me know in the comments below👇👇👇  <center>  </center>

| author | xabi |

|---|---|

| permlink | choice-between-variable-or-fixed-interest-rate |

| category | hive-167922 |

| json_metadata | {"app":"peakd/2022.07.1","format":"markdown","tags":["banking","markup","finance","neoxian","hive-engine","leo","proofofbrain","pgm"],"users":[],"image":["https://files.peakd.com/file/peakd-hive/xabi/23yJdxbTePmFrYSA1wrHXm8WKfyfaiktWtnANm9evL1VmvPKFATWoakf4jd8kd5i2y9xp.jpg","https://files.peakd.com/file/peakd-hive/xabi/EokjSUeF7dbZ7XA6YraSmNKnK6NcqGHDFB6HZVZVjr1tW3v6mWBUJv5ywXAmtb15fwn.png","https://images.hive.blog/DQmdisJ17KCgNjTqvDz8tR9p9FvrdE48tUKTDm9gdNXBEG1/image.png","https://images.hive.blog/DQmXB6WS5JzbZAHdaPn5WbmQ7ymz55KUSzTPzpSbRophUsZ/image.png","https://files.peakd.com/file/peakd-hive/xabi/vzEZjOB9-1588178363726455042045.png"]} |

| created | 2022-08-11 04:00:00 |

| last_update | 2022-08-11 04:00:00 |

| depth | 0 |

| children | 0 |

| last_payout | 2022-08-18 04:00:00 |

| cashout_time | 1969-12-31 23:59:59 |

| total_payout_value | 8.221 HBD |

| curator_payout_value | 8.151 HBD |

| pending_payout_value | 0.000 HBD |

| promoted | 0.000 HBD |

| body_length | 4,019 |

| author_reputation | 482,761,352,312,564 |

| root_title | "Choice Between Variable or Fixed Interest Rate" |

| beneficiaries | [] |

| max_accepted_payout | 1,000,000.000 HBD |

| percent_hbd | 10,000 |

| post_id | 115,621,087 |

| net_rshares | 21,876,679,329,918 |

| author_curate_reward | "" |

| voter | weight | wgt% | rshares | pct | time |

|---|---|---|---|---|---|

| kevinwong | 0 | 39,567,720,740 | 5% | ||

| kaylinart | 0 | 2,918,514,123 | 5% | ||

| gerber | 0 | 5,424,512,858 | 3% | ||

| daan | 0 | 51,762,180,718 | 8% | ||

| ezzy | 0 | 135,253,122 | 3% | ||

| neoxian | 0 | 19,163,572,865,502 | 100% | ||

| sinzzer | 0 | 7,292,455,823 | 10% | ||

| exyle | 0 | 25,301,233,877 | 3% | ||

| joshglen | 0 | 576,120,042 | 5% | ||

| happyphoenix | 0 | 10,557,236,131 | 10% | ||

| webdeals | 0 | 2,613,727,006 | 10% | ||

| randomblock1 | 0 | 745,797,212 | 10% | ||

| theb0red1 | 0 | 28,632,857,827 | 10% | ||

| someguy123 | 0 | 14,206,591,509 | 1.5% | ||

| mikehere | 0 | 2,132,530,904 | 10% | ||

| richardcrill | 0 | 2,587,467,613 | 1.26% | ||

| rymlen | 0 | 6,547,366,751 | 10% | ||

| bigtakosensei | 0 | 9,823,579,973 | 10% | ||

| hattaarshavin | 0 | 18,216,185,603 | 10% | ||

| sixexgames | 0 | 558,832,365 | 5% | ||

| intrepidthinker | 0 | 37,163,232,017 | 10% | ||

| pouchon | 0 | 357,211,841,717 | 10% | ||

| sharkface | 0 | 10,559,204,859 | 10% | ||

| numpypython | 0 | 506,332,491 | 10% | ||

| sames | 0 | 4,553,636,555 | 10% | ||

| l337m45732 | 0 | 9,317,823,108 | 20% | ||

| linakay | 0 | 4,511,533,666 | 10% | ||

| dune69 | 0 | 1,126,011,073 | 2.85% | ||

| iansart | 0 | 9,894,389,792 | 3% | ||

| karensuestudios | 0 | 161,563,751,008 | 100% | ||

| bitrocker2020 | 0 | 113,693,645,367 | 10% | ||

| tj4real | 0 | 1,124,104,594 | 10% | ||

| reloadbeatbox | 0 | 2,121,183,288 | 10% | ||

| roncoejr | 0 | 2,580,774,917 | 10% | ||

| aaronli | 0 | 33,512,330,825 | 10% | ||

| moemanmoesly | 0 | 3,283,354,478 | 10% | ||

| joeyarnoldvn | 0 | 572,956,289 | 1.68% | ||

| zainalbakri | 0 | 4,332,746,975 | 10% | ||

| eturnerx | 0 | 29,032,235,061 | 1.4% | ||

| phelimint | 0 | 3,595,584,378 | 10% | ||

| resiliencia | 0 | 835,926,893 | 10% | ||

| otage | 0 | 2,178,374,809 | 10% | ||

| felander | 0 | 13,563,183,074 | 3% | ||

| rehan12 | 0 | 17,011,976,241 | 50% | ||

| spaminator | 0 | -6,982,973,762 | -0.25% | ||

| chimzycash | 0 | 3,723,412,770 | 10% | ||

| aamirijaz | 0 | 7,800,751,695 | 50% | ||

| mawit07 | 0 | 68,773,640,873 | 10% | ||

| jaforce | 0 | 4,201,843,956 | 10% | ||

| dbooster | 0 | 17,405,038,809 | 10% | ||

| myach | 0 | 2,201,857,227 | 10% | ||

| coyotelation | 0 | 1,203,785,567 | 100% | ||

| tworealsolutions | 0 | 4,514,542,145 | 10% | ||

| mattroconnor | 0 | 2,776,991,595 | 10% | ||

| xabi | 0 | 15,109,470,794 | 10% | ||

| joedukeg | 0 | 1,324,955,221 | 25% | ||

| suzn.poudel | 0 | 539,192,134 | 5% | ||

| elderson | 0 | 5,852,966,469 | 10% | ||

| cheva | 0 | 17,537,384,125 | 10% | ||

| theonlyway | 0 | 87,107,809,536 | 100% | ||

| abmakko | 0 | 5,723,539,277 | 50% | ||

| dudeontheweb | 0 | 3,466,478,505 | 6.6% | ||

| burlarj | 0 | 14,165,597,900 | 10% | ||

| emjoe | 0 | 18,871,940,455 | 100% | ||

| slacktmusic | 0 | 1,691,528,543 | 10% | ||

| bala41288 | 0 | 608,468,108,506 | 50% | ||

| ikrahch | 0 | 39,385,779,593 | 10% | ||

| badmusgreene | 0 | 752,214,759 | 10% | ||

| sanach | 0 | 687,957,023 | 10% | ||

| nnaraoh | 0 | 187,929,447,954 | 100% | ||

| chronocrypto | 0 | 28,095,283,984 | 50% | ||

| jlordc | 0 | 117,425,687,387 | 100% | ||

| moeenali | 0 | 79,478,583,484 | 10% | ||

| fireguardian | 0 | 707,764,991 | 5.5% | ||

| funkymunky20000 | 0 | 1,281,175,944 | 10% | ||

| anikys3reasure | 0 | 2,513,643,135 | 50% | ||

| bhattg | 0 | 1,731,880,315 | 50% | ||

| makingthebest09 | 0 | 607,706,842 | 10% | ||

| randumb | 0 | 517,705,784 | 7.5% | ||

| reazuliqbal | 0 | 13,400,977,320 | 3% | ||

| oadissin | 0 | 549,001,378 | 5.5% | ||

| babarakas43 | 0 | 7,095,997,053 | 10% | ||

| indiebandguru | 0 | 765,698,774 | 5% | ||

| vonaurolacu | 0 | 2,890,837,292 | 5% | ||

| greendeliverence | 0 | 4,969,630,653 | 10% | ||

| bestboom | 0 | 758,642,287 | 3% | ||

| truce | 0 | 2,626,370,008 | 10% | ||

| hypersonic1 | 0 | 30,201,257,116 | 10% | ||

| mimidee74 | 0 | 2,171,488,652 | 10% | ||

| thomasbrown | 0 | 13,674,281,403 | 10% | ||

| paragism | 0 | 504,238,918 | 30% | ||

| yameen | 0 | 14,007,759,942 | 10% | ||

| blessed-girl | 0 | 18,533,001,650 | 100% | ||

| elizabeth-22 | 0 | 2,511,861,406 | 5% | ||

| headcrypto | 0 | 1,596,772,491 | 10% | ||

| legendchew | 0 | 42,570,335,664 | 100% | ||

| manojbhatt | 0 | 11,014,982,524 | 60% | ||

| steemexperience | 0 | 1,765,041,187 | 1.26% | ||

| chinyerevivian | 0 | 6,883,293,233 | 10% | ||

| xawi | 0 | 130,292,366,279 | 100% | ||

| break-out-trader | 0 | 5,254,090,175 | 7.5% | ||

| meanbees | 0 | 563,070,476 | 0.3% | ||

| lordgod | 0 | 591,982,949 | 10% | ||

| bafi | 0 | 496,490,952 | 11% | ||

| softmetal | 0 | 566,221,906 | 10% | ||

| rightwing670 | 0 | 23,454,476,122 | 10% | ||

| tronsformer | 0 | 1,042,622,721 | 30% | ||

| steem.services | 0 | 1,850,279,720 | 0.75% | ||

| ifeoluwa88 | 0 | 46,837,869,413 | 100% | ||

| ragnar94 | 0 | 1,928,207,559 | 10% | ||

| meher04 | 0 | 8,357,980,945 | 100% | ||

| steemxp | 0 | 1,255,551,239 | 10% | ||

| decepticons | 0 | 848,304,692 | 30% | ||

| byebyehamburgers | 0 | 6,942,214,566 | 10% | ||

| nattybongo | 0 | 1,826,216,791 | 10% | ||

| abacam | 0 | 737,818,217 | 100% | ||

| abcor | 0 | 4,873,369,849 | 100% | ||

| lilzmom902 | 0 | 3,897,269,568 | 10% | ||

| pardinus | 0 | 20,295,248,355 | 10% | ||

| zeeon | 0 | 495,623,645 | 100% | ||

| ireenchew | 0 | 44,753,954,323 | 10% | ||

| jluvs2fly | 0 | 8,837,610,660 | 10% | ||

| dlike | 0 | 9,905,538,924 | 3% | ||

| justinchicken | 0 | 2,909,032,812 | 10% | ||

| maeusenews | 0 | 2,095,216,798 | 10% | ||

| pedrocanella | 0 | 579,191,435 | 11% | ||

| dosh | 0 | 1,235,659,142 | 11% | ||

| mmunited | 0 | 6,681,701,355 | 100% | ||

| minhaz007 | 0 | 1,127,246,991 | 10% | ||

| sanjeev021 | 0 | 12,338,586,871 | 5.5% | ||

| marianaemilia | 0 | 81,226,419,445 | 11% | ||

| maonx | 0 | 3,289,804,678 | 50% | ||

| nureza | 0 | 598,800,215 | 10% | ||

| mango-juice | 0 | 81,633,299,905 | 100% | ||

| nworb | 0 | 6,138,071,046 | 10% | ||

| solaiman | 0 | 4,833,172,291 | 10% | ||

| unitqm | 0 | 825,697,737 | 5% | ||

| brucutu | 0 | 8,788,042,074 | 10% | ||

| ferrate | 0 | 8,762,781,854 | 10% | ||

| bittrio | 0 | 3,603,229,265 | 10% | ||

| steemturbo | 0 | 1,071,221,028 | 10% | ||

| detour | 0 | 5,299,202,210 | 100% | ||

| steemegg | 0 | 1,381,900,081 | 5% | ||

| cryptovues | 0 | 5,503,678,518 | 10% | ||

| ragnarhewins90 | 0 | 509,201,437 | 10% | ||

| a1004 | 0 | 1,385,190,671 | 100% | ||

| apokruphos | 0 | 3,422,858,882 | 1% | ||

| goodysam | 0 | 21,051,095,755 | 100% | ||

| brada2550 | 0 | 552,086,216 | 10% | ||

| paleotwist | 0 | 2,669,712,999 | 10% | ||

| zellypearl | 0 | 8,078,927,516 | 10% | ||

| hans001 | 0 | 932,829,273 | 10% | ||

| mister-eagle | 0 | 905,497,922 | 100% | ||

| jlordz | 0 | 2,304,618,781 | 100% | ||

| c4cristi3 | 0 | 3,996,976,968 | 10% | ||

| foreversteem | 0 | 813,461,602 | 10% | ||

| ano123 | 0 | 72,139,858,739 | 10% | ||

| q-news | 0 | 748,110,029 | 10% | ||

| jackramsey | 0 | 1,095,683,913 | 8.5% | ||

| kathe-art | 0 | 125,111,622,685 | 100% | ||

| coreyssteemit77 | 0 | 1,090,965,960 | 10% | ||

| backscratcher | 0 | 4,531,332,566 | 10% | ||

| rocketpower | 0 | 2,611,550,110 | 100% | ||

| curtley | 0 | 498,234,801 | 100% | ||

| x-tech | 0 | 703,404,806 | 10% | ||

| moro1992 | 0 | 735,400,791 | 10% | ||

| rollingbones | 0 | 0 | 1.81% | ||

| xyzxyz | 0 | 4,653,222,187 | 10% | ||

| trydice | 0 | 15,725,446,462 | 10% | ||

| bastter | 0 | 718,815,868 | 11% | ||

| evanstinger | 0 | 4,112,640,027 | 10% | ||

| aekraj | 0 | 10,158,416,358 | 10% | ||

| hamza-sheikh | 0 | 954,545,459 | 100% | ||

| h-hamilton | 0 | 3,434,566,314 | 10% | ||

| triplea.bot | 0 | 626,756,239 | 3% | ||

| tiffin | 0 | 1,052,759,032 | 2.85% | ||

| steem.leo | 0 | 3,373,531,374 | 3% | ||

| everythingsmgirl | 0 | 3,724,823,308 | 50% | ||

| bala-ag | 0 | 1,929,024,086 | 50% | ||

| supremebape | 0 | 19,612,750,969 | 10% | ||

| kryptoking1 | 0 | 5,544,104,544 | 10% | ||

| chiema | 0 | 583,796,272 | 100% | ||

| beta500 | 0 | 3,210,465,462 | 3% | ||

| kanibot | 0 | 18,065,841,451 | 50% | ||

| marriakjozhegp | 0 | 4,726,297,541 | 100% | ||

| naej | 0 | 1,919,069,528 | 10% | ||

| therealyme | 0 | 30,487,314,013 | 0.45% | ||

| dalz2 | 0 | 975,741,194 | 100% | ||

| ribary | 0 | 1,030,461,762 | 1.5% | ||

| photosnap | 0 | 456,282,937 | 10% | ||

| splinterzine | 0 | 672,695,639 | 11% | ||

| mice-k | 0 | 226,639,516 | 3% | ||

| libertypal27 | 0 | 528,441,554 | 100% | ||

| dcityrewards | 0 | 71,223,421,441 | 3% | ||

| holoferncro | 0 | 2,124,886,501 | 5% | ||

| mami.sheh7 | 0 | 2,951,872,186 | 50% | ||

| brofund-leo | 0 | 2,363,139,418 | 100% | ||

| zartisht | 0 | 56,048,072,604 | 10% | ||

| neoxcur | 0 | 1,030,130,998 | 100% | ||

| brofund-ag | 0 | 3,523,530,545 | 100% | ||

| aceh-media | 0 | 2,514,367,675 | 10% | ||

| text2speech | 0 | 2,499,053,210 | 50% | ||

| meritocracy | 0 | -1,283,625,161,603 | -11.56% | ||

| jmsansan.leo | 0 | 65,775,027,790 | 50% | ||

| dcrops | 0 | 16,335,198,068 | 1.5% | ||

| mejiasclaudia | 0 | 1,152,766,453 | 5.5% | ||

| carlosro | 0 | 1,924,288,991 | 11% | ||

| zanoz | 0 | 8,979,722,532 | 10% | ||

| brucolac | 0 | 870,368,533 | 6.6% | ||

| curatorcat.pal | 0 | 6,645,675,393 | 100% | ||

| brando28 | 0 | 1,303,568,354 | 5.5% | ||

| utopis | 0 | 26,668,455,143 | 2.33% | ||

| nyxlabs | 0 | 538,258,612 | 2.5% | ||

| proofofbrainio | 0 | 2,362,351,133 | 1.81% | ||

| ricestrela | 0 | 1,630,490,347 | 4% | ||

| drricksanchez | 0 | 981,462,993 | 0.22% | ||

| eythorphoto | 0 | 561,564,005 | 5% | ||

| xylliana | 0 | 1,582,778,071 | 100% | ||

| investing-dude | 0 | 35,997,757,498 | 100% | ||

| sabujdip | 0 | 3,621,454,803 | 80% | ||

| memesupport | 0 | 7,625,286,925 | 80% | ||

| duwiky | 0 | 2,674,256,107 | 10% | ||

| kamaleshwar | 0 | 6,151,974,868 | 50% | ||

| chandra.shekar | 0 | 9,774,609,219 | 50% | ||

| kannannv | 0 | 28,901,310,437 | 50% | ||

| cugel | 0 | 1,176,654,194 | 5% | ||

| vrezyy | 0 | 6,291,280,400 | 50% | ||

| zasktrader | 0 | 1,764,799,413 | 10% | ||

| hkinuvaime | 0 | 612,443,661 | 5.5% | ||

| beyondhorizonmm | 0 | 10,876,929,384 | 100% | ||

| circlebubble | 0 | 2,002,309,299 | 7% | ||

| h3m4n7 | 0 | 699,951,885 | 5.5% | ||

| mistural | 0 | 3,143,547,305 | 10% | ||

| waivio.curator | 0 | 1,420,869,010 | 2.69% | ||

| lordtimoty | 0 | 4,833,346,463 | 1.1% | ||

| femcy-willcy | 0 | 1,667,883,838 | 50% | ||

| eijibr | 0 | 641,523,569 | 6.6% | ||

| yameen-ag | 0 | 554,092,115 | 80% | ||

| killerwot | 0 | 636,675,885 | 5% | ||

| jagmeet12 | 0 | 515,018,460 | 10% | ||

| balaz | 0 | 13,401,223,048 | 50% | ||

| dragonmk47 | 0 | 6,105,604,408 | 5.5% | ||

| shrazi.hold | 0 | 21,494,561,132 | 100% | ||

| huolian | 0 | 3,471,237,131 | 10% | ||

| zawiel | 0 | 334,707,093 | 100% |

hiveblocks

hiveblocks